We’ve already told you about the epic work Ryanair’s social media team does, and this time it even gave birth to the current “Big Idiot Seat Sale”. Indeed, it’s to highlight the feud between Elon Musk and Ryanair that this name was chosen for the flash sale, which has flights for 17 EUR (an excellent example of why the self-transfer trick is awesome).

Airlines’ formal sales are almost always terrible, as we’ve often told you. The potential exceptions are when you already had a flight to book or when it’s an ultra low-cost carrier (ULCC). Like Ryanair.

To really save on your flights (and the rest of your trips), Flytrippers helps you travel for less with our 3 types of content: flight deals, travel rewards, and tips/inspiration/news.

Here’s what you need to know about the Ryanair sale.

What’s the Ryanair sale?

It’s a flash sale with reduced-price flights offered by Ryanair, which is the #1 airline in Europe in terms of passengers, and the pioneer of the ultra low-cost business model. The current sale is called the “Big Idiot Seat Sale” and prices are as low as 16.99 EUR.

What a sale banner, though.

It’s similar to what Ryanair does on social media; they constantly create very funny content.

Most of all, they don’t care about displeasing and offending people, and I absolutely love that, as I explained when talking about their new policy of banning paper boarding passes (but it’s not really banned).

Here are the essentials about the current Ryanair sale:

- One of Ryanair’s frequent sales

- Titled “Big Idiot Seat Sale” this time

- Flights for as low as 16.99 EUR

- Several cheap destinations

- All mandatory taxes and fees are included

- As for all flights (always)

- 100,000 discounted seats

- Ryanair has a fleet of 624 aircraft

- Limited dates for flights:

- January, February, March, April

- Limited dates for the sale:

- Until January 22 (time not specified)

- It’s a very short 1-day “flash” sale

Flytrippers very often spots flights from Canada to Europe in the C$600s roundtrip.

By combining that with a flight from this Ryanair sale (details below), you can easily go almost anywhere in Europe completely free with the amazing $825 welcome bonus on one of the best cards for travel rewards beginners!

Here are a few basic tips to take advantage of the Ryanair sale:

- The lowest prices are easy to see

- As always with Ryanair

- They’re listed on the Ryanair sale page

- By city

- And then there’s a useful calendar view

- Perfect for Canadians who want to save

- Thanks to the self-transfer trick

- Flexibility on everything helps find the best prices

- As is always the case with flights

- Pay with the right credit card with free insurance

- The card that has the travel rewards if you want to use some on this flight

- Or ideally one on which you’re unlocking a welcome bonus

- Or at least one that does not charge FX fees (because it’s not in $C)

- Or the one with the best multiplier rate to minimize your FX fee loss

- As a last resort, an old card that at least has insurance

As for the feud that gave this Ryanair sale its name, it started from the fact that Elon Musk, the billionaire owner of X/Twitter, would like Ryanair to install Starlink Internet on its fleet (as so many other airlines are doing).

Ryanair’s CEO believes that his clientele wouldn’t be willing to pay to cover the costs (including the significant additional fuel costs because of the antenna).

It’s a logical argument, by the way. Most Ryanair flights are short, and most Ryanair passengers want to travel for less.

Why is the Ryanair sale relevant for Canadian travelers?

We just reshared a preview of the self-transfer trick. A detailed guide with the step-by-step process will follow soon, but this Ryanair sale allows us to show it to you a bit already.

I’m going to use a different European example than the one in the article, which was my real example from one of my trips to Bulgaria, one of the most underrated countries in Europe (it’s also the foreign country where Kevin, Flytrippers’ other co-founder, spent the most time in the world).

Let’s choose neighboring Romania, which many consider even more beautiful.

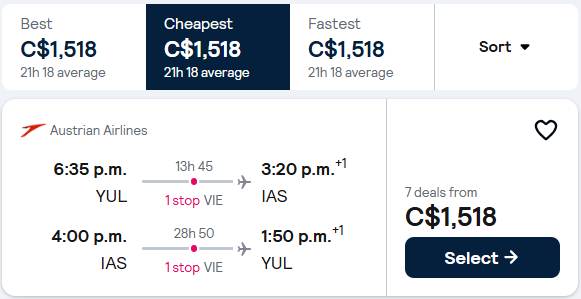

If you do like 99% of people and sadly book your flights on 1 single ticket, it’ll cost you 1518 CAD if you want a maximum of 1 stop. Direct flights don’t exist (get over always wanting direct flights, if you want to be a travel pro 😉)!

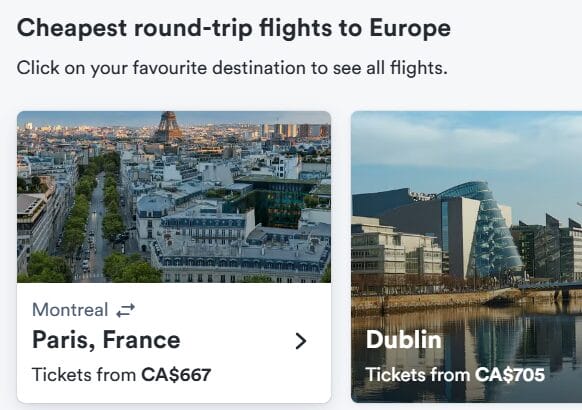

The cheapest flights (today) to cross the ocean from Montreal are to Paris, at 667 CAD roundtrip. Nonstop.

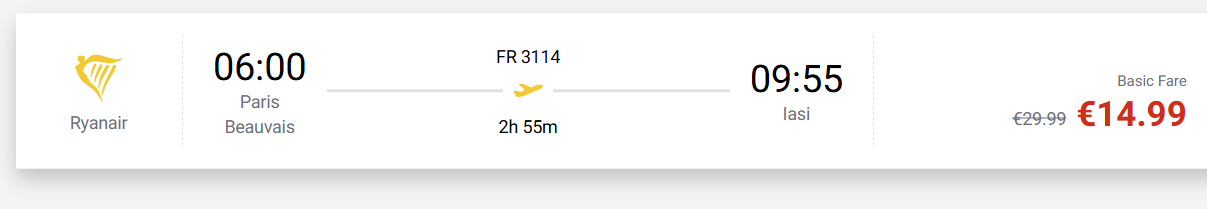

The cheapest Paris–Romania flights (today) are 14.99 EUR with the Ryanair sale. Nonstop.

So I’m sure we can agree that it’s way savvier to book with a self-transfer in Paris! It costs 700 CAD in flights instead of 1500 CAD!

And you can choose to visit Paris for a few extra days, for free better than free: you save hundreds of dollars on flights.

It’s better to plan more time in your self-transfer city before your longer and more expensive flight, as explained in the article about the self-transfer tip. So in this case, at the end of your trip, before the return flight from Paris to Montreal.

Obviously, the trick won’t work for all dates (like literally ALL 31 tips to save on flights). But it’s worth at least taking 5 minutes to check!

What are the prices of the Ryanair sale?

It’s easy to see the prices on the Ryanair sale page, as mentioned. But here are some examples for cities that are often the best for the self-transfer trick.

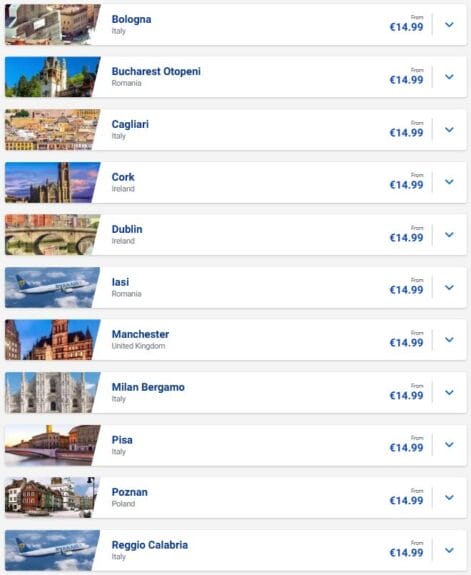

Ryanair sale from Paris:

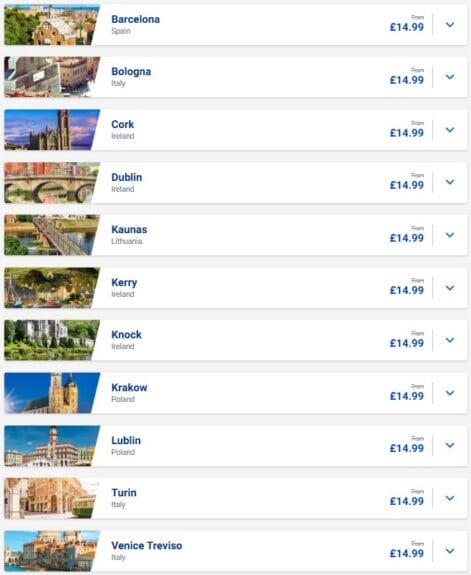

Ryanair sale from London:

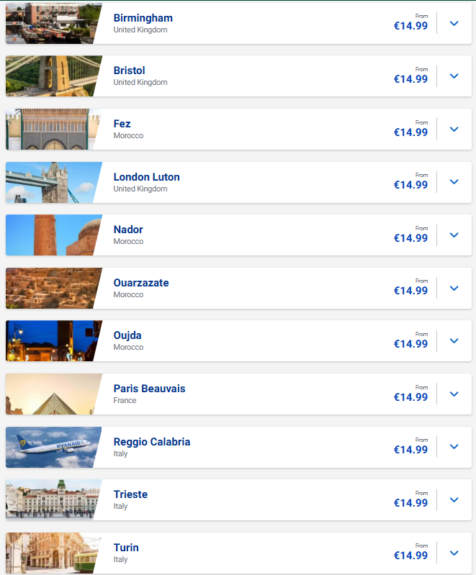

Ryanair sale from Barcelona:

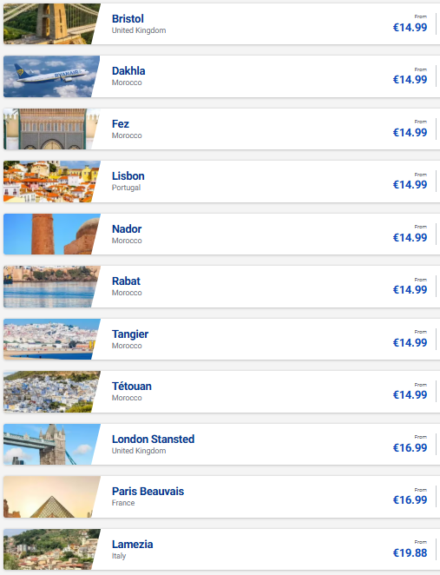

Ryanair sale from Madrid:

What is the best card to pay for flights during the Ryanair sale?

To pay for all your airline tickets (not just on Ryanair), it’s very important to choose the right credit card.

It’s that in addition to all the free travel they give you easily, they have good insurance (cancellation, interruption, flight delay, delayed/lost baggage, etc.)!

It’s so simple to not have to whine about paying for a hotel during a flight cancellation: just pay with a good credit card.

You have to pay with the card to be covered (EXCEPT for the medical insurance — the most important one — which usually covers you even without paying with your card, contrary to the common myth). Detailed post coming very soon.

Here are the 5 options in order of priority to pay for your flights:

- Card that has the travel rewards you want to use on the flight AND has insurance

- Card that has a welcome bonus you’re currently unlocking AND has insurance

- Card that has no foreign currency transaction fees AND has insurance

- Card that has a multiplier rate on travel AND has insurance

- Card that at least has insurance

Card that has the travel rewards you want to use on the flight AND has insurance

If you want to use bank rewards for the flights, you have to pay with the card in question.

Make sure the card has insurance.

Card that has a welcome bonus that you’re currently unlocking AND has insurance

If you don’t want to use travel rewards, which makes sense in many scenarios, you should ideally pay with a credit card on which you are unlocking a huge welcome bonus.

Because welcome bonuses are key! Most give the equivalent of 10-15% back; a little better than the 1% or 2% that people usually earn, huh!

| Best credit card offers (March 2026) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(13.3% back on $7.5k)

Rewards: $1000

Annual fee: $0 $139

Spend required:$7.5k in 6 mos.

Best for: 13.3% back on $7,500 & simple points

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(9.4% back on $7.5k)

Rewards: $825

Card fee: $120

Spend required:$7.5k in 12 mos. (or $2k)

Best for: ≈ 11.0% back on $7,500 & simple points

ends July 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 8.8% back on $18k)

Rewards: ≈ $1590

Card fee: $0 $199

Spend required:$18k in 12 mos. (or $5k/$9k)

Best for: ≈ 8.8% back on $18,000 & simple points

ends June 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit card offers (March 2026) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: $1000

Annual fee: $0 $139 (13.3% back on $7.5k)

Spend required:

$7.5k in 6 mos.

Best for: 13.3% back on $7,500 & simple points

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

12k

Valuation (BONUS) Valuation (BONUS)

Rewards: $825

Card fee: $120 (9.4% back on $7.5k)

Spend required:

$7.5k in 12 mos. (or $2k)

Best for: ≈ 11.0% back on $7,500 & simple points

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

80k/150k

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1590

Card fee: $0 $199 (≈ 8.8% back on $18k)

Spend required:

$18k in 12 mos. (or $5k/$9k)

Best for: ≈ 8.8% back on $18,000 & simple points

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1180

Card fee: $250 (≈ 7.8% back on $12k)

Spend required:

$12k in 12 mos.

Best for: ≈ 7.8% back on $12,000 & 8 lounge passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $120 (≈ 15.6% back on $5k)

Spend required:

$5k in 6 mos.

Best for: ≈ 15.6% back on $5,000 & lucrative pts

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Of course, if the card you’re currently unlocking the welcome bonus on doesn’t have good insurance, it should be avoided.

But it should also be avoided if the card has insurance but the flight you book is for after the end of your 1st year of the card (unless it’s one like the Marriott Bonvoy American Express Card that gives you value every year instead of just the 1st year like most cards).

Because you obviously still have to have the card during the flight, if you want the insurance that is very useful during the flight. If you have to pay the 2nd year’s fee just to get the insurance for a flight you booked, it lowers the net value of the deal on that card.

Card that has no foreign transaction fees AND has insurance

You’ll pay a 2.5% foreign transaction fee (FX fee) for nothing with almost all Canadian cards (often people don’t even know they’re paying this unfortunately). It completely eliminates the rewards you earn… and with most cards, it even makes you use your card at a loss instead of making a profit like you should!

Since welcome bonuses give 10-15% back, it’s okay to pay 2.5% in the previous option. You have to know how to count as I said.

But if you’re not unlocking a welcome bonus (you really should, I repeat), take that into account.

Most independent booking sites allow you to pay in Canadian dollars. So if this is your case, foreign transaction fees are not a factor.

(Always compare to see if the price of the same flight in the local currency of the country of departure would not be cheaper; it happens! It’s one of the tricks in our free ebook with 100+ travel tips!)

But if you book on the website of an airline that does not serve Canada (which you should often do if you want to save), the option to pay in Canadian dollars is often not available. That’s the case with the Ryanair website.

Among the few credit cards with no foreign transaction fees, not all of them have insurance. Here are the ones that do (they all have a minimum income though).

| Best credit cards with no FX fees and insurance |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(9.4% back on $7.5k)

Rewards: $825

Card fee: $120

Spend required:$7.5k in 12 mos. (or $2k)

Best for: Very good travel insurance and earn rate

ends July 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(6.0% back on $10k)

Rewards: $1000

Card fee: $399

Spend required:$10k in 14 mos. (or $3k)

Best for: Airport lounge access 10 passes

ends July 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(14.5% back on $2k)

Rewards: $440

Card fee: $150

Spend required:$2k in 3 mos.

Best for: Airport lounge access 6 passes

ends July 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards with no FX fees and insurance |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

12k

Valuation (BONUS) Valuation (BONUS)

Rewards: $825

Card fee: $120 (9.4% back on $7.5k)

Spend required:

$7.5k in 12 mos. (or $2k)

Best for: Very good travel insurance and earn rate

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $1000

Card fee: $399 (6.0% back on $10k)

Spend required:

$10k in 14 mos. (or $3k)

Best for: Airport lounge access 10 passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: $440

Card fee: $150 (14.5% back on $2k)

Spend required:

$2k in 3 mos.

Best for: Airport lounge access 6 passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Card that has a multiplier rate on travel AND has insurance

For most people, it’s worth paying the 2.5% FX fee rather than not having free insurance.

If you do this, prioritize using a card that at least has a multiplier earn rate on the travel category to make a small profit despite the FX fee (or to minimize your losses with the ones that aren’t as good).

| Best credit cards for earn rates on travel category |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(7.3% back on $4.5k)

Rewards: $330

Card fee: $0 $150

Spend required:$4.5k in 3 mos.

Best for: 3.33% and 4 annual airport lounge passes

ends October 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(4.2% back on $6k)

Rewards: $853

Card fee: $599

Spend required:$6k in 3 mos.

Best for: 3.33% and 6 annual airport lounge passes

ends October 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.8% back on $12k)

Rewards: ≈ $1180

Card fee: $250

Spend required:$12k in 12 mos.

Best for: ≈ 3% and 4 annual airport lounge passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards for earn rates on travel category |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)

Rewards: $330

Card fee: $0 $150 (7.3% back on $4.5k)

Spend required:

$4.5k in 3 mos.

Best for: 3.33% and 4 annual airport lounge passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $853

Card fee: $599 (4.2% back on $6k)

Spend required:

$6k in 3 mos.

Best for: 3.33% and 6 annual airport lounge passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1180

Card fee: $250 (≈ 7.8% back on $12k)

Spend required:

$12k in 12 mos.

Best for: ≈ 3% and 4 annual airport lounge passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $2101

Card fee: $799 (≈ 13.0% back on $10k)

Spend required:

$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 14-17 Best for: ≈ 3% and unlimited airport lounge access

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $120 (≈ 15.6% back on $5k)

Spend required:

$5k in 6 mos.

Best for: ≈ 1.875% and very valuable points

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $191.88 ($15.99/mo.) (≈ 7.9% back on $9k)

Spend required:

$9k in 12 mos.

Best for: ≈ 1.5% and best card overall in Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Card that at least has insurance

At the very least, pay with an old card that has insurance; even if you’re paying a 2.5% FX fee and it will cause you to use the card at a loss.

Learning how to travel for less

Join over 100,000 savvy Canadian travelers who already receive Flytrippers’ free newsletter so we can help you travel for less (and keep you updated on all things travel)!

Sign up for our free newsletter

Sign up for our newsletter

Summary

The Ryanair sale offers very low prices, because it’s a sale from an ultra low-cost carrier (ULCC) that already has very low prices to begin with. It’s worth keeping an eye on Ryanair sales when you need to book flights to Europe or the destinations around it, too.

What would you like to know about the Ryanair sale? Tell us in the comments below.

See the flight deals we spot: Cheap flights

Discover free travel with rewards: Travel rewards

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Featured image: Sale banner (image credit: Ryanair)