Best credit cards in Canada

March 2026

Getting new credit cards is one of the best ways for Canadians to travel more for less.

It’s how we easily get over a thousand dollars in travel rewards every year ourselves, all the while improving our credit score and getting plenty of other awesome travel benefits.

The key is to choose cards among the best credit cards in Canada (offers change constantly) and to always pay balances on-time and in full.

Here’s our monthly ranking, which focuses mainly on our Flytrippers Valuation of the credit cards’ welcome bonuses alone, since that’s what will be the same for any type of traveler—and because that is what is most important to maximize travel rewards.

(More details about how the ranking works or our Flytrippers Valuation.)

Flytrippers ranking of the best credit card offers in Canada (March 2026)

These are the best of the best, the credit cards with the highest welcome bonus offers in Canada right now. You can’t go wrong with any of these credit cards that all offer at least hundreds of dollars in travel rewards with their welcome bonuses alone, but we help you choose below too.

You can watch our detailed video about the best credit card offers in Canada this month (and come see the next video live).

| Best credit card offers (March 2026) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(≈ 19.6% back on $6k)

Rewards: ≈ $1293

Card fee: $120

Spend required:$6k in 6 mos.

Best for: Very lucrative hotel points for specific hotels

ends April 7th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 11.9% back on $10k)

Rewards: ≈ $1335

Card fee: $150

Spend required:$10k in 6 mos.

Best for: For those who already have the one above

ends April 7th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(13.3% back on $7.5k)

Rewards: $1000

Annual fee: $0 $139

Spend required:$7.5k in 6 mos.

Best for: Simple points for any travel expense & 4 lounge passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 8.8% back on $18k)

Rewards: ≈ $1590

Card fee: $0 $199

Spend required:$18k in 12 mos. (or $5k/$9k)

Best for: Incredible offer for those with more spending

ends June 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.9% back on $9k)

Rewards: ≈ $900

Card fee: $191.88 ($15.99/mo.)

Spend required:$9k in 12 mos.

Best for: Best overall card in Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 15.6% back on $5k)

Rewards: ≈ $900

Card fee: $120

Spend required:$5k in 6 mos.

Best for: Lucrative rewards w/ unlim. value great if you're flexible

ends June 15th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(9.4% back on $7.5k)

Rewards: $825

Card fee: $120

Spend required:$7.5k in 12 mos. (or $2k)

Best for: Very good travel insurance and earn rate

ends July 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.5% back on $10k)

Rewards: ≈ $750

Card fee: $0 $89

Spend required:$10k in 12 mos. (or $3k/$6k)

Best for: Great offer for those with more spending

ends June 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.8% back on $12k)

Rewards: ≈ $1180

Card fee: $250

Spend required:$12k in 12 mos.

Best for: Lucrative rewards and 4 passes for VIP airport lounges

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 8.5% back on $10k)

Rewards: ≈ $1651

Card fee: $799

Spend required:$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17

Best for: Unlimited access to VIP airport lounges and lucrative rewards

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(6.0% back on $10k)

Rewards: $1000

Card fee: $399

Spend required:$10k in 14 mos. (or $3k)

Best for: 10 airport lounge passes and no FX fees

ends July 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 2.2% back on $24k)

Rewards: ≈ $1126

Annual fee: $599

Spend required:$24k in 12 mos.

Best for: For Air Canada lounge access and 6 passes (other lounges)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 10.4% back on $5k)

Rewards: ≈ $919

Card fee: $399

Spend required:$5k in 6 mos.

Best for: Lucrative pts and 6 passes for VIP airport lounges

limited time

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 5.9% back on $7.5k)

Rewards: ≈ $1041

Card fee: $599

Spend required:$7.5k in 3 mos.

Best for: For Air Canada lounge access & other AC benefits

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 11.9% back on $10k)

Rewards: ≈ $1335

Card fee: $150

Spend required:$10k in 6 mos.

Best for: For those who already have the one above

ends April 7th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit card offers (March 2026) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1293

Card fee: $120 (≈ 19.6% back on $6k)

Spend required:

$6k in 6 mos.

ends April 7th Best for: Very lucrative hotel points for specific hotels

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1335

Card fee: $150 (≈ 11.9% back on $10k)

Spend required:

$10k in 6 mos.

ends April 7th Best for: For those who already have the one above

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: $1000

Annual fee: $0 $139 (13.3% back on $7.5k)

Spend required:

$7.5k in 6 mos.

Best for: Simple points for any travel expense & 4 lounge passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

80k/150k

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1590

Card fee: $0 $199 (≈ 8.8% back on $18k)

Spend required:

$18k in 12 mos. (or $5k/$9k)

ends June 1st Best for: Incredible offer for those with more spending

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $191.88 ($15.99/mo.) (≈ 7.9% back on $9k)

Spend required:

$9k in 12 mos.

Best for: Best overall card in Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $120 (≈ 15.6% back on $5k)

Spend required:

$5k in 6 mos.

Best for: Lucrative rewards w/ unlim. value great if you're flexible

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

12k

Valuation (BONUS) Valuation (BONUS)

Rewards: $825

Card fee: $120 (9.4% back on $7.5k)

Spend required:

$7.5k in 12 mos. (or $2k)

ends July 1st Best for: Very good travel insurance and earn rate

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $750

Card fee: $0 $89 (≈ 7.5% back on $10k)

Spend required:

$10k in 12 mos. (or $3k/$6k)

ends June 1st Best for: Great offer for those with more spending

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1180

Card fee: $250 (≈ 7.8% back on $12k)

Spend required:

$12k in 12 mos.

Best for: Lucrative rewards and 4 passes for VIP airport lounges

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1651

Card fee: $799 (≈ 8.5% back on $10k)

Spend required:

$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17 Best for: Unlimited access to VIP airport lounges and lucrative rewards

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $1000

Card fee: $399 (6.0% back on $10k)

Spend required:

$10k in 14 mos. (or $3k)

ends July 1st Best for: 10 airport lounge passes and no FX fees

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1126

Annual fee: $599 (≈ 2.2% back on $24k)

Spend required:

$24k in 12 mos.

Best for: For Air Canada lounge access and 6 passes (other lounges)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $919

Card fee: $399 (≈ 10.4% back on $5k)

Spend required:

$5k in 6 mos.

limited time Best for: Lucrative pts and 6 passes for VIP airport lounges

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1041

Card fee: $599 (≈ 5.9% back on $7.5k)

Spend required:

$7.5k in 3 mos.

Best for: For Air Canada lounge access & other AC benefits

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1335

Card fee: $150 (≈ 11.9% back on $10k)

Spend required:

$10k in 6 mos.

ends April 7th Best for: For those who already have the one above

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Best credit cards in Canada by category

Since there is no such thing as one “best card”, our ranking of the best credit cards is also split into various different sections based on your own preferences, profile, and strategy.

You can read a teaser about how to choose the best credit cards for you below the ranking, with more to come.

We’ll soon have even more categories, detailed credit card pages, comparison features, and more: sign up for free to be the first to get the full version.

Beginners: our upcoming free course (written & video) will explain how travel rewards & credit cards work in greater detail, but if you are new to this world, it’s important to read some basic knowledge (like not canceling old cards) also below the ranking.

Best credit cards in Canada for groceries

A lot of travel rewards beginners have a hard time understanding that earn rates aren’t as important as welcome bonuses, so we figured adding this section would be a great opportunity to remind you. But with groceries being such a big expense, these cards are great for those getting started out.

You can read our detailed page about the best credit cards in Canada for groceries (coming soon).

| Best credit cards for groceries |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(≈ 7.9% back on $9k)

Rewards: ≈ $900

Card fee: $191.88 ($15.99/mo.)

Spend required:$9k in 12 mos.

Best for: ≈ 7.5% as Aeroplan/Avios pts $2.5k monthly cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(4.5% back on $9k)

Rewards: $600

Card fee: $191.88 ($15.99/mo.)

Spend required:$9k in 12 mos.

Best for: 5% as cash back $2.5k monthly cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(9.4% back on $7.5k)

Rewards: $825

Card fee: $120

Spend required:$7.5k in 12 mos. (or $2k)

Best for: 6% (Sobeys brands) in simple credit $50k annual cap

ends July 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(9.4% back on $7.5k)

Rewards: $825

Card fee: $120

Spend required:$7.5k in 12 mos. (or $2k)

Best for: 5% in simple credit $50k annual cap

ends July 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(14.0% back on $2k)

Best for: 5% as simple points $50k annual cap*

SIMPLE

80k/150k

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(4% back on $24k)

Rewards: $960

Card fee: $0 $120

Spend required:$24k in 12 mos.

Best for: 5% as cash back $500 monthly cap

SIMPLE

80k/150k SIMPLE

80k/150k

ends October 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(4% back on $2k)

Rewards: $200

Card fee: $119.88 ($9.99/mo.)

Spend required:$2k in 3 mos.

Best for: 4% as cash back $30k annual cap

SIMPLE

No min. inc. SIMPLE

No min. inc.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(10% back on $2k)

Rewards: $200

Card fee: $0 $120

Spend required:$2k in 3 mos.

Best for: 4% as cash back $25k annual cap

SIMPLE

60k/100k SIMPLE

60k/100k

ends April 30th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(12% back on $3k)

Rewards: $360

Card fee: $0 $120

Spend required:$3k in 3 mos.

Best for: 3.33% in simple credit $50k annual cap

ends October 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(15.5% back on $5k)

Rewards: $775

Annual fee: $0 $139

Spend required:$5k in 6 mos.

Best for: 3% in simple pts (6 TD Rewards pts/$) $25k annual cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(10% back on $3.5k)

Rewards: $350

Annual fee: $0 $139

Spend required:$3.5k in 3 mos.

Best for: 3% as cash back $15k annual cap

SIMPLE

60k/100k SIMPLE

60k/100k

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(12% back on $1k)

Rewards: $120

Card fee: $0

Spend required:$1k in 2 mos.

Best for: 2% as cash back no cap

SIMPLE

50k/80k

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards for groceries |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $191.88 ($15.99/mo.) (≈ 7.9% back on $9k)

Spend required:

$9k in 12 mos.

Best for: ≈ 7.5% as Aeroplan/Avios pts $2.5k monthly cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: $600

Card fee: $191.88 ($15.99/mo.) (4.5% back on $9k)

Spend required:

$9k in 12 mos.

Best for: 5% as cash back $2.5k monthly cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

12k

Valuation (BONUS) Valuation (BONUS)

Rewards: $825

Card fee: $120 (9.4% back on $7.5k)

Spend required:

$7.5k in 12 mos. (or $2k)

ends July 1st Best for: 6% (Sobeys brands) in simple credit $50k annual cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

12k

Valuation (BONUS) Valuation (BONUS)

Rewards: $825

Card fee: $120 (9.4% back on $7.5k)

Spend required:

$7.5k in 12 mos. (or $2k)

ends July 1st Best for: 5% in simple credit $50k annual cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $400

Card fee: $120 Best for: 5% as simple points $50k annual cap*

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

SIMPLE SIMPLE80k/150k

Valuation (BONUS) Valuation (BONUS)

Rewards: $960

Card fee: $0 $120 (4% back on $24k)

Spend required:

$24k in 12 mos.

ends October 31st Best for: 5% as cash back $500 monthly cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $200

Card fee: $119.88 ($9.99/mo.) (4% back on $2k)

Spend required:

$2k in 3 mos.

Best for: 4% as cash back $30k annual cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $200

Card fee: $0 $120 (10% back on $2k)

Spend required:

$2k in 3 mos.

ends April 30th Best for: 4% as cash back $25k annual cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $360

Card fee: $0 $120 (12% back on $3k)

Spend required:

$3k in 3 mos.

ends October 31st Best for: 3.33% in simple credit $50k annual cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: $775

Annual fee: $0 $139 (15.5% back on $5k)

Spend required:

$5k in 6 mos.

Best for: 3% in simple pts (6 TD Rewards pts/$) $25k annual cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $350

Annual fee: $0 $139 (10% back on $3.5k)

Spend required:

$3.5k in 3 mos.

Best for: 3% as cash back $15k annual cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $120

Card fee: $0 (12% back on $1k)

Spend required:

$1k in 2 mos.

Best for: 2% as cash back no cap

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Best credit cards in Canada for airport lounge access

The only thing better than airport lounge access is free airport lounge access. We love airport lounges. And it’s easy for any Canadian to get free airport lounge access with these cards, no matter how often you travel.

You can read our detailed page about the best credit cards in Canada for airport lounge access.

| Best credit cards for airport lounge access |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(≈ 8.5% back on $10k)

Rewards: ≈ $1651

Card fee: $799

Spend required:$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17

Best for: Unlimited + 1 guest worldwide Priority Pass + more

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(14.5% back on $2k)

Rewards: $440

Card fee: $150

Spend required:$2k in 3 mos.

Best for: 6 passes worldwide DragonPass

ends July 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 5.9% back on $7.5k)

Rewards: ≈ $1041

Card fee: $599

Spend required:$7.5k in 3 mos.

Best for: Unlimited + 1 guest in North America Air Canada Lounges (on *A)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.8% back on $12k)

Rewards: ≈ $1180

Card fee: $250

Spend required:$12k in 12 mos.

Best for: 8 passes in Canada Plaza Premium only

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(6.0% back on $10k)

Rewards: $1000

Card fee: $399

Spend required:$10k in 14 mos. (or $3k)

Best for: 10 passes worldwide Priority Pass & Plaza Premium

ends July 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(4.2% back on $6k)

Rewards: $853

Card fee: $599

Spend required:$6k in 3 mos.

Best for: 6 passes worldwide DragonPass

ends October 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 2.2% back on $24k)

Rewards: ≈ $1126

Annual fee: $599

Spend required:$24k in 12 mos.

Best for: Unlimited + 1 guest in North America AC Lounges* + 6 DragonPass

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(7.3% back on $4.5k)

Rewards: $330

Card fee: $0 $150

Spend required:$4.5k in 3 mos.

Best for: 4 passes worldwide DragonPass

ends October 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.5% back on $15k)

Rewards: ≈ $1922

Card fee: $799

Spend required:$15k in 3 mos. spend $15k in 3 mos. &

make 1 purchase in months 15-17

Best for: Unlimited + 1 guest worldwide Priority Pass + more

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 5.5% back on $10.5k)

Rewards: ≈ $1172

Card fee: $599

Spend required:$10.5k in 3 mos.

Best for: Unlimited + 1 guest in North America Air Canada Lounges (on *A)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards for airport lounge access |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1651

Card fee: $799 (≈ 8.5% back on $10k)

Spend required:

$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17 Best for: Unlimited + 1 guest worldwide Priority Pass + more

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: $440

Card fee: $150 (14.5% back on $2k)

Spend required:

$2k in 3 mos.

ends July 1st Best for: 6 passes worldwide DragonPass

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1041

Card fee: $599 (≈ 5.9% back on $7.5k)

Spend required:

$7.5k in 3 mos.

Best for: Unlimited + 1 guest in North America Air Canada Lounges (on *A)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1180

Card fee: $250 (≈ 7.8% back on $12k)

Spend required:

$12k in 12 mos.

Best for: 8 passes in Canada Plaza Premium only

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $1000

Card fee: $399 (6.0% back on $10k)

Spend required:

$10k in 14 mos. (or $3k)

ends July 1st Best for: 10 passes worldwide Priority Pass & Plaza Premium

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $853

Card fee: $599 (4.2% back on $6k)

Spend required:

$6k in 3 mos.

ends October 31st Best for: 6 passes worldwide DragonPass

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1126

Annual fee: $599 (≈ 2.2% back on $24k)

Spend required:

$24k in 12 mos.

Best for: Unlimited + 1 guest in North America AC Lounges* + 6 DragonPass

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $330

Card fee: $0 $150 (7.3% back on $4.5k)

Spend required:

$4.5k in 3 mos.

ends October 31st Best for: 4 passes worldwide DragonPass

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1922

Card fee: $799 (≈ 7.5% back on $15k)

Spend required:

$15k in 3 mos. spend $15k in 3 mos. &

make 1 purchase in months 15-17 Best for: Unlimited + 1 guest worldwide Priority Pass + more

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1172

Card fee: $599 (≈ 5.5% back on $10.5k)

Spend required:

$10.5k in 3 mos.

Best for: Unlimited + 1 guest in North America Air Canada Lounges (on *A)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Best credit cards in Canada for flight delay insurance

I don’t take this statement lightly, but paying for all your flights with a credit card that offers flight delay insurance is one of the most basic and most important travel tips. It’s such an easy way to get free hotels and meals whenever your flights are delayed or canceled!

You can read our detailed page about the best credit cards in Canada for flight delay insurance (coming soon).

| Best credit cards with flight delay insurance |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(9.4% back on $7.5k)

Rewards: $825

Card fee: $120

Spend required:$7.5k in 12 mos. (or $2k)

Best for: Very good travel insurance and earn rate

ends July 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(13.3% back on $7.5k)

Rewards: $1000

Annual fee: $0 $139

Spend required:$7.5k in 6 mos.

Best for: Simple points for any travel expense & 4 lounge passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 15.6% back on $5k)

Rewards: ≈ $900

Card fee: $120

Spend required:$5k in 6 mos.

Best for: Lucrative rewards w/ unlim. value great if you're flexible

ends June 15th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.9% back on $9k)

Rewards: ≈ $900

Card fee: $191.88 ($15.99/mo.)

Spend required:$9k in 12 mos.

Best for: Best overall card in Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 14.0% back on $3k)

Rewards: ≈ $540

Card fee: $120

Spend required:$3k in 3 mos. + $1k

Best for: Valuable Aeroplan pts without min. income and lower min. spend

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 5.9% back on $7.5k)

Rewards: ≈ $1041

Card fee: $599

Spend required:$7.5k in 3 mos.

Best for: For Air Canada lounge access & other AC benefits

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 2.2% back on $24k)

Rewards: ≈ $1126

Annual fee: $599

Spend required:$24k in 12 mos.

Best for: For Air Canada lounge access and 6 passes (other lounges)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 8.5% back on $10k)

Rewards: ≈ $1651

Card fee: $799

Spend required:$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17

Best for: Unlimited access to VIP airport lounges and lucrative rewards

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards with flight delay insurance |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

12k

Valuation (BONUS) Valuation (BONUS)

Rewards: $825

Card fee: $120 (9.4% back on $7.5k)

Spend required:

$7.5k in 12 mos. (or $2k)

ends July 1st Best for: Very good travel insurance and earn rate

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: $1000

Annual fee: $0 $139 (13.3% back on $7.5k)

Spend required:

$7.5k in 6 mos.

Best for: Simple points for any travel expense & 4 lounge passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $120 (≈ 15.6% back on $5k)

Spend required:

$5k in 6 mos.

Best for: Lucrative rewards w/ unlim. value great if you're flexible

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $191.88 ($15.99/mo.) (≈ 7.9% back on $9k)

Spend required:

$9k in 12 mos.

Best for: Best overall card in Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $540

Card fee: $120 (≈ 14.0% back on $3k)

Spend required:

$3k in 3 mos. + $1k

Best for: Valuable Aeroplan pts without min. income and lower min. spend

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1041

Card fee: $599 (≈ 5.9% back on $7.5k)

Spend required:

$7.5k in 3 mos.

Best for: For Air Canada lounge access & other AC benefits

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1126

Annual fee: $599 (≈ 2.2% back on $24k)

Spend required:

$24k in 12 mos.

Best for: For Air Canada lounge access and 6 passes (other lounges)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1651

Card fee: $799 (≈ 8.5% back on $10k)

Spend required:

$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17 Best for: Unlimited access to VIP airport lounges and lucrative rewards

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Best credit cards in Canada for easy fixed-value travel credits

While rewards of the more lucrative type are the best to maximize the value you get, many prefer rewards of the more simple type for a lot more flexibility (and are okay with sacrificing value for that). The simplest are the easy fixed-value travel credits that can be applied to any travel expense.

You can read our detailed page about the best credit cards in Canada for easy fixed-value travel credits (coming soon).

| Best credit cards for easy travel credits |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(9.4% back on $7.5k)

Rewards: $825

Card fee: $120

Spend required:$7.5k in 12 mos. (or $2k)

Best for: Very good travel insurance and earn rate

ends July 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(4.5% back on $9k)

Rewards: $600

Card fee: $191.88 ($15.99/mo.)

Spend required:$9k in 12 mos.

Best for: Big spenders or beginners

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(9.6% back on $5k)

Rewards: $600

Card fee: $120

Spend required:$5k in 6 mos.

Best for: Non-Amex with flexible rewards

ends June 15th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(27.3% back on $1k)

Rewards: $273

Annual fee: $0 $89

Spend required:$1k in 3 mos.

Best for: One of the best offers with no min. income required

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(12.8% back on $1.5k)

Rewards: $192

Card fee: $0

Spend required:$1.5k in 3 mos.

Best for: One of the highest bonuses (no-fee cards)

SIMPLE

No min. inc.

ends January 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(4.8% back on $12k)

Rewards: $820

Card fee: $250

Spend required:$12k in 12 mos.

Best for: Those who already have the Cobalt Card

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(3.0% back on $10k)

Rewards: $1101

Card fee: $799

Spend required:$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17

Best for: Unlimited airport lounge access higher spend req.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards for easy travel credits |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

12k

Valuation (BONUS) Valuation (BONUS)

Rewards: $825

Card fee: $120 (9.4% back on $7.5k)

Spend required:

$7.5k in 12 mos. (or $2k)

ends July 1st Best for: Very good travel insurance and earn rate

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $600

Card fee: $191.88 ($15.99/mo.) (4.5% back on $9k)

Spend required:

$9k in 12 mos.

Best for: Big spenders or beginners

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: $600

Card fee: $120 (9.6% back on $5k)

Spend required:

$5k in 6 mos.

Best for: Non-Amex with flexible rewards

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $273

Annual fee: $0 $89 (27.3% back on $1k)

Spend required:

$1k in 3 mos.

Best for: One of the best offers with no min. income required

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $192

Card fee: $0 (12.8% back on $1.5k)

Spend required:

$1.5k in 3 mos.

ends January 31st Best for: One of the highest bonuses (no-fee cards)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $820

Card fee: $250 (4.8% back on $12k)

Spend required:

$12k in 12 mos.

Best for: Those who already have the Cobalt Card

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $1101

Card fee: $799 (3.0% back on $10k)

Spend required:

$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17 Best for: Unlimited airport lounge access higher spend req.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

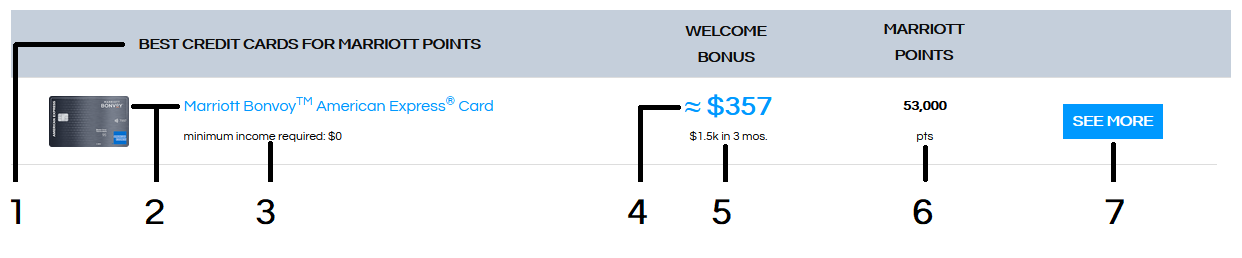

Best credit cards in Canada for Marriott Bonvoy points

Marriott has by far the best hotel rewards program for Canadians, and it is so easy to get many many free hotel nights. This is especially great for those who are like us and are able to find cheap flights anyways (and want to maximize the value they get from rewards).

You can read our detailed page about the best credit cards in Canada for Marriott Bonvoy points (coming soon).

| Best credit cards for Marriott points |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(≈ 19.6% back on $6k)

Rewards: ≈ $1293

Card fee: $120

Spend required:$6k in 6 mos.

Best for: 122,000 pts after welcome bonus

ends April 7th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 11.9% back on $10k)

Rewards: ≈ $1335

Card fee: $150

Spend required:$10k in 6 mos.

Best for: 130,000 pts after welcome bonus

ends April 7th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 5.2% back on $12k)

Rewards: ≈ $878

Card fee: $250

Spend required:$12k in 12 mos.

Best for: 86,400 pts after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 5.1% back on $9k)

Rewards: ≈ $648

Card fee: $191.88 ($15.99/mo.)

Spend required:$9k in 12 mos.

Best for: 72,000 pts after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 3.9% back on $10k)

Rewards: ≈ $1189

Card fee: $799

Spend required:$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17

Best for: 168,000 pts after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 11.7% back on $7.5k)

Rewards: ≈ $1080

Card fee: $199

Spend required:$7.5k in 3 mos.

Best for: 120,000 pts (100,000 Amex pts) after welcome bonus

ends April 7th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 3.6% back on $15k)

Rewards: ≈ $1340

Card fee: $799

Spend required:$15k in 3 mos. spend $15k in 3 mos. &

make 1 purchase in months 14-17

Best for: 190,500 pts after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 11.9% back on $1k)

Rewards: ≈ $119

Card fee: $0

Spend required:$1k in 3 mos.

Best for: 13,200 pts after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards for Marriott points |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1293

Card fee: $120 (≈ 19.6% back on $6k)

Spend required:

$6k in 6 mos.

ends April 7th Best for: 122,000 pts after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1335

Card fee: $150 (≈ 11.9% back on $10k)

Spend required:

$10k in 6 mos.

ends April 7th Best for: 130,000 pts after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $878

Card fee: $250 (≈ 5.2% back on $12k)

Spend required:

$12k in 12 mos.

Best for: 86,400 pts after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $648

Card fee: $191.88 ($15.99/mo.) (≈ 5.1% back on $9k)

Spend required:

$9k in 12 mos.

Best for: 72,000 pts after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1189

Card fee: $799 (≈ 3.9% back on $10k)

Spend required:

$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17 Best for: 168,000 pts after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1080

Card fee: $199 (≈ 11.7% back on $7.5k)

Spend required:

$7.5k in 3 mos.

ends April 7th Best for: 120,000 pts (100,000 Amex pts) after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1340

Card fee: $799 (≈ 3.6% back on $15k)

Spend required:

$15k in 3 mos. spend $15k in 3 mos. &

make 1 purchase in months 14-17 Best for: 190,500 pts after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $119

Card fee: $0 (≈ 11.9% back on $1k)

Spend required:

$1k in 3 mos.

Best for: 13,200 pts after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Best credit cards in Canada for Aeroplan points

Aeroplan points are the best airline rewards in Canada.

You can read our detailed page about the best credit cards in Canada for Aeroplan points.

| Best credit cards for Aeroplan points |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(≈ 5.3% back on $12k)

Rewards: ≈ $641

Annual fee: $0 $139

Spend required:$12k in 12 mos.

Best for: 52,000 pts (40k pts with bonus + 12k by unlocking it) & free checked bags

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.8% back on $12k)

Rewards: ≈ $1180

Card fee: $250

Spend required:$12k in 12 mos.

Best for: 72,000 pts + 8 lounges and $100 travel credit

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.9% back on $9k)

Rewards: ≈ $900

Card fee: $191.88 ($15.99/mo.)

Spend required:$9k in 12 mos.

Best for: 60,000 pts + 5X the points best card in Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 8.5% back on $10k)

Rewards: ≈ $1651

Card fee: $799

Spend required:$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17

Best for: 110,000 pts + unlimited PP lounges and $200 travel credit

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 5.9% back on $7.5k)

Rewards: ≈ $1041

Card fee: $599

Spend required:$7.5k in 3 mos.

Best for: 69,375 pts + unlimited AC lounges & other AC benefits

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 14.0% back on $3k)

Rewards: ≈ $540

Card fee: $120

Spend required:$3k in 3 mos. + $1k

Best for: 44,000 pts + a free bag on Air Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 2.2% back on $24k)

Rewards: ≈ $1126

Annual fee: $599

Spend required:$24k in 12 mos.

Best for: 85k pts with bonus (115,000 pts total) 85k + 30k on min. spend

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 24% back on $1k)

Rewards: ≈ $240

Annual fee: $0 $89

Spend required:$1k in 3 mos.

Best for: 16,000 pts (15k pts with bonus + 1k by unlocking it) low min. spend and lower fee

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 4.3% back on $30k)

Rewards: ≈ $1500

Card fee: $199

Spend required:$30k in 12 mos. (or $7.5k)

Best for: 100,000 pts + simpler min. spend structure

ends April 7th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 16.5% back on $1k)

Rewards: ≈ $165

Card fee: $0

Spend required:$1k in 3 mos.

Best for: 11,000 pts + no fees but way less value

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards for Aeroplan points |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $641

Annual fee: $0 $139 (≈ 5.3% back on $12k)

Spend required:

$12k in 12 mos.

Best for: 52,000 pts (40k pts with bonus + 12k by unlocking it) & free checked bags

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1180

Card fee: $250 (≈ 7.8% back on $12k)

Spend required:

$12k in 12 mos.

Best for: 72,000 pts + 8 lounges and $100 travel credit

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $191.88 ($15.99/mo.) (≈ 7.9% back on $9k)

Spend required:

$9k in 12 mos.

Best for: 60,000 pts + 5X the points best card in Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1651

Card fee: $799 (≈ 8.5% back on $10k)

Spend required:

$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17 Best for: 110,000 pts + unlimited PP lounges and $200 travel credit

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1041

Card fee: $599 (≈ 5.9% back on $7.5k)

Spend required:

$7.5k in 3 mos.

Best for: 69,375 pts + unlimited AC lounges & other AC benefits

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $540

Card fee: $120 (≈ 14.0% back on $3k)

Spend required:

$3k in 3 mos. + $1k

Best for: 44,000 pts + a free bag on Air Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1126

Annual fee: $599 (≈ 2.2% back on $24k)

Spend required:

$24k in 12 mos.

Best for: 85k pts with bonus (115,000 pts total) 85k + 30k on min. spend

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $240

Annual fee: $0 $89 (≈ 24% back on $1k)

Spend required:

$1k in 3 mos.

Best for: 16,000 pts (15k pts with bonus + 1k by unlocking it) low min. spend and lower fee

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1500

Card fee: $199 (≈ 4.3% back on $30k)

Spend required:

$30k in 12 mos. (or $7.5k)

ends April 7th Best for: 100,000 pts + simpler min. spend structure

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $165

Card fee: $0 (≈ 16.5% back on $1k)

Spend required:

$1k in 3 mos.

Best for: 11,000 pts + no fees but way less value

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Best credit cards in Canada for Avios points

Avios points are valuable airline rewards for Canadians.

You can read our detailed page about the best credit cards in Canada for Avios points (coming soon).

| Best credit cards for Avios points |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(≈ 15.6% back on $5k)

Rewards: ≈ $900

Card fee: $120

Spend required:$5k in 6 mos.

Best for: 60,000 pts + wider acceptance than Amex

ends June 15th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.8% back on $12k)

Rewards: ≈ $1180

Card fee: $250

Spend required:$12k in 12 mos.

Best for: 72,000 pts + 8 lounge passes and $100 travel credit

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 4.3% back on $30k)

Rewards: ≈ $1500

Card fee: $199

Spend required:$30k in 12 mos. (or $7.5k)

Best for: 100,000 pts + quicker unlocking of pts

ends April 7th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 10.4% back on $5k)

Rewards: ≈ $919

Card fee: $399

Spend required:$5k in 6 mos.

Best for: 60,000 pts + 6 passes for airport lounges

limited time

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.9% back on $9k)

Rewards: ≈ $900

Card fee: $191.88 ($15.99/mo.)

Spend required:$9k in 12 mos.

Best for: 60,000 pts + 5X the points best card in Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 8.5% back on $10k)

Rewards: ≈ $1651

Card fee: $799

Spend required:$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17

Best for: 110,000 pts + unlimited PP lounges and $200 travel credit

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards for Avios points |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $120 (≈ 15.6% back on $5k)

Spend required:

$5k in 6 mos.

Best for: 60,000 pts + wider acceptance than Amex

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1180

Card fee: $250 (≈ 7.8% back on $12k)

Spend required:

$12k in 12 mos.

Best for: 72,000 pts + 8 lounge passes and $100 travel credit

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1500

Card fee: $199 (≈ 4.3% back on $30k)

Spend required:

$30k in 12 mos. (or $7.5k)

ends April 7th Best for: 100,000 pts + quicker unlocking of pts

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $919

Card fee: $399 (≈ 10.4% back on $5k)

Spend required:

$5k in 6 mos.

limited time Best for: 60,000 pts + 6 passes for airport lounges

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $191.88 ($15.99/mo.) (≈ 7.9% back on $9k)

Spend required:

$9k in 12 mos.

Best for: 60,000 pts + 5X the points best card in Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1651

Card fee: $799 (≈ 8.5% back on $10k)

Spend required:

$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17 Best for: 110,000 pts + unlimited PP lounges and $200 travel credit

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Best credit cards in Canada for other airline points

Aeroplan and Avios points are the best, but there are a few other interesting airline points.

You can read our detailed page about the best credit cards in Canada for other airline points (coming soon).

| Best credit cards for other airline points | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(≈ 13.3% back on $5k)

Rewards: ≈ $845

Card fee: $180

Spend required:$5k in 3 mos.

Best for: 65,000 Asia miles by unlocking bonus & Cathay Pacific benefits

limited time

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 24% back on $2k)

Best for: 40,000 Alaska miles by unlocking bonus later in 2024

SIMPLE

80k/150k

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 36% back on $500)

Rewards: ≈ $180

Card fee: $0

Spend required:$500 in 3 mos.

Best for: 12,000 Alaska miles by unlocking bonus later in 2024

SIMPLE

No min. inc.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)Rewards: $0

Card fee: $0 $132

Spend required:$0 no

welcome bonus

Best for: 0 Flying Blue miles (no welcome bonus currently)

LUCRATIVE

80k/150k

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

| Best credit cards for other airline points | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $845

Card fee: $180 (≈ 13.3% back on $5k)

Spend required:

$5k in 3 mos.

limited time Best for: 65,000 Asia miles by unlocking bonus & Cathay Pacific benefits

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $600

Card fee: $120 Best for: 40,000 Alaska miles by unlocking bonus later in 2024

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $180

Card fee: $0 (≈ 36% back on $500)

Spend required:

$500 in 3 mos.

Best for: 12,000 Alaska miles by unlocking bonus later in 2024

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $0

Card fee: $0 $132 Spend required:

$0 no

welcome bonus Best for: 0 Flying Blue miles (no welcome bonus currently)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Best credit cards in Canada for WestJet dollars

The WestJet Rewards program gives you airline points of the more simple type that are easy to use for any WestJet flight, some limited partner flights, and soon for Sunwing flights as the airline will be integrated into WestJet in 2024.

You can read our detailed page about the best credit cards in Canada for other WestJet dollars (coming soon).

| Best credit cards for WestJet dollars | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(10.7% back on $5k)

Rewards: $675

Card fee: $139

Spend required:$5k in 3 mos.

Best for: 67,500 WestJet pts by unlocking bonus & free bag + BOGO/lounge

ends February 4th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(12.1% back on $1k)

Rewards: $160

Card fee: $39

Spend required:$1k in 3 mos.

Best for: 16,000 WestJet pts by unlocking bonus & Buy One Get One ticket

ends February 4th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 4.3% back on $5k)

Rewards: ≈ $613

Card fee: $399

Spend required:$5k in 6 mos.

Best for: 613 WestJet dollars by unlocking bonus or more valuable uses

limited time

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 9.6% back on $5k)

Rewards: ≈ $600

Card fee: $120

Spend required:$5k in 6 mos.

Best for: 60,000 pts by unlocking bonus after welcome bonus

ends June 15th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 9.6% back on $5k)

Rewards: ≈ $600

Card fee: $120

Spend required:$5k in 6 mos.

Best for: 60,000 pts by unlocking bonus after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(13.8% back on $1.5k)

Rewards: $255

Card fee: $48

Spend required:$1.5k in 6 mos.

Best for: 25,500 pts by unlocking bonus or more valuable uses

ends May 6th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(23.6% back on $500)

Rewards: $118

Card fee: $0

Spend required:$500 in 3 mos.

Best for: 11,750 pts by unlocking bonus or more valuable uses

ends May 6th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

| Best credit cards for WestJet dollars | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)

Rewards: $675

Card fee: $139 (10.7% back on $5k)

Spend required:

$5k in 3 mos.

ends February 4th Best for: 67,500 WestJet pts by unlocking bonus & free bag + BOGO/lounge

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $160

Card fee: $39 (12.1% back on $1k)

Spend required:

$1k in 3 mos.

ends February 4th Best for: 16,000 WestJet pts by unlocking bonus & Buy One Get One ticket

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $613

Card fee: $399 (≈ 4.3% back on $5k)

Spend required:

$5k in 6 mos.

limited time Best for: 613 WestJet dollars by unlocking bonus or more valuable uses

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $600

Card fee: $120 (≈ 9.6% back on $5k)

Spend required:

$5k in 6 mos.

Best for: 60,000 pts by unlocking bonus after welcome bonus

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||