RBC Avion Rewards points are pretty much the only ones among all of Canada’s travel rewards currencies that even try to compete with Amex points in terms of ways to use them for outsized value and transfer partner options (and ease of earning a lot of points). Let’s start with the basics, but we’ll have much more content about this currency!

We’ll look at 15 good uses for those RBC Avion Rewards points.

Basics of RBC Rewards points

The RBC Avion Visa Infinite Card is currently offering its regular welcome bonus. It’s already one of the most popular cards in Canada, as the main card for the country’s largest bank.

Basically, you’ll earn 35,000 RBC Avion Rewards points with no minimum spend requirement to reach, so it’s perfect as a 2nd card to apply for on the same day as a 1st one with a minimum spend requirement and a bigger bonus.

You can get this welcome bonus even if you’ve had this card before; that’s the beauty of all cards that aren’t issued by Amex (often there’s a minimum wait period; but not with RBC). And that’s why you can get a literally infinite amount of free rewards to travel more for less! Save your spot for our free webinar on travel rewards for beginners to learn more!

You can read all the details on our RBC Avion Visa Infinite Card page, and on our review (which includes a video presentation if you prefer that format).

We’ll also have a lot more content, tips, and guides on all the major programs (including RBC, Amex, Aeroplan, Avios, Marriott, etc.) very soon.

How to use RBC Avion Rewards points

With other RBC cards, the RBC Avion Rewards points you get work differently. So we’ll just focus on the RBC Avion Rewards “Elite” points that are relevant here, as the RBC Avion Visa Infinite Card‘s welcome bonus is by far the most valuable among RBC cards.

RBC Avion Rewards points can be used as both of the 2 only types of rewards use options that exist: uses that are more valuable (less simple) or uses that are more simple (less valuable).

So we will divide the article into the 4 different ways that RBC Avion points can work:

- Transfer to Avios (12 good uses)

- Transfer to WestJet Rewards and others (1 good use)

- Reward flights with the RBC price chart (1 good use)

- Travel credit to erase almost any travel expense (1 good use)

1. Transfer to Avios (12 good uses)

The Avios program is far from being as simple as the ubiquitous airline rewards program in Canada (the Aeroplan program), but depending on your travel preferences, it can be very valuable too.

We’ve put together an article that lists 12 good uses of Avios points.

Note that 60,000 RBC Avion points = 60,000 Avios points (1 to 1 transfer rate). The increased welcome bonus on the RBC Avion Visa Infinite Card that is offered regularly gives you those 60,000 points (sign up to get an alert when it returns).

But usually, RBC has a transfer bonus promo with at least a 30% bonus every year. That means you get 30% more Avios points when transferring RBC points, giving you 30% more free travel! And 30% more value than our Flytrippers Valuation for the RBC Avion Visa Infinite Card‘s welcome bonus. That’s even more amazing!

This option can give you up to 9 one-way short-distance flights in some countries, or 4 one-way flights to/from Miami from Toronto or Montreal for example.

But with Avios, you’ll have much fewer options compared to Aeroplan. So you’re better off choosing the cards with amazing offers that earn Aeroplan points or American Express points if you want airline rewards (the most valuable type of rewards) but prefer some that are simpler than Avios points.

2. Transfer to WestJet Rewards and others (1 good use)

Okay, there is more than 1 good use with the other airline partner programs, but it’s really a lot rarer that it’s a good value. So we’ll say 1 good use for now: for a sweet spot with other partners.

The 3 other RBC airline program partners are:

- WestJet Rewards (1 to 1 transfer rate)

- Cathay Pacific Asia Miles (1 to 1 transfer rate)

- American Airlines AAdvantage (1 to 0.7 transfer rate)

We’ll discuss it in more detail in our RBC Avion Rewards program guide soon, but the main appeal used to be for those who often fly WestJet. But now, their program is so bad that the RBC points option #4 below is probably more valuable even for WestJet flights.

(The WestJet RBC World Elite Mastercard also has an increased offer and the WestJet RBC Mastercard is a no-fee option, if you really like WestJet — we’ll cover those cards later since the welcome bonus is hundreds of dollars lower than the RBC Avion Visa Infinite Card and the other incredible offers right now!)

The Asia Miles program can be interesting, especially since it is also a transfer partner with the Amex Membership Rewards program and the HSBC Rewards program. So it’s easy to earn many Asia Miles. But it’s a program with sweet spots that are even more specific than Avios, which I’ll cover soon to keep this post shorter today.

Finally, the American AAdvantage program has a much less appealing transfer rate for starters. And the program is not great, as is the case with most US airline programs. That said, I did make my 1st AAdvantage redemption in 15+ years in the world of travel rewards… and it was literally one of the most valuable redemptions I’ve ever made. I was glad to have RBC Avion points to transfer to AAdvantage!

3. Reward flights with the RBC price chart (1 good use)

We’re now at the first of the 2 uses of RBC points that don’t involve transferring to another program.

I’ll do a separate article for you soon, but basically, the RBC award chart has only one good use: when airline tickets are very expensive in cash.

The thing is the price chart will give you a ticket for a fixed number of points, regardless of the cash price (with a maximum price though).

It’s harder to maximize than airline partner programs, at least for those who don’t normally buy expensive flights. And it’s much more restrictive: you have to book flights only departing from Canada or the USA. However, RBC does allow you to book one-ways at least (compared to the Amex price chart that only allows roundtrips for example).

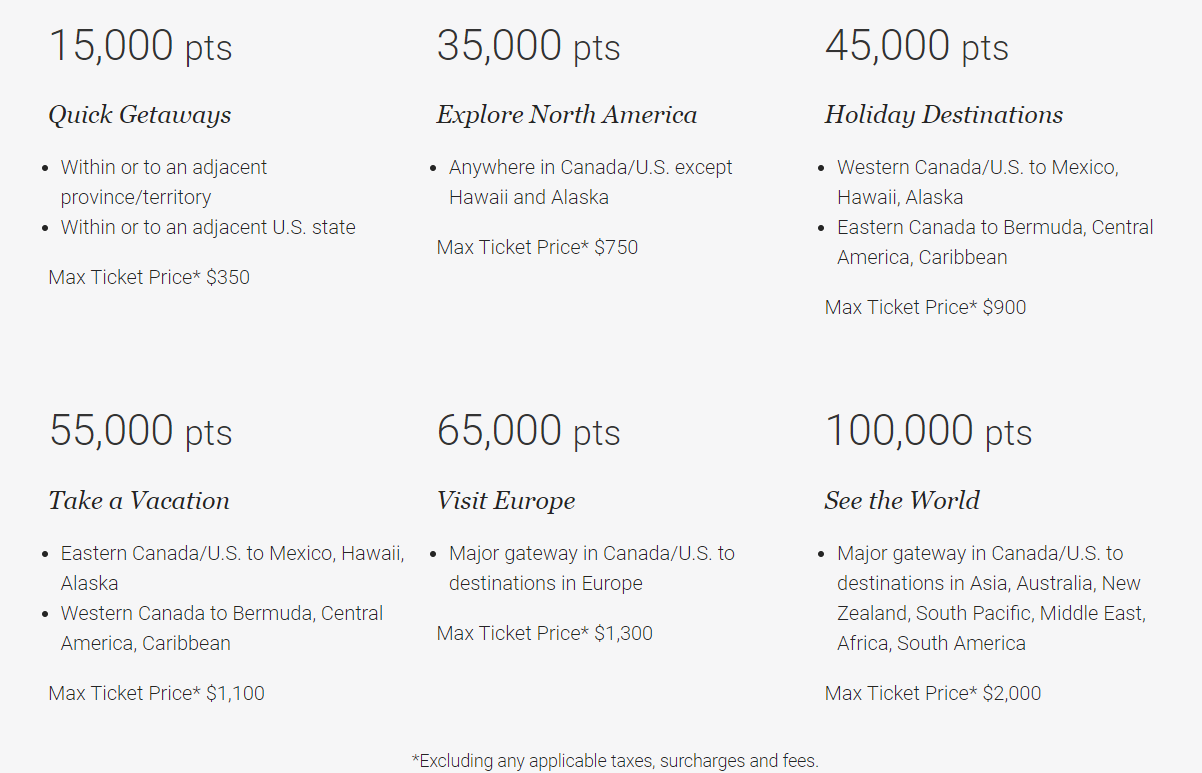

Here is the full RBC price chart for roundtrip reward flights (directly through the RBC program instead of having to transfer points).

(One-ways simply cost half the amount of points with half the maximum price too!)

So for example, let’s say you use your 60,000 RBC Avion points for 4 roundtrip flights that cost 15,000 points… you could “save” $1400 ($350 x 4)!

That would give a great value of 2.3 ¢ per point (and the RBC Avion Visa Infinite Card‘s often-increased welcome bonus would be worth $1280 instead of ≈ $780 at our always conservative Flytrippers Valuation).

However, that means you’d be paying for very, very expensive tickets. So it’s just a good use if you were really going to pay a lot of money for those flights (if you didn’t have any flexibility for example). And when the plane ticket’s base fare is as close as possible to the maximum ticket price in the RBC price chart.

When used this way, RBC points only cover the base fare, so not the taxes and some other fees. The maximum ticket price in the price chart is also only for the base fare (the same as the Amex price chart for reward flights).

Remember that what’s important is not how much you pay out of pocket, but how much you SAVE in total, at least if you know how to do the math and if you want to get the most value with your rewards.

So the RBC price chart can still be interesting if you have to go somewhere and the flights are very expensive. For example, if you are going to a European destination that is very expensive for your dates, that can easily cost $1600, especially if you’re not in Toronto or Montreal (which is sad considering we often spot deals to Europe in the $400s roundtrip).

But then again, like all redemption option of the more lucrative type… certain redemptions are just not good. This time, it’s because of airline surcharges. For example, they’re often high to Europe, making that a bad redemption most of the time.

With 65,000 RBC Avion points (the 5,000 missing after the RBC Avion Visa Infinite Card‘s often-increased welcome bonus are pretty easy to earn), you could save $1300, a great use on paper. But it’s not a good use if the alternative is a flight to Europe paid with cash that has just a $300 base fare.

To give you an idea, I’ve used airline reward programs for dozens and dozens of flights in the past 10 years, and I have used the bank price charts only once (it was with RBC during the Christmas holidays this year because flights during the holidays are expensive).

I usually don’t buy expensive flights so it’s less beneficial for me. And when I do buy expensive flights, I’m flexible, so airline points are a lot more valuable.

In short, the value you can get with the RBC price chart really depends on your personal situation and how good you are at finding cheap flights. As is always the case in the world of travel, you have to compare!

4. Travel credit to erase any travel expense (1 good use)

Finally, the only option that has a fixed value… isn’t really a good use at all in fact.

It’s a “good” use only if you want to keep it simple and are willing to get a lot less value in return, as so many people are.

Instead of being worth ≈ $780, the RBC Avion Visa Infinite Card‘s often-increased welcome bonus is worth a flat $480 net if you use it like this. Because as a travel credit, 60,000 RBC Avion points = a $600 credit.

But it’s much simpler: you can apply the points to any travel expense.

It’s always going to be worth 1¢ per point. Any travel use. Very simple.

That’s why the other options are about 50% more valuable… but even $480 for free is pretty good!

With this option, you don’t have to think anything through, you don’t have to maximize anything, you don’t have to take any specific flights… it’s really as simple as it gets.

Well, almost as simple as it gets. There is one restriction: you need to book on the RBC Avion website (you cannot book on other websites as you can with other rewards programs).

If you want to use points for any travel expense, you really shouldn’t “waste” valuable points like RBC Avion points anyway (unless you’re never going to use them for more valuable flight redemptions, in that case of course take the points instead of not taking them).

Instead, use points that cannot give you more value AND can be used by booking on any website! Like Scene+ points (the Scotiabank Gold American Express Card), BMO Rewards points (the BMO eclipse Visa Infinite Card), or AIR MILES miles (the BMO AIR MILES World Elite MasterCard).

Or points that can be used by booking on any website without losing too much value. Like TD Rewards points (the TD First Class Travel Visa Infinite Card) or HSBC Rewards points (if you already have some).

Summary

The RBC Avion Visa Infinite Card is a great option to get points of the more valuable type. These examples may give you a good idea of what you could do with the welcome bonus, while you wait for our more comprehensive guides.

Have any questions about RBC Avion Rewards points? Ask me in the comments below.

Want to be the first to get our free travel rewards course and all our content?

See the deals we spot: Cheap flights

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Discover free travel: Travel rewards

Featured image: Beach (photo credit: Nico David)