National Bank® Platinum Mastercard®

| Flytrippers opinion: TBD | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Flytrippers Valuation of Welcome bonus (net value) |

via NBC secure application link |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

–$70ⓘ Rewards: $0 Card fee: $70 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Card eligibility

no minimum income required Welcome bonus eligibility currently no bonus |

NBC Rewards (more simple)

Bonus: None Earn on min. spend: 0 pts (total: 0k pts) |

How to unlock bonus

no welcome bonus Interest rates: Purchases: 20.99% Cash advances: % Cash advances (QC): % |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. NBC is not responsible for maintaining the content on this site. Please click "Apply Now" to see most up-to-date information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

How to learn more

- Go to our editorial card review page (coming soon)

- Keep scrolling here for all the details

Card details

Welcome bonus structure

Currently no bonus

‣Subscribe to Flytrippers’ free travel rewards newsletter to get all card updates

Flytrippers Valuation of the welcome bonus

$0 Welcome bonus

≈ $150 Travel extras credit (to use in 2023)

≈ $150 Travel extras credit (to use in 2024)

–$150 Card fee (first year free)

≈ $150 Total net value the first year alone

(incredible return rate percentage since there is no minimum spending requirement)

Rewards from welcome bonus

You will have 0 points after unlocking the main part of the welcome bonus AND $300 in credits for travel extras ($150 to use in 2023 AND $150 to use in 2024).

That gives you:

- $0 in free travel at the Flytrippers Valuation + $300 in credits for travel extras

━

Concrete examples of redemptions

Here are some of the actual redemptions you can get with the rewards portion:

$0 as a simple travel credit that can be applied to any travel expense booked through the À la carte Travel service

≈ $0 as a simple travel credit that can be applied to any travel expense booked with any provider

Here are some of the actual redemptions you can get with the travel credits:

$150 as credit that can be applied to airport parking, baggage fees, seat selection, seat upgrades, or airport lounge access (to use in 2023)

$150 as credit that can be applied to airport parking, baggage fees, seat selection, seat upgrades, or airport lounge access (to use in 2024)

‣Learn more about the best uses of À la carte points and National Bank credits for travel extras (coming soon)

Earn rates (at Flytrippers Valuation)

5 points per $ (5%):

- Grocery stores

- Indirectly at retailers available via grocery store gift card displays

- Restaurants and food delivery apps

2 points per $ (2%):

- Travel purchases booked with NBC À la carte Travel

- Gas and electric vehicle charging

- Recurring bill payments

1 point per $ (1%):

- Everywhere else

(The multiplier earn rates only apply to $30,000 in purchases by membership year)

━

Earning with additional cards

Fee for additional cards: $50

Quantity allowed: N/A

Minimum age: N/A

‣Learn more about additional cards (coming soon)

$150 credits for travel extras

You get annual credits of $150 for baggage fees, airport parking, seat selection, seat upgrades, or airport lounge access. The $150 credits are offered every calendar year, so you can use it in 2023, then again in early 2024.

‣Learn more about the National Bank travel credits (coming soon)

━

Travel insurance that covers all points redemptions

You will be covered for all flights, even if they are booked as points redemptions with other reward programs, as long as you charge any portion to your card (so just the taxes is fine).

‣Learn more about insurance for points redemptions (coming soon)

━

Access to YUL airport lounge

The card gives you unlimited access to just 1 airport lounge for you and 1 guest (Montreal airport, non-USA international flights only).

Insurance included

Medical travel insurance for 60 days (54 years and under)

Medical travel insurance for 31 days (55 years to 64 years)

Medical travel insurance for 15 days (65 years to 75 years)

Trip cancellation insurance

Trip interruption insurance

Flight delay insurance

Car rental insurance

Delayed and lost baggage insurance

Travel accident insurance

Mobile device insurance

Purchase protection

Extended warranty

‣Learn more about the National Bank® Platinum Mastercard®‘s insurance coverage (coming soon)

━

Insurance not included

None

‣Learn more about the different types of insurance coverage (coming soon)

Redemptions

NBC À la carte points can be used as a simple travel credit (which can be applied to any travel booked through the À la carte Travel service).

‣Learn more about the NBC À la carte rewards program (coming soon)

━

Value

NBC À la carte points are fixed-value rewards (fixed value of 1¢).

‣Learn more about NBC À la carte points (coming soon)

━

Expiry

NBC À la carte points never expire as long as you have the card. And even if you no longer have the card, you can easily extend the expiration indefinitely.

‣Learn more about NBC À la carte points expiry (coming soon)

━

Pooling

NBC À la carte points cannot be pooled with travel companions.

‣Learn more about pooling NBC À la carte points (coming soon)

━

Transfers

NBC À la carte points cannot be transferred to more valuable rewards programs.

‣Learn more about point transfers (coming soon)

━

Other redemption options

NBC À la carte points can be used for rewards other than travel but this should be avoided.

‣Learn more about why you should always use your rewards for travel (coming soon)

━

Logistics of redemptions

NBC À la carte points can be redeemed directly on the NBC website.

‣Learn more about how to get started with NBC À la carte rewards (coming soon)

━

Program summary

Rewards: NBC À la carte points

Type: Fixed-value rewards

Subtype: Standard rewards

Variety: Bank rewards

Flytrippers Valuation: 1¢ per point

Minimum value: 0.8¢ per point

Maximum value: 1¢ per point

Transferable: No

‣Learn more about rewards programs basics (coming soon)

Card eligibility

Minimum income: $80,000 (personal) OR $150,000 (household)

Age: Majority in your province

Estimated credit score: Good

Credit bureau: Equifax Canada

‣Learn more about credit card eligibility requirements (coming soon)

━

Welcome bonus eligibility

Currently no bonus, but normally you must not have held a Mastercard issued by National Bank in the past 24 months to get a welcome bonus, so getting the card now will keep you from getting a welcome bonus for years

‣Learn more about credit card welcome bonus eligibility rules (coming soon)

━

Offer end date

Currently no bonus

‣Subscribe to Flytrippers’ free travel rewards newsletter to get all card updates

━

Card details

Issuer: National Bank of Canada (NBC)

Network: Mastercard

Card Type: Credit card

Product Type: Personal card

‣Learn more about credit card types (coming soon)

Fees and rates

Card fee: $150/year

Fee for optional additional card: $50

FX fee: 2.5%

Annual interest rate (purchases): 20.99%

Annual interest rate (funds advances): 22.49%

Balance transfer fee: 22.49%

‣Learn more about why Flytrippers recommends ignoring fees and rates (coming soon)

Currently no bonus

Credit Terms

Grace period: No interest will be charged on purchases made during the month, provided the client pays the balance in full within twenty-one (21) days of the statement date. This grace period does not apply to cash advances or balance transfers. Minimum payment: If your account balance is lower than $10, you must pay the entire balance. If you reside in the province of Quebec, your minimum payment will correspond to 5% of the credit card account balance plus any overdue payment or $10, whichever amount is higher. If you reside outside of Quebec, your minimum payment represents 2.5% of the credit card account balance plus any overdue payment or $10, whichever amount is higher. Account statement: A statement is sent monthly.

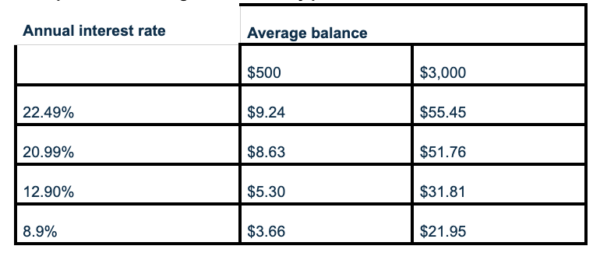

Example of credit charges over a 30-day period

*Variable interest rate in effect on September 1, 2021

Balance transfer and cash advance are subject to credit approval by National Bank. Each balance transfer must be at least $250.

Details of eligible rewards points

Certain restrictions apply. For more information, consult the Rewards plan section or the Plan rules regarding how to earn points.

The amount of points earned on grocery and restaurant purchases depends on the total gross monthly amount charged to the credit card account, regardless of the purchase category. You will earn 2 points for every dollar in eligible grocery and restaurant purchases until a total of $1,000 in gross monthly purchases is charged to the account. After that, you will earn 1.5 points per dollar in eligible grocery and restaurant purchases. The total gross monthly amount is calculated based on your monthly billing period. Grocery purchases include any purchase made at a store that primarily sells food, i.e., grocery store, delicatessen, supermarket, greengrocer or speciality food store. Ready-to-eat meal services and meal delivery services are eligible. This definition excludes purchases made at retail stores and big box stores whose core business is the sale of non-food items. Certain merchants may sell products and services that appear identical or similar to those sold by eligible merchants, or may be separate merchants located on the same premises as eligible merchants, but are classified in different categories by Mastercard. For purchases at other merchants, you will only earn regular rewards points. Restaurant purchases include purchases at a restaurant, fast food restaurant, bar, nightclub or pub. For a full list of Mastercard codes associated with eligible merchants, download the terms and conditions of the À la carte Rewards Plan®.

To earn 1.5 points per dollar in purchases, you will need to purchase gas or an electrical vehicle charge from a service station or from certain big box stores. Certain merchants may sell products and services that appear identical or similar to those sold by eligible merchants, or may be separate merchants located on the same premises as eligible merchants, but are classified in different categories by Mastercard. For purchases at other merchants, you will only earn regular rewards points. For a full list of Mastercard codes associated with eligible merchants, download the terms and conditions of the À la carte Rewards Plan®.

Recurring bill payments are defined as monthly or regular payments automatically charged by a merchant to your National Bank Platinum Mastercard credit card. Not all merchants offer recurring bill payments, and not all recurring payments are considered recurring bill payments. Certain payments therefore may not entitle you to earn more points.

To earn 1.5 points per dollar in purchases, you must make your eligible purchases via the À la carte TravelTM Agency section of our À la carte RewardsTM site.

For example, if each month you charge $400 in groceries, $200 in gas, $100 in recurring bill payments and $150 in other purchases to your card, your $850 in purchases will earn you 1,350 points, as follows: 800 points for grocery purchases (since the total gross monthly amount is $850, i.e., under $1,000), 300 points for gas purchases, 150 points for recurring bill payments and 100 points for other purchases.

Travel and health insurance conditions

This coverage applies to purchases and rentals charged in part to the card, except out-of-province medical/hospital insurance for which the travel arrangements need not be charged to the card, and lost or delayed luggage insurance where all transportation costs must be charged to the card. This coverage applies to the primary cardholder, their spouse and/or dependent children when they (spouse and/or dependent children) travel with the primary cardholder. Extended warranty coverage applies to most new items purchased with the card, in Canada or abroad, as long as the manufacturer’s warranty is valid in Canada. Certain conditions and restrictions apply. For more information and for details of your insurance coverage, please consult the insurance certificate associated with your card.

Mobile device protection

The device must have been purchased using your National Bank Platinum Mastercard credit card, or your phone plan must be paid via recurring payments charged to your National Bank Platinum credit card starting September 1, 2022. For complete terms and conditions, please consult the insurance certificate associated with your card.

Start earning rewards today

And make sure to download our free checklist for when you get a new card—it includes very important mistakes to avoid

(it will open in a separate tab, or you can click here)

via NBC secure application

Questions?

Make use of Flytrippers' expertise

Our travel tips have been featured in many major media outlets in Canada!

We've been earning rewards since 2008 and sharing content since 2017.

Millions of Canadian travelers have taken advantage of our experience.

We can help you by answering all your questions!

Sign up for our free newsletter to receive all our content about NBC Rewards

We’ll help you know everything about your rewards and your card so you can maximize them!

Join 100,000+ savvy Canadians who get the best newsletter for travelers.

Don't miss out on these rewards

Terms & conditions — Travel rewards

†Terms and conditions apply.

This content is not sponsored. However, this page may contain some affiliate links that allow Flytrippers to earn a commission at absolutely no cost to you. Thank you for using our links and helping us keep all our content free for everyone. This helps us fulfill our mission of helping Canadians travel more for less.

The views and opinions expressed on this page are purely our own. They have not been provided, approved, endorsed, or ratified by any third party mentioned on the site.

Financial institutions are not responsible for updating or ensuring the accuracy of the information on Flytrippers’ website. All the information was independently collected by Flytrippers and not provided by financial institutions.

All offers described on the Flytrippers website are subject to the financial institutions’ latest terms and conditions, which can be found on their official website. No efforts are spared to ensure this page is up to date but offers from financial institutions change quickly. It is your responsibility to ensure the accuracy of these offers on their website. Flytrippers will not accept any responsibility for the accuracy of the offers or the result of your actions.

Flytrippers’ website does not contain all available credit card offers or all available credit card products on the market. In addition, Flytrippers never shares an offer if it is not considered advantageous for some travelers, at its sole discretion.

No author on Flytrippers’ website is a financial advisor, a financial planner, a legal professional, or a tax professional. No author on Flytrippers’ website can in any way be considered as such.

All articles, pages, and content on Flytrippers’ website are merely personal opinions of a general nature and are for informational purposes only and should not be considered advice for specific situations. It is your responsibility to perform your own personal research to ensure that travel rewards are appropriate for your own situation.

You can learn more about our terms of use here.