Travel rewards points are simply amazing, but they can be intimidating. Some of you are even highly skeptical. Taking a few (okay… a bit more than a few) minutes to read this post will give you all the facts and give you a very thorough introduction. In fact, just knowing that these 25 myths are false means you’ll understand travel rewards points better than about 99% of Canadians (for real).

As someone who literally decided to dedicate his entire professional life to helping people travel more for less, I still can’t believe that so many people don’t take a bit of time to get informed about something that can save them thousands of dollars!

So I am very glad that you are open-minded enough to check out this post; you definitely won’t regret it!

By the way, this is just a teaser for our upcoming free beginners’ course (in written form AND video form) that will teach you everything you need to know about travel rewards (sign up for free to be the first to get access when it’s launched).

But since now is the best time to start earning rewards with two of the best cards in Canada (the Marriott Bonvoy Card and the American Express Cobalt), here are the 25 myths (or common comments we read) that you need to know are false. The most vital (and most detailed) ones are at the beginning.

1. “Travel rewards are a scam”

Look at it this way:

- With travel rewards point, I’ve personally earned $10,000 net in free travel in the past 12 years

- Most people have paid for 100% of their travel with cash

I wonder who got scammed the most?

The only good reasons not to take advantage of travel rewards are not knowing they exist, or not wanting any free travel. But most people don’t take advantage of this because they think it’s a scam and don’t seek to learn more about it.

Some also think that the way to earn travel rewards is by traveling, which is not the case at all… and could explain why some think this is not worth it (of course it’ll be terribly slow if you just earn points by traveling).

Seriously, this is not too good to be true, I assure you. The logical explanation is the next point.

Look, of course, it’s okay to be prudent and make sure things are legit… but it’s not okay to just always assume everything is a scam without even looking into the facts! The real scam is always paying full price for travel and not earning the thousands of dollars in free travel than banks and travel brands want to give to savvy travelers.

Some will keep refusing to even consider that they might be missing out on a very rewarding world. It’s their loss (they’ll keep losing, literally); depriving themselves of very valuable rewards that are pretty easy to get.

But not you, you are at least keeping an open mind. That’s all we’re asking. That you learn why all the myths you’ve heard or read are false, especially this one about travel rewards being a scam (whatever that would mean exactly… the thousands of people using rewards points for free travel are all part of a major conspiracy maybe?).

All kidding aside, it’s actually very understandable why this myth and the others are very widespread: the truth is travel rewards go against conventional wisdom and are completely counterintuitive. That’s precisely why so few people earn a lot of travel rewards and it’s not “mainstream”.

You need to put aside everything you think you know about the topic, especially about credit cards, because what you think you know is probably all wrong. But that’s okay, many of these things seem to make sense and most people think they’re true, that’s normal. But they are still myths, and that’s why we want to share how it all works.

My own experience—and that of thousands of other Canadian travelers—is proof that travel rewards points are not a scam at all.

2. “Credit card bonuses are a scam”

This is probably where the whole scam myth comes from. Good credit cards give you welcome bonuses (or “signup bonuses”). You get points for free travel just for getting the card. Really.

These are the key to travel rewards. You often have to reach a small amount of spending in the first 3 months that you would’ve spent anyway (usually a very manageable $1,500… so just $500 a month) and the bonus is yours. You don’t even have to do anything ever again (and it’s easy to reach these low amounts with our tips).

I honestly am shellshocked by how many people believe these bonuses are a scam, when it’s the most easily verifiable part. It’s written on the bank’s official site. Maybe people believe there are strings attached or something? Well, there isn’t. You reach the minimum spend, and then you get the bonus. That’s it. No scam.

You might be thinking “but banks are evil, they wouldn’t give free stuff”. Also false. They have been giving these bonuses for decades.

It’s just marketing.

The reasoning is very simple: instead of spending ≈ $500 on ads to convince you to get a card that would be a lot less valuable to you with no welcome bonus, they’re giving you the ≈$500 directly because that is something that is a lot more convincing.

It’s really that simple. It’s not part of the conspiracies about 5G towers or the Earth being flat.

I don’t want to bore you with former management consultant analyses, but if you want to get more technical, client acquisition costs are very expensive in the financial products industry, and the average lifetime value of a customer is also high. So the welcome bonuses are high.

Banks hope you use the card after, so that merchants give them a percentage of each transaction. But you certainly aren’t obligated in any way. After my bonuses, I only use the cards that are the most valuable for me, so most don’t get used much. This is entirely allowed, as long as you don’t cancel it before the 11th month (see further myths).

They need a larger pool of card members to reach the overall spending level they need. All in allll, those who’ll spend more after the welcome bonus will compensate for those who spend little or nothing, and everything works out. Anyway, don’t even worry about banks… they have plenty of money.

Take your share, they want to give it to you!

3. “Credit is risky/bad”

Let’s cover the very basics. This is absolutely not true. Credit is only bad if you use it badly.

If you cannot pay for what you buy in full every month STOP READING NOW. This is literally the only requirement to get into travel rewards. If you can’t pay everything in full, don’t ever use credit cards. That is obviously bad indeed, and risky (get that under control and come back for free travel after).

Just because many use credit badly doesn’t mean that you, who won’t use it badly, shouldn’t use it at all. That would make no sense. Did you stop drinking just because some people drive after they’ve been drinking (which is very bad)? Of course not. It’s the same thing.

In fact, using credit is not even just “not bad”, it’s a lot better than not using it. You’ll never pay a fee for using a card if you pay it in full, just like paying with cash.

But in fact, you’ll be essentially getting at least a 1% discount on the thousands of dollars you pay in a year, because even the most basic card will earn 1%… compared to earning 0% without credit cards. And that 1% isn’t even what I’m talking about when I tell you you can earn $1,000 a year by the way.

4. “I have a card and earn rewards; I’m doing this right!”

Almost everyone thinks they’re doing it right because they have one card that earns rewards. Sorry, but no. It’s a start and it’s infinitely better than getting nothing of course, but that’s not how to maximize rewards.

As I just said, welcome bonuses are the key!!!

This is the single most important thing to understand in all of travel rewards. You’ll never earn as many rewards by just getting 1% or 2% on your everyday purchases, never.

Welcome bonuses will accelerate this exponentially. One example: some cards offer 50,000 point welcome bonuses, like the aforementioned Marriott Bonvoy Card.

It would take you $25,000 in regular spending to accumulate that at 2%; that’s insane. Get the card, you get that same 50,000 points with just the $1,500 minimum spend. That’s like getting 35% back instead of 2%. See how those effective earn rates aren’t even in the same universe?

Earning welcome bonuses is how you should earn most of your points. Understand that, and you’re already going to earn a lot more rewards than almost everyone else. Even if you just get one new card welcome bonus every year.

5. “Having many cards is bad for my credit score”

This is exactly where you need to forget all the things you think you know, because it’s completely false. In fact, the truth is having multiple cards is BETTER for your credit score.

It’s mathematical and not debatable. Remember, most credit card “advice” is for average credit users, and average users don’t pay on time in full. Of course, if you don’t pay on time in full, having more cards is not better. But if you do, yes it is.

I currently have 10 credit cards and have an 828 credit score. It’s not surprising/impressive or anything, it’s literally just how the math works.

By the way, don’t go getting 10 cards at once, you need to start slow at the beginning, so that your newest cards have the time to get older. This is very important.

One of the most common mistakes beginners make is they cancel their old cards when they get a new one. That is the absolute worst thing you can do for your credit score. No wonder they then think “I got a new card, and my score dropped massively”. It’s not the new card that does that. It’s closing the old one. It’s because the average age of your credit accounts is important (the older the better).

That’s what I mean when I say credit cards are counterintuitive and the opposite of what most people think.

There will be a detailed post, but since this is arguably the biggest myth to debunk, I’ll make this point the longest one of the 25 myths.

Getting a new card:

- a positive effect

- on a component worth a lot in your credit score (30%)

- a major impact (affects the entire component)

- an effect that is permanent (a constant impact every single month)

A new credit request will have:

- a negative effect

- on a component worth the least in your credit score (10%)

- a minor impact (doesn’t affect the entire component)

- an effect that is temporary (only once, when you request)

So in a few months, the minor negative effect of a request will be more than compensated by the fact your credit utilization (worth 3 times more in the score) will improve. Everyone that gets into travel rewards who is careful and follows the rules ends up with a credit score just as good or even better than when they started.

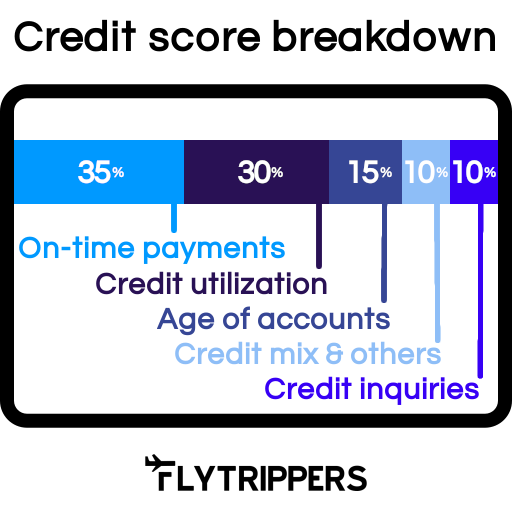

Here’s what goes into your credit score. The calculation is not random, it doesn’t depend on every situation or vary, it’s how it’s calculated, period. The components are weighted this way:

Having multiple cards is much better for one of the most important components, and one is the least-known: credit utilization is how much of your available credit you use, regardless of on-time payments.

If you have one card with a $5,000 limit that you spend $2,000 on every month, you’re using 40% of your credit, and that’s very bad. Even if you pay it in full on time. The same $2,000 is just 10% utilization if you have 4 cards with a $5,000 limit, which is good.

And credit utilization is 30% of your score!!! It’s the most important one, except for on-time payments at 35% (and more cards mean more on-time payments; also good). The negative effect of a new application is minor, since that entire component is just worth 10% of the credit score (the least important) and the effect is partial: your score won’t go down by a full 10% every time you order a card!

How credit scores work is easily verifiable by the way, if my 10 years doing this, my hours of weekly reading on the topic, and attendance at multiple credit card conferences in Canada and the USA aren’t enough for you, I completely understand. I genuinely also always prefer to check everything myself (that’s precisely why I learned everything about rewards points).

So by all means, take a look, for example on the Equifax website, where they tell you what goes into credit scores—they’re the ones who calculate them. You can also read our detailed post about credit scores soon.

6. “This is only for those who want 10 cards”

No. You don’t have to be that intense. Even just getting one new card a year will likely double the rewards you earn. That’s pretty interesting! And requires almost no effort. One every six months is pretty easy too.

It’s really up to you. The world of travel rewards can be whatever you want it to be. You’ll get out what you put in. You can go as slow as you want (and as I said, at first you have to go slow so the first cards get older).

But if you want to maximize your rewards, you can do that too. I invest a lot of time into travel rewards because I am passionate about this, and because I want to keep going on 12 international trips like I did in 2019. There are so many possibilities with travel rewards.

7. “This is just to earn points”

There’s actually more to travel rewards than free travel: credit cards have many other great benefits that are unrelated to the welcome bonuses and points you earn.

The main one is free insurance coverage. Medical travel insurance, trip cancelation/interruption insurance, rental car insurance, flight delay insurance, lost baggage insurance, etc. These can easily save you hundreds of dollars a year. It’s included for free on many cards. You can read more about each type of travel insurance.

You’ll also get retail protection on everything you buy, instead of getting no protection at all by paying with cash/debit. This extends your warranty by a year for free on most items, and even covers a new purchase entirely for theft or accidents in the first 3 months in many cases.

Some cards offer airport lounge passes for free. I am not a luxury traveler at all, but I’m officially addicted to lounge access; it’s amazing. Some cards have no foreign transaction fee (while almost all others in Canada charge 2.5% on every purchase in a foreign currency).

Finally, there are plenty of other travel benefits like airline perks, companion tickets, travel concierge services, elite status perks in hotels, and more. We’ll cover all these in our upcoming new rewards section.

8. “Travel rewards cards are cards to use while traveling”

No. Travel cards are to earn free travel, not to use while traveling. Which card to use when traveling has almost nothing to do with any of this. Sure you’ll use one while traveling, and one to cover your travel expenses, but that’s a completely separate consideration and that is not what a travel card means.

The best travel credit cards are the best because they give your travel rewards to redeem for travel. The cards to use to get travel rewards points. Not to use while traveling.

9. “You have to be rich or spend a lot”

This is not true. Some great cards have no minimum income requirement, like the Marriott Bonvoy Card.

However, it’s true that many are exclusively for those who earn over $60,000 a year, so it’s definitely a lot easier to earn a lot of rewards if you are above that threshold. But you can still earn a lot if you aren’t, it’s just going to be a bit slower.

And about the spending part, that’s a no as well. Especially if you forget myth #4, because welcome bonuses are the key and don’t require that much spending. Again, of course if you spend more, you’ll earn even more. But I’m very frugal and have earned a lot of rewards points.

10. “But cards with fees are evil”

Probably the myth that frustrates me the most. I know it’s a natural reflex to avoid fees in life (and it usually is wise—remember, travel rewards are counterintuitive), but the card fee ALONE is completely irrelevant. What matters is the net value.

If I offered you the option between:

- giving you $500 if you pay me $120;

- or giving you $0 if you pay me $0

What would you choose? That’s exactly how credit cards work, and sadly so many people stick to getting a big fat zero. Only the net value matters, not the fee on its own.

i am not saying you should not look at the fee: I’m saying you need to look at the fee AND the welcome bonus. The total! Not just the fee!

Again, it’s really that simple. If you don’t agree with the above calculation that is such a no-brainer, travel rewards might not be for you, because doing math is very important in the world of travel rewards in general. And most importantly because cards with no fees almost never give welcome bonuses, and if you remember myth #4 above which is the most important one: welcome bonuses are the key.

You can still earn points without paying fees and without getting welcome bonuses, but you’ll go infinitely slower while waiting for 1% or 2% on purchases to add up, which will take forever.

Just to be crystal clear: not all cards with fees are good either. Many have a $120 fee and still give you $0. You should obviously avoid those even more. But not because of the fee itself; because the net value is negative. And don’t pay a fee just for insurance or other perks: most cards will give you those in addition to a welcome bonus.

11. “But then I’ll have to pay the fee every year”

Credit cards are not lifetime contracts. Closing cards is another thing beginners have a hard time with, because this is just not something most people usually invest any time or thought into.

You don’t have to keep the card after the first year. If the card no longer provides value for you the second year, in other words, if the benefits it offers aren’t worth the fee without the welcome bonus (remember: the net value is what matters), then you simply close it.

In most cases, you can “downgrade” the card to a no-fee card that the same bank offers. It’s easy and can be done in minutes. That way you protect your credit score (because having old cards is good) and you don’t pay a fee that isn’t offset by a welcome bonus.

But again… do the math. Some cards are worth keeping even with a fee if they have benefits that are worth more than the card fee (net value). For example, the Marriott Bonvoy Card with its annual certificate that is worth hundreds of dollars and more than compensates for the fee.

Beware though: other cards could offer those same benefits in addition to a welcome bonus. For example, the Scotia Passport gives you 6 lounge passes. You could keep it after year 1 if you value those lounge passes as much as the fee amount… but there are also 3-4 other cards with lounge passes that you could get instead, before paying a fee for lounges. That said, that card also has no foreign transaction fee… saving you 2.5% on each of those purchases. Is that worth the fee? It depends on how much you spend in foreign currencies. Math once again!

12. “I can choose any rewards card”

No. Choosing the right cards is really the most important part. We have a monthly ranking of the best credit card offers (which will be revamped in our new travel rewards section as well). It changes regularly, since the welcome bonus offers change regularly.

The factors to consider are obviously how valuable the offer is, what type of points you want, any benefits you value, what your overall rewards strategy is, and of course any restrictions in terms of minimum income. We’ll cover this topic a lot more in the new section, since it’s so vital.

By the way, the rewards that cards give you are called points. The points you earn are always associated with a rewards program; points are the rewards programs’ currency. For example, Aeroplan points are what you need to earn to use for free travel with Air Canada’s Aeroplan rewards program.

Okay, in that particular case, they actually they call them Aeroplan Miles, but that’s just a synonym for point that means the exact same thing. So we’ll always use point in general, to make things simpler. While we’re in the semantics basics, a “rewards program” can be called a “frequent flier program” or a “loyalty program”… it’s the same thing.

13. “There is ONE best card”

There are 3 reasons why there is just no “best” card.

First, welcome bonuses are the key, and welcome bonuses change all the time. So there can’t be a “best card”. The best card today is often one to avoid tomorrow, when the welcome bonus offer ends.

Secondly, saying there is a “best card” also implies that having one is enough or the right thing to do, which we’ve already explained is very wrong.

Finally, there are a variety of different rewards points programs and a variety of card benefits. The “best” card for you will not be the best card for someone who travels differently and has different preferences.

That’s why once it’s updated in the new section launch, our new credit card ranking will be easier to sort depending on your own travel patterns.

14. “I’ll have to change my current bank”

No you won’t. Your banking accounts and credit cards are completely unrelated, you don’t need to change a thing. I have credit cards issued by 7 different banks and I pay them all from my longtime chequing account.

These are simple bill payments that can be set up and paid in 3 clicks. You don’t need to change your banking account. You don’t need to set up a new one.

This is non-issue. Focus on the different cards’ welcome bonuses, benefits, and types of points… but don’t worry about whether you want to deal with that bank at all. The only warning is that many Canadian banks will want to identify you in branch to deliver the card, so just take that into account if for example RBC is not present in your town.

15. “I shouldn’t get a card that isn’t accepted in 100% of the places where I shop”

That’s irrelevant. What is the thing that matters in travel rewards? Welcome bonuses. You are not getting a card to use it. You are getting the card because the welcome bonus offers a net value that is interesting. That’s the most important part.

This is an especially common complaint with AMEX cards, since they have many of the best rewards cards and aren’t as widely accepted in stores (although it’s not nearly as bad as it used to be when I started in travel rewards in 2008). But you have to stop thinking that you need to use a card for 100% of your purchases (you should have more than one anyway if you rid yourself of myth #5).

The Marriott Bonvoy Card gives you 50,000 Marriott points for $120. The only thing to consider is whether you want 50,000 Marriott points for $120, or if other cards can give you more value. Not if you can use the card at your local bakery. That has nothing to do with anything. Stop focusing on the everyday purchases, keep your eye on the bigger prize: welcome bonuses.

16. “I have to use this card because I have it”

A lot of people have a hard time understanding this, so I’ll give it it’s own point even if it’s similar to the previous one and I’ve covered this in myth #2. Just because you have a card, doesn’t mean that you need to use it.

If the card is not the best one for you to use once you’ve unlocked the welcome bonus, you can simply “sock-drawer” it as we say. You put it in your sock drawer. It’s fine.

The only thing you need to do is unlock the welcome bonus. Then, you compare your cards’ earning rates and benefits, and based on that and on the type of points you value the most, you decide which to use where.

But it’s very common to not use it at all, it’s normal and it’s what you need to do sometimes. I have 10 cards, but 5 of them are never in my wallet and are not ever being used.

17. “I should use the same card everywhere”

If you are not currently unlocking a welcome bonus, you should not be using the same card everywhere. Well, you could, it’s not the end of the world (because welcome bonuses are the key, not earning on regular purchases).

But if you really want to maximize your rewards as I do, compare your cards’ earn rates and category bonuses (category multipliers). At the grocery store you’ll use the card with the best earn rate on groceries, for travel expenses you’ll use the card with the best earn rate on travel, etc.

18. “Having points in multiple rewards programs is complicated”

While it is obviously more complicated than having points in just one program, it’s also infinitely more rewarding and lucrative. But it’s really not that complicated.

Let’s say you have simple travel credits from 3 different banks. One can pay for the flight, one for the first few hotel nights, and the other for other hotel nights. If you have points from airlines or that can only be used for flights, you can use one for the outbound flight and one for the inbound flight (or for separate trips—the point is to travel more too). Have bank points and hotel points? Easy to pay for separate things. Have a mix of all those? Even more possibilities.

It’s not really an issue to even worry about honestly. At least if you want to get a maximum amount of points (and if you ignore myth #23).

19. “Using points is always complicated”

It’s not always complicated. Some types of points definitely are. Fittingly, those are the most rewarding.

But some points are extremely easy-to-use travel credits that can simply be applied to any travel expense, with absolutely no complications, if that’s what you prefer. You always have a choice.

There are two types of points in the world of travel rewards:

- fixed-value points

- variable-value points

Whether the points are from an airline program, a hotel program, a bank program, or another type of program… the points will always either have a fixed value that never changes or a variable value that depends on how you use them.

To summarize both:

- Fixed-value points are simpler, and therefore offer a lot less potential value. You can never get outsized value: they’re always worth the same thing.

- Variable-value points are more complex, but they offer a lot more potential value. You can get outsized value: it depends on how you use them.

You can read more about the difference between both.

20. “All points work the same and are worth the same”

No points program works the same, and each points currency is worth a different amount, nothing is one-size-fits-all. They don’t have the same rules at all. Every program has its own rules and specificities.

There 3 main points issuers:

- banks

- airlines

- hotels

(This is secondary compared to understanding that they can either have a fixed value or a variable value, no matter the issuer category.)

And within the same issuer type, they will still work very differently. For example, Air Canada Aeroplan Miles and WestJet Dollars have absolutely nothing in common (well, except that credit cards are the fastest way to earn them—the only thing all points have in common).

I think you get it, but I’ll summarize it to be sure… two points programs will not work the same even if they both:

- are the same type (fixed-value/variable-value)

- are from the same issuer category (bank/airline/hotel)

- have the same value

It’s especially true with airline points, which vary even more greatly by program. For example, a nonstop Toronto-Miami flight costs 22,000 points with British Airways Avios but 25,000 points with Air Canada Aeroplan. Yet our Flytrippers valuation of those two variable-value point currencies is the same.

Oh, and if you’re leaving from Canadian cities other than Montreal or Toronto, the same destination will go up to 33,000 points with Avios… but still exactly 25,000 points with Aeroplan. Oh and a Toronto-San Francisco flight at 25,000 points with Aeroplan will cost you just taxes if you fly United, but you will pay more (taxes and surcharges) if you fly Air Canada (see myth #24).

That’s why variable-value points require you to learn more than the easy fixed-value points: they really have completely different rules. Thankfully, hotel points are a lot simpler, meaning it’s a good way to start with the more rewarding variable-value points with fewer complexities.

Because of these different rules, most points often don’t even have the same value. Many think “1 point” is a universal currency that is worth the same thing no matter the program, but nothing could be further from the truth. All points are worth a different amount.

Think of them as currencies: 1 dollar in Canada is 257 dollars in Zimbabwe. They’re both called “dollars” but obviously aren’t worth the same thing at all. It’s the same thing for points, except that most can’t be exchanged for other points like foreign currencies can.

But some points are transferable points, which has its own complexities. This is the exception more than the rule. Since they’re not worth the same, and since there are transfer rates to take into account, transferring points is not always a good deal at all. You can read a lot more about these more complicated transferable points soon.

21. “Points will expire”

Yes, but it’s irrelevant. Most points won’t expire as long as you have the card. Others are easy to keep from expiring. For example Marriott only requires you to earn one point every 2 years, it’s really not that hard, especially with the card: each purchase will reset the clock for 2 years, even a $1 purchase.

Just stay organized (we’ll have great tools and templates for you in our free course) and follow the rules, this won’t even be an issue.

If you really want to keep it simple, stick to bank points that won’t expire as long as you have the card. You’ll earn less, but you won’t have to worry about this if it’s really that stressful for you. Like I said earlier, the world of travel rewards can be anything you want it to be; you decide.

But context is important: they’re literally giving you free stuff. It’s not all unreasonable to ask for one yearly task.

22. “It’s good to use points for other things than travel”

No it is most definitely not. Using points is a topic that we’ll cover a lot more of, but if you can remember one thing, and one thing only, it’s to never use points for anything other than travel. The value is almost always worse, even with popular programs like AIR MILES. But even the fixed-value points often have a lower fixed value for non-travel expenses.

Avoid that. There’s a reason all programs always try to promote using your points for plenty of crap that isn’t travel: it’s extremely bad for you, and great for them.

It’s a very common mistake that you might have already committed, that’s okay, it happens. No one knows. But now, you should never do that again.

Speaking of good uses, this one is specific to variable-value points, but just to be clear: using your points well is very important. For the exact same amount of variable-value points, you can save either $200 or $1,000 depending on how you use them. The difference can really be that huge. It’s simple: their value depends on how you use them, so you need to make sure to use them well.

23. “Trips should be completely free with travel rewards”

Here I go with math again. Some think that all trips should be 100% free, or else this is a waste of time. This is definitely not the case. Like with card fees, what you need to look at is the total, in this case the total savings!

You can prioritize paying zero dollars if you prefer, it’s definitely easily feasible with many types of points. But focusing on paying zero instead of maximizing value will mean less value overall; in other words you’ll save less in total. Still, it’s always better than not earning any rewards at all, of course.

But earning $1,000 worth of free travel in a year does not necessarily mean you’ll get a full $1,000 trip for free. It means you’ll get a free $1,000 off of the price of trips.

Here’s what I mean in terms of total savings. For the exact same amount of points, you could get a $300 ticket for $0, or get a different $800 ticket for $200. If you want to maximize your rewards, it’s obviously much better to use the points to save $600 than to save $300 (of course, assuming you would have bought that $800 ticket). Paying zero out-of-pocket is fun, but saving twice as much is even better.

Using points for flights often involves a certain amount of taxes (especially if you can’t leave from US border airports). But whether you have to pay out-of-pocket is completely irrelevant in and of itself: it’s how much you’re saving that matters. Again, the net value is what matters. Using points to pay for flights that involve taxes can be a very very bad idea indeed. But it can also be great value for your points, depending on that particular flight’s cash price and the math.

Paying taxes and saving $500 with 25,000 points can be great. Paying those same taxes but saving just $100 with those same 25,000 points is horrible. The taxes alone mean nothing! Airline points are the most complicated, and each type of bank point will work differently in terms of cash portion to pay, since the rules all differ.

Again, using points for hotels is a lot simpler: a free night is a free night, there are no taxes.

24. “If I have Air Canada Aeroplan Miles, I have to fly Air Canada”

Now this is all I’ll say about variable-value airline points in this already-long article, but this is such a common misconception that it’s worth mentioning.

Not only can you use your Aeroplan Miles on airlines other than Air Canada, you almost always should! Air Canada redemptions are often the worst way to use your Aeroplan Miles. Air Canada imposes surcharges, while many of their partner airlines don’t.

By using your Aeroplan Miles for flights on United Airlines, you’ll save money. You don’t have to talk to United, to do anything with United, or even know what United is. Airline points can always be used on their partner airlines, and it’s often the best use! More details to come.

25. “My spouse won’t want to get into travel rewards”

Well this 25th and final one is not a myth, haha. Unless you’re really lucky, your life partner likely will not be interested in this at all. That part is true. The myth is more believing that fact should stop you from getting into what we call “two-player mode”. Just take over their credit card and rewards strategy and coordinate it with yours (with their permission of course).

The simple fact is if you want to use rewards for two, you have to earn rewards for two. Makes sense. If not, it’s still possible, but it will be a lot slower. In two-player mode, you can double your travel rewards and get so many free travel for amazing trips.

I am lucky enough that my girlfriend gives me a blank cheque, so I decide which cards she applies for and when. I designed a little cheat sheet that she saves on her phone to know which cards to use where (to reach the minimum spend requirements or earn category multipliers), and I update it regularly based on our common travel rewards plan.

I make it as simple as I can for her so that with little effort, she can reap the reward with cool affordable trips… and that helps her tolerate the whole thing (and gets her to let me go spend a few weekends a year at travel rewards conferences for fun).

Yes, if making it easy is not convincing enough for your life partner, just taking them on one cool trip paid for with points usually will be. Everyone falls in love with free trips. Especially if you splurge for cards with lounge access, elite benefits, or use points for luxury travel, as most do (although here at Flytrippers, we’ll also be unique in covering using points for MORE travel too).

Bonus: “Travel rewards are too complicated”

Okay, this one is partly true unlike all the others. I mean if it was completely easy, every single person would get $1,000 a year in free travel. There is a bit of effort required… so most won’t bother.

Honestly, if you’ve made it this far, you’ve already understood almost everything you need to know. At least the most important and complicated part.

It looks more complicated than it is because this is a topic you’ve never looked into that much, but it’s really not that bad:

- Keep your old card

- Get a new card based on the best welcome bonus for you

- Wait a few months

- Repeat.

That’s obviously an oversimplification, but seriously, the rest is just details. You can learn a bit every month if you want to know more, better understand the right cards to choose, the best uses for points… but just the basics are enough to get started.

Want to get more content to become a travel hacking pro?

Summary

With those 25 myths debunked, you are now pretty much a travel rewards points expert.

What do you think of these myths? Tell us in the comments below.

Explore awesome destinations: travel inspiration

Learn pro tricks: travel tips

Discover free travel: travel rewards

Featured image: lighthouse (photo credit: Evgeni Tcherkasski)

Advertiser Disclosure: In the interest of transparency, Flytrippers may receive a commission on links featured in this post, at no cost to you. Thank you for using our links to support us for free, we appreciate it! You allow us to keep finding the best travel deals for free and to keep offering interesting content for free. Since we care deeply about our mission to help travelers and our reputation and credibility prevail over everything, we will NEVER recommend a product or service that we do not believe in or that we do not use ourselves, and we will never give any third-party any control whatsoever on our content. For more information on our advertiser disclosure, click here.