We’ve talked a lot about regular (“personal” or “consumer”) credit cards, but there are also a few “business” cards. Those issued by Amex offer some of the most valuable welcome bonuses in Canada (with amazing benefits too), and you don’t need an incorporated business to be eligible to get them!

Here are the details.

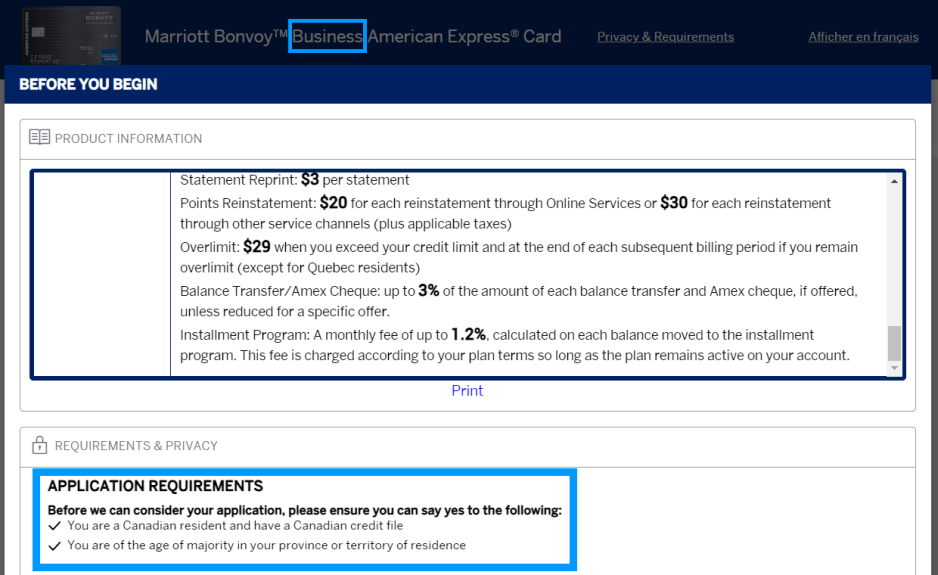

Eligibility for Amex “business” cards

Having the word “business” in the card name can seem a little confusing indeed.

But no, contrary to the widespread myth, you do not need to be incorporated as a business and you do not even need to be self-employed or anything at all to get an Amex “business” card.

There are no requirements at all in fact, as you read yourself on their official application page!

There are a few special instructions for the application itself though!

How to apply for Amex “business” cards

For the legal name of the business, put your full name.

For the business income, you can estimate a very minimal non-employment income that you might want to reach in any given way (maybe you’ll resell things on Facebook Marketplace, for example), they won’t ask for proof of income this way.

The number of employees would be 1 (you) if you don’t have any employees.

That’s what I did with my Amex Business Gold Card just to show you, even though I could’ve used Flytrippers as a business. My name appears as the business name under my name.

As with personal credit cards, Amex pretty much only looks at your credit score, unlike all other banks.

(Other banks often have minimum income requirements for regular cards and only allow businesses to get “business” cards, too!)

So with Amex, you can get those “business” cards to have even more potential to earn free travel!

The welcome bonuses for “business” credit cards are very high, but some of them come with higher minimum spend requirements than regular consumer cards. So that’s sometimes the main obstacle, as it can be a bit more difficult to reach them, even with our tips.

It’s worth the effort though, to get the most valuable points out there, which are often those offered by Amex (either Amex points, Aeroplan points, or Marriott points).

The best Amex “business” cards in Canada

Here are the best Amex “business cards” worth considering at the moment!

| Best Amex "business" credit cards |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(≈ 8.2% back on $7.5k)

Rewards: ≈ $814

Card fee: $199

Spend required:$7.5k in 3 mos. spend $7.5k in 3 mos. &

make 1 purchase in months 15-17

Best for: More valuable Amex points for Aeroplan or Avios

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 9.5% back on $15k)

Rewards: ≈ $2222

Card fee: $799

Spend required:$15k in 3 mos. spend $15k in 3 mos. &

make 1 purchase in months 15-17

Best for: Big spenders & luxury travelers

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 15.6% back on $6k)

Rewards: ≈ $1083

Card fee: $150

Spend required:$6k in 3 mos. spend $6k in 3 mos. &

make 1 purchase in months 15-17

Best for: Valuable Marriott certificate another must-have

ends August 18th

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best Amex "business" credit cards |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $814

Card fee: $199 (≈ 8.2% back on $7.5k)

Spend required:

$7.5k in 3 mos. spend $7.5k in 3 mos. &

make 1 purchase in months 15-17 Best for: More valuable Amex points for Aeroplan or Avios

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $2222

Card fee: $799 (≈ 9.5% back on $15k)

Spend required:

$15k in 3 mos. spend $15k in 3 mos. &

make 1 purchase in months 15-17 Best for: Big spenders & luxury travelers

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1083

Card fee: $150 (≈ 15.6% back on $6k)

Spend required:

$6k in 3 mos. spend $6k in 3 mos. &

make 1 purchase in months 15-17 Best for: Valuable Marriott certificate another must-have

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1172

Card fee: $599 (≈ 5.5% back on $10.5k)

Spend required:

$10.5k in 3 mos.

Best for: Frequent Air Canada travel & maximizing Aeroplan

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Want to get more content about travel rewards points?

Summary

Amex “business” cards are a great way to earn even more travel rewards. All travelers are eligible to get them, despite what the name seems to indicate!

Have any questions about Amex “business” cards? Ask us in the comments below.

Explore awesome destinations: travel inspiration

Learn pro tricks: travel tips

Discover free travel: travel rewards

Featured image: Coworking space (photo credit: Shridhar Gupta)