Si tu n’as pas encore la seule carte qu’on recommande à littéralement tous les voyageurs canadiens sans exceptions, voici une présentation détaillée! C’est une de nos cartes préférées, elle n’exige pas de revenu minimum… et sa prime de bienvenue te donne 8 nuits entièrement gratuites dans de beaux hôtels (ou 17 avec un compagnon de voyage), incluant sur la jolie île de Bali, pour juste 120$ total (15$/nuit). Ce deal est l’un des «secrets» de voyageurs les mieux gardés… mais il fonctionne et il est génial (et facile)!

Les points de la Carte Marriott Bonvoy American Express peuvent même être encore plus simples à utiliser si tu préfères: au lieu de devoir choisir des hôtels spécifiques pour les maximiser, la prime de bienvenue devrait valoir ≈ 477$ de rabais sur presque tous les 8000+ hôtels Marriott, pour juste 120$.

Par contre, c’est loin d’être la meilleure offre du moment! Je prendrais une autre en premier pour profiter des offres augmentées et ensuite celle-ci plus tard.

Premièrement, tu peux regarder notre présentation vidéo de la Carte Marriott Bonvoy Amex si tu préfères ce format (depuis que j’ai filmé ça, la prime de bienvenue a un peu changé, mais le reste de la carte n’a pas changé).

Sinon, continue à lire.

Important: si tu ne fais pas partie des lecteurs de Flytrippers qui ont déjà accumulé plus d’un million de dollars grâce à nos recommandations de primes de bienvenue, lis d’abord les 5 bases des récompenses-voyage.

Parce qu’on va supposer que tu sais que les primes de bienvenue sont la clé et qu’on s’en fout de pouvoir utiliser la carte pour 100% de tes achats, qu’avoir plusieurs cartes est meilleur pour ta cote de crédit, qu’il ne faut pas que tu fermes tes actuelles vielles cartes, que les frais annuels à eux seuls ne sont pas pertinents et qu’il y a 2 types de récompenses-voyage très différents.

Parenthèse à un million de dollars

Tu connais peut-être Flytrippers grâce à nos nombreuses apparations dans les grands médias comme experts des voyage ou grâce aux deals de billets d’avion à 50% de rabais qu’on repère…

Mais savais-tu que depuis notre lancement il y a quelques années, les voyageurs qui nous suivent ont accumulé un énorme million de dollars en primes de bienvenue? Oui, tu as bien lu; un million de dollars!

C’est juste avec des primes de bienvenue. Et juste avec les meilleures cartes de crédit au Canada qu’on a recommandé, parce qu’on ne recommande que les meilleures offres… celles avec d’énormes primes de bienvenue.

Comme cette prime de bienvenue sur la Carte Marriott Bonvoy Amex, qui te donne jusqu’à 8 nuits d’hôtels gratuites… et plusieurs des hôtels éligibles sont très beaux, autant pour les amateurs de la nature que pour les amateurs de villes!

Bref, cette statistique d’un million de dollars nous fait tellement plaisir puisque notre mission est de t’aider à voyager pour mois… et les récompenses-voyage sont vraiment importantes pour faire ça.

Alors, combien est-ce que tu as eu en primes de bienvenue toi? J’obtiens bien plus que 1000$ chaque année… et si tu veux arrêter de passer à côté de ça, c’est vraiment une bonne carte pour commencer dès maintenant très facilement!

Survol de l’avis Flytrippers sur la Carte Marriott Bonvoy Amex

Nos «reviews» éditoriaux détaillés des cartes commencent toujours par une section qui va droit au but et qui inclut:

- Pourquoi obtenir la carte

- Qui devrait obtenir la carte

- Comment obtenir la carte

Pourquoi obtenir la Carte Marriott Bonvoy Amex

Voici les 5 meilleures raisons d’obtenir la Carte Marriott Bonvoy American Express:

- La prime de bienvenue incroyable qui donne jusqu’à 8 nuits gratuites

- Le certificat annuel de nuit gratuite génial pour des hôtels de grand luxe

- La flexibilité d’avoir des points qui n’expireront pas

- Le bon taux d’accumulation de base

- Les autres avantages: statut élite, carte supplémentaire, assurances

Qui devrait obtenir la Carte Marriott Bonvoy Amex

Voici les types de voyageurs qui devraient obtenir la Carte Marriott Bonvoy American Express:

- Littéralement tous les voyageurs

On a rarement — voire jamais — un seul énoncé global simple comme celui-là, mais la Carte Marriott Bonvoy American Express est vraiment si bonne que ça.

C’est un «no-brainer» comme ils disent en anglais. C’est l’une des meilleures cartes.

La carte est si bonne pour débuter dans le monde des récompenses-voyage que je vais même répondre avec plaisir personellement à toute question que tu pourrais avoir sur le sujet; il suffit de l’envoyer à points@flytrippers.com ou remplir ce formulaire!

Comment obtenir la Carte Marriott Bonvoy Amex

Voici le processus simplifié en 4 étapes pour profiter de ce deal:

- Demande la Carte Marriott Bonvoy American Express (lien sécurisé Amex)

- Débloque la prime de bienvenue en dépensant 1500$ en 3 mois

- Obtiens 53 000 points Marriott (prime de bienvenue + accumulation sur les dépenses minimums)

- Utilise tes points pour obtenir soit:

- 8 nuits gratuites dans certains hôtels (ou moins dans plus d’hôtels)

- ≈ 477$ de rabais plus simple sur les 8000+ hôtels Marriott

Tu vas bientôt pouvoir télécharger notre guide gratuit sur la Carte Marriott Bonvoy Amex (tu vas aussi recevoir notre «checklist» pour quand tu obtiens une nouvelle carte pour éviter les erreurs communes et quelques autres outils pratiques en boni).

Essentiels de la Carte Marriott Bonvoy Amex

Voici un compte-rendu détaillé des 5 meilleures raisons d’obtenir la Carte Marriott Bonvoy American Express.

1. L’incroyable prime de bienvenue

Tout d’abord, le plus évident. La prime de bienvenue est l’élément le plus important à prendre en compte pour n’importe quelle carte. Donc je t’explique ça en 3 parties.

1.1. Utiliser les 53 000 points de la prime

Une fois que tu vas avoir débloqué la prime de bienvenue de la Carte Marriott Bonvoy American Express, tu vas avoir 53 000 points Marriott Bonvoy (prime de bienvenue de 50 000 points + 3 000 points accumulés sur les dépenses minimales).

Ça vaut ≈ 477$ selon notre Valorisation Flytrippers, mais ça peut être plus si tu les utilises bien!

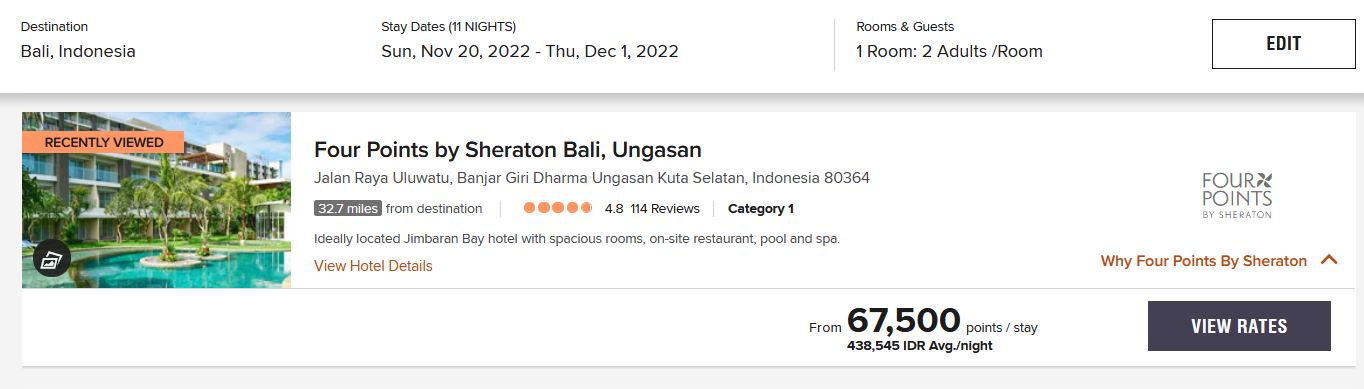

C’est assez pour 8 nuits gratuites dans plein de destinations magnifiques comme l’Indonésie, la Malaisie, l’Inde, l’Afrique du Sud et l’Espagne pour la majorité de dates (hôtels Marriott de catégorie 1).

Tu veux encore plus d’options de destinations?

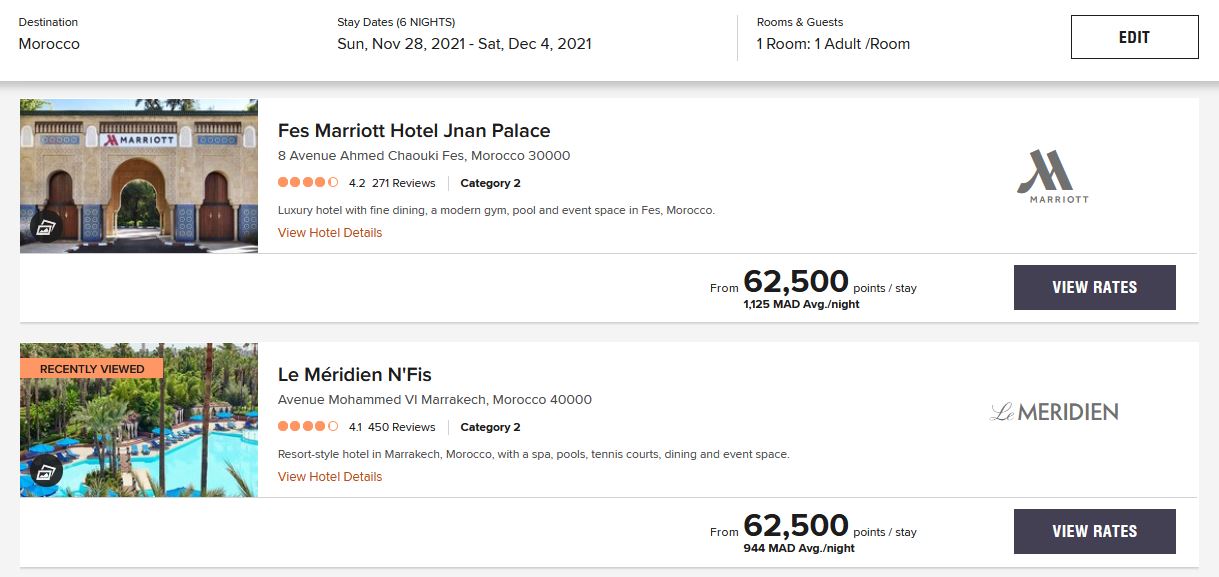

Tu peux plutôt obtenir 5 nuits gratuites dans plus de 1100 hôtels dans 50+ pays pour la majorité de dates (ce sont les hôtels Marriott de catégorie 2).

Avoir 5 nuits gratuites est quand même un deal assez incroyable et ça te donne tellement plus de choix de destinations, comme l’Égypte, la Thaïlande, le Cambodge, plusieurs pays européens et sud-américains, etc.

Même les hôtels plus abordables de Marriott ne sont pas des hôtels «cheap» de base et sont assez beaux, en passant. Surtout en-dehors de l’Amérique du Nord.

En gros: planifie simplement des voyages autour de ces destinations et hôtels spécifiques et c’est aussi facile que ça.

Pour plus de détails sur les hôtels et destinations, avec photos:

- Les 5 meilleurs pays où tu peux obtenir 17 nuits d’hôtel gratuites

- Les 26 meilleurs pays où tu peux obtenir 10 nuits d’hôtel gratuites

D’où sort ce 17?

Eh bien, si ton compagnon de voyage préféré obtient également la carte … vous partagerez ensemble 17 nuits d’hôtel gratuites (ou 10 nuits gratuites pour plus d’options). C’est ce que j’ai fait avec ma copine et nous avons profité d’un voyage épique en Espagne en octobre 2019 avec nos points Marriott.

En Indonésie ou en Malaisie, tu peux par exemple faire un voyage de près de 3 semaines pour ≈ 1100$ total (vols inclus)! On va avoir cet itinéraire, beaucoup d’autres itinéraires, des astuces et des infos dans les prochaines semaines pour t’aider à maximiser ce deal!

Et si tu ne veux pas planifier de voyages autour de ces hôtels, tu peux quand même avoir quelques nuits gratuites dans un autre 2500 hôtels… plusieurs nuits avec une seule prime de bienvenue n’est pas un mauvais deal — mais ce n’est certainement pas 8 nuits.

Mais tu peux quand même sauver autant d’argent comme ça, surtout si tu paies habituellement pour des hôtels chers.

Ah et les nuits d’hôtel gratuites avec des points d’hôtel sont vraiment entièrement gratuites, il n’y a pas de taxes à payer (contrairement à certains programmes de récompenses pour les vols).

1.2. Débloquer la prime de bienvenue

Comme avec presque toutes les bonnes cartes et primes de bienvenue, tu dois dépenser un montant d’argent dans les 3 premiers mois pour la débloquer: c’est 1500$ dans les 3 premiers mois dans ce cas.

Bien que ça peut sembler élevé, c’est juste l’équivalent de 115$ par semaine (3 mois = 13 semaines, pas 12), ce qui est très faisable avec nos 5 astuces de pro… surtout si tu changes pour une des épiceries au Canada qui acceptent les cartes Amex.

Pour une prime aussi géniale, ça vaut le petit effort de plus.

Si le montant de dépenses minimales n’est vraiment pas un enjeu pour toi, on a aussi une astuce de pro pour ceux qui veulent accumuler encore plus de récompenses facilement.

1.3. Faire les calculs pour les frais de la carte

La carte a des frais de 120$ qui est plus que compensé par l’énorme prime de bienvenue la première année, pour une Valorisation Flytrippers de ≈ 357$ pour la prime de bienvenue seulement (des récompenses qui valent ≈ 477$ moins 120$).

Encore une fois, c’est un excellent exemple de pourquoi ça n’a pas de sens d’éviter les cartes avec des frais annuels simplement pour éviter des frais. Les frais annuels à eux seuls ne sont pas pertinents: c’est la valeur nette totale qui compte, toujours. Une carte à 120$ qui te donne 477$ est évidemment mieux qu’une carte à 0$ qui te donne 0$… si tu sais compter.

Écoute… c’est un bon réflexe d’éviter les frais normalement. Mais avec les récompenses-voyage, cela n’a tout simplement pas de sens (le monde des récompenses-voyage est très contre-intuitif).

Les frais sont bons… tant que tu choisisses les bonnes cartes qui ont de bonnes primes de bienvenue (certaines personnes paient des frais annuels pour les cartes qui ne leur donnent pas de valeur… ce n’est pas la même chose ça, c’est sûr que ça ce n’est pas bon).

Malheureusement, beaucoup de gens passent à côté d’obtenir plus de 1000$ par an en valeur nette avec les primes de bienvenue comme j’ai obtenu chaque année depuis plus d’une décennie… à cause qu’ils ne comprennent pas l’importance de bien compter.

Dans les années suivantes après la prime de bienvenue, il n’y a évidemment aucune obligation de garder la Carte Marriott Bonvoy American Express…

Mais tu devrais définitivement, parce que l’incroyable certificat annuel de nuit gratuite de luxe compense également les frais et plus encore!

2. L’incroyable certificat annuel pour une nuit gratuite de luxe

Chaque année, tu vas obtenir un certificat pour une nuit gratuite qui offre une valeur incroyable, parce qu’il peut être utilisé dans des milliers d’hôtels vraiment très luxueux (dans les hôtels Marriott jusqu’à la catégorie 5, dont plusieurs qui sont des hôtels 5-étoiles).

Contrairement aux hôtels de catégorie 1 ou 2, qui nécessitent que tu planifies tes voyages autour d’eux et qui te donnent moins de flexibilité pour maximiser la prime de bienvenue, les hôtels pour le certificat de nuit gratuite peuvent être trouvés à peu près partout sans effort.

C’est l’une des meilleures raisons d’obtenir la Carte Marriott Bonvoy American Express. Ça vaut définitivement beaucoup plus que 120$. C’est un de mes avantages de cartes préférés… et j’en ai beaucoup des cartes!

L’autre co-fondateur de Flytrippers, Kevin, a utilisé un certificat Marriott pour un bungalow sur pilotis qui vaut 1000$ par nuit au Marriott Momi Bay Resort à Fidji.

C’est un exemple extrême en raison de son «upgrade» gratuite en tant que membre avec statut Élite, mais même la chambre de base que tu obtiendrais là-bas vaut plus de 300$.

Notre Valorisation Flytrippers du certificat est de ≈ 315$, ce n’est donc tout simplement pas logique d’annuler cette carte (jamais).

En tant que voyageur, tu passes certainement au moins une nuit dans un hôtel dans l’année, et elle te coûte presque certainement 120$ avec les taxes. Alors garde la carte et échange ta chambre de base à 100$+taxes pour une chambre de grand luxe grâce au certificat qui te coûte le même 120$ dans le fond.

3. La flexibilité des points qui n’expirent pas

Tes points accumulés avec la Carte Marriott Bonvoy American Express n’expireront pas et tu n’as rien à réserver d’avance. Il n’y a pas de limite de temps quelconque. C’est vraiment aussi flexible que ça peut l’être.

Donc, tu peux passer à l’action maintenant même si tu ne voyages pas bientôt… peu importe, il n’y a aucun risque du tout puisque les points n’expirent pas si tu utilises simplement ta carte pour un achat de 1$ une fois tous les 2 ans…

Aussi, Marriott est la plus grande chaîne d’hôtels au monde (par le nombre de chambres) et Marriott Bonvoy est le plus grand programme de fidélité au monde (par le nombre de membres). Il y a 30 marques hôtelières Marriott différentes et plus de 8000 hôtels dans presque tous les pays (avec environ un demi-million d’autres chambres en cours de développement)…

Il n’y a donc pas de quoi s’inquiéter: ils seront encore bien présents, peu importe quand tu vas être prêt à voyager.

4. L’excellent taux d’accumulation de base

La Carte Marriott Bonvoy American Express offre un excellent taux d’accumulation (même si ce n’est pas aussi important que beaucoup le pensent).

Voici ce que tu vas accumuler:

- 5 pts / $ (≈ 4,5%) chez Marriott

- 2 pts / $ (≈ 1,8%) partout ailleurs

Le taux de retour effectif entre parenthèses est basé sur notre valorisation Flytrippers de ≈ 0,9 ¢ par point Marriott, mais tu peux évidemment obtenir beaucoup plus de valeur si tu utilises bien tes points Marriott.

Ce sont des récompenses à valeur variable, donc en d’autres mots pour une remise plus élevée, utilise-les pour les catégories d’hôtels inférieures pour obtenir plus de nuits gratuites ou utilise-les si le prix d’un hôtel en argent est plus élevé que la valorisation des points requis.

Donc, il y a toujours 2 choses quand on regarde les taux d’accumulation:

- Le taux d’accumulation de base

- Les bonus de catégorie (ou multiplicateurs de catégorie)

4.1. Taux d’accumulation de base

Premièrement, le taux d’accumulation de base. Il est excellent pour tous les endroits qui ne sont inclus dans aucune autre catégorie de bonus de carte. Obtenir ≈ 1,8% sur toutes les catégories non-bonifiées est même parmi les meilleurs taux au Canada.

Personnellement, malgré que j’aie plusieurs cartes, j’utilise ma Carte Marriott Bonvoy American Express pour tous mes achats qui ne sont pas dans des catégories bonus sur une autre carte (lorsque je ne suis pas en train de débloquer des nouvelles primes de bienvenue, bien sûr).

C’est une des raisons que j’ai pu obtenir 53 nuits gratuites dans des hôtels Marriott rien qu’en 2019.

4.2. Taux multipliés pour catégories bonus

Deuxièmement, la carte n’a qu’une seule catégorie bonus: chaque achat chez Marriott rapporte un énorme ≈ 4,5 %.

Le meilleur dans ça, c’est que c’est en plus de la remise de ≈ 8% en points accumulée directement auprès du programme de récompenses Marriott lorsque tu séjournes dans l’un de leurs hôtels et que tu paies en argent, pour un total d’au moins 12% en remise…

Mais il y aussi en plus des promos saisonnières quasi-constantes, comme celle en ce moment qui offre 1000 points bonis par nuit. Avec d’autres récemment qui doublaient les points de base, ça te donnait une très belle remise totale de 20% sur tes séjours Marriott avec la Carte Marriott Bonvoy American Express.

C’est très payant, surtout si tu prévois de séjourner dans les hôtels Marriott plus souvent pour profiter de l’avantage #5.1 aussi…

5. Les autres avantages

Finalement, voici 3 autres avantages.

5.1. Le statut Élite

La Carte Marriott Bonvoy American Express te donne automatiquement le statut Silver Élite avec Marriott. Ce n’est pas grand chose honnêtement, puisque c’est le statut d’entrée de gamme. Mais ça te donne quelques avantages dans les 8000 hôtels, comme des points bonis et des «check-out» tardifs gratuits.

Mais surtout, ça donne un raccourci vers le statut Gold Élite plus facilement, et ce niveau-là est plus intéressant parce que ça peut commencer à donner des rehaussements de chambres gratuits.

Tu peux lire les détails des statuts Élite Marriott Bonvoy pour plus d’information.

5.2. Les cartes supplémentaires gratuites

Un autre avantage intéressant est la carte supplémentaire sans frais. Cela signifie que si tu veux que quelqu’un de ton ménage puisse t’aider à accumuler plus de points, tu peux leur obtenir une carte liée à ton compte entièrement gratuite.

Bien sûr, on recommande plutôt aux couples de commander chacun une Carte Marriott Bonvoy American Express pour maximiser les primes de bienvenue (surtout avec une telle offre) et aussi avoir 2 certificats annuels.

Mais une fois que les primes sont débloquées, certains préfèreront accumuler dans un seul compte grâce aux cartes supplémentaires, pour simplifier les choses.

Cela dit, les points peuvent être combinés gratuitement entre comptes — jusqu’à 100 000 points par année.

5.3. La bonne couverture d’assurance incluse

J’ai parlé du fait que le fait d’avoir ou non un frais annuel n’était pas pertinent, mais en fait c’est même une bonne chose quand il y en a (du moins avec les bonnes cartes qui te donnent beaucoup de valeur avec la prime de bienvenue et les avantages annuels).

C’est que les cartes avec frais annuels ont de belles couvertures d’assurances-voyage incluses gratuitement, et c’est l’une des meilleures raisons d’obtenir des bonnes cartes de voyage comme la Carte Marriott Bonvoy American Express.

La carte inclut les deux plus importantes assurances:

- Retard de vol (parce que les compagnies aériennes ne te doivent rien si c’est la météo qui est en cause, c’est normal)

- Location d’autos (ce n’est pas cher louer une auto quand tu peux refuser les assurances)

Et également quelques autres types de couverture: l’assurance de retard de bagages, l’assurance de bagages perdus ou volés, l’assurance de cambriolage d’hôtel, l’assurance-accident de voyage, l’assistance d’urgence, le plan de protection des achats et la protection de l’assurance de l’acheteur.

Les seules assurances-voyage que cette carte n’a pas sont l’assurance médicale et l’assurance annulation de voyage, que tu peux simplement obtenir avec une autre carte, plusieurs cartes voyage les ont en fait. Tu peux lire plus de détails sur les assurances-voyage en général.

Sommaire

La Carte Marriott Bonvoy American Express est excellente si tu veux voyager pour moins. La prime de bienvenue est excellente alors tu devrais considérer cette carte si tu es intéressé à avoir des nuits d’hôtels gratuites dans des pays géniaux (en obtenir 8 est phénoménal).

As-tu des questions sur cette offre Marriott? Dis-le-nous dans les commentaires ci-dessous.

Bonjour, j’ai commandé la carte dans l’offre de mai et j’ai ouvert un compte Marriot, mais comment appliquer mes points récompenses à mon nouveau numéro de membre? Dans votre séance d’information vous disiez qu’un compte serait automatiquement créé par Amex. Je vois mes points Bonvoy dans mon compte Amex, mais pas de numéro de membre associé pour pouvoir faire le transfert vers le compte Marriot que j’ai ouvert. Où puis-je trouver l’info?

Bonjour Rosalie,

Tu peux demander à Amex le numéro de compte qu’ils t’ont créé avec le chat sur leur site ou app, ou bien en les appelant. Ensuite sur le site Marriott tu suis ces instructions.

Bonjour, si moi et mon conjoint faisont la demande pour obtenir chaqu’un une carte, et qu’aprés avoir deboqué la prime de bienvenue on utilise juste une carte….. comment ça marche pour avoir le même nombre des nuits gratuites tous les 2 dans le même hotel, si une carte aurait plus de points que l’autre?

Ma deuxième question c’est concernant les enfants. Si on voyage avec un enfant de 6 ans on peut profiter pareil des nuits gratuites ou on doit payer separement? Merci!

Juste pour être clair, les 2 vous devriez garder la Carte Marriott Bonvoy Amex, pour avoir chacun le certificat génial chaque année.

Mais que les points soient dans un compte ou l’autre, ça ne change rien pour le fait de les utiliser. Peu importe quel compte est utilisé pour réserver la nuit, les 2 vous allez pouvoir profiter de la chambre ensemble.

Par contre, on recommande de combiner les points dans un compte “principal”, pour pouvoir simplifier le tout (et atteindre un statut élite plus élevé si ça vous intéresse). Ça se fait facilement en ligne en quelques clics (article détaillé à venir).

Ensuite, le fait d’utiliser juste 1 des cartes (après que les primes de bienvenue soient débloquées), c’est justement pour simplifier la logistique. Tous les points vont être dans le même compte sans avoir besoin de les combiner.

Pour les enfants, dans la quasi-totalité des hôtels ça ne coûte rien de plus si tu n’as pas besoin de lit de plus. Mais c’est à valider pour être sûre quand tu vas choisir l’hôtel précis tout simplement 🙂

Est-ce que la carte American Express Mariott Bonvoy donne accès à des salons dans les aéroports?

La Carte Marriott Bonvoy Amex est déjà littéralement la seule carte qui vaut la peine d’être gardée pour tous les voyageurs sans exception chaque année (son certificat annuel est un des meilleurs avantages de cartes de crédit qui existent), donc non elle n’a pas l’accès aux salons en plus.

Il suffit d’avoir d’autres cartes dans ton portefeuille pour ça (notre classement des meilleures cartes de crédit a une section sur les salons).

Non, mais elle donne des avantages très intéressants pour les hôtels. Certificat de 35 000 points/ année. D’autres cartes offrent des accès ou des remboursements pour les salons.

Bonjour,

Considérant que la carte donne 50 000 points Mariott présentement (avec un crédit de 100$ au compte lorsque l’on passe par le site de Mariott), est-ce que par votre expérience il faudrait attendre une meilleure promo avant de la commander ?

J’aimerais la combiner avec une Amex cobalt (que je possédais l’an passé, mais que j’ai annuler pour la AMEX or banque scotia et son bonus) et ainsi faire un transfert de points vers la Bonvoy quand il y a des promotions (exemple: bonus 25%). Le but c’est probablement de faire un voyage aux Maldives et de payer les nuits avec les points Mariott). Ma deuxième question: j’ai déjà eu le droit à la prime COBALT l’an passé, est-ce que comme certaines autres cartes après 24 mois je peux faire une nouvelle demande et profiter de la prime ou bien la cobalt est plus restrictive sur ce point ?

Merci !

Bonjour, ça dépend quand tu prévois faire ton voyage. C’est sûr que l’offre actuelle est à son plus bas en ce moment. Mais depuis quelques années, elle est seulement augmentée une fois par année et c’est au printemps ou à l’été.

Et en plus, il y a tellement de grosses primes de bienvenue offertes en ce moment aussi. C’est sûr que si l’alternative est de ne juste pas obtenir de carte, littéralement tout est toujours mieux que ça. Alors prends la Carte Marriott Bonvoy Amex pour au moins ne pas gaspiller tes dépenses des prochains mois, même si l’offre n’est pas à son maximum.

Toutes les banques (sauf Amex) te laissent avoir la prime de bienvenue sur chaque carte un nombre illimité de fois. Amex est la seule qui est plus stricte, les primes de bienvenues sont limitées à 1 fois “à vie” pour chaque carte individuellement en théorie, même si après quelques années en pratique plusieurs s’essaient et ça fonctionne. Si tu es en mode multi-joueurs (conjoints, famille, amis, etc.), ils peuvent tous obtenir la Carte Cobalt Amex et les points peuvent être partagés avec toi (autant pour les vols que pour les hôtels).

La Carte Cobalt Amex est effectivement une incontournable, mais les points valent théoriquement beaucoup plus pour des vols que pour des hôtels. Mais encore là, c’est mieux de le prendre pour des hôtels que de ne pas les prendre du tout évidemment.

Et le crédit de 100$, peut-être que j’ai manqué ça parce que je suis en voyage mais Marriott n’a jamais offert des crédits de plus sur leur site pour les cartes canadiennes. Tu es sûr que ce n’est pas la version américaine de la carte?

Bonjour Andrew, merci encore pour Flytrippers. C’est de l’excellente information. Je suis titulaire de la carte AMEX Bonvoy depuis bientot 1 an. Je me demandais avant le renouvellement, est-ce que je devrais l’annuler et me commander la meme carte AMEX Bonvoi Entreprise. Je sais que je risque de perdre le 1 nuit mais est-ce que la prime de bienvenue compense la valeur de la nuit si je ne paie pas le renouvellement de la carte. Merci encore !

Bonjour, non ne ferme surtout pas la Carte Marriott Bonvoy Amex, le certificat de nuit gratuite vaut au minimum 120$ et même beaucoup plus.

Si tu veux la Carte Marriott Bonvoy entreprise Amex et sa nouvelle offre géniale qui vaut définitivement la peine, tu peux la prendre même si tu as déjà la Carte Marriott Bonvoy Amex, c’est une carte complètement séparée 🙂

Assure-toi de juste entrer ton nom complet comme nom d’entreprise sur la demande (juste permis avec Amex, pas avec les cartes entreprise de toutes les autres banques).

Bonjour Andrew , merci beaucoup pour le service que tu nous rends vraiment excellent.

J ai une question stp, j habite en France et cotise des points Marriott depuis le 2019 (je suis membre élite titanium) . Je voudrais passer à la carte de crédit américain express bonvoy marriott pour cotiser plus d avantage (points et nuite cadeau à date anniversaire, ect ). Peut tu me conseiller stp en sachant que j habite en France ? Merci beaucoup

Bonjour, tu dois être résident canadien ou américain malheureusement. On va bientôt avoir un guide pour expliquer comment les autres nationalités peuvent avoir accès à ces deals, ne manque pas ça 🙂

Bonjour, en étant seul, est-ce qu’il est possible de demander les carte Alex Bonvoy, soit celle de particulier et celle Entreprise avec le même # compte Mariot Bonvoy? Merci beaucoup!

Bonjour, oui absolument. Seul ou à 2, tout le monde devrait prendre autant la Carte Marriott Bonvoy Amex que la Carte Marriott Bonvoy entreprise Amex pour avoir 2 belles primes de bienvenue par personne, mais aussi 2 certificats super précieux chaque année ensuite 🙂

Amex ne nécessite pas d’avoir d’entreprise enregistrée pour avoir une carte entreprise.

Bonjour,

Merci pour votre article!

J’ai fais une demande pour cette carte le 10 mai, pour pouvoir profiter de la prime de bienvenue améliorée de la Carte Marriott Bonvoy American Express qui se terminait le 11 mai. Ma demande a cependant été approuvé le 10 juin. Comme la demande a été approuvé le 11 mai, est-ce que j’ai tout de même accès à l’offre qui était en cours jusqu’au 11 mai?

De plus, je ne suis pas certaine si je dois dépenser 1500$ ou 3000$ en trois mois pour débloquer la prime de bienvenue. Plusieurs articles et sites semblent indiquer différentes informations.

Merci!

Bonjour, pour Amex, c’est la date de la demande qui compte pour pouvoir profiter d’une offre. Par contre, le délai pour le 3 mois de la prime de bienvenue débute le jour de l’approbation (à valider selon tes dates de fin de relevés tout simplement).

Pour ce qui est de l’offre, je t’encourage fortement à télécharger notre guide gratuit qui avait été préparé pour cette offre là:

https://flytrippers.com/fr/guide-gratuit-pour-ta-nouvelle-carte-marriott/

Il vient aussi avec une checklist très importante pour chaque fois que tu demandes une nouvelle carte qui inclut comme rappel vital de toujours prendre en note les détails de l’offre à laquelle tu appliques, c’est très important pour savoir exactement combien il faut dépenser justement 🙂 Dans ce cas-ci c’est 1500$, mais pour tes futures primes de bienvenue peut-être que l’info ne sera pas aussi facile à retrouver 🙂

Bonjour

J’adore votre article.

J’ai reçu ma carte Amex Bonvoy. J’aimerai savoir les 3 mois de dépenses 1 500$ pour débloquer les primes débute à partir de la date de la demande ou date d’activation carte ?

Merci pour tout

Bonjour, ni un ni l’autre: à partir de la date d’approbation de la demande. Voici une checklist gratuite avec plein d’infos vitales de base quand on commence dans le domaine 🙂

https://flytrippers.com/fr/checklist-nouvelle-carte/

Bonjour, J’ai choisie la Amex coblat après vos reviews. Est-ce que ça vaut la peine de prendre la Amex mariott aussi?

Bonjour, bien sûr, à moins que tu ne veuilles pas des centaines de dollars gratuits 😉

Évidemment j’assume que tu as lu la base des récompenses-voyage, et que tu paies toujours tout à temps au complet, sinon clairement non tu ne devrais pas. Si oui, c’est la seule carte qu’on dit que tout le monde devrait avoir sans exception 🙂

https://flytrippers.com/fr/base-recompenses-voyage/

Bonjour, pour les non vaccinés… avec l’incertitude qu’on a concernant les restrictions pour sortir du Canada, serait il quand-même une bonne idée d’acheter la carte? On ne sais pas si on pourra voyager en 2002 malheureusement

Bonjour, les points n’expirent pas et la prime est ≈ 235$ plus élevée que la normale, mais c’est sûr que ça peut toujours revenir plus tard, personne peut le savoir malheureusement. Mais c’est sûr que si tu n’es pour pas prendre d’autre carte en attendant et donc avoir 0$, vaut mieux avoir ça et garder les points pour quand tu vas voyager 🙂

Salut, comment ça fonctionne pour récupérer les nuits d’hôtels ?

Bonjour, on a fait ce guide gratuit de 28 pages pour répondre à toutes les questions pour ceux qui commencent: https://flytrippers.com/fr/guide-gratuit-pour-ta-nouvelle-carte-marriott/

Mais en gros, tu dépenses 1500$ en 3 mois et tu crées les comptes en ligne pour accéder aux points 🙂

Bonjour, merci pour l’article. Je viens de me procurer la carte. Je sais à présent que je dois appliquer un minimum de 1500$ sur la carte dans les 3 prochains mois. Je pense commander une carte de plus pour mon conjoint. Est-ce que cela signifie que nous devons mettre 1500$ sur chaque carte? Et donc un total de 3000$ en 3 mois? Merci de m’éclairer. Je n’ai pas trouvé la réponse exacte dans l’article.

Bonjour, oui mais il faut que tu fasses une demande séparée (une nouvelle carte) à son nom pour avoir une autre prime de bienvenue. Donc oui un autre 1500$. À ne pas confondre avec lui prendre une carte supplémentaire sur ton compte à toi, qui ne donne pas de prime du tout et qui fait juste simplifier l’atteinte du montant minimum sur ta carte.

Bonjour, je viens de commander ma carte AMEX Bonvoy. Juste pour être certaine de bien comprendre et de bien débloquer la prime, est-ce que la dépense minimale de 1,500$ doit être répartie sur les trois premiers mois ou peut être fait tout dans le premier mois? J’ai des billets d’avion à acheter (environ 1,500$) et je pensais l’effectuer avec cette carte pour débloquer les points en une transaction. Est-ce possible? L’objectif serait aussi de réserver des nuitées avec mes 53,000 points avant que le programme change à la fin mars. Est-ce réalisable aussi, vais-je avoir reçu mes points à temps? Merci! 🙂

Allo, ouais le 1500$ ça peut être n’importe quand, tant que c’est fait au plus tard à la fin du 3ème mois aucun problème. Pour ce qui est des points, ça risque d’être un peu serré, il se peut très bien que tu les aies dès ton premier relevé de compte si tu dépasses le 1500$. Sinon, seulement 200 hôtels sur les 8000 vont changer de beaucoup le 29 mars, donc au moins ce n’est pas trooooooop grave 🙂

Bonjour,

Suite l’une de vos conférence, j’ai demandé la Carte Marriott Bonvoy Amex. Apres avoir dépensé près de 3000$ en 3 mois j’ai contacté le service a la clientèle pour savoir comment débloquer la prime de bienvenue et on m’a dit que je n’y avait pas droit, car il fallait l’avoir dépensé dans les 6 premiers mois (j’ai dépassé ce delais de quelques semaines). j’avais pourtant compris qu’il fallait dépensé 1500$ en 3 mois importe le temps apres avoir fait la demande !

Bonjour, je ne suis pas tout à fait certain de comprendre, mais dans le fond tu as fait le montant, mais pas dans les premiers mois? Si c’est ça, malheureusement ça ne fonctionne pas: les primes de bienvenue fonctionnent toutes de la même façon, le montant minimum doit être fait dans les premiers mois dès que tu obtiens la carte. Soit 3, 4 ou 6 mois selon l’offre, mais toujours dans les premiers mois oui :S

Bonjour,

J’ai la carte Marriott Bonvoy depuis fin juillet à la suite de vos articles sur la plus haute prime de bienvenue pour cette carte. Merci encore du tuyau. Il s’agit de ma première carte American Express. J’ai déjà débloqué la prime pour le 3000$ d’achat minimum. Je n’ai pas seulement utilisé la carte dans les épiceries et restaurants (probablement 1000$ dans cette catégorie sur les 3000$). Je sais qu’il y a un bonus de points jusqu’à concurrence de 5000$ dans les épiceries et restaurants. Ma question est la suivante : Devrais-je maximiser le plus possible mes achats d’épicerie avec ma carte Bonvoy ou bien plutôt commander la carte Cobalt (qui a elle aussi une grosse prime de bienvenue pour le moment) et utiliser cette dernière à la place ?

Merci d’avance pour votre réponse et au plaisir de se voir au webinaire du 5 octobre.

Salut! Personellement, j’irais avec la Cobalt vu que les points sont plus précieux.

Dans le fond, si tu choisis la Cobalt, ce que tu perds, c’est 20 000 points Marriott (≈ 180$), soit le 4000$ à 5X les points.

Mais si tu choisis de prendre la Cobalt plus tard pour maximiser la Marriott, tu perds (probablement) la portion améliorée/supplémentaire de la prime de bienvenue de la Cobalt, soit le 20 000 points Amex (≈ 300$) qui est présentement en plus de la prime régulière.

Encore mieux: pourquoi ne pas avoir les 2 primes? Si tu n’es pas en mesure de faire les dépenses des 2 dans les 3 prochains mois (mais que tu peux les faire dans la prochaine année et que tu peux “avancer” les fonds), suis l’astuce #4 de cet article pour atteindre le 3000$ en 3 mois de la Cobalt et maximiser Marriott en attendant (ou vice-versa).

https://flytrippers.com/fr/comment-atteindre-le-montant-minimum-pour-debloquer-la-prime-de-bienvenue-des-cartes-de-credit/

Est-ce que ça répond à ta question 🙂 ?

Bonjour Andrew,

J’ai actuellement plus de 70,000 points sur ma carte AExpress Platine ainsi que 55400 points Marriott. Ma copine, elle a son 50,000 Marriott. Il y a actuellement une promo de transfert de point American Express VERS Marriott au taux de 50,00 Amex pour 75,000 Marriott.

J’ai en attente plus de 3,000$ de billets en attente de remboursement (je n’y crois plus), aussi on va se tenir tranquille cet hiver. De toute façon, j’ai pris ces cartes Marriott afin de pouvoir profiter d’hébergement en Espagne…

Est-ce que cette promotion est aussi avantageuse que celle de la veille du Jour de l’An?

Pour être honnête, je ne me souviens plus à quel taux ils échangent les points cette journée là ?

Merci,

icare2

P.S. Pour de beaux voyages en Iran,commentaires et trucs récents va à : https://www.youtube.com/channel/UC-wzCLovRXvXrXXF7vFpW5A?pbjreload=101

ou recherche ”Les Artisans de demain” sur You Tube … Au moins 6 videos donnant l’heure juste.Ça a changé énormément et pour le mieux depuis dix ans que j’y suis allé.

Bonjour, désolé du délai! Effectivement, la promo de 25% est la plus élevée depuis des années, mais ça ne veut pas nécessairement dire que c’est mieux que transférer tes points Platine à Aéroplan ou Avios. Ça dépend de tes plans pour le printemps prochain et l’année qui suit en fait. Où tu veux aller? Et surtout, as-tu l’habitude d’être bon pour trouver des vols pas chers? J’ai donné un peu d’infos sur la promo ici: https://flytrippers.com/fr/promotions-american-express-septembre/

Et merci pour l’Iran! Comment avais-tu trouvé cela il y a 10 ans par curiosité?

Salut Andrew, je regarde pour effectivement commander cette carte et j’ai déjà un numéro de membre Marriott. Je serai pour un court séjour à LA en janvier prochain (4 jours), mais je ne vois pas d’hôtel de catégorie 2 ou moins. Ou puis je voir les hôtels par catégorie ? Parce que si ça me donne juste une nuit (a cause de la catégorie d’hôtel disponible) … peut être que ça ne vaut pas le peine non ?

L’Amérique du Nord est effectivement le pire endroit pour maximiser la valeur des points, ça c’est certain. Et la Californie et LA sont parmi les plus chers endroits d’un pays déjà très cher :S Donc si tu prévois aller ailleurs aussi, vaut mieux conserver tes points pour les maximiser, et sinon bien ça dépend de ta perspective. Il y a quelques hôtels de catégorie 3 à LA, donc ça te donne 3 nuits gratuites, ce qui n’est quand même pas si mal pour une seule prime de bienvenue, même si ce n’est pas 8 nuits!

Bonjour, ma conjointe et moi prévoyons partir en Afrique du Sud vers la mi-mars et nous pensons faire une demande pour cette carte suite à vos articles à ce sujet! Cependant, comme nous avons moins de 3 mois d’ici au départ on se demande si les points sont octroyés une fois le 1500$ d’achats atteints ou bien à la fin des 3 mois? Nous voulons pouvoir profiter des points pour loger dans les hôtels Protea si cela est encore en vigueur. Merci!

Bonjour Frédéric, en théorie c’est lors de la production du relevé de compte où tu as débloqué la prime qu’elle est envoyée à Marriott, mais cela dit, ce n’est pas garanti :S

Bonjour,

A-t-on une limite de temps pour dépenser les points ? Ex. Dans la même année que leur obtention ?

Merci,

Bonjour, non ils n’expirent à toute fin pratique jamais: dès que tu utilises la carte, la date d’expiration de tous tes points est repoussée de deux ans.

Bonjour

Dans les 6 prochains mois, je ferai deux voyages de 1 mois chaque à l’extérieur du Canada. J’ai une carte de crédit master card BMO airmiles depuis de nombreuses années. Je passe tous mes achats sur ma carte de crédit pour accumuler des points (environ 2000$ par mois). Pour mes futurs voyages, j’aimerais une carte de crédit rentable pour les voyages. Je travaille et gagne un assez bon salaire. Je paie mes cartes avant la fin de chaque mois. Je voyage environ 5 fois par année, Nous aimons utiliser les lounges. Je veux une bonne assurance. Je lis vos articles et je ne sais plus quel serait le meilleur choix pour une autre carte de crédit voyage. Aidez-moi.

Bonjour Nicole, notre nouvelle section revampée sur les récompenses voyage sera relancée cet automne avec beaucoup beaucoup de ressources pour t’aider, incluant un nouveau cours pour expliquer le monde du travel hacking à ceux qui commencent.

Le meilleur choix pour une autre carte de crédit voyage c’est de ne pas en choisir juste une justement, l’erreur que la plupart des gens font malheureusement car il y a tellement de mythes très répandus qui les induisent en erreur. Ces mythes s’adressent à ceux qui ne paient pas leurs soldes en entier à chaque mois, ce qui n’est pas ton cas.

Dans le fond, en partant ce qu’il faut comprendre, la clé c’est de réaliser que le meilleur moyen d’accumuler des voyages gratuits, c’est avec les primes de bienvenue de cartes de crédit, c’est-à-dire commander plusieurs cartes par année. Et cela *augmente* ta cote de crédit contrairement au mythe bien répandu (si tu suis les règles, la première étant de ne pas annuler ta carte actuelle comme plusieurs débutants font malheureusement). Je fais du Travel Hacking depuis 10 ans: j’ai 10 cartes, j’en commande au moins 6 par année, et j’ai une cote dans les 800. Ce n’est pas surprenant ou rien, c’est mathématique: c’est comme ça que les cotes de crédit fonctionnent 🙂

Donc si tu paies tout à temps, tu devrais te faire une stratégie de travel hacking et ouvrir au moins 3-4 cartes au minimum puisque ta carte est vieille. Tu pourras facilement accumuler 1000$ et sinon même beaucoup plus avec ton niveau de dépenses, et en plus ta cote de crédit va augmenter, ou à tout le moins rester la même.

Tes dépenses de 2000$ par mois, ça doit présentement te donner un retour de 1% environ seulement, soit 240$ de valeur dans l’année. Une seule nouvelle carte va te donner ça, juste avec la prime de bienvenue. 4 cartes, et tu viens de quadrupler tes voyages gratuits. Sans compter tout les points que tu vas accumuler sur tes achats réguliers quand même! On parle d’au moins 5 fois plus dans tes poches dans l’année.

5 fois plus de voyages gratuits; mêmes dépenses, même cote de crédit.

Et comme ça tu pourras également en choisir une qui inclus des accès aux lounges, ou même 2 dans ton cas puisque tu voyages beaucoup et en a besoin de plus. Toutes les bonnes cartes ont des bonnes assurances ou presque, mais en en ayant plusieurs justement, tu seras assurément couverte.

Donc, ensuite pour le choix des cartes, ça dépend de plein de facteurs: tu veux des points faciles à utiliser qui rapportent un peu moins, ou des points plus complexes mais qui rapportent plus? Ça dépend de ton niveau de flexibilité, de où tu voyages, etc. On aura un article qui explique les choix de cartes bientôt.

Mais pour ton cas spécifique, un bon début, vu que tu dépenses beaucoup, serait la American Express Cobalt. Elle est particulière, sa prime de bienvenue est unique comme fonctionnement au Canada: tu dois dépenser 500$ par mois pour la débloquer. Comme tu dépenses beaucoup, tu seras capable de faire ça sans t’empêcher de commander d’autres cartes aussi dans l’année (car plusieurs demandent parfois 1500$ de dépenses dans les 3 premiers mois pour débloquer la prime de bienvenue).

La Cobalt accumule incroyablement beaucoup de Points (la meilleure au Canada sur cet aspect) sur tes achats en épicerie, restaurant, essence payée chez Couche-Tard, et chez tous les commercants dont tu peux acheter une carte-cadeau chez Metro ou Couche-Tard. Si tu dépenses 500$ par mois dans ces catégories (je dépense facilement ça et je ne suis pas très dépensier, avec l’épicerie seulement on n’est pas loin du 500$), ça te donne une prime de bienvenue de 600$ en crédit-voyage facilement utilisable sur n’importe quel voyage, ou bien jusqu’à 18 nuits gratuites dans certains hôtels Marriott (ce qui vaut beaucoup plus que 600$ bien sûr, mais requiert beaucoup plus de flexibilité… quoique même en étant moins flexible, ça peut être plus que 6 nuits, donc plus que le 600$ facilement).

Ça c’est avec seulement le quart de tes dépenses annuelles 600$ (ou beaucoup plus avec Marriott). L’autre 1500$ par mois, tu vas quand même accumuler 1 à 2% (ou même un peu plus, dépendant de tes choix de cartes) et débloquer d’autres primes de bienvenue. Tu pourrais avoir 2000$ cette année.

On aura beaucoup d’autre contenu pour t’aider à choisir les cartes: je t’invite également à te joindre à notre infolettre gratuite de Travel Hacking pour recevoir l’accès à notre nouvelle section en primeur 🙂

https://flytrippers.com/fr/infolettre-travel-hacking

En espérant que ça réponde à ta question, n’hésite pas sinon 🙂

Bonjour

Comment on fait pour linker la carte de crédit avec le compte du site de récompense de marriot…

Sur mon sommaire de carte de crédit j’ai 55 000 pts mais sur celui de marriot je suis toujours a zéro…

Y doit y avoir de quoi que je comprend pas.

Bonjour, c’est que tu ne dois pas avoir fourni ton numéro Marriott en commandant la carte. Ça ne dérange pas, ils t’ont donc créé un compte et y ont déposé tes Points.

Tu devras malheureusement appeler AMEX comme si on était en 1999 (ou utiliser la fonction chat sur le site) pour qu’ils te donnent le numéro du compte, et ensuite aller sur Marriott.com pour te créer un compte en ligne pour y accéder.

D’ailleurs,on aura un beau guide avec plus de détails là-dessus et pour ceux qui veulent maximiser leurs points Marriott aussi, on t’invite à te joindre à la nouvelle infolettre de Travel Hacking gratuitement: https://flytrippers.com/fr/infolettre-travel-hacking/

Réponse rapide…merci!!

Ça fait plaisir:)

Bonsoir,

Vous devez demander vôtre numéro de compte marriott à Amex via le chat et vous inscrire avec un nouveau compte sur le site web de marriott et vous allez recevoir 1x/mois vos points.

Je viens de voir la réponse 🙁

Pas de problème 🙂

Pour la amex bonvoy, je l’ai depuis quelques mois …Est ce qu’on doit s’inscrire en ligne sur le sur de marriott ou activer notre compte pour voir et échanger nos points ?

Merci

Bonjour,

De ce que j’ai pu lire dans les commentaires, les points doivent être utilisée pour réserver des chambres doubles, est-ce exact? J’ai l’habitude de voyager seule ( et donc aller dans des hostels pour le prix et rencontrer des gens ). Est ce que ce genre de carte peut être vraiment avantageuse pour les voyageur solo? Si jai bien compris, en étant seule je ne pourrais pas utiliser les points pour les nuits d’hôtels gratuites…

Bonjour, tu peux les utiliser sans problème si tu es seule, je le fais régulièrement. Le prix par nuit donne droit à la chambre de base, qu’elle ait un lit queen, deux lits doubles, etc. aucune restriction par rapport au fait d’être seul ou pas. Alors comme c’est quand même jusqu’à 12 nuits gratuites comme bonus de bienvenue, ça vaut quand même la peine. Moi personnellement je privilégie aussi les hostels et je garde mes Points seulement quand je voyage avec ma copine ou quand je suis dans les destinations où il y a des hôtels de catégorie 1 où ça coûte très peu de Points et je peux les maximiser 🙂

Allo! je viens tout juste de recevoir ma Amex Marriott Bonvoy. Je suis entrée sur le site pour l’activer et j’ai tenté de devenir membre Marriott pour lier les points…. mais sans réussir (le site me sort et me dit de réessayer plus tard)… à la convention du titulaire, pages 25 à 29, ils nous expliquent les points Mariott et je comprends que je dois m’inscrire au programme Mariott (celui qui me sort et me demande de revenir plus tard…) mais aucune précision sur le bonus de 50000 points après $1500 de dépenses en 3 mois…. Je dois en comprendre quoi…..

Bonjour, les bonus de bienvenue ne sont jamais abordés dans les documents, car ils changent constamment.

AMEX t’a déjà créé un compte Marriott en activant ta carte de crédit, si tu n’en avais pas. Alors communique avec AMEX via leur chat sur leur site (ou au téléphone si tu préfères) et demande leur ton numéro de compte Marriott, tu pourras ensuite créer un compte en ligne sur le site Marriott 🙂

Bonjour!

Je trouve cette carte très intéressante! Est-ce que les points s’accumulent à l’infini ou sont remis à zéro à chaque année?

À l’infini, et n’expirent pas tant que tu accumules 1 point par 2 ans (donc à toutes fins pratiques jamais)!

Bonjour, est-ce que nous devons faire quelque chose après avoir dépensé les 1500$ pour avoir les points de la prime de bienvenue ou c’est automatiquement dans notre compte?

Merci

Bonjour, la seule chose que tu dois faire c’est communiquer avec AMEX pour avoir ton numéro de compte Marriott (si tu n’en avais pas avant ou tu ne l’as pas donné lors de la demande de la carte). Tu peux le faire au téléphone ou sur le chat sur le site d’AMEX, ce n’est que pour la première fois et ensuite tu vas pouvoir tout accèder directement sur le site Marriott 🙂

Bonjour,

Merci beaucoup pour les informations, j’aimerais planifier un voyage en Espagne pour l’an prochain, la carte Marriott c’est vraiment une bonne option ou une autre serait meilleure?

Pour l’utilisation des points, faut-il passer par le site web pour réserver?

Pour un voyage à 4 personnes, comme c’est seulement pour 2 personnes les points, l’idéal serait d’avoir 2 cartes de crédit?

Merci et bonne journée!

Bonjour, je n’ai jamais réservé de chambres pour plus de 2 personnes, mais de ce que semble lire en ligne, tu peux possiblement réserver avec les Points et ne pas avoir à payer de supplément si la chambre a le bon nombre de lits requis. C’est certain qu’en Europe les chambres sont souvent plus petites et les configurations avec 2 lits doubles sont plus rares. Dans ce cas, il est possible de réserver la chambre de base avec les points et communiquer avec l’hôtel pour voir si c’est possible de payer un supplément pour une chambre rehaussée, mais je n’ai jamais eu à essayer cela. Ça peut quand même revenir une meilleure aubaine et le meilleur moyen de faire du Travel Hacking, surtout si tu peux trouver des chambres où ça fonctionne pour toi (je ne sais pas si tes enfants sont en bas âge ou plus grands).

Donc pour l’Espagne, oui c’est un excellent usage car il y a beaucoup d’hôtels qui coûtent peu de points (et j’obtiendrais une carte chaque quand même étant donné la valeur des Points Marriott, c’est ce qu’on a fait chez nous). Pour la réservation oui c’est directement sur le site Marriott, très simple comme processus.

En espérant que ça réponde à tes questions 🙂

Bonjour,

Merci beaucoup, je vais vérifier mes enfants vont avoir en 2020 14-16 ans. Avec 2 points/achat, il est facile d’en accumuler beaucoup en un an moi qui paye seulement avec ma carte. Nous utilisons seulement la carte Costco et pour un futur voyage ça va être plus rentable de prendre la Marriott et en Espagne il y a plusieurs categire1.

Merci.

En effet ça va vite! Astuce de plus, surtout si tu dépenses beaucoup par mois et si tu veux davantage de Points Marriott, ce serait de te procurer une carte AMEX Cobalt. Elle accumule 6X les Points Marriott en épicerie (si tu vas chez Metro ou Super C, qui acceptent AMEX) ce qui est phénoménal. Je l’utilise même chez Costco en achetant une carte Mastercard pré-payée de 500$ chez Couche-Tard (qui “code” comme épicerie et donne donc 6X les Points Marriott) et j’utilise la dite carte pré-payée chez Costco. Il y a un frais de 5,95$ d’activation pour la carte pré-payée, mais considérant que ça te donne 6X les Points Marriott sur les achats de Costco, ça vaut amplement la peine quand tu fais le calcul!!!

La prime de bienvenue de la Cobalt est unique au Canada, elle est par mois au lieu de dans les 3 premiers mois (il faut dépenser 500$ par mois sur la carte et obtenir 2500 Points AMEX par mois, soit 3000 Points Marriott… donc x12 c’est un autre 36 000 Points Marriott, sans compter le 6X les Points que tu accumules sur ce 500$ par mois si tu l’atteins uniquement en épicerie/carte-cadeaux vendues chez Metro/Couche-Tard).

Si tu veux plus de détails sur la Cobalt, voici (et notre section Travel Hacking sera ravampée dans les prochaines semaines, avec beaucoup plus d’infos) :

https://flytrippers.com/fr/meilleures-cartes-de-credit/#american-express-cobalt

Bonjour Andrew,

je veux commander la carte, seulement j’ai déjà une carte Amex, et elle est régulièrement refusée…beaucoup d’endroits ne la prenne pas à cause du pourcentage plus élevé que le marchand doit défrayer. En plus, je me fais souvent “regarder de travers” chez Shell quand je la présente parce que la “madame” doit utiliser un autre terminal pour la carte American Express. Tu as des suggestions d’endroits où l’utiliser sans problèmes?

Merci 🙂

À peu près partout, c’est vrai qu’elle est un peu moins acceptée que Visa et Mastercard mais de nos jours c’est surtout les petits commerçants qui ne l’acceptent pas (et même là AMEX travaille fort à en ajouter le plus possible). Je dirais qu’au moins 75% de mes achats je suis en mesure de faire avec AMEX: tout ce qui est en ligne, les grandes surfaces (exception: Costco), les épiceries (j’ai changé pour Metro/Super C qui me donnent 5X les Points avec la AMEX Cobalt), toutes les boutiques de “chaînes”, toutes les stations-services (même Dollarama l’accepte maintenant).

C’est sûr que personnellement je me fous pas mal de si quelqu’un me regarde de travers haha, même que je pense que je ferais exprès d’y aller tous les jours pour la faire suer (mais bon ça c’est juste moi) mais bref pour son taux d’accumulation et la super valeur des Points Marriott, je dirais que ça vaut la peine même si tu ne peux pas l’utiliser 100% partout, suffit d’avoir une autre carte Visa ou Mastercard aussi 🙂

Allo! Je suis très intéressé par cette carte. Je me demandais par contre si c’était difficile d’avoir des nuitées d’hôtel disponible. Je compare avec Aeroplan par exemple. Il est souvent difficile d’avoir des vols aux dates qui nous intéressent. Il faut être très flexible. Des billets sont disponibles sur le site d’Air Canada mais via Aeroplan il n’y a pas de disponibilité. Pour les hôtels avec cette carte, doit-on être également très flexible ou c’est généralement facile d’utiliser nos points pour réserver la date voulue, en n’étant pas dernière minute évidemment?

De plus, si je comprends bien le travel hacking, le mieux dans ma situation (en couple) serait que moi et ma conjointe on prenne chacun la carte Bonvoy pour accumuler chacun la prime de bienvenue dans les 3 premiers mois. Par la suite, on la garderait comme 2e carte chacun pour la nuitée gratuite annuelle mais on prendrait la carte Cobalt chacun pour au moins les 12 premiers mois pour la prime de bienvenue. Après, l’un des 2 la laisserait tomber et l’autre deviendrait la carte conjointe.

Merci et félicitations pour ton site, vraiment bien fait. Merci de partager tes trucs!

Merci beaucoup, et tu n’as rien vu, notre nouvelle section sur le Travel hacking va être 10X mieux 😉 !

Excellente stratégie pour des nuits gratuites oui. Chacun une carte donnera 120 000 Points, c’est quand même énorme! Et la Cobalt en effet, c’est une indispensable après (et la seule autre que je dirais que tout le monde presque sans exception devrait avoir pour le 5X les Points).

Et non, les points d’hôtels ce n’est vraiment pas comme Aeroplan/les miles de compagnies aériennes. Si il reste une chambre disponible, elle est à toi en Points, vraiment différent. C’est pourquoi nous-mêmes on est rendus à mettre presque toutes nos dépenses sur cette carte et la Cobalt pour avoir un max de Points d’hôtels, c’est tellement mieux! Et même dernière minute, à part peut-être les périodes de pointe / événements majeurs, c’est excessivement rare que les hôtels sont 100% pleins.

Il faut quand même être flexible, mais dans le sens où pas tous les hôtels reviennent à être un bon deal avec les Points, ça dépend vraiment de où et quand. Donc oui il faut une certaine flexibilité, mais vraiment pas comme Aeroplan.

J’explique un peu plus sur cette notion de bien utiliser dans cet article:

https://flytrippers.com/fr/comment-utiliser-les-points-marriott-bonvoy-pour-maximiser-leur-valeur/

En espérant que ça réponde à tes questions 🙂

Salut ! J’ai un doute sur l’accès à la nuit gratuite dès la première année. Dans les conditions de la carte sur le site de Amex, c’est écrit : «Chaque année, 8 à 10 semaines après votre date de remise à zéro des achats annuels, vous obtiendrez une nuitée gratuite dans une chambre de catégorie standard pour une ou deux personnes disponible dans un établissement Marriott Bonvoy participant.» C’est quoi cette date de remise à zéro des achats annuels ? Si quelqu’un prend la carte 1 mois avant sa fête, il y a accès quand même ? Merci !

Bonjour, le certificat dans le fond c’est à “l’anniversaire” de ton membership avec la carte, c’est-à-dire le jour que ta carte se renouvelle pour l’année. C’est ça la “date de remise à zéro des cahats annuels”, un an après que tu aies été approuvé pour la carte et ensuite à chaque année à cette date là 🙂

Et je peux te confirmer que ça fonctionne très bien, dans les semaines qui suivent tu reçois un certificat dans ton compte Marriott que tu peux facilement appliquer à toute réservation en ligne d’un hôtel Catégorie 5 ou moins 🙂

En espérant que ça réponde à ta question 🙂

Moi avant de commander j’avais appelé chez Amex pour avoir du détail concernant le fait qu’ils disent occupation double pour la chambre. L’employé de Amex m’a répondu qu’à la date anniversaire on allait recevoir en fait 35000 points et qu’on peut les utiliser comme bon nous semble. Quelqu’un peut-il confirmer ?

Ca fait pas de sens avec le fait qu’ils écrivent que la nuité gratuite est valide pour 1 an.

Salut Jeremie, en effet ce ne sont pas 35 000 Points qu’ils t’envoient, mais bien un certificat qui vaut 35 000 Points. Tu peux ensuite l’appliquer hyper facilement en ligne sur n’importe quelle réservation d’un hôtel qui est de Catégorie 5 (ou moins) 🙂

Bonjour a vous. Est ce que si j’achete une carte prépayé visa chez couche tard (par exemple) avec ma american express mariott bonvoy cela sera considéré comme un achat pour arriver au 1500$ et ainsi débloquer mes points. Merci a l’avance.

Bonjour, oui absolument mais recommandé seulement en dernier recours (si tu n’as pas d’autres choix pour atteindre ton montant minimum) car les cartes pré-payées ont un frais d’activation. Mais oui ça fonctionne. Encore mieux: l’achat de cartes-cadeaux, qui elles n’ont pas de frais 🙂

Bonjour, pour avoir la prime il faut dépenser 1500$ en 3 mois. Est-ce-que je peux remboursé le solde a la fin de chaque mois ou je dois attendre d’avoir les 1500$ sur ma carte pour la remboursé ? Merci

Il faut absolument payer le compte au complet à 100% à chaque mois c’est vraiment la règle la plus importante. Rien ne change jamais cet aspect.

Le 1500$ c’est seulement le cumulatif que tu dois charger à ta carte dans les 3 premiers mois pour débloquer la prime ?

Suite a vos excellents articles a ce sujet, j’ai commande avec enthousiame cette carte et j’ai recu une carte SPG et il n’est fait mention nulle part de la prime de bienvenue liee a la carte Marriott Bonvoy…

J’espere bien avoir droit a la prime annoncee malgre tout…?.

Quoiqu’il en soit, dommage que cette prime largement annoncee dans les publicites, on n’en fasse plus mention nulle part dans la documentation envoyee avec la carte…

Bonjour, aucune inquiétude si tu as passé par un lien qui mentionnait 60 000 Points, tu l’auras si tu atteint le montant minimum pour débloquer la prime. C’est presque toujours le cas que les documentations n’incluent pas les détails de la prime de bienvenue (d’où l’importance de lire ce qu’on fait quand on commande) simplement parce que ces offres changent constamment tout au long de l’année 🙂

Premièrement Andrew, merci pour tous ces infos. Très compréhensif.

Petite question.

Avec l’outil excel que tu as bâti j’ai identifié un hôtel catégorie 1 qui m’intéresse. Si par example on veut rester au “Fairfield Inn & Suites Albany East Greenbush” et on veut une SUITE (Upgrade your stay with this spacious Studio Suite featuring a King bed and pull-out sofa. Not only is this studio larger than our guest rooms, but it also features two HD TVs with premium channels, a living area and amenities such as a microwave, mini-fridge and coffee/tea maker.)

Est-ce que cette suite serait considéré « une nuit dans un Hôtel catégorie 1 »?

Bonjour, non malheureusement ce ne sont que les chambres standard de base qui sont au prix indiqué par nuit!

Bonjour,

Si je vis à Montréal et que je souhaite utiliser cette carte de crédit dans mon quotidien (station d’essence, épicerie, achats internets). Est-ce qu’elle me permettra d’accumuler des points pour bénéficier de nuits gratuites?

Merci de m’informer.

Bonjour! Oui en effet c’est une des meilleures cartes pour l’accumulation sur les dépenses quotidiennes (2 Points Marriott par dollar), du moins dans deux circonstances surtout: si tu veux des nuits d’hôtels Marriott car ce n’est pas utilisable pour rien d’autre et surtout si tu utilises bien les Points, car comme ce sont des points à valeur variable, tu peux en avoir pas mal plus pour ton argent mais tu peux aussi en avoir pas mal moins si tu les utilises mal.

Le taux d’accumulation est exceptionnel, la seule exception est pour les catégories bonus (par exemple ma carte Cobalt me donne 5X les Points sur la nourriture, là c’est plus avantageux que la Marriott) mais sinon on estime le retour à 1.8% sur tout, mais c’est très conservateur (si tu utilises les Points sur du Catégorie 1 et 2, c’est pas mal plus).

AMEX est accepté dans pas mal tous les endroits en ligne, station d’essences aussi. Les épiceries moi j’ai changé pour Metro/Super C car ce sont les seules qui acceptent AMEX.

Bonjour, j’aimerais savoir comment ça fonctionne si on voyage à deux. Est-ce que les 15 nuits sont pour des chambres doubles en occupation double?

Bonjour, les chambres sont pour deux personnes 🙂

Bonjour,

Est-ce que dès qu’on obtient la carte, nous avons les points pour booker des séjours aux hôtels, ou devrons-nous attendre après avoir dépenser 1500$ pour commencer à réserver les hôtels avec les points?

Je demande car j’ai un voyage prévu pour bientôt et j’aimerais bien commencer à réserver le plus tôt possible.

Merci!

Bonjour, en effet il faut atteindre le montant de dépenses de 1500$ pour débloquer la prime de bienvenue avant de pouvoir utiliser les points.

Où trouver la liste complète des hôtels de catégorie 1 ?

Bonjour, la carte dont on parle est le plus pratique pour les voir visuellement, mais sinon sur le site Marriott il y a la liste que tu peux trier par catégorie également 🙂

Carte: https://flytrippers.com/fr/carte-de-tous-les-hotels-marriott-triable-par-categorie/

Liste: https://points-redemption.marriott.com/hotel-redemption/marriott-bonvoy/

Je vous remercie pour votre excellent travail et c’est tellement agréable de vous lire.

J’ai la carte Desjardins Odyssée world elite. Est-ce que je peux faire des lounges ailleurs qu’à Montréal?

Merci de l’attention portée à cette demande.

Bonjour non, cette carte-là ne donne pas accès à des réseaux de lounges malheureusement, seulement le leur à Montréal.

Il y a 4 cartes qui donnent accès aux lounges, voici la liste:

https://flytrippers.com/fr/voici-comment-cest-dans-les-lounges-vip-daeroport/#access

Bonjour, est ce que cette carte donne l’accès aux lounges VIP d’aéroport?

Bonjour non c’est un avantage assez populaire, si ce serait le cas on le mentionnerait c’est certain haha! Mais il y a 4 cartes qui donnent accès aux lounges:

https://flytrippers.com/fr/voici-comment-cest-dans-les-lounges-vip-daeroport/#access

Bonjour, est-ce-que les points on une date d”expiration ou sont-il bon tout le temps ?

Bonjour!

Les Points Marriott n’expirent qu’après 24 mois sans accumulation (et suffit d’utiliser la carte une fois pour accumuler et repartir le décompte)

En espérant que ça réponde à ta question ?

Bonjour, si je comprends bien, les points expirent après 24 mois sans accumulation. Mais si on utilise la carte au moins une fois chaque mois (n’importe quelle usage, n’importe quel montant ???), il y a accumulation et le décompte de 24 mois repart à zéro. Finalement si on l’utilise régulièrement, les points n’expireront pas ? c’est bien ca ?????

Exact 🙂

Bonjour! Petite question basique pour être sûr que j’ai bien compris. La prime de bienvenue doit être utilisé seulement dans les hôtels Marriott? Merci

Annie

Oui exactement, c’est une carte avec des points moins flexible. Quand on veut des points plus flexibles on en a toujours moins pour notre argent, mais si tu ne veux pas d’hôtels Marriott, il vaut mieux regarder les autres bonnes offres sur notre classement des cartes de crédit 🙂

https://flytrippers.com/fr/meilleures-cartes-de-credit/

quel sont les vip lounges a montreal a t-on acces

Pas avec cette carte non, les seules cartes qui offrent l’accès aux lounges sont dans cet article-ci:

https://flytrippers.com/fr/voici-comment-cest-dans-les-lounges-vip-daeroport/#access

Bonjour

C’est malheureux que vous disiez que cette carte est totalement gratuite mais lorsqu’on clique sur votre lien, elle est à 120$ part année…

Est-ce qu’on aurait une vue différente de ce qu’est gratuit?

Bonjour, les mots exacts sont “essentiellement gratuite” et c’est expliqué clairement elle coûte 120$ mais elle donne une nuit gratuite à chaque année dans des hôtels qui coûtent tous plus de 120$ la nuit donc c’est essentiellement gratuit oui pour tous ceux qui savent compter 😛 Et pour ceux qui ne prévoient pas réserver au moins un hôtel par année, et bien faire du travel hacking n’est clairement pas nécessaire donc inutile de regarder les cartes haha! En espérant que ça réponde à ta question!

Bonjour, comment ça fonctionne pour obtenir la nuit gratuit? Faut-il garder la garde plus de 12 mois?

Bonjour les nuits gratuites de la prime de bienvenue, tu les as dès que tu atteins 1500$ de dépenses. Pour le certificat de nuit gratuite oui c’est à chaque “anniversaire” de ton compte donc à chaque année, et si tu séjournes ne serait-ce qu’une fois dans l’année dans un hôtel, ça ne fait pas de sens de ne *pas* garder la carte 🙂

Donc si je comprends bien, j’ai commandé la carte en janvier 2019 alors j’aurai mon certificat de nuit gratuite en janvier 2020?

Oui exact 🙂

Est-ce que la carte Amex est acceptée partout dans le monde?

Bonjour, non mais ça ne change rien. Le but premier de commander toute carte c’est la prime de bienvenue, et donc peu importe où ils la prennent ou pas ?

Mais en plus à l’international comme 99% des cartes au Canada elle charge un frais de conversion alors ce n’est pas elle qu’il faut utiliser en voyage du tout de toute façon, mais hors États-Unis et Canada, ce ne sont que les chaînes habituellement qui l’acceptent (et vraiment pas toujours).

En espérant que ça réponde à ta question ?

Je trouve cet article très intéressant et je me pose cette question: mon conjoint et moi avons les cartes World elite MasterCard avec Desjardins et nous amassons nos points sur ces deux cartes conjointes. Nous sommes une petite famille avec un bébé qui vient de naître et nous voulons partir en septembre pour deux ou trois semaines…

Est ce intéressant d’ajouter cette carte?? Parce qu’à ce moment, si je comprends bien, je n’ajouterai plus de points sur la MasterCard (qui me donne à un certain moment 2%)…. donc, est ce que ça vaut la peine d’avoir les deux cartes ou je continue à amasser seulement sur la World elite (en pensant que nous sommes une famille).

Merci!

Bonjour, si tu veux des nuits d’hôtels gratuites, oui ça vaut certainement la peine! Après la prime de bienvenue, pour ce qui est de ton utilisation quotidienne, là ça dépend de ce que tu recherches. Les points Desjardins sont des points à valeur fixe, tu obtiens 1.5% ou 2% de retour, ce qui ne peut pas te donner plus de valeur que ça, c’est fixe. Si vous aimez aller à l’hôtel et que vous allez dans des endroits où il y a des hôtels Marriott de Catégorie 1 et 2 (ou même peut-être 3), accumuler des Points d’hôtels peut te donner l’équivalent de plus que 1.5% ou 2% de retour, mais à condition de bien les utiliser !

Tu peux lire notre article ci-dessous sur comment bien les utiliser justement, et si tu as encore des questions n’hésite pas 🙂

https://flytrippers.com/fr/comment-utiliser-les-points-marriott-bonvoy-pour-maximiser-leur-valeur/

Bonjour,

J’aimerais avoir des conseils concernant la carte Bonvoy. Nous sommes 4 adultes à séjourner 7 nuits à waikiki en novembre 2022. Est ce que l’adhésion a cette carte serait la meilleure option pour nous?…Est -ce que nous pouvons avoir des points supplémentaires si nous référons pour de nouveaux adhérents ?

Avez vous des exemples de ce que nous pourrions réserver avec nos 4 cartes Bonvoy?

Merci

Bonjour, c’est sûr que Hawaï c’est très cher et très populaire, et donc un des pires endroits pour maximiser le nombre de nuits gratuites. Mais comme c’est cher, ça peut être un bon endroit pour maximiser l’argent économisé, dépendant du prix en argent de l’hôtel en question (ou de l’hôtel où vous iriez sans les points). Donc ça dépend 😛

C’est sûr que c’est un beau montant de points quand même, mais est-ce que des points Aéroplan ou même des points à valeur fixe peuvent être mieux? Ça dépend du prix en argent, c’est ce qu’il faut comparer toujours en fait.

Bonjour,

J’ai la Amex Or depuis juillet et j’ai utilisé mes points récemment (février). Est-ce que je peux commander cette carte maintenant ? Est-ce que je dois annuler l’autre avant et si oui, à partir de quand je peux le faire ? Je me questionne sur l’impact pour la cote de crédit même si le paiement n’est pas un problème, mais le fait d’annuler et prendre une nouvelle ..!

Un GROS merci 😉

Bonjour, l’idéal pour la cote de crédit c’est de garder ta plus vieille carte ouverte pour l’historique, mais sinon le fait de faire d’autres demande nuit surtout si tu annules l’autre justement. Si tu l’as depuis juillet, tu n’as rien à payer avant juillet, alors ça ne donne rien de l’annuler avant. Tu peux simplement faire une demande pour la carte Marriott Bonvoy, pas besoin de toucher à l’autre. Une demande affecte de quelques points ta cote, mais qui sont repris très rapidement grâce au fait que tu as maintenant plus de cartes (eh oui! le mythe qu’avoir plusieurs cartes est mauvais est non seulement trompeur, c’est carrément le contraire de comment fonctionne les cotes de crédit). Il y a plus d’information dans cet article, laisse-moi savoir si ça ne répond pas à ta question 🙂

https://blog.flytrippers.com/fr/regles-savoir-pour-les-cartes-de-credit-de-travel-hacking/

Bonjour! Est ce qu’on accumuler les points seulement en faisant notre épicerie?

Et est ce que les points sont applicables dans les hôtels mariott québécois?

Merci ?

Bonjour, non pas du tout la carte n’a pas de catégorie bonus de dépenses (outre chez Marriott), tu accumules 2 points par dollars partout.

Et oui c’est utilisable au Québec (il y a d’ailleur les Delta de Saguenay et Sherbrooke en Catégorie 2) mais sinon ça ne fait pas toujours de sens d’utiliser ses points ici vus que les hôtels requièrent beaucoup de points. Voir cet article pour plus d’infos, particulièrement la section “une erreur commune” :

https://flytrippers.com/fr/comment-utiliser-les-points-marriott-bonvoy-pour-maximiser-leur-valeur/

J’ai la carte amex gold avec de bonnes assurances voyage, si je commande celle-ci et que je reserve mon voyage avec…. est-ce que les assurances de la gold sont en vigueur quand même ou non car faut payer le voyage avec?

Bonjour, toutes les couvertures d’assurances qui viennent avec les cartes de crédit, il faut payer le vol / item avec la carte pour l’activer. La seule exception, c’est l’assurance médicale, qui elle te couvre d’office en tant que détenteur de la carte, peu importe si tu as payé le voyage avec la carte. Mais juste pour confirmer, l’assurance-médicale c’est la seule que cette carte-ci n’a pas ? Donc tu peux réserver ton voyage avec la carte Marriott et être couvert exemple pour les retards de vols avec la carte Marriott, et tu seras quand même couvert avec ta carte AMEX Or pour les assurances MÉDICALES seulement 🙂

Bonjour. Lors de l utilisation des points y a t il un minimum de nuits à réserver à un même hotel

Pierre

Bonjour, non pas du tout, une seule nuit peut être payée avec les points si tu le désires 🙂 C’est juste qu’en en prenant 4, la 5ième est gratuite, ça maximise donc la valeur 🙂

Merci pour les infos!!

J’ai déjà la carte spg d’american Express, est ce que ca fait que je ne pourrai pas commander cette nouvelle carte et avoir les bonus de bienvenue?

Bonjour, non c’est la même carte en fait, ta carte American Express n’existera plus et sera remplacée par celle-ci 🙂 Tu es donc déjà équippée 🙂 Tu auras ton certificat annuel de nuit gratuite et tout le reste!

Si j’ai pris la SPG auparavant et que je l’avais annulé, je ne suis donc plus éligible à la prime de bienvenue?

Selon les modalités, AMEX considère que c’est la même carte alors non malheureusement!

Moi aussi j’ai encore ma carte SPG mais je n’ai toujours rien reçu par rapport aux points gratuits… est-ce que c’est normal?

Salut, je ne suis pas sûr de comprendre la question. Si tu as obtenu la carte alors qu’elle s’appelait la SPG, tu as sûrement eu la prime de bienvenue et les Points associés (du moins si tu as atteint le montant minimum à temps). Tu dois obtenir ton numéro de membre SPG/Marriott auprès d’AMEX et ensuite te créer un compte en ligne sur le site de Marriott si ce n’est pas déjà fait, tu verras tous tes points accumulés là-dessus 🙂

Désolé si ce n’était pas clair… j’ai commandé ma carte à l’époque de la promo 75000 points SPG et j’avais reçu ma prime. Par contre pour cette nouvelle promo de 60,000 points bonvoy tu sembles indiquer qu’elle s’applique à tout le membres, même ceux qui ne sont pas nouveaux membres, est-ce que c’est bien ça? Si oui, je n’ai pas reçu les 60,000 points. Même chose pour mon certificat annuel de nuits gratuites, est-ce que c’est normal?

Non, c’est vraiment la même carte qui ne fait que changer de nom. Alors si tu as déjà eu une prime de bienvenue, malheureusement tu ne peux pas la ravoir (AMEX sont les plus sévères pour ce qui est des bonus pour une même carte). Tu pourrais avoir la prime de bienvenue pour la AMEX Or, la AMEX Cobalt et la AMEX Platine sans problèmes (je l’ai eu pour toutes moi-même) mais la même carte c’est une fois seulement. Mais pour le certificat de nuit annuel, ça aucun problème tu l’auras à chaque année dès le premier anniversaire, c’est pour tous les gens qui ont la carte 🙂

Bonjour

J’ai la carte American express or, je voulais transférer mes points amex en points Marriott et annuler ma carte. Aurais-je droit à la prime de bienvenue pour la carte Bonvoy même si je suis pas une nouvelle adhérente chez Amex.

Merci!

Annie

Bonjour, oui c’est tout à fait faisable, les Points AMEX se transfèrent au taux de 1 Point AMEX = 1.2 Points Marriott (certains préférent transférer en Miles Aeroplan car théoriquement ça donne plus de valeur, mais les vols c’est plus compliqué que les hôtels). Sinon, pas de problème pour la Carte Bonvoy ce sont des produits tout à fait différents et tu es éligible à la prime de bienvenue sans problème! J’ai moi-même eu la prime sur plusieurs cartes AMEX comme la Platine, la Or, la Cobalt et la Bonvoy; aucun problème:)

Bonjour,

C’est une carte qui m’intéresserait beaucoup mais elle est peu acceptée à Québec. Pouvez vous m’indiquer où je pourrais l’utiliser ici pour pouvoir accu user ce 1500$ en trois mois. C’est pas avec des achats chez McDo qu’onpeut Y arriver. Merci

Bertrand Lavoie

Bonjour, ça ne devrait vraiment pas être un problème. Ils l’acceptent pas mal partout de nos jours dans les grandes chaînes (à part IGA/Maxi) et sinon il est possible d’acheter des cartes-cadeaux chez Couche-Tard pour “pré-payer” les dépenses à venir. Voici d’autres détails et astuces:

https://flytrippers.com/fr/comment-atteindre-le-montant-minimum-pour-debloquer-la-prime-de-bienvenue-des-cartes-de-credit/

Bonjour,

Merci beaucoup pour l’info, est ce que la nuit gratuite annuelle est cumulable où elle doit être prise à l’intérieur des 12 mois qui suivent?

De plus, je venais voir les options pour changer ma BMO air miles régulière pour la BMO World élite ou la BMO World élite air miles. Est ce qu’il serait conseiller de prendre et la bon voy et la Workday élite ou bien conserver la BMO régulière et la bon voy? Merci :]

Bonjour, les points n’expirent pas tant que tu gardes ton compte actif et que tu accumules des Points mais le certificat de nuit gratuite expire après un an (puisque tu en obtiens un nouveau chaque année). En théorie.

Cela dit, j’ai personnellement été capable de les faire extensionner d’une autre année (mais ce n’est pas garanti que ça fonctionne quoique c’est pas mal à leur avantage de dire oui) mais ce n’est pas garanti car officiellement c’est un an.

Rebonjour, pour ce qui est de la BMO, c’est très important de ne pas annuler ta plus vieille carte de crédit, pour en conserver l’historique. Donc si tu décides d’y ajouter une nouvelle BMO, assure-toi que tu es éligible à la prime de bienvenue (car on dérecommande fortement de commander une carte sans prime de bienvenue). Certains préfèrent commander deux nouvelles cartes à la fois (car en faisant la demande le même jour, ça ne compte que pour une demande au bureau de crédit) alors que d’autres préfèrent en commander plus régulièrement (aux 3-4 mois) pour pouvoir plus facilement atteindre le montant minimum requis pour débloquer la prime. Ça, ça dépend de ton niveau de dépenses régulières 🙂

Bonjour, si la carte ne couvre pas l’assurance médicale, que recommandez vous de faire ou quelle compagnie d’assurance médicale de voyage recommandez-vous(À meilleure coût)?

Bonjour, simplement d’avoir une autre bonne carte de voyage simultanément, à peu près toutes les autres ont l’assurance-médicale. Tu peux voir la liste des meilleures offres du moment et pour ceux qui pourraient croire au mythe que c’est mauvais d’avoir plusieurs cartes de crédit, c’est complètement faux 🙂

– Meilleures cartes: https://flytrippers.com/fr/meilleures-cartes-de-credit/

– Comprendre le Travel Hacking: https://blog.flytrippers.com/fr/regles-savoir-pour-les-cartes-de-credit-de-travel-hacking/

Bonjour,

Est-ce que la prime de Bienvenue s’applique aussi si nous avons déjà eu la Amex SPG dans le passé?

Merci!

Bonjour,

Je viens de trouver la réponse…regardez dans ”modalités” Il y a une phrase (je suis incapable de copier-coller) qui dit exactement que les détenteurs de l’amex SPG ne sont PAS éligibles aux 60 000 points de bonus 🙁 🙁

Oui, c’est écrit en effet! Donc c’est considéré la même carte aux yeux d’AMEX!

Selon les modalités, AMEX considère que c’est la même carte alors non malheureusement!

Si je décide quand même de ne pas renouveler ma carte après 1 an , est-ce que mes points marriot seront aussi annulés ? Merci ?

Bonjour, premièrement je veux juste réitérer que si tu séjournes ne serait-ce qu’une nuit dans un hôtel dans l’année, tu ne devrais jamais annuler cette carte et utiliser le certificat annuel gratuit 🙂 Mais si tu l’annulais, non ça ne dérange pas car tes points sont dans ton compte Marriott directement.

Cela dit les Points Marriott n’expirent qu’après 24 mois sans utilisation (et suffit d’utiliser la carte une fois pour accumuler et repartir le décompte)