It’s well known that Canada’s airplane ticket taxes are already factually among the highest in the world. Like many other government services here, that certainly doesn’t mean better services; far from it (see: airport chaos, passport/NEXUS waits, etc.)… well, taxes are going to get even higher!

In ita budget presented yesterday, the federal government announced a 33% increase for one of the 3 taxes on flights.

They also announced changes to our traveler protection program, which has been terrible since its inception, but I’ll save that for a separate article tomorrow (you can join 95,000+ savvy Canadian travelers and receive our free newsletter so you never miss a thing).

Here we’re just talking about the tax side of the federal budget to start.

Overview of the tax increase announced

Here’s the meme we shared yesterday about how the federal government feels about taxes on flights here.

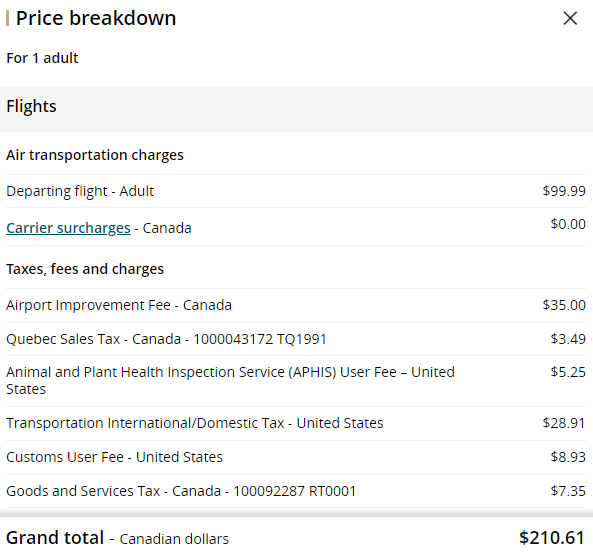

As a reminder, there are currently a few elements in the price of a plane ticket:

- What goes to the airline

- Airfare

- Surcharges

- What doesn’t go to the airline

- Security tax (fixed tax depending on the destination)

- Airport fees (fixed tax depending on the airport)

- Sales tax (variable rate depending on the province)

Officially, the security tax is called the “Air Travellers Security Charge” or ATSC. That’s the one that is going to be increased.

The airport fees are the highest tax and have already been increased by several airports during the pandemic, often significantly so. The sales tax is the same percentage as on any purchase, but the GST portion also applies to the amount of other taxes (so it’s a tax on the taxes in addition to being a tax on the amount that goes to the airline).

With this tax increase, it’s going to be even more important to check out our ultimate guide on how to save on airfare coming soon (there’s a teaser of 100+ pro tips for traveling for less in our free ebook in the meantime)!

Anyway, here’s what was announced yesterday about the security tax:

- 33% increase

- Effective May 2024

Here’s what the 33% increase announced looks like in dollars:

- Domestic flights (Canada)

- From $7.48 to $9.94

- Transborder flights (United States)

- From $12.71 to $16.89

- International flights (except United States)

- From $25.91 to $34.42

For a roundtrip flight, it’s 2 times that: these are the amounts for one-way flights of course, because every airplane ticket is always considered individually.

(By the way, for many flights, especially short-distance flights, you should very often buy 2 one-way flights instead of one roundtrip, but many travelers pay more because they are so used to always just buying roundtrips: it’s one of the tips in our free ebook that you should definitely download and read if you didn’t know you could save money by doing something as simple as buying 2 one-way flights instead of a roundtrip!)

So airfares in Canada are going to start at an even higher minimum than they do now — and airfares in Canada already start at a much higher minimum here than in just about any developed country on the planet.

Comparisons with the United States and Europe

To give some comparisons, let’s look just south of the border since many Canadians already fly from a nearby USA airport.

(And with this tax increase, the government just gave even more incentive to go encourage USA airlines and support the USA economy instead of Canada’s; in addition to often saving on the price, the ticket change policies are often more flexible too as explained in that article!)

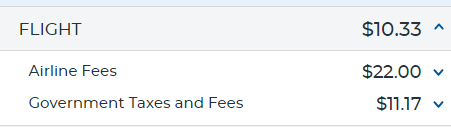

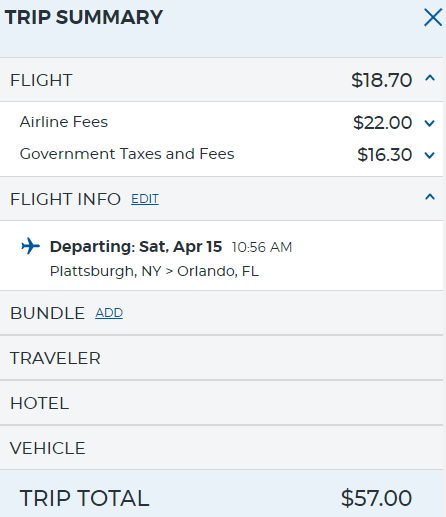

In short, for a domestic flight, in the USA, total taxes are as low as 15$C per one-way flight (11$US).

So not much more than just the new security tax in Canada for our domestic flights, without even taking into account our terrible airport fees which are $35 in Toronto (YYZ) and Montreal (YUL) for each one-way flight for example. And without taking into account the approximately 15% sales tax on these 2 taxes and on the actual airfare too.

That’s why the cheapest flight prices we spot on our cheap flight deals page are are around $90 roundtrip in Canada, while they’re often $50 roundtrip in the USA.

So let’s say you want to travel to the United States (which still has a mandatory vaccination rule, but has legal exceptions that we just found out about in case they extend the rule again April 10; post to come in case you’re interested or still think these rules are based on science).

A one-way ticket from Canada will cost at least $105 in taxes, plus the amount that goes to the airline (and the tax on that amount). Because the security tax is even higher than for domestic flights (and the USA will charge its international taxes too in that case).

For the same destination, departing from the USA will cost as little as C$22 (US$16) in taxes. This will make departures from a USA airport even more attractive, especially for the 90% of the Canadian population who live within 150 miles (240 kilometers) of the USA border.

In other words, Canadian taxes will be at least 377% higher for a Canadian departure than for a USA departure.

But it’s not just in the United States.

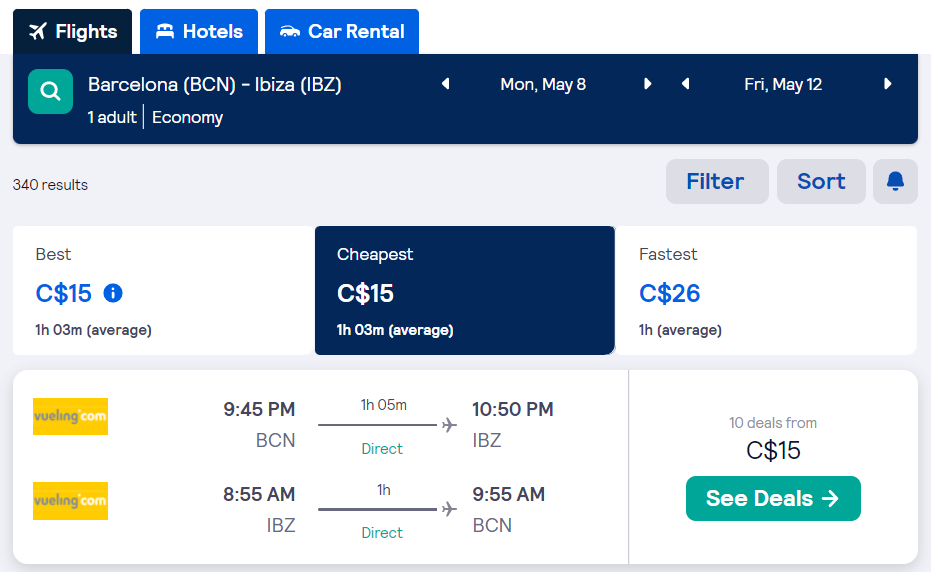

For a domestic flight in Spain for example, we told you about the flights at $15 ROUNDTRIP recently to make you understand that to go to Europe, the self-transfer tip is vital to know.

You can see that at most, taxes are $7.50 per one-way in this example.

Quite a bit lower than in Canada.