There are so many travel tips that are soooooo simple that even relatively experienced travelers sadly don’t know. A great example is dynamic currency conversion (DCC), which is when a payment terminal offers you the option to pay in the local currency or in your card’s currency. You should ALWAYS pay in the local currency, and yet many people unfortunately fall for this monumental scam that’s so easy to avoid.

Obviously, like in Canada, when traveling, you should always pay for everything with a credit card to get rewards (like 20.5% back) and free protections on your purchases (several types of free insurance).

But in addition to choosing the right card (which is even more important when traveling, as I’ll explain), you should definitely not pay in Canadian dollars… unless you enjoy throwing money away.

Here is what you need to know about dynamic currency conversion (and part 2 soon will tell you how to disable the sneaky newly applied default option in the Uber app).

What is dynamic currency conversion?

There’s not much to add, as it’s very simple: on their credit card payment terminals, some merchants have pre-programmed a feature called dynamic currency conversion (DCC). Some ATMs do this too.

This means the screen shows you 2 options before letting you pay:

- An amount in the local currency

- An amount in your card’s currency

Why does dynamic currency conversion exist?

It’s a normal reflex to choose your card’s currency, the currency you know.

That’s why the scam works very well for merchants. Even though travelers should actually enjoy stepping out of their comfort zone at least a little (it’s kind of the point of traveling)… people always love everything that’s familiar to them, unfortunately.

This is the simple concept that explains why there are still people who pay 15 times more by using their roaming plan for internet access, why people withdraw money before leaving their country at a worse rate, why Canadian airlines charge more to Canadians than to Americans for the same flights, why restaurants with an English menu are twice as expensive as the others, etc. In short, why lots and lots of other things are overpriced and why almost everyone pays way too much for their travels.

So you may have paid too much by choosing this payment option in your local currency before.

If that’s the case, you are almost certainly also overpaying on so many other aspects of travel just because you don’t know certain simple tips. Dynamic currency conversion is one example among so many others of very easy travel tips, but that you simply can’t know if no one has told you.

It’s also yet another example of how simplicity and convenience always cost more: it’s simpler and more convenient for the average uninformed traveler to know exactly the amount in their currency without having to know how their bank will convert the amount.

Why should I avoid dynamic currency conversion?

It’s also very simple: dynamic currency conversion always charges you an atrocious conversion rate. What else could it be?

And why do you think they go to the trouble to offer to convert the amount for you? To scam you, obviously. They make profits off of badly-informed travelers, like so many others do.

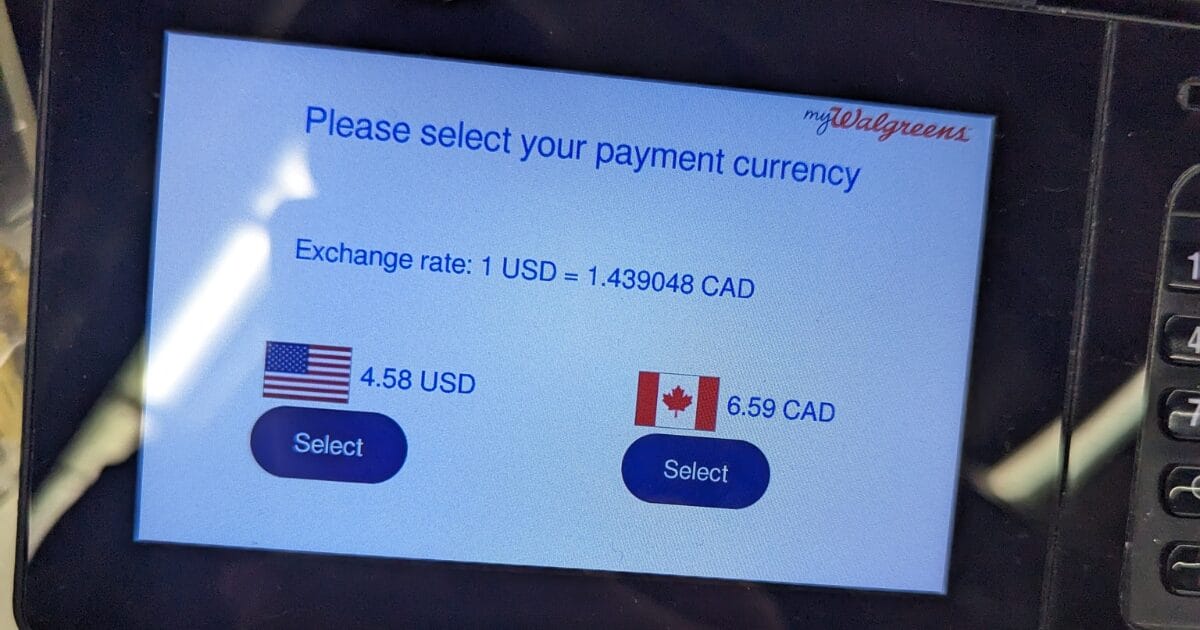

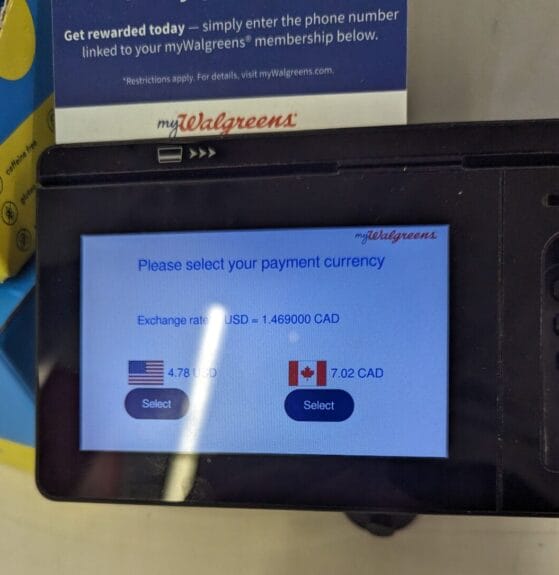

To give just one example, in the photo above, I paid US$4.78 at Walgreens in the United States on October 19th, 2023.

The dynamic currency conversion offered me to pay C$7.02.

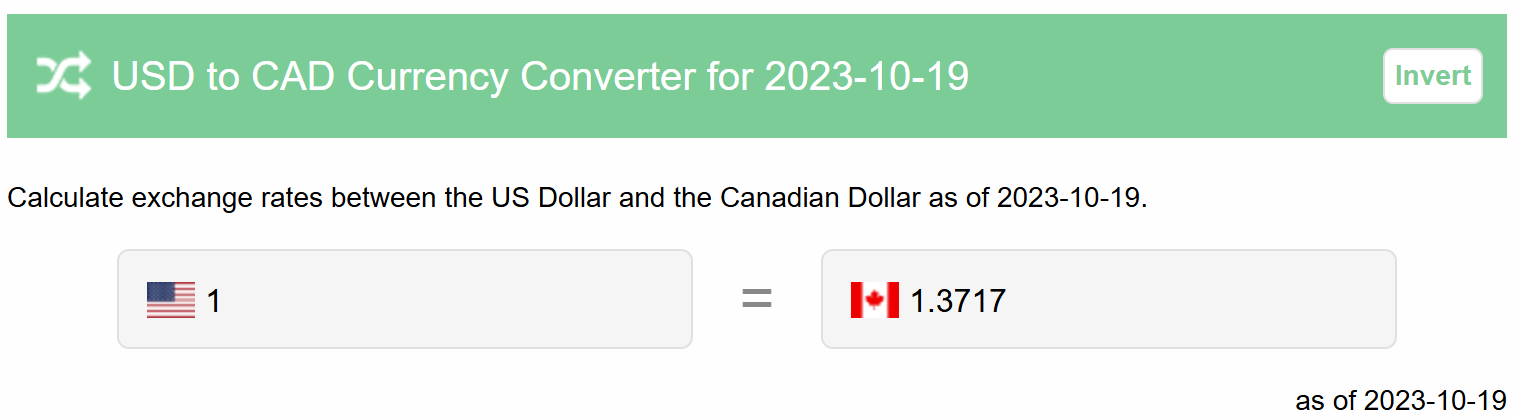

At the real conversion rate of the day, the equivalent should have been C$6.56.

That’s therefore a fee of 7.09% that’s completely unnecessary just because you don’t click on the right button. And 7% is not nothing!!!

Most people like to spend a lot when traveling, so if you get caught paying 7% for nothing on everything, it will add up very quickly. Sometimes, it’s a bit lower, like in this post’s cover pic (6.5%). And sometimes it’s 5%. It’s rarely under 5%, though.

Honestly, the least logical comment I see on this subject is as follows: “but it’s not that big a difference”. Of course not, at least not in absolute terms on any individual transaction.

But it’s still throwing money away. Why would you pay more for absolutely no reason? It makes no sense at all. Like the 2.5% fee that almost everyone pays on everything, too (next section).

I know very well how so many people want to make the absolute minimum effort in their life, and that’s fine. But it’s not even any extra effort at all in this case. Just click on the local currency. As easy as clicking on the *wrong* one that flushes 7% of your!

Don’t forget that saving just 40 CAD is enough for a full day of travel expenses (accommodation, food, transportation, activities, etc.) in plenty of awesome countries if you want to travel for less.

But even without knowing how to do math and without wanting to be super strategic and all… the principle is so simple: why pay more for nothing?

Why is it important to choose the right card?

The world of travel rewards is by far the easiest way to travel for less. It’s therefore always important to choose the right cards: the right cards to *get* throughout the year and the right cards to *use* throughout the year.

But it’s even more important for expenses made in a currency other than your local currency, so including everything you buy when traveling, obviously (except trips in Canada).

The thing is that almost all cards in Canada charge you a foreign currency transaction fee of 2.5%. It’s absolutely terrible to throw money away like that; really terrible. But…

If you’re a savvy traveler who understands that all your spending should be used to unlock huge welcome bonuses (like the one that gives you 1025 CAD in free travel), you still come out way ahead by using your card.

That deal gives you 20.5% back, so even by paying 2.5% in transaction fees, you earn a net rate of 18% back. A bit better than the atrocious rates of 1% or 2% back that most people sadly settle for, no? And better than earning 1% on a card you’re not unlocking a bonus on, just to save the 2.5% fee. Yes, 18% is much higher than 1%!

If you’re not unlocking a welcome bonus, however, it’s different (it should never be the case, I repeat: it’s literally THE most important thing about travel rewards).

In that case, the 2.5% fee is always less than the fee with dynamic currency conversion. At least! But it’s still not very savvy.

At minimum, open a completely free account with EQ Bank and get their free prepaid card: it’s NOT a credit card, so no verification or impact on your credit score and therefore EVERYONE should have it (no exceptions). This card doesn’t charge the 2.5% foreign currency transaction fee.

If they fit into your travel rewards strategy, you can also get one of Scotiabank’s no-foreign-transaction-fee credit cards, which are the only ones in Canada that don’t charge the 2.5% foreign currency transaction fee (along with 2 others that aren’t great).

You can read our ultimate guide on foreign currency transaction fees.

Learning how to travel for less

Join over 100,000 savvy Canadian travelers who already receive Flytrippers’ free newsletter so we can help you travel for less!