There are some amazing deals ending TONIGHT that are literally the highest ever in Canada. This is THE time to apply for a card and get lots of free travel, even if you (sadly) just do it once a year. There are 2 that stand out, giving ≈ $945 and ≈ $915 in net value just with their increased welcome bonus! We’ll help you decide between the 2 with this comparison because you should ABSOLUTELY take advantage of them!

You can’t go wrong: the American Express Aeroplan Card and the American Express Gold Card are both phenomenal — these are the 2 highest welcome bonuses ever seen (premium cards excluded) and by far the best available right now!

Offers that give you close to $1000 are extremely rare! That’s a lot of free travel!

(By the way, we’ll do another free webinar on travel rewards for beginners: it’s going to be the most rewarding hour of your year, guaranteed!)

Important: if you’re not part of the Flytrippers readers who have now earned over 1 million dollars in travel rewards thanks to our welcome bonus recommendations, start by reading the 6 basic things to know about travel rewards.

Because in this head-to-head, we’ll assume you know that:

- welcome bonuses are the key and it doesn’t matter whether or not you can use your card for 100% of your purchases

- you always have to pay everything on time and there’s no “scam”

- having multiple cards is better for your credit score

- you must not cancel your current cards

- annual fees alone are irrelevant

- there are 2 types of travel rewards that work very differently

(1 million dollar sidenote: you may know Flytrippers from our many appearances in the mainstream media as travel experts or from the 50% off flight deals we spot, but our readers have also earned 1 million dollars just with welcome bonuses! Read why you should stop missing out and why that million makes us so much happier than the thousands of dollars we’ve earned ourselves for our own trips).

So let’s get started with the head-to-head between the Amex Aeroplan Card and the Amex Gold Card.

Our recommendation of which card to choose

So many people ask us which one to choose. A lot of you tell us you want to be spoon-fed the recommendation and for us to just say which card to get, without any other details.

If you really want that, I’ll do it here because it’s pretty easy in this case: get the Amex Gold Card.

But we don’t like to do that because it doesn’t do you any favors. If you want to get $20,000+ in free travel as I’ve earned (yes, $20,000+ in the 10+ years I’ve been in this hobby), you have to learn for yourself too. At least a little bit.

Knowledge is power. So I’d much rather explain it so you can become a travel rewards pro too!

Our mission at Flytrippers is to help you travel more for less. So I don’t want you to get just the ≈ $900+ of this offer; I want you to be well informed and make it even easier for you to maximize this wonderful world.

And most importantly, the reality is that every traveler is different! I want you to pick the card that’s right for you!

For some people (for most of them, in my expert opinion), the Amex Gold Card is the best one right now! But for others, the Amex Aeroplan Card is the best.

I’ll personally apply for the Amex Aeroplan Card today myself though, since I don’t need access to lounges (already got that) and don’t need flexible points (I want to maximize them so I’d transfer them to Aeroplan anyway).

Overview of the differences between the 2 cards

Below, I’ll obviously compare all the features of the Amex Gold Card and the Amex Aeroplan Card, but I want to look at the highlights first.

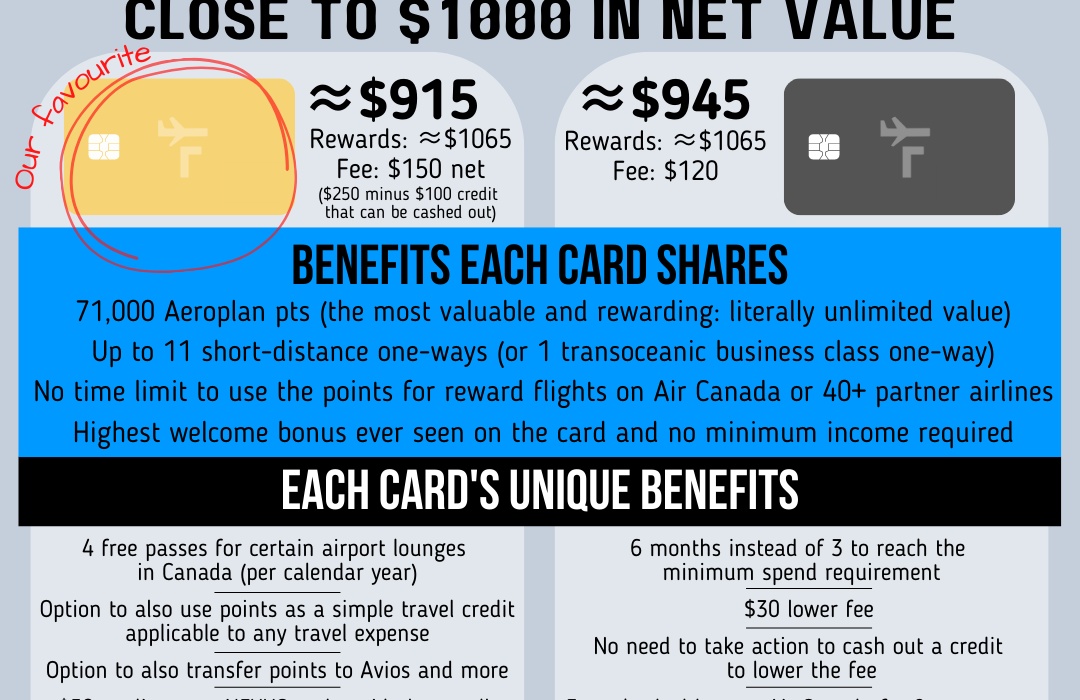

Here’s the infographic version.

Here’s our Flytrippers Valuation of the welcome bonus for these 2 cards:

- Amex Gold Card: ≈ $915

- Amex Aeroplan Card: ≈ $945

Why is the Amex Gold Card better for most travelers if it gives you $30 less than the Aeroplan Amex Card (when we always say that value is what matters most)?

That’s because our Flytrippers Valuation is super conservative: we always include just the rewards and the fees! This is to really give you the true value that everyone can easily get and to not inflate that just for you to end up getting less! When we say ≈ $945, it’s really ≈ $945 in profit (rewards minus fees) just with the welcome bonus, easily!

It can be a lot more with the other card benefits: they’re not included in our Valuation, but they’re often worth at least something to many travelers (not to mention that the “≈” symbol in front of the Valuation means that the rewards can easily be worth more too, if you follow our maximization tips)!

In short, what’s not included in our Flytrippers Valuation doesn’t often tip the scales for all travelers, but in a case where the difference in the offer value is just $30… it can.

The Amex Gold Card costs just a net of $30 more in fees: the number of points you get is the same and there are quite a few more benefits!

What both cards offer

Before looking at the differences, it’s worth mentioning the most important things that both cards have:

- Rewards that can be used as Aeroplan points (the most valuable ones in Canada)

- The potential value of rewards is unlimited (≈ $900+ in value can really be $1,500 in value!)

- The number of points earned (71,000 points; Amex points can be transferred to Aeroplan at a 1-to-1 rate)

- The incredible amount of options for all tastes (like 11 one-way short-distance reward flights or 1 one-way business class reward flight to Europe)

- No time limit to use the points (whether or not you renew the card)

- A special multiple-part welcome bonus structure that includes grocery store spending (including gift cards to other retailers)

- Everyone is eligible to get the card (no minimum income requirement)

- Best-ever increased offer on this card (and the same limited time offer)

- Base earn rate of ≈ 1.5% (1 pt/$) and a few category multipliers

- At least 1 free supplementary card (“joint” card) for someone to help you earn points

- Standard Amex benefits (Amex Offers program, American Express Experiences, The Hotel Collection, etc.)

- Flight delay, baggage delay, lost or stolen baggage, car rental theft and damage, hotel burglary, and travel accident insurance, as well as purchase protection insurance and extended warranty

Additional benefits of the Amex Gold Card

Here’s everything that’s unique to the Amex Gold Card (that the other one doesn’t have):

- 4 free passes to airport lounges in Canada (6 at YYZ, 1 at YUL, 4 at YVR, 2 at YEG, 1 at YWG)

- A $50 credit to get the NEXUS card so you can avoid almost all wait lines when you travel almost for free (not even included in our Valuation)

- The ability to use points as a simple travel credit applicable to any expense (simpler, less valuable)

- The ability to transfer points to non-Aeroplan reward programs (in addition to Aeroplan)

- A simpler welcome bonus structure in 2 parts instead of 3

- Medical travel insurance, trip cancellation insurance, trip interruption insurance, and better, more generous purchase protection insurance

- Better or equal earn rates for all expense categories

- 10% discount, free 2nd driver, and free rental car upgrade at Hertz

- A metal card offered in 2 colors (if you’re interested in these things)

For most travelers, it’s easy to justify sacrificing $30 in rewards value to get all of this.

But maybe:

- You already have another card with access to airport lounges (or you just don’t like free food and beverages or you love waiting at the crowded gate)

- You’re a savvy traveler who already has a NEXUS card

- You’re going to use your points as Aeroplan points anyway (this is the best use)

- You already have all that insurance coverage on your other cards

- You know that earn rates don’t matter that much and that it’s better to use your spending to unlock other welcome bonuses

- You know that Hertz is not often the cheapest car rental option

- You’re able to get organized and figure out a 3-part welcome bonus

- You don’t care if your card is made of metal or not

More importantly, maybe you’re not able to reach the minimum spend requirement (despite our pro tips): you have half the time to do so with the Amex Gold Card.

Maybe the benefits below, which only the Amex Aeroplan Card has, are more interesting for you.

In short, that’s what I mean by “every traveler is different.”

Additional benefits of the Amex Aeroplan Card

Here’s everything that’s unique to the Amex Aeroplan Card (that the other one doesn’t have):

- 6 months instead of 3 months to reach the minimum spend to unlock the welcome bonus

- $30 more in net value

- Lower fees (but it doesn’t matter: fees are always already deducted from our Valuation, that’s the $30 value difference)

- Less importance for the grocery store expenses in the welcome bonus structure

- Free checked bag for you and 8 travel buddies on Air Canada flights

- A few hundred Aeroplan points off Air Canada flights (not partner airlines)

- 9 supplementary cards (“joint” cards) for free (the Amex Gold Card has just 1 supplementary free card)

- A shortcut to Aeroplan Elite status (really just for those who travel and spend a lot on Air Canada)

- Flight and bag delay insurance coverage on tickets paid with Aeroplan points

- Doesn’t count towards the total of 4 Amex cards you can have at once

More info on both cards

So, this summary should be plenty to go on to decide!

Depending on your personal preferences (and your ability to meet the minimum spend), you can choose the Amex Gold Card or the Amex Aeroplan Card.

We also have plenty of content to learn more about each card if you want.

For the Amex Gold Card:

- Resource page with all the card details

- Free 30-page guide to getting started

- Detailed text and video card review

- Secure link to apply on the official Amex website

For the Amex Aeroplan Card:

- Resource page with all the card details

- Free 30-page guide to getting started

- Detailed text and video card review

- Secure link to apply on the official Amex website

Detailed head-to-head comparison of both cards

If you want a very detailed analysis, let’s look at each aspect of the cards to help you make the best decision based on your own situation.

Eligibility

Here are the minimum income requirements for the cards:

The first step every time you choose your next card is always to check if you’re eligible to get it.

There’s no minimum income for either card, and that’s for all cards issued by American Express — whereas other banks discriminate more.

(Even for the premium card which gives you unlimited access to airport lounges, the Platinum Card from American Express, or for the premium card that gives you many luxury travel benefits on Air Canada, the American Express Aeroplan Reserve Card, or even for the Amex “business” cards that don’t require you to have a business: Amex is the least restrictive issuer, in addition to giving the biggest welcome bonuses!)

In short, this one is very simple: it’s not a factor to consider at all.

(For pros: the exception is if you already have 4 Amex cards, because then you can’t get the Amex Gold Card — unless among your 4 cards, you have the Amex Platinum Card or Amex “business” cards that don’t count towards the total, just like the Amex Aeroplan Card).

Welcome bonus

Here’s our Flytrippers Valuation of the cards’ welcome bonus:

- American Express Gold Card: ≈ $915

- American Express Aeroplan Card: ≈ $945

We’ve already covered it. It’s pretty similar!

It’s everything else that should guide your choice, not this tiny difference.

Minimum spend requirement to unlock the welcome bonus

Here’s the minimum spend amount required to unlock the full value:

- American Express Gold Card: $3,000 in the first 3 months

- American Express Aeroplan Card: $3,000 in the first 6 months

That’s a pretty big difference. The same amount, but twice as long to reach it with the Amex Aeroplan Card.

It’s easier to reach than it sounds. Don’t forget to read our top 5 tips for reaching required card spending amounts, because we also share some important mistakes to avoid.

Here’s the equivalent per week that it adds up to, just to put the amounts into perspective:

- American Express Gold Card: ≈ $231 per week

- American Express Aeroplan Card: ≈ $115 per week

Structure of the welcome bonus

Here’s how to maximize each welcome bonus, because both are structured a little differently to allow for such high offers:

- American Express Gold Card:

- Standard welcome bonus: $3,000 in the first 3 months to get 50,000 points

- Special rate as part of the welcome bonus: $2,000 of that $3,000 at grocery stores (including gift cards) to earn 20,000 points (10X the points at grocery stores and restaurants in the first 3 months; maximum $2,000)

- American Express Aeroplan Card:

- Standard welcome bonus: $3,000 in the first 6 months to earn 45,000 points

- Special rate as part of the welcome bonus: $2,000 of that $3,000 at grocery stores (including gift cards) to earn 10,000 points (5X the points at grocery stores and restaurants in the first 3 months; maximum $2,000)

- Monthly welcome bonus: $3,000 split evenly each month to get 15,000 points (2,500 points per month during which you spend $500; maximum 6 months)

(In both cases, you’ll also earn a minimum of 1,000 more points from the regular earning on the 1,000$ left to spend in addition to the special rate at grocery stores, which is limited to $2,000!)

So while it gives you more time for the spending, the structure of the Amex Aeroplan Card welcome bonus is a bit more complex: it has 3 separate and independent parts instead of 2.

For both cards, the bulk of the bonus is with the $3,000 in 3 (or 6) months, as usual. It’s just that when you add up the other special welcome bonuses, it gives you a lot of value.

Both cards give you a special bonus on spending at grocery stores that accept Amex (Sobeys, Metro, Food Basics, FreshCo, Whole Foods Market, Foodland, Safeway, Giant Tiger, etc. are all coded as grocery stores).

Just be aware that the special grocery bonus is only valid for 3 months on the Amex Aeroplan Card, even though the main welcome bonus gives you 6 months.

The grocery portion is worth double the points on the Amex Gold Card, so if you don’t want to take advantage of that portion, the Amex Aeroplan Card is more interesting.

In exchange for giving fewer bonus points on groceries, the Amex Aeroplan Card gives you another bonus each month during which you spend $500.

That part is actually 6 bonuses: you can skip any month and still get the other monthly bonuses. Each month is really separate. And those are the same $3,000 as the main bonus, just split evenly.

Effective return rate with the welcome bonus

Here’s the effective return rate with the welcome bonus (value earned/spending required):

- American Express Gold Card: ≈ 31% back on $3,000

- American Express Aeroplan Card: ≈ 32% back on $3,000

It’s the same amount to spend and almost the same net value, so unsurprisingly, the effective return rates are very similar.

(Much better than the 1% or 2% most people get on their purchases, right? That’s why welcome bonuses are the key!)

Earn rates

Here’s how many points* each card earns (excluding the special rate on groceries and restaurants that’s part of the welcome bonus):

- American Express Gold Card:

- 2 pts per $ (≈ 3.0%) on travel, gas, groceries, grocery store gift cards, pharmacies, restaurants, and delivery services

- 1 pt per $ (≈ 1.5%) everywhere else

- American Express Aeroplan Card:

- 2 pts per $ (≈ 3.0%) with Air Canada

- 1.5 pts per $ (≈ 2.25%) on restaurants and delivery services

- 1 pt per $ (≈ 1.5%) everywhere else

*The Amex Aeroplan Card earns Aeroplan points while the Amex Gold Card earns American Express Membership Rewards points — but Amex points can be transferred to Aeroplan at a 1-to-1 rate and that’s usually the best use!

Again, it bears repeating, because it’s so important and so misunderstood: earning points on your purchases isn’t the way to maximize your travel rewards. It’s really the slowest way to earn; you should be using your spending to unlock welcome bonuses (and thus improve your credit score at the same time if you pay everything on time).

But it’s still one of the factors to consider. I unlock many welcome bonuses every year, but I still maximize the multiplier rates on many of my many cards. So I get many many points.

There are always 2 things to understand about earn rates:

- Category bonuses (multipliers)

- Base rates

Here, it’s a win all around for the Amex Gold Card:

- A 100% higher earn rate on gas, groceries, grocery store gift cards, pharmacies, and travel (excluding Air Canada)

- A 33% higher earn rate on restaurants and delivery services

- An equal earn rate on Air Canada travel and everything else

But once your welcome bonus is unlocked (and if you don’t get another one right away), some of your current cards may have better earn rates! Always be sure to check. That’s why we often tell you not to use the same card everywhere. It always depends.

Annual fee

Here are the cards’ annual fees:

- American Express Gold Card: $250 ($150 net)

- American Express Aeroplan Card: $120

The annual fee is already deducted from the total net value of the welcome bonuses above, as always (the total value of the Amex Gold Card welcome bonus is actually ≈ $1,165, but we deducted the $250 for our Flytrippers Valuation of ≈ $945).

So this specific section is for subsequent years, not the 1st year. Every card you get from now on (NOT your current cards) should be reevaluated when the 1st year ends, and simply canceled/downgraded if it no longer provides value (our free checklist for when you get a new card will help you stay organized).

Again, this is a great example of why it doesn’t make sense to avoid cards with annual fees just for the sake of avoiding fees. The annual fee alone is irrelevant: it’s the total net value that counts, always. A $250 card that gives you $1,165 is obviously better than a $0 card that gives you $0… if you can count.

(Look… it’s a good idea to avoid fees normally, but with travel rewards, it just doesn’t make sense — the world of travel rewards is very counter-intuitive.)

In this case, the $250 Amex Gold Card fee scares a lot of people, even though it’s not rational, but in fact, it’s just a net $150 because the card comes with a $100 “travel” credit each year.

It can be easily cashed out with our pro tip, so it’s really $150 if you know how to do the math.

That’s just $30 more than the Amex Aeroplan Card. Since both cards cost almost the same, it’s not really a factor for those who would like to keep the card after the 1st year.

No matter which one you choose, as per our free checklist, set a reminder for 1 year from now.

Then, evaluate whether the Amex Gold Card’s 4 airport lounge passes and other benefits are worth $150 to you or evaluate whether the Amex Aeroplan Card’s free bag and other benefits are worth $120 to you. If not (as is usually the case), move on. Simple.

But many have a hard time understanding that this has absolutely nothing to do with the year 1 decision, it’s for year 2! The year 1 decision should obviously be based on the net value with the welcome bonus!

Supplementary cards

Here’s the cost for supplementary cards (“joint” cards):

- American Express Gold Card: $0 (for the 1st one, $50 after)

- American Express Aeroplan Card: $0 (for 9 cards)

Both cards let you get the 1st supplementary card for free so you can earn more points faster in the same account. But the Amex Aeroplan Card gives you 8 more.

In short, this is still not really a factor to consider, since few people will need more than 1 supplementary card.

Travel and other benefits

Here are the benefits for each card (those unique to each card are in bold):

- American Express Gold Card:

- 4 passes to Plaza Premium airport lounges in Canada

- $50 credit towards a NEXUS card

- Hertz benefits and discounts

- Access to the Amex Offers program

- Access to the American Express Experiences program

- Access to The Hotel Collection program

- American Express Aeroplan Card:

- Free checked bag on Air Canada

- Aeroplan flight discounts on Air Canada

- Shortcut to Aeroplan Elite status

- Access to the Amex Offers program

- Access to the American Express Experiences program

- Access to The Hotel Collection program

Access to airport lounges is the big draw of the Amex Gold Card, even though access is a lot more limited than with most other cards. It’s better than the Amex Aeroplan Card, which just doesn’t have access at all.

If you like to bring too much stuff on your trip, the free checked bag on Air Canada is interesting. If you’re a pro flier who always travels with just a carry-on (or avoid the high cost of flying by not taking Air Canada), this provides zero value — every traveler is different!

How much value you give to all of these benefits is really extremely personal.

So check out the Amex Gold Card and Amex Aeroplan Card pages while you await our reviews for a ton of details on the benefits.

Determine the value you place on each. And simply factor that into your card choice.

Points uses

Here are the point redemption options for these cards (those unique to each card are in bold):

- American Express Gold Card:

- Transfer to Aeroplan

- Transfer to Avios and other airline programs

- Transfer to Marriott and Hilton

- Amex award chart for flights

- Simple travel credit applicable to any travel expense

- American Express Aeroplan Card:

- Within the Aeroplan program

As mentioned, these 2 cards are among the best cards to earn Aeroplan points. Amex points can be transferred to Aeroplan at the 1 for 1 rate as mentioned. This is often the best use.

All travel rewards pros prioritize Aeroplan points every year, because these variable-value rewards that offer outsized value and unlimited value are the most valuable.

It’s also my favorite program, as a traveler who likes to maximize value. I almost always transfer all my many Amex points into Aeroplan points.

But the Amex Gold Card also gives you the flexibility to use your points in other ways that the Amex Aeroplan Card doesn’t. There’s no downside: you can still use Amex points as Aeroplan points, it’s just that you have more options.

You can use Amex points as a simple travel credit (which can be applied to any travel expense), which gives you a welcome bonus that’s still worth $560 instead of ≈ $915. You can obviously use your desired combination of rewards as Amex points or as Aeroplan points (it’s 100% flexible).

Amex points can also be used for flights with the Amex award chart, which can give you as much value as Aeroplan points if you usually buy flights that are expensive in cash.

In short, if you only want Aeroplan points (the points we highly recommend focussing on for travelers who want maximum value, especially those who use their points well), this is not an issue. But if you want more flexibility, the Amex Gold Card is definitely the best option.

Insurance coverage

Here are the types of insurance included with the cards (those unique to each card are in bold):

- American Express Gold Card:

- Medical travel insurance

- Trip cancelation insurance

- Trip interruption insurance

- Flight delay insurance

- Baggage delay insurance

- Lost or stolen baggage insurance

- Car rental theft and damage insurance

- Hotel burglary insurance

- Travel accident insurance

- Purchase protection insurance

- Extended warranty

- American Express Aeroplan Card:

- Flight delay insurance

- Baggage delay insurance

- Lost or stolen baggage insurance

- Car rental theft and damage insurance

- Hotel burglary insurance

- Travel accident insurance

- Purchase protection insurance

- Extended warranty

The most important insurance is obviously medical insurance, and only the Amex Gold Card has it.

That said, it shouldn’t be a deciding factor if you’re already a travel rewards pro and have other cards: many travel cards have medical insurance so you may already be covered (and your regular insurance plan may offer it). And contrary to common myth, medical insurance is the only insurance that doesn’t even require you to pay for your trip with the card in question to be covered.

The Amex Gold Card also has trip cancellation insurance and trip interruption insurance (but unlike the other types, those have exclusions because of COVID-19 right now, so let’s say it’s not as important).

For all other types of very useful insurance coverage, both cards have the exact same inclusions, except for purchase protection insurance. Both cards have it, but the Amex Gold Card‘s one is more generous ($25,000 per item vs. $1,000 per occurrence with the Amex Aeroplan Card).

In short, if you don’t have another card that has medical travel insurance, if you want cancelation/interruption coverage for non-COVID reasons, or if you want purchase protection for very expensive items, the Amex Gold Card is definitely the better option in terms of insurance.

Want to receive all our travel rewards content?

Summary

The American Express Gold Card and the American Express Aeroplan Card are great cards to earn a huge amount of valuable points through increased welcome bonus offers. Which one is best for you depends on your preferences, but you just can’t go wrong with either of these!

What would you like to know about the best deals of the summer? Tell us in the comments below.

See the deals we spot: Cheap flights

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Discover free travel: Travel rewards

Featured image: Guanacaste, Costa Rica (photo credit: Arianne Beeche)

Advertiser disclosure: In the interest of transparency, Flytrippers may receive a commission on links featured in this post, at no cost to you. Thank you for using our links to support us for free, we appreciate it! You allow us to keep finding the best travel deals for free and to keep offering valuable travel content for free. Since we care deeply about our mission to help travelers and our reputation and credibility prevail over everything, we will NEVER recommend a product or service if we don’t believe in it and/or use it ourselves, and we will never give any third-party any control whatsoever on our content. For more information on our advertiser disclosure, click here.