If you still don’t have the one card that we recommend for literally every Canadian traveler, here is a detailed presentation! It’s one of our favorite cards, it has no minimum income requirement… and its great welcome bonus gives you 8 completely free nights in great hotels, including in beautiful Bali, for just $120 ($15/night) — or 17 nights with a travel buddy. This deal is one of the best-kept “secrets” for travelers… but it works and it’s amazing (and easy)!

The Marriott Bonvoy™ American Express® Card‘s points can be even simpler to use if you prefer: instead of having to choose specific hotels to maximize them, the welcome bonus should be worth ≈$477 off almost any of the 8,000+ Marriott hotels, for just $120.

First, you can watch our video presentation of the Marriott Bonvoy American Express Card if you prefer that format (since I filmed that, the welcome bonus that was 10 nights has changed to 8 nights, but the rest of the card has not changed).

If not, read on.

Important: If you are not one of the Flytrippers readers who have already earned over one million dollars with our welcome bonus recommendations, please read the 5 basics of travel rewards first.

Because we’ll assume you know that welcome bonuses are the key and that using your card for 100% of your purchases is not relevant, that having more cards is better for your credit score, that you shouldn’t close your current old cards, that annual fees alone are irrelevant, and that there are 2 types of travel rewards that work very differently.

Million-dollar sidenote

You might have learned about Flytrippers from the 50%-off flight deals we spot…

But did you know that since we launched just a few years ago, travelers who follow us have earned a whopping one million dollars in welcome bonuses alone? Yes, you read that right; a million dollars!!!

That is just with welcome bonuses. And just with the best credit cards in Canada that we’ve recommended, because we only recommend the very best deals… the ones with huge welcome bonuses.

Like this welcome bonus on the Marriott Bonvoy American Express Card, giving you up to 8 free nights… and many of the eligible hotels are very beautiful, both for those who love nature or cities!

Anyway, we’re so happy about that million-dollar stat, since helping you travel more for less is our mission… and travel rewards are such a huge part of doing that.

How much did you earn in welcome bonuses? I get well over $1,000 every year… and if you want to stop missing out, this is really a great card to get started right now very easily!

Overview of Flytrippers’ take on the Marriott Bonvoy Amex Card

Our detailed editorial card reviews always start with a to-the-point section that includes:

- Why get the card

- Who should get the card

- How to get the card

Why get the Marriott Bonvoy Amex Card

Here are the 5 best reasons to get the Marriott Bonvoy American Express Card:

- The incredible welcome bonus worth up to 8 free nights

- The amazing annual free night certificate for very luxurious hotels

- The flexibility of having points that won’t expire

- The great base earn rate

- The other benefits: Free additional card, insurance, and elite status

Who should get the Marriott Bonvoy Amex Card

Here are the travelers who should consider the Marriott Bonvoy American Express Card:

- Literally every traveler

We rarely—if ever—have just one simple at-large bullet like that, but the Marriott Bonvoy American Express Card really is that good.

It’s a no-brainer. It’s one of the best cards.

This is such a great card to get started in the world of travel rewards, so I will even gladly personally answer any question you may have about it; just send it to points@flytrippers.com or fill in this form!

How to get the Marriott Bonvoy Amex Card

Here is the 4-step simplified process to take advantage of this deal:

- Apply for the Marriott Bonvoy American Express Card (secure Amex link)

- Unlock the welcome bonus by spending $1,500 in 3 months

- Get 53,000 Marriott points (welcome bonus + earn on minimum spend)

- Use your points for either:

- 8 completely free nights in certain hotels (or fewer in more hotels)

- A simpler ≈ $477 off the 8,000+ Marriott hotels

You can download our free Marriott Bonvoy Amex Card guide (and you’ll also receive our checklist for when you get a new card to avoid common mistakes and a few other bonus tools).

Highlights of the Marriott Bonvoy Amex Card

Here is a detailed look at the 5 best reasons to get the Marriott Bonvoy American Express Card.

1. The amazing welcome bonus

First, the most obvious. The welcome bonus is the most important thing to consider for any card. So I’ll cover this in 3 parts.

1.1. Using your 53,000 Marriott Bonvoy points

Once you unlock the Marriott Bonvoy American Express Card‘s welcome bonus, you will have 53,000 Marriott Bonvoy points (welcome bonus of 50,000 points + 3,000 points earned on the minimum spend).

That’s worth ≈ $477 based on our Flytrippers Valuation, but it can be more if you use them well!

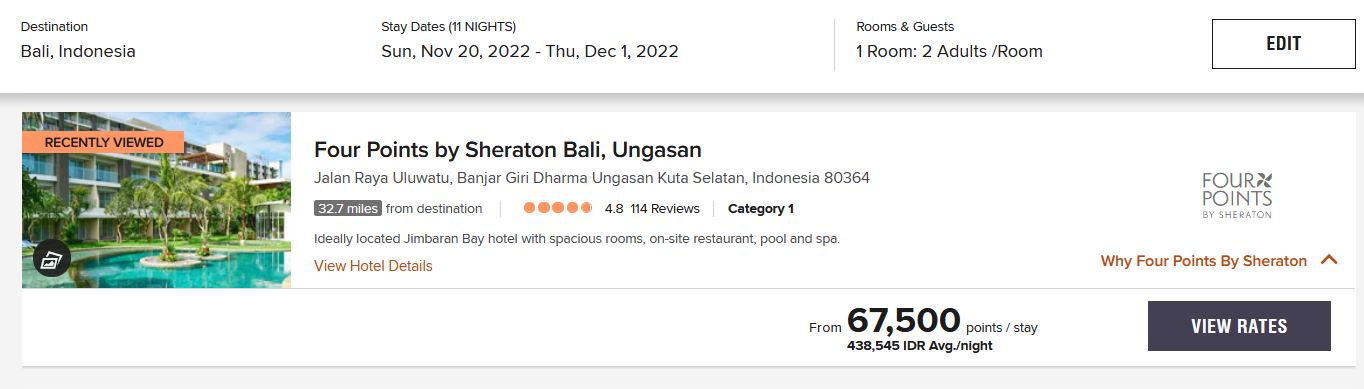

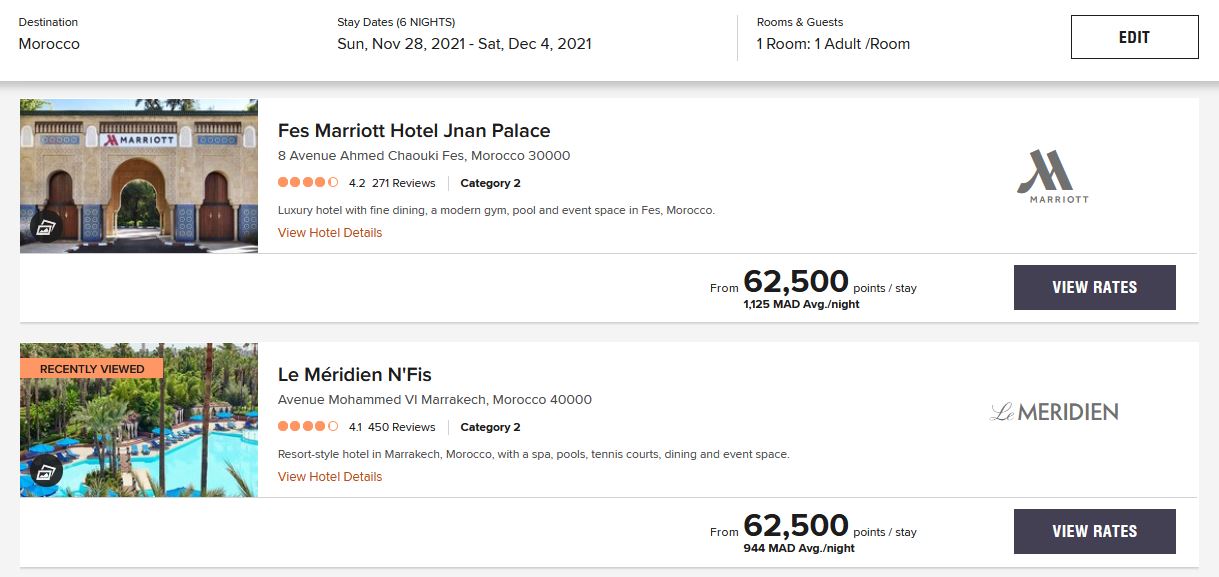

It’s enough for 8 free nights in many amazing destinations like Indonesia, Malaysia, India, South Africa, and Spain on a majority of dates (Marriott category 1 hotels).

Want even more destination options?

You can instead get 5 free nights in 1,100+ hotels in 50+ countries on a majority of dates (Marriott category 2 hotels).

Getting 5 free nights is still a pretty amazing deal and that gives you so much more choices in terms of destinations, like Egypt, Thailand, Cambodia, many European/South American countries, etc.

And by the way, even the most affordable Marriott hotels are not cheap basic hotels; they’re very nice. Especially outside of North America.

In short: Simply plan trips around those specific destinations and hotels and it’s that easy.

For more details about the hotels and destinations, with photos:

- The 5 best countries where you can get 17 free hotel nights

- The 26 best countries where you can get 10 free hotel nights

Where does that 17 come from?

Well, if your favorite travel buddy gets the card too… you’ll share a whopping 17 free hotel nights together (or 10 free nights for more options). That’s what I did with my girlfriend and we enjoyed an epic trip to Spain in October 2019 with our Marriott points.

In Indonesia and Malaysia for example, you can go on a nearly 3-week trip for about $1,100 total (flights included)! We’ll have that itinerary and other itineraries, great pro tips, and more info in the coming weeks to help you maximize this deal.

And if you don’t want to plan trips around those hotels, you’ll still get 3 free nights in another 2,500 hotels (or 7 nights with a travel buddy)… 3 free nights with one welcome bonus is not bad—but it sure isn’t 7 nights.

But you can save just as much money this way, especially if you usually pay for expensive hotels.

Oh and with hotel points, free nights are really completely free. No taxes or fees to pay (unlike with some airline rewards programs).

1.2. Unlocking the welcome bonus

As with almost all good cards and welcome bonuses, all you need to do to unlock it is spend a set amount in the first few months: It is $1,500 in the first 3 months in this case.

While it seems high, that’s just the equivalent of $115 per week (3 months = 13 weeks, not 12), which is very doable with our 5 pro tips… especially if you switch to one of the grocery stores in Canada that accept Amex cards.

For such a great welcome bonus, it’s worth the slight effort.

And if the minimum spend requirement is not an issue for you, we have a pro tip for those who want to earn even more rewards very easily.

1.3. Doing the math on the card fee

The card has a $120 fee that is more than offset by the huge welcome bonus the first year, for a Flytrippers Valuation of ≈ $357 for the welcome bonus alone (rewards worth ≈ $477 minus $120).

Again, it’s a great example of why it makes no sense to avoid cards with annual fees just for the sake of avoiding fees. Annual fees alone are irrelevant: It’s the total net value that matters, always. A $120 card that gives you $477 is obviously better than a $0 card that gives you $0… if you know how to do the math.

Look… it’s a good reflex to avoid fees normally. But with travel rewards, it just doesn’t make sense (the world of travel rewards is a very counter-intuitive one).

Fees are good… as long as you choose the right cards that have good welcome bonuses (some people pay annual fees for cards that don’t give them value… that’s really not the same thing; that is obviously very bad).

Unfortunately, many people still miss out on getting over $1,000 a year in net value from welcome bonuses like I have gotten every single year for over a decade… just because they don’t understand how important it is to do the math correctly.

In the following years, there is obviously no obligation to keep the Marriott Bonvoy American Express Card…

But you really should, since the incredible annual free night certificate also more than offsets the fee.

2. The amazing annual certificate for a free luxury night

Every year, you will get an incredibly valuable certificate for a free night that can be used in thousands of very luxurious hotels (up to Marriott category 5 hotels, many of which are 5-star hotels).

Unlike category 1s or 2s that you need to plan around to maximize the welcome bonus, the hotels for the free night certificate can be found pretty much everywhere in the world effortlessly.

It’s one of the best reasons to get the Marriott Bonvoy American Express Card. Definitely worth more than $120. It’s one of my favorite card benefits… and I have a lot of cards!

Flytrippers’ other co-founder Kevin used his for a $1,000-a-night overwater bungalow at the 5-star Marriott Momi Bay Resort in Fiji.

That’s an extreme example because of his free upgrade as an Elite member, but even the basic room you would get there is worth over $300.

Our Flytrippers Valuation of the certificate is ≈ $315 so it just makes no sense to cancel this card (ever).

As a traveler, you certainly spend at least one night in a hotel in a year, and it almost certainly costs you $120 with taxes. So keep the card and trade that very basic $100+tax room for a luxury room with the certificate that costs you the same $120.

3. The flexibility of having points that don’t expire

Your points earned with the Marriott Bonvoy American Express Card won’t expire, and you don’t have to book anything in advance or anything. There’s no time limit whatsoever. It’s really as flexible as it can be.

So you can take action now and be ready and already have your points for your next trip… but regardless, there is no risk at all since the points don’t expire if you just use your card for a $1 purchase once every 2 years…

Also, Marriott is the world’s largest hotel chain (by the number of rooms) and Marriott Bonvoy is the world’s largest loyalty program (by the number of members). There are 30 different Marriott hotel brands and over 8,000 hotels in nearly every country (with about half a million other new rooms under development)…

So nothing to worry about: They will still be going strong no matter when you are ready to travel.

4. The great base earn rate

The Marriott Bonvoy American Express Card has a great earn rate (even though this isn’t as important as many believe).

Here’s what you’ll earn:

- 5 pts/$ (≈ 4.5%) at Marriott

- 2 pts/$ (≈ 1.8%) everywhere else

The effective return rate in parentheses is based on our Flytrippers Valuation of ≈ 0.9¢ per Marriott point, but you can obviously get much more value if you use your Marriott points well.

They are variable-value rewards so in other words for a better return, use them for the lower categories of hotels to get more free nights or use them if the price of a hotel in cash is more than the value of the required points.

So there are always 2 things when looking at earn rates:

- The base earn rate

- The category bonuses (or category multipliers)

4.1. Base earn rate

First, the base earn rate. It is excellent for everywhere that isn’t included in any other card’s category bonuses. Getting ≈ 1.8% on all the non-bonused categories is even among the best rates in Canada.

Personally, despite having many cards, I use my Marriott Bonvoy American Express Card for all purchases that aren’t bonused on any other card (when I’m not unlocking new welcome bonuses, of course).

It’s one of the reasons I was able to get 53 free nights in Marriott hotels in 2019 alone.

4.2. Category bonuses

Second, the card only has one bonus category: Every Marriott purchase will earn a whopping ≈ 4.5% back.

The best part is that this is in addition to the ≈ 8% back in points earned directly from Marriott’s rewards program when you stay in one of their hotels and pay in cash, for a total of at least 12% back…

But there are also near-constant seasonal promos, like the current one offering an extra 1,000 points bonus per stay. With a recent one that offered double points, you got a very nice ≈ 20% total return on your Marriott stays with the Marriott Bonvoy American Express Card.

This is very valuable if you plan to stay in Marriott hotels more often to take advantage of benefit #5.1 too…

5. The other benefits

Finally, here are 3 other benefits.

5.1. Elite status

The Marriott Bonvoy American Express Card gives you automatic Silver Elite status with Marriott, which is admittedly not much since it’s the entry-level elite status. But you still get a few benefits at over 8,000 hotels, like bonus points and free late check-out.

But most importantly, you get a shortcut to reach Gold Elite status quite easily, and that level is more interesting since it can start giving you free room upgrades.

You can read more details about Marriott Bonvoy Elite Status.

5.2. Free additional card

Another interesting benefit is the no-annual-fee additional card. That means if you want someone in your household to help you earn points, you can get them their own card on your account completely free.

Of course, we’d recommend each getting a Marriott Bonvoy American Express Card in your own right instead if you want to maximize your welcome bonuses (especially with such a great offer) and get 2 annual certificates.

But once the bonuses are unlocked, some might prefer earning in one same account to make things simpler.

That said, points from different accounts can be pooled together for free (up to 100,000 points per year).

5.3. The good insurance coverage included

I talked about the fact that annual fees were irrelevant, well in fact it’s even a good thing when there’s an annual fee (at least with good cards that give you huge value with the welcome bonus and the subsequent years’ benefits).

That’s because cards with annual fees have travel insurance coverage, and it’s one of the best reasons to get good travel cards like the Marriott Bonvoy American Express Card. Two of the most easily avoided complaints in the world of travel will be covered with this card’s insurance: flight delay insurance and car rental insurance.

- Airlines owe you nothing if the weather delays your flight. It makes sense since they don’t control the weather. But your flight delay insurance coverage will give you $500 for hotels and meals if your flight is delayed, as long as you charge the flight to your card.

- Renting a car doesn’t have to be expensive. It can be very cheap in North America if you decline the very high damage insurance fees. You can do that thanks to the car rental theft and damage coverage, as long as you charge the rental to your card.

There are also a few other types of coverage: baggage delay insurance, lost or stolen baggage insurance, hotel burglary insurance, travel accident insurance, emergency assistance, purchase protection plan, and buyer’s assurance protection.

The only key insurance coverages that this card doesn’t include are medical travel insurance and trip cancelation insurance, which you can get from carrying another card as many other travel cards have it. You can read more about travel insurance in general in upcoming articles.

Summary

The Marriott Bonvoy American Express Card is excellent if you want to travel more for less. The welcome bonus is excellent, so you should consider this card if you are interested in getting free hotel nights in amazing countries (getting 8 free nights is phenomenal value).

Have any questions about the Marriott Bonvoy Card offer? Tell us in the comments below.

Hi Andrew, I see this card is not part of your list in the flytrippers.com/insta link. Is it because this card doesn’t have a bonus anymore, or you no longer recommend it, or else?

Hi, I wouldn’t get it right now unless you’re going to the program sweet spots like Bali and a few others very soon, because the offer is at its lowest and more importantly, there are sooooo many amazing higher offers right now 🙂 It’s a card everyone should eventually get though. Last spring there was an increased offer, let’s hope the same thing will happen this year 🙂

Hi. I am just starting to travel and so excited to learn these tips. Does “purchase” to reach thewelcome bonus mean only retail purchases or can it be used for things like paying off other debt, rent, or transfer a balance? What about cash withdrawals?

Hi, only retail purchases. Nothing else. We have this great free checklist for when you get a new card, it has a ton of useful info, especially if you are starting out:

https://flytrippers.com/new-card-checklist/

Thank you Andrew for all the great and useful travel tips!!! I was wondering if one can this Amex Marriott Bonvoy card and get the welcome bonus if already had the Amex Aerrplan card? Thanks!

Hi Micky, it’s my pleasure… nothing better than helping others travel the world for less 🙂 Thank *you* for following us!!!

And no problem, Amex considers all cards entirely separately. So you can get the welcome bonus on the Marriott Bonvoy Card (as long as you’ve never received the welcome bonus on the Marriott Bonvoy Card specifically).

Hi Andrew, thank you for all the info you’re sharing!

I definitely profited 🙂

I requested this card when you wrote about it in August (?) … obtained the points etc.

Now, for the life of me I cannot see the points anymore.

Each statement shows the point cumulated that particular month but there is no total .

I’ve created a Marriot Bonvoy account thinking the card is linked to it, the points will show there etc but …nothing. Can you please shed some light? Many thanks!

Hi! Glad we could help 🙂

Amex created a new Marriott account number for you automatically, it’s just that they don’t give you the number directly. You can ask them for it on the chat function on the Amex website (or call them), then you’ll have to call Marriott to merge your accounts. Or just create an online account at Marriott.com with the membership number Amex gave you, if you just created the other one and have no points earned there anyway 🙂

No medical travel insurance. Caring a second travel card with medical insurance means I have to buy the flight with it, which means I lose out on all the other travel insurance benefits of this card.

No, simply get a card with good insurance coverage as one of your other cards, and don’t use this one for flights. It’s not the most rewarding for travel purchases anyway, it’s especially good for non-bonused spend (and travel purchases are bonused on so many great cards) and the great signup bonus.

And by the way, with most cards medical travel insurance does NOT require you to have bought the trip with the card, contrary to all other types of coverage. It is a benefit that covers you as a cardholder, for any trip (that fits the criteria outlined), regardless of which card you used. Again, this is only true for the medical insurance, and check your card’s booklet to be sure.

Do the free nights obtained by using the Bonvoy card expire?

Hi Ellie, Marriott Points obtained throught the Welcome Bonus (and subsequent use of the card) expire after 24 months with no activity. That means simply by using your card once, the clock would reset for 2 years.