American Express points are our favorites among the dozens of types of rewards we earn. They’re also a favorite of most travel rewards pros in Canada. They’re so versatile… but more importantly, they’re so valuable. Amex points are really must-haves, especially if you want to maximize your free travel!

So we’ll look at 34 good uses of Amex points, to give you concrete examples. This is while you await more content, tips, and guides on all the major rewards programs — including Amex — very soon.

(You can also join our free webinar for beginners on May 17!)

Basics of Amex points

Among the best credit cards in Canada, some of the most valuable cards earn Amex points, which can be transferred 1 to 1 to Aeroplan points (spoiler alert: often the best use), but are way more flexible than Aeroplan points.

That’s because they can also be transferred to more airline programs, be used as a simple travel credit (for the many travelers who always prefer things that are more simple rather than more valuable), and be used in a few other ways instead (while Aeroplan points can only be used as Aeroplan points).

It gives you more choices.

Best credit cards for

Amex MR points

American Express® Gold Rewards Card

Card:

Bonus: spend $1k/mo for 12 mos.

WELCOME BONUS

(

Rewards: ≈ $1180

Card fee: $250

Best for: 72,000 pts

+ 4 lounge passes

and $100 travel credit

American Express Cobalt® Card

Card:

Bonus: spend $750/mo for 12 mos.

WELCOME BONUS

(

Rewards: ≈ $900

Card fee: $156

Best for: 60,000 pts

+ 5X earn rate

no increased offer

Platinum Card® from American Express

Card:

Bonus: spend $10k in 3 mos.

WELCOME BONUS

(

Rewards: ≈ $1600

Card fee: $799

Best for: 80,000 pts

+ unlimited lounges

and $200 travel credit

American Express® Green Card

Card:

Bonus: spend $1k in 3 mos.

WELCOME BONUS

(

Rewards: ≈ $165

Card fee: $0

Best for: 11,000 pts

+ no fees

but way less value

American Express® Business Gold Rewards Card

Card: no business required

Bonus: spend $5k in 3 mos.

WELCOME BONUS

(

Rewards: ≈ $1125

Card fee: $199

Best for: 75,000 pts

+ simpler

min. spend structure

American Express Business Edge™ Card

Card: no business required

Bonus: spend $5k in 3 mos.

WELCOME BONUS

(

Rewards: ≈ $750

Card fee: $99

Best for: 50,000 pts

+ 3X earn rate

no increased offer

Business Platinum Card® from American Express

Card: no business required

Bonus: spend $15k in 3 mos.

WELCOME BONUS

(

Rewards: ≈ $1801

Card fee: $799

Best for: 98,750 pts

+ unlimited lounges

different min. spend

Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information.

In short, you can get 60,000 American Express points with the Amex Cobalt Card, which is the best overall card in Canada. Its business version, the Amex Business Edge Card, gives you just 50,000 so it isn’t as interesting — unless you want a lower fee instead of doing what you should do, which is looking at the total value.

(A reminder: no need to have a business for Amex “business” cards, but the minimum spend requirements are higher though!)

The Amex Gold Rewards Card requires a lot of spending with its current offer. The Amex Business Gold Card is therefore better right now.

If you choose the premium cards with the amazing unlimited airport lounge access perk, the Amex Platinum Card or the Amex Business Platinum Card, you get a lot more points but you need to spend a lot more to unlock the bonus too.

Finally, the Amex Green Card has no fee, so there’s no upside for those who want to earn fast, as usual! But it’s the best among all no-fee cards in Canada at least, if you insist on earning slowly and getting a lower total value.

How to use Amex points

Amex points are hybrid rewards since they can be used as both of the 2 only types of rewards that exist: variable-value rewards (more complicated, more value) or fixed-value rewards (less complicated, less value).

But as I said, Amex points are very flexible so they can be used in more than just 2 ways!

So we will divide the article into the 6 different ways that Amex points can work:

- Transfer to Aeroplan (18 good uses)

- Transfer to Avios (12 good uses)

- Transfer to Flying Blue and others (1 good use)

- Transfer to Marriott or Hilton (1 good use)

- Reward flights with the Amex price chart (1 good use)

- Travel credit to erase any travel expense (1 good use)

1. Transfer to Aeroplan (18 good uses)

This is almost always going to be the best use, because Aeroplan is such a great program since it was revamped in November 2020.

We’ve put together an article that lists 18 great uses of Aeroplan points to give you plenty of easy-to-see real-world examples.

Note that 60,000 Amex points = 60,000 Aeroplan points (1 to 1 transfer rate).

This option can give you up to 10 one-way short-distance reward flights!

2. Transfer to Avios (12 good uses)

The Avios program is not as simple (and has fewer good options), but depending on your travel preferences, it can be very valuable too.

We’ve put together an article that lists 12 good uses of Avios points.

Again, 60,000 Amex points = 60,000 Avios points (1 to 1 transfer rate).

This option is very similar and can also give you 10 one-way short-distance flights, but with much fewer options compared to Aeroplan.

3. Transfer to Flying Blue and others (1 good use)

Okay, there is more than 1 good use with the other airline partner programs, but it’s really a lot rarer that it’s a good value. So we’ll say 1 good use for now: for a sweet spot with other partners.

The 4 other Amex airline transfer partners are:

- Air France / KLM Flying Blue

- Cathay Pacific Asia Miles

- Etihad Guest

- Delta SkyMiles

Sweet spots are less common with these 4 partner programs in large part because they have a worse transfer rate! It’s a 1 to 0.75 rate… instead of the 1 to 1 rate for Aeroplan and Avios. So 60,000 Amex points = 45,000 points from these programs.

We’ll discuss it in more detail, but one of the sweet spots is when Flying Blue has monthly promotions like in April: only 15,000 Flying Blue points for Montreal-Europe roundtrip. So 60,000 Amex points would give you 3 one-ways to France, which is not bad despite the sometimes higher taxes with Flying Blue.

The Asia Miles, Etihad Guest, and Delta SkyMiles programs can be interesting too, but it’s just a lot less frequent. More details to come.

4. Transfer to Marriott and Hilton (1 good use)

On the hotel side, the value is not exceptional compared to how valuable Amex points can be for flights.

I’d very rarely recommend this, so again we’ll say 1 good use: if you find a good sweet spot to really maximize hotel points (most likely Marriott points).

We’ve put together an article that lists 5 countries where you make good use of Marriott points. For example, with your 60,000 Amex points, you’d get 12 completely free hotel nights! At the other end of the spectrum, hotels that are very expensive with cash can be an even better use, in terms of monetary value. Even if you get fewer nights.

It depends on what you want to maximize: the amount of trips you get or the amount of money you save! Our ultimate guide to the Marriott Bonvoy program is one that’s ready and it explains everything.

But you really must understand that it’s far from certain that transferring to hotel partners is a good use of Amex points.

This time, 60,000 Amex points = 72,000 Marriott points (1 to 1.2 rate). That seems like a much better transfer rate, but no: hotel points are worth much less than airline points.

As for Hilton, the other hotel transfer partner, that’s almost never a good use (60,000 Amex points = 60,000 Hilton points… and those are worth less than Marriott points on top of that). We’ll have an overview of all the other major hotel rewards programs soon.

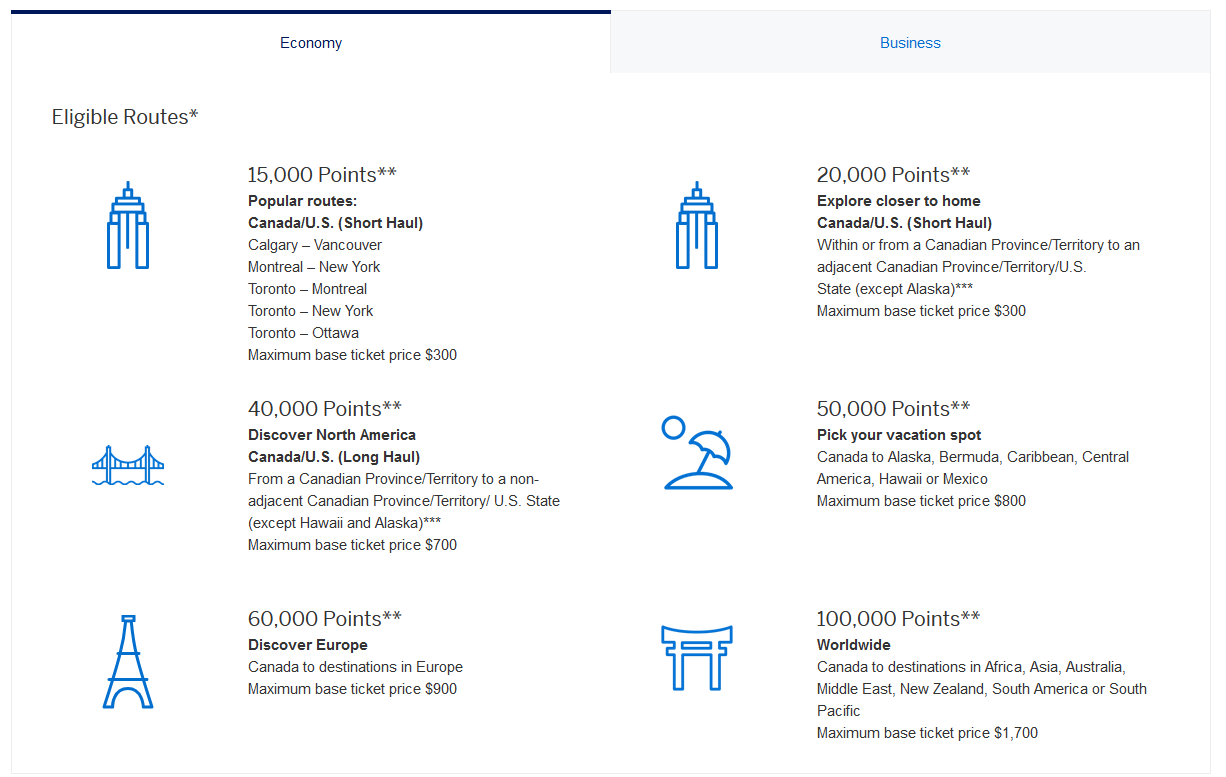

5. Reward flights with the Amex price chart (1 good use)

We’re now at the first of the 2 uses of Amex points that don’t involve transferring to another program. The Amex price chart is officially called the Amex Fixed-Points Travel Program.

I’ll do a separate article for you soon, but basically, the Amex price chart has only one good use: when airline tickets are very expensive in cash.

The thing is the price chart will give you a ticket for a fixed number of points, regardless of the cash price (with a maximum price though).

It’s harder to maximize than airline partner programs, at least for those who don’t normally buy expensive flights. And it’s much more restrictive: you have to book flights only departing from Canada and you can only book roundtrips (compared to the RBC price chart that also allows one-ways and USA departures for example).

Here is the Amex price chart for roundtrip reward flights (directly through the Amex program instead of having to transfer points).

So for example, let’s say you use 60,000 of your Amex points for 4 roundtrip flights that cost 15,000 points… you could “save” $1200 ($300 x 4)!

That would give a great value of 2¢ per point (and the Amex Cobalt Card‘s welcome bonus would be worth $2344 instead of ≈ $744 at our always conservative Flytrippers Valuation).

However, that means you’d be paying for very, very expensive tickets. So it’s just a good use if you were really going to pay a lot of money for those flights (if you didn’t have any flexibility for example). And when the plane ticket’s base fare is as close as possible to the maximum ticket price in the Amex price chart.

When used this way, Amex points only cover the base fare, so not the taxes and some other fees. The maximum ticket price in the price chart is also only for the base fare (the same as the RBC price chart for reward flights).

Remember that what’s important is not how much you pay out of pocket, but how much you SAVE in total, at least if you know how to do the math and if you want to get the most value with your rewards.

So the RBC price chart can still be interesting if you have to go somewhere and the flights are very expensive. For example, if you are going to a European destination that is very expensive for your dates, that can easily cost $1600, especially if you’re not in Toronto or Montreal (which is sad considering we often spot deals to Europe in the $400s roundtrip).

With 65,000 RBC points (the 5,000 missing after the welcome bonus are pretty easy to earn), you could save $1300, a great use on paper. But it’s not a good use if the alternative is a flight to Europe paid with cash that has just a $300 base fare.

To give you an idea, I’ve used airline reward programs for dozens and dozens of flights in the past 10 years, and I haven’t used the bank price charts even once. Because I usually don’t buy expensive flights so it’s less beneficial for me.

In short, the value you can get with the Amex price chart really depends on your personal situation and how good you are at finding cheap flights. As is always the case in the world of travel, you have to compare!

6. Travel credit to erase any travel expense (1 good use)

Finally, the only option that has a fixed value… isn’t really a good use at all in fact.

It’s a “good” use only if you want to keep it simple and are willing to get a lot less value in return, as so many people are.

Instead of being worth ≈ $744, the Amex Cobalt Card‘s welcome bonus is worth a flat $444 net if you use it like this. Because as a travel credit, 60,000 Amex points = $600.

But it’s much simpler: you can apply the points to any travel expense.

You don’t have to think anything through, you don’t have to maximize anything, you don’t have to take any specific flights, you don’t have to book on any particular site… it’s really as simple as it gets.

Any travel expense. Very simple.

That’s why the other options are about 50% more valuable… but even $444 for free is pretty good!

Summary

The American Express Cobalt Card has one of the best offers in Canada. These examples may give you a good idea of what you could do with the welcome bonus, while you wait for our more comprehensive guides.

Have any questions about American Express points? Ask me in the comments below.

Want to be the first to get our free travel rewards course and all our content?

See the deals we spot: Cheap flights

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Discover free travel: Travel rewards

Featured image: Ecuador landscape (photo credit: Robinson Recalde)

Advertiser Disclosure: In the interest of transparency, Flytrippers may receive a commission on links featured in this post, at no cost to you. Thank you for using our links to support us for free, we appreciate it! You allow us to keep finding the best travel deals for free and to keep offering interesting content for free. Since we care deeply about our mission to help travelers and our reputation and credibility prevail over everything, we will NEVER recommend a product or service that we do not believe in or that we do not use ourselves, and we will never give any third-party any control whatsoever on our content. For more information on our advertiser disclosure, click here.

The views and opinions expressed in this blog are purely our own. Redemption values evoked are also Flytrippers’ own and solely based on our own points valuation estimates as described. All offers described on the Flytrippers website are subject to the financial institutions’ latest terms and conditions that can be found on their website.

Offers from financial institutions change quickly; it is your responsibility to ensure the accuracy of these offers on their website when applying for a card. Flytrippers will not accept any responsibility for the accuracy of the offers or the result of your actions.

American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information click on the provided links to proceed to product website. All the information was independently collected by Flytrippers and not provided by financial institutions.

Flytrippers’ website does not contain all available credit card offers or all available credit card companies on the market. Flytrippers never shares an offer if it is not considered advantageous for certain travelers, at its sole discretion.

No author on Flytrippers’ website is a financial advisor, a financial planner, a legal professional, or a tax professional and no author on Flytrippers’ website can in any way be considered as such.

All articles and pages on Flytrippers’ website are merely personal opinions of a general nature and are for informational purposes only and should not be considered as advice for specific situations. It is your responsibility to perform your own personal research to make sure that travel rewards points are appropriate for your own situation.

The opinions expressed on Flytrippers’ website are those of the authors only and have not been provided, approved, endorsed, or ratified by any third party mentioned on the site.

You can learn more about our terms of use here.