The world of travel rewards is awesome and will easily give you over a thousand dollars in free travel every year. But to be very clear, always paying all your balances in full and on time is one of the 3 most important rules. If you can’t manage to do it yet, you’re not alone — and this tip is for you.

Flytrippers wants to help you get back on track and this tip will definitely help you regain control.

Here’s how you can pay 0% interest on your current credit card balances for 12 months (with a nice infographic of your savings, too).

How to save interest on your unpaid credit card balances

This great tip is very simple:

- Apply for the MBNA True Line Mastercard (no annual fee)

- Transfer your outstanding balances from other cards to your MBNA True Line Mastercard

- Pay no interest for 12 months on your transferred balances (0% promotional rate)

- Pay only a one-time transfer fee of 3% of the amount transferred

- Save hundreds and hundreds of dollars on interest

(If you live in Québec, that offer is not available. The Scotiabank Value Visa Card is the next best one!)

Let’s say you have $5,000 in unpaid balances… that’s $874 in savings in those 12 months!

There are credit cards with fantastic welcome bonuses that give you $1025 with no annual fee the 1st year, but if you have unpaid balances, you probably won’t be approved for them. Most importantly, it’s not a good idea to apply for a new card before you’ve sorted out your situation.

However, there is one exception to that application rule: you should absolutely get a card that offers a special interest rate on balance transfers!

Our Flytrippers recommendation is the MBNA True Line Mastercard, which is the best right now. It will allow you to get a 0% interest rate on your credit card balances that you transfer to this card, for a full 12 months!

There is a one-time transfer fee of 3% of the amount transferred, but that’s nothing compared to the savings you’ll make!

Imagine how much you could save in interest over 12 months, considering that many cards charge over 20% interest!

With this pro tip, you’ll pay 0% for almost a whole year! A big difference!

It’s really amazing:

- At the 20.99% rate of many cards, you’ll pay about $1024 in interest over 12 months if you don’t change anything

- With the 3% transfer fee from the MBNA True Line Mastercard, you’ll pay $150 and that’s it for 12 months

It’s not too good to be true! Balance transfer promotions are just not very well-known, like the rest of the world of credit cards — there are also still a lot of people who sadly don’t know that banks give welcome bonuses worth $1025 in travel rewards!

How to take advantage of this deal on credit card balance interest rates

You can easily and quickly apply via our secure MBNA link.

For all the details, you can read our resource page for the MBNA True Line Mastercard.

Good news: there is no annual fee. So if you don’t need it in 1 year, you can close it and pay nothing.

What’s important, however, is to never close your old cards, as this is very bad for your credit score. Downgrade them to a no-fee version if they have fees. Put them away in your drawer if you don’t want to use them, but never close them!

There is no minimum income requirement for the MBNA True Line Mastercard, but the balance transfer promotion won’t work if your balance is on another MBNA card or a TD card (TD Bank owns MBNA).

Knowing how to do the math is important in the world of travel rewards (and travel in general and even in life in general). This 3% transfer fee is the best example. Of course, a fee is bad if you look at the fee alone, but this 3% fee saves you 20.99% in interest on many cards!

The same principle always applies to everything: always look at the fee AND at what the fee gives you! It’s the most basic thing about math: looking at both sides of an equation.

What to do after you’ve seized the 0% interest deal

In terms of logistics, the actual balance transfer is easy to do once you receive your MBNA True Line Mastercard.

Make sure not to add any new balances to your cards, though.

You can read the tip about fee-free risk-free prepaid cards that offer rewards in the teaser for our guide on how to improve your credit score. It’s a good trick to know and it’s also super easy!

In short, the MBNA True Line Mastercard will give you 12 months to focus on repaying your balances, without having to pay a single penny in interest.

Then, you’ll be able to take advantage of the great deals that almost always require a good credit score.

As motivation, keep in mind that you’ll soon be able to join our Flytrippers readers, who have earned over 3 million dollars in free travel thanks to our travel rewards deals (in addition to getting many amazing travel benefits, like free access to airport lounges)!

Plus, when you pay off all your balances in full and on time, applying for more cards will even improve your credit score, contrary to the common myth.

Having unpaid credit card balances

You’re definitely not the only one in this situation. Statistics in Canada show that many people have unpaid balances on their credit cards.

I don’t need to tell you it’s not a good idea and the interest rates are horrible.

You know it’s something you have to pay off as quickly as possible, but it can sometimes be hard to get out of because the interest you have to pay is so high. And things happen. The holidays can be difficult. Etc.

That’s why I wanted to explain this great tip that will help you if you need a boost to pay it all back. The MBNA True Line Mastercard will help you!

By eliminating unpaid credit card balances:

- You’ll save a lot of cash in interest

- Money that could be used for travel

- Or to invest in your future

- You’ll improve your credit score

- To be approved for good travel reward cards

- Or to help you financially in general

How to improve your credit score with other pro tips

Of course, the most important thing you can do to improve your credit score is to pay all your balances in full and on time.

It’s by far the most fundamental thing, and it’s the absolute priority.

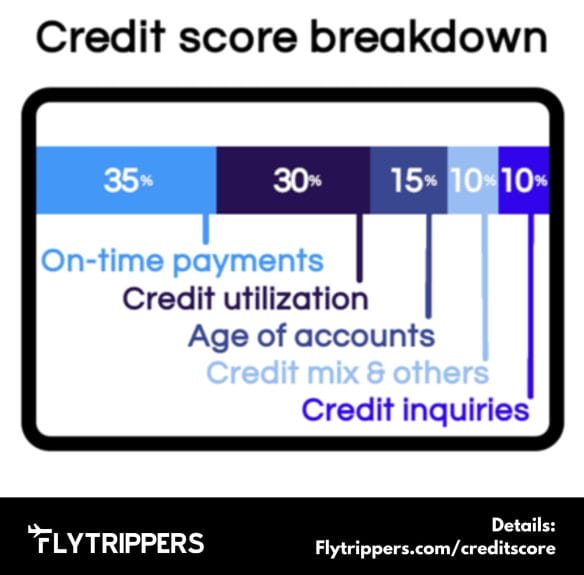

On-time payments account for 35% of your credit score. It’s the component that’s worth the most in the calculation!

But while working on this, you can (and you should) also apply a few other tips that are excellent for improving your credit score.

To find out more, read the teaser for our upcoming guide on how to improve your credit score.

Learning how to travel for less

Join over 100,000 savvy Canadian travelers who already receive Flytrippers’ free newsletter so we can help you travel for less — including thanks to the wonderful world of travel rewards!

What would you like to know about how to get a 0% interest rate? Tell us in the comments below.

See the flight deals we spot: Cheap flights

Discover free travel with rewards: Travel rewards

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Featured image: Fuvahmulah, Maldives (photo credit: Nattu Adnan)

What happens if you want to transfer $5000 but your card is only approved with a $2000 limit? Do you transfer $2,000 and then pay it off, and then transfer another $2,000 and then pay it off, and then transfer the remaining $1,000 and then pay it off?

That seems to be the way to go indeed. The promotional 0% interest rate applies to all balance transfers during the first 10 months, so there’s no requirement for all the transfers to be done at once (for the Scotiabank Value Visa Card at least, others have different rules).