It’s back: Take advantage of one of the highest offers currently available in Canada. It’s also the highest offer ever on this card, one that gives you a net value of ≈ $780 in free travel. These points can be very valuable and give you outsized value on expensive flights, or they can be simple and applied to any travel expense.

It’s the increased offer for the RBC Avion Visa Infinite Card that is back for a limited time (or the inferior RBC Avion Visa Platinum Card if your income is lower).

It gives you significantly less than the free $925 from the TD First Class Travel Visa Infinite Card IF you want to redeem them for any trip without having to be flexible.

But RBC Avion points have the potential to be worth a lot more, like Aeroplan points. Their value is literally unlimited.

So here’s a review of the card to explain the record-high offer (with more content coming in February).

Video on the RBC Avion Visa Infinite Card

You can watch this short video about the RBC Avion Visa Infinite Card if you prefer this format.

Otherwise, here is the text version.

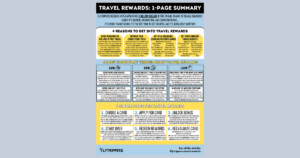

Basics of travel rewards

If you’re already one of our savvy Flytrippers readers who’ve earned nearly 3 million dollars in free travel with the travel rewards welcome bonuses we’ve shared, you can skip this section.

Otherwise, I’ll remind you of the basics. Because travel rewards is an overly intimidating, unfamiliar, and counterintuitive world.

(When you just don’t know about it, it’s obviously totally normal to believe all the myths, to not understand how it really works, and to be a bit baffled… but now you will know!)

Welcome bonuses are the key! If you remember just ONE thing, make it this.

The RBC Avion Visa Infinite Card gives you ≈ $780 with the welcome bonus… imagine the amount you have to spend at a 1% or 2% rate just to hit that, and how insanely high it would be!

And more importantly, having more cards is going to give you a better credit score (in addition to giving you lots of free travel and great card benefits), contrary to the very common (and very false) myth.

But it’s only true if you follow the 3 rules at the top of our great one-page summary with lots of info for beginners.

I’ve been doing this myself for the past 15 years and have a credit score in the 800s (and I’ve earned over $25,000 in free travel), because I’ve followed these 3 simple rules and because I understand that welcome bonuses are the key (as has everyone else who earns a lot of travel rewards)!

Sign up for our free newsletter specifically about travel rewards to get all our content, including more details on each part of that infographic summary.

And finally, we’ll soon be doing another edition of our popular free webinar on travel rewards basics if you want to learn more (and you really should!).

Details of the RBC Avion Visa Infinite Card

If you’d rather be independent and read all the details and features of the RBC Avion Visa Infinite Card in a neat and organized way, click on that link to go to our card resource page, which has SO much information.

(There are lots of tabs with pretty much everything you could possibly want to know about each element of the card!)

Why get the RBC Avion Visa Infinite Card

The most important thing every time you get a new card during the year is always the welcome bonus:

- The QUANTITY of free travel

- The TYPE of free travel

The RBC Avion Visa Infinite Card‘s welcome bonus gives you RBC Avion points worth ≈ $900 for just $120, so a net value of ≈ $780 in free travel.

How to use that $900 is obviously the key, as with all types of rewards (which are all very different of course)! To get that value there, RBC Avion points are less flexible than other types of points.

But that also means they can be worth as much as $1400 or $3000 instead of $900: they’re points with redemption options that can give you outsized value and even unlimited value, depending on how you redeem them. You can also use them for any travel expense if you want to keep it simple, but the value is lower that way obviously.

Like anything in life, you can choose more simplicity or more value; it’s always like that! I’ll get back to the examples for the $900 in free travel in a few seconds.

The RBC Avion Visa Infinite Card has a few other benefits as well:

- Points with no time limit to use them (even if you decide to close the card after 1 year)

- Free insurance (all types of coverage are offered)

- Free DashPass from DoorDash (free delivery with the app)

- 3¢/litre gas discount at Petro-Canada (and 20% more points)

- Visa Infinite luxury benefits

How to get the welcome bonus

All you have to do to unlock the full bonus on the RBC Avion Visa Infinite Card is spend $5000 in a maximum of 6 months.

That may sound like a lot, but it’s very easy for just about anyone (it’s the equivalent of just $192 a week). And most importantly, over a long period of time like 6 months (instead of the usual 3 months), you’re bound to have a big expense to help you.

Otherwise we have some tips, with a new one called Chexy to pay your rent for a fee if you really can’t reach the amount for free (detailed guide coming soon).

This welcome bonus gets you ≈ 16% back on your $5000. A bit better than 1% or 2%!

Unlocking the welcome bonus is going to give you a minimum of 60,000 RBC Avion points.

Here’s the breakdown:

- 35,000 points upon approval (no spending required)

- 20,000 points after spending $5,000 (maximum 6 months)

- 5,000 points earned on the $5,000 in spending (1 pt/$)

Our conservative Flytrippers Valuation for RBC Avion points is ≈ 1.5¢ per point, so 60,000 points are worth ≈ $900.

How to redeem RBC Avion points

Savvy travelers who are signed up for our free newsletter specifically on travel rewards are going to get a nice feature on how to redeem all points very soon.

In short, all rewards programs are different. And within all programs, there are several different redemption options that give your points a different value depending on the option chosen.

Most importantly, some redemption options are more complex… but can give you more value. That’s the case with the RBC Avion Visa Infinite Card‘s points.

Specifically, you have 3 options with RBC Avion points:

- Redeem them for specific flights by transferring them to airline programs

- Redeem them for almost any flight with the RBC Avion award chart

- Redeem them for any travel expense

That order is from the most valuable to the least valuable, and therefore necessarily from the least simple to the most simple.

Here’s how much free travel your 60,000 RBC Avion points can give you with each option:

- ≈ $900 to UNLIMITED (transfer to airline points)

- ≈ $900 to ≈ $1260 (RBC Avion award chart)

- $600 (any trip)

In short, the 2 most valuable options for using RBC Avion Visa Infinite Card points give you discounts on flights based on award charts (price charts).

These redemption options have a variable value. That means the value depends on how you redeem them — the value depends on the cash price! Because the amount of points required is unrelated to the cash price.

It’s the most important thing to understand about these point redemptions, especially for those who are used to just using less valuable points that are always worth the same (more simple, therefore less valuable) or the terrible cash back that objectively has the lowest value of any type of rewards (and lower welcome bonuses to boot too).

Here is a concrete overview of the 3 options.

How to redeem RBC Avion points with partner transfers

Airline rewards programs are the most valuable, but are obviously the least flexible. Eligible routes are limited and seats are limited. So you need to be more flexible.

Especially with RBC Avion partners (the best being British Airways Avios) which are MUCH less easy to maximize than the best airline program for example (Air Canada Aeroplan, the one with the TD Aeroplan Visa Infinite Card for example).

The price in points is governed by an award chart and is not related to the cash price! But the price is advantageous just for some routes only and you have to be flexible to find the available seats. And Avios has far fewer partner airlines than Aeroplan, so fewer seats are available.

For example, the 60,000 RBC points from the RBC Avion Visa Infinite Card give you 1 Toronto-London roundtrip flight regardless of the price in cash (as I showed you for last summer). Or almost 3 Toronto-Miami roundtrips.

With just the taxes to pay (no surcharges for most airlines), about $100 for a Toronto-Miami roundtrip for example or 200$ for some Toronto-London flights.

So this redemption option can give you ≈ $900 in value quite easily, if the price is relatively high in cash. But it could give a lot less if the cash price is low, so it’s not always a good option.

It could also give a lot more! The 60,000 points is almost enough (you’ll be able to top it off easily) for a Montreal-Qatar flight in one of the world’s best business classes, Qatar Airways’ Qsuite (one-way). That’s worth at least $3500 in cash! That’s what the unlimited value is all about! The price in points does NOT depend on the price in cash.

There are many possibilities! For example, it gives you 3 roundtrips between Miami and any destination within a fairly large radius, like the Caribbean, a place where flights are sometimes expensive with cash.

I paid 9,000 Avios points (so 9,000 RBC Avion points) for a Miami-Colombia flight during the holidays, when the price in cash was $450! By deducting the $60 in taxes I paid, I saved $390 with 9,000 points.

That gave me a value of 4.3¢ per point, almost 3 TIMES more than our conservative Flytrippers Valuation. And getting to Miami is often super affordable with cash too!

Even better: usually every year, RBC offers a 30% transfer bonus to British Airways Avios! This means that your $900 is automatically worth $1170, easy as pie. Our Flytrippers Valuation becomes ≈ $1050 instead of ≈ $780 for the offer.

But be sure to understand the limitations of the Avios program, it’s really less flexible than Aeroplan. And transfers can’t be undone.

You can read our article on the 12 best redemptions of Avios points to see concrete examples of interesting routes with this program, while waiting for our detailed guide on the programs and the basics of redeeming airline points.

How to redeem RBC Avion points with the award chart

The RBC Avion award chart is very good for people who buy flights that are very expensive with cash. Not all flights that are expensive with cash, but most flights that are expensive with cash. Especially those that are short or medium distance.

If you’re good at finding cheap flights with cash like we are, this option is less attractive. But considering how terrible many people are at finding cheap flights (not being mean here; just objective… it’s crazy how much many people pay), then the award chart should interest many.

Some flights have surcharges on top of the taxes (for example many to Europe), so it’s not always interesting, again. But almost all flights are available on the RBC Avion portal at the fixed prices from the chart (regardless of the price in cash), there are no limited routes or limited seats, unlike airline points.

For example, a flight from Montreal to Costa Rica would cost you 45,000 points and $209 in taxes with the award chart because that whole area always costs just 45,000 points, regardless of the price in cash. Considering that many people pay $1000 for this flight (ouch), it’s a good deal. But if you were to buy the same flight for $600 as is common to find, then it’s a much worse deal to pay 45,000 points and $209.

The value depends on the price in cash! Because the amount of points required does NOT depend on the price in cash!

So the award chart is good if you were going to pay a flight that is expensive in cash. Unlike airline points, bank award charts like the RBC Avion program’s chart also have a maximum price per ticket though. So it’s not an unlimited value, unlike airline points.

But for example, with the 60,000 points from the RBC Avion Visa Infinite Card, with the award chart you could theoretically get $1400 off 4 specific roundtrip flights (very short distance) that are very expensive with cash.

So you could also easily get at least $900 in free travel like that if you normally buy expensive flights.

You can read our article on the RBC Avion award chart to see concrete examples of the prices, while waiting for our detailed guide on the programs and the basics for using bank award charts.

How to redeem RBC Avion points for any trip

The last one is the simplest and therefore the least valuable of course.

You can apply RBC Avion points from the RBC Avion Visa Infinite Card to any trip. The 60,000 points will always give you $600 no matter what you do, so it’s always a fixed value of 1¢ per point no matter how you use them.

So you can easily get 50% more value with the other options, which is not insignificant at all. It’s the difference between traveling 2 times a year and traveling 3 times a year; that’s what 50% more means concretely. It’s worth learning how to maximize the most valuable points, if you want to travel more.

But if you want simple points, there’s a card that has a much better deal than the RBC Avion Visa Infinite Card right now.

RBC Avion Visa Infinite Card vs. best others right now

Struggling to decide if the RBC Avion Visa Infinite Card is the best one to choose this time for you? That’s why we do live videos every month to help you (the next one is January 25th).

In the meantime. I’m sharing a sentence or 2 for each of the other top few to tell you what advantages they have over the RBC Avion Visa Infinite Card.

So here are the other 3 similar alternatives that have deals worth $630 and up right now… it’s just crazy how there are so many good deals out there right now; GET ONE, any of them in the worst-case scenario, but stop wasting your spending by just earning at a terrible, slow rate.

All of the current best deals are always on our ranking of the best credit cards in Canada too of course!

TD First Class Travel Visa Infinite Card

It’s an offer with the 1st year free and it’s the highest offer ever seen in Canada for simple points (that can be redeemed for any travel expense).

So if you want simple points, this one is much better than the RBC Avion Visa Infinite Card (and it ends March 4th instead of April 30th for the RBC). But TD Rewards points will never be worth more than their fixed value.

It does have a minor drawback in terms of logistics though: read the details in our review of the TD First Class Travel Visa Infinite Card.

TD Aeroplan Visa Infinite Card

It gives you Aeroplan points that are even easier to maximize if you want very valuable airline points. If you’re just starting out with airline points, it’s really easier with this program (and you get NEXUS for free to avoid wait lines and free checked bags on Air Canada).

But the bonus is lower and it does require you to renew and spend a bit more to unlock the full bonus. The American Express Aeroplan Card is very similar, as an alternative that does not require a minimum income.

Also, you can’t get the TD Aeroplan Visa Infinite Card if you’re one of those who have gotten the American Express Aeroplan Card or CIBC Aeroplan Visa Infinite Card in the last year (Aeroplan cards are the only ones with rules that transcend different card issuers).

American Express Cobalt Card

It has no minimum income and gives you Amex points which are the best, because they can be transferred to Aeroplan and Avios (and others). They can also be applied to any trip.

It’s the best card overall in Canada, by far. It earns 5 points per dollar at the grocery store and almost anywhere with the gift card tip.

Even 5 pts/$ is much slower than with welcome bonuses (welcome bonuses are the key). But if you don’t want to earn fast and don’t want to get several, the earn rate is much more important and in that case, the American Express Cobalt Card is really the best.

Want to get more content to learn how to earn free travel?

Summary

The RBC Avion Visa Infinite Card has an increased offer that ends on April 30th. It’s good especially for those who buy expensive short and medium distance flights or want to maximize British Airways Avios points, including for luxurious business class seats.

What do you want to know about the RBC Avion Visa Infinite Card? Tell us in the comments below.

See the deals we spot: Cheap flights

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Discover free travel: Travel rewards

Featured image: Costa Rica (photo credit: Berti Benbanaste)

Valuation ≈ $519

Valuation ≈ $519