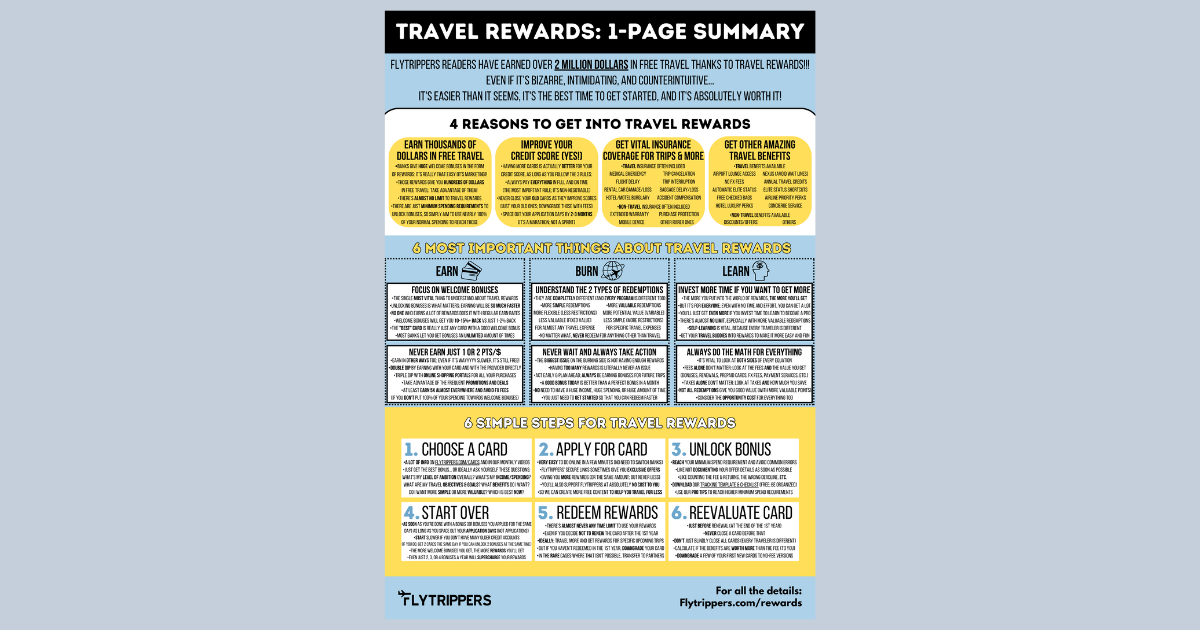

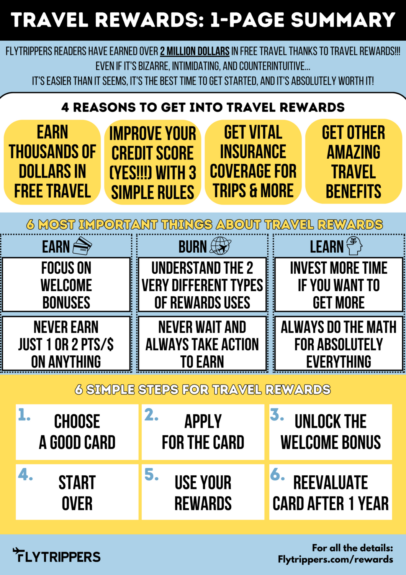

The very basics. Everything you need to know to get into the wonderful world of travel rewards. On just 1 page. All the information in the same place to get started the right way. Here’s the absolutely vital summary you must read first!

I’ll have more details about literally every aspect mentioned in the infographic — join the more than 100,000 savvy travelers who receive our newsletters by subscribing to our free newsletter specifically about travel rewards.

But I want to share this one-page summary with you right now — a version that requires less than 2 minutes and a version to easily become a pro in barely more time.

Infographic if you have under 2 minutes

You can see the full-size version.

Infographic if you want to really understand all the basics

You can see the full-size version.

Best way to get started

Stay tuned for full details in the coming weeks, but right now there’s an amazing deal on the best starter card!

Learn how to earn free travel

Sign up for free and stay tuned for more!

What would you like to know about travel rewards? Tell us in the comments below.

See the deals we spot: Cheap flights

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Featured image: Infographic (photo credit: Flytrippers)