It’s important to know how to improve your credit score, especially if you’re one of the many Canadians with a slightly lower credit score. There are plenty of ways to improve it. It will allow you to easily get thousands of dollars in free travel thanks to travel rewards.

Contrary to the very common and very false myth, getting into the world of travel rewards will IMPROVE your credit score, in addition to giving you huge welcome bonuses, benefits, and insurance. But you need a good credit score to start with.

My credit score is excellent, in the 800s, because for 15 years I’ve been paying attention to it and investing time into travel rewards.

So here’s how you too can improve your credit score, with explanations about the basics and concrete pro tips you probably didn’t know about.

(This is just a teaser, I’ll have a more detailed guide for you soon: join over 100,000 savvy Canadian travelers who receive all our content and sign up for our free newsletter specifically about travel rewards!)

Overview of how to improve your credit score

To understand how to improve your credit score, you first need to understand the basics.

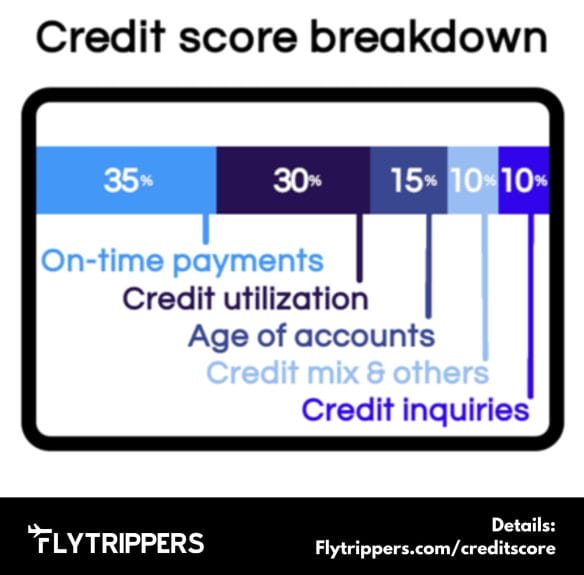

Here’s what goes into calculating your credit score.

There are 5 components to the credit score:

- On-time payments (35%)

- Credit utilization rate (30%)

- Average age of your accounts (15%)

- Credit mix (10%)

- Credit inquiries (10%)

This is not an opinion; it’s not subjective. It’s factually the way it’s calculated, that’s all. By TransUnion and Equifax, the 2 Canadian credit bureaus.

So how to improve your credit score is relatively simple:

- Always pay everything on time and in full

- Don’t use a too-big portion of your credit

- Never close your old credit cards

- Have different types of credit

- Space out your credit application days by at least 2-3 months

It’s not always easy, of course, but the theory is simple. It’s really just mathematical. That’s why I have a credit score in the 800s despite applying for many, many, many credit cards every year.

Because I follow the 3 simple rules of travel rewards that Flytrippers has been repeating for years:

- Always pay everything on time and in full

- Never close your old credit cards

- Space out your credit application days by at least 2-3 months

Our rules cover 3 of the 5 components. The credit mix is one we haven’t talked much about, because most people already have a car loan, a line of credit, or a mortgage.

What’s left is the credit utilization rate, the least-known component… and the one that’s really wonderful and improves your credit score without you having to do anything except apply for new cards.

Because applying for new cards:

- It will increase your available credit

- So it’ll lower your utilization rate

So it’ll improve your credit score IN ADDITION to giving you thousands of dollars in free travel and lots of other great perks!

Plus, having more cards also means more on-time payments are reported to the credit bureaus month after month! So having more cards has a major impact, which is entirely positive… on the 2 most important components of the score (which represent 65% of the score). And this major positive impact is really every single month!

But only if you pay everything on time, obviously.

If you don’t do that yet, here are some concrete pro tips to improve your credit score:

- Take advantage of a 0% interest rate on your outstanding balances

- Eliminate all your outstanding balances

- Use risk-free and fee-free reloadable prepaid cards

- Use KOHO Credit Building

- Use the Chexy Credit Builder (if you rent)

The absolute priority should be to pay all your balances off as quickly as possible, but the few other more concrete tips will improve your credit score faster too, so you should do them at the same time!

Here are some details on these 5 tips to improve your credit score, while we wait for our detailed guide to come soon.

Tip 1: Take advantage of a 0% interest rate on your outstanding balances

The Scotiabank Value Visa Card will allow you to get a 0% interest rate on your current balances for 10 months (with a one-time transfer fee of 1% of the amount).

This will save you literally hundreds of dollars in interest. Of course, just saving on interest won’t change your credit score. But the interest you owe stops going up at least.

So you can apply the money you save on interest to your outstanding balances. And that is vital to improve your credit score.

In short, it’s the 1st step because it’s going to help you get back on track and stop the new interest being added because of your unpaid balances, allowing you to stop impoverishing yourself and to stop enriching the banks.

You can read our detailed post on balance transfer promotions.

Tip 2: Eliminate all your outstanding balances

This is the top priority since it’s 35% of your credit score, the largest portion. Sorry, but none of the other tips will have a noticeable effect if you don’t pay off your balances.

The interest rates are so high that it’s not sustainable to keep balances. You have to tackle this as if your financial survival depended on it. Because it does.

It means making short-term sacrifices and depriving yourself of all expenses that aren’t absolutely essential. It’ll be so lucrative and you’ll have so much more money afterward. It’s worth it.

Because at 22.99% (the interest rate on many cards), it’s absolutely terrible to pay so much down the drain, and you know you have to get back on track.

Budgeting is the key. Investing time in finding ways to either reduce expenses or increase income.

It can certainly be difficult, but it’s essential to understand the importance of delayed gratification. Improving your self-control and psychological and mental strength like this… will benefit all areas of your life, not just the financial aspect.

Tip 3: Use risk-free and fee-free reloadable prepaid cards

With the Scotiabank Value Visa Card, you’ll be able to pay off your balances more easily without paying interest for 10 months… but it’s very important not to ADD to your unpaid balances too.

If you want to be on the safe side, there are no-fee no-risk reloadable prepaid cards that also let you earn rewards. They’re not credit cards, but they have some of the advantages of credit cards.

So they’re a great alternative to credit cards if you’re not confident that you’ll be able to pay off your credit cards 100% every month, as they do not charge interest.

Our Flytrippers recommendation is to get 3:

- EQ Bank Card (Pepaid Mastercard)

- KOHO Card (Prepaid Mastercard)

- Neo Money Card (not available in Québec)

Because all 3 are completely free and all 3 don’t involve a hard credit check (they’re not credit cards)! So there’s literally no reason not to get all 3. All 3 are reliable and safe too!

All 3 give you rewards on your spending and even interest on the money you’ll have loaded onto the card (a lot better than charging interest).

In short, it’s like a debit card, so you can’t spend more than you load onto your card yourself! Guaranteed!

Unlike debit cards, which are all terrible, you earn:

- At least a bit of rewards

- Much more interest than a bank chequing account

Rewards are microscopic compared to credit cards. But since your priority is to improve your credit score, it’s better to be sure you’re paying 0% interest on all your purchases until you’re sure you’re able to use credit cards the right way.

The EQ Bank Card earns 0.5% cash back on everything. The KOHO Card earns 1% just on groceries (including grocery gift cards) and transportation, but 0% on everything else. The Neo Money Card earns 1% on gas and groceries, but up to 5% at select Neo partners that you can see in the app.

Hence the reason why savvy travelers get them all: to get 5% at some retailers, 1% on groceries and transportation, and at least 0.5% on everything else. The best of all worlds. Because again: it’s completely free and there are no credit checks. It really doesn’t make sense not to get them if you want to maximize your rewards.

In terms of earned interest, you get 4% with EQ Bank (if you send your payroll by direct deposit, otherwise it’s 2.5%). If you don’t do the payroll deposit, KOHO is better because it’s 3% interest for everyone. Interest adds up until the very moment you spend the money loaded on your card (calculated daily).

Personally, my main everyday account is now with EQ Bank. It’s hard to beat 4% on a standard savings/chequing account. All transactions are free and unlimited, and there are really no monthly fees or anything like that.

The EQ Bank Card even offers 0% foreign transaction fees, while all debit and credit cards (except 8) in Canada charge 2.5% on everything you buy while traveling!

To be very clear, reloadable prepaid cards are not at all as good as credit cards, which have:

- Welcome bonuses of up to $925

- Much better earn rates

- Much better benefits and privileges

- Free insurance

But credit cards should absolutely be used only if you can pay them back on time and in full every month.

So if you’re not quite there yet, using EQ Bank and KOHO prepaid cards is the best way to make sure you don’t add to your balances.

Tip 4: Use KOHO Credit Building

KOHO Credit Building is an optional tool that can come in very handy.

KOHO says that, on average, their users gain 22 points on their credit score after 3 months. Approval is guaranteed and there are no credit inquiries or even applications to complete.

For a fixed monthly fee of just a few dollars a month, KOHO Credit Building will open an interest-free line of credit for you, and you determine the amount you’ll pay each month to generate an on-time payment.

This on-time payment will be reported to the Equifax credit bureau to help you improve your credit score — because more on-time payments are better for your credit score.

Once again, that’s why having more cards is better for your credit score IF you pay them in full on time.

(I repeat it because there’s such a persistent myth that it’s bad to have more cards — when it’s completely false. If you don’t pay on time and in full, of course it’s bad to have more cards. But only if you don’t pay on time and in full!)

You can stop the KOHO Credit Builder easily at any time. Personally, if I had to rebuild my credit, I’d try it because the cost is so low compared to the thousands of dollars you’ll earn in travel rewards once your credit is improved. It’s worth speeding up the process to get to those welcome bonuses faster!

You can add KOHO Credit Builder to your account online or in the app once you’ve applied for the KOHO Card (prepaid Mastercard) which is completely free and requires no credit request.

Tip 5: Use the Chexy Credit Builder (if you rent)

Chexy is a service that lets you pay your rent with your bank account (not interesting except for building credit) or with a credit card (very lucrative if you have the right cards; I’ll explain briefly below to tease the full post).

Paying your rent with Chexy itself doesn’t require getting your landlord’s approval, or even notifying them (including for payment by credit card).

However, the optional Chexy Credit Builder service does require your landlord to complete a 30-second online verification, for security and fraud reasons. Not complicated, but obviously not every landlord will want to.

If it works with yours, you’ll pay your rent from your bank account via Chexy and their Credit Builder service will report your rent as an on-time payment to the Equifax credit bureau to improve your credit score, like the KOHO Credit Building above.

The Chexy Credit Builder costs just $9.99 a month, with a special offer at $7.99 right now for a limited time. You can also stop it at any time.

So it’s not free, but since rent is often one of the biggest monthly expenses, it may be worth it to speed up your credit score improvement on top of the KOHO Credit Building if your landlord agrees to give you 30 seconds.

More on-time payments reported to the credit bureaus each month will enable you to get an easy 2.25% profit on your rent by paying it with a credit card via Chexy.

Because Chexy is coded in the “recurring payment” category, you can pay with the Scotia Momentum Visa Infinite Card, which gives you 4% cash back.

So even by paying Chexy‘s 1.75% fee (just for credit card payments, not from your bank account), you’re still making a 2.25% profit!

If you pay $1,200 a month in rent, that’s $27 free every month for a total of $324 free in the year effortlessly (because there’s no annual fee in the 1st year on the Scotia Momentum Visa Infinite Card).

This part of Chexy is going to be a separate post very soon.

Learning how to travel for less

Join over 100,000 savvy Canadian travelers who already receive Flytrippers’ free newsletter so we can help you travel for less — including thanks to the wonderful world of travel rewards!