HSBC is a major global bank that is one of the most interesting for Canadian travelers, thanks to their proprietary rewards program, HSBC Rewards, being literally one of the most flexible for travel redemptions: rewards can be used for any travel expense. And most importantly for savvy deal-lovers, the program also offers the potential for outsized value and unlimited value (with 1 of the 3 cards).

I personally love the many benefits the HSBC Rewards program offers. And for many travelers, it sure is a great program to consider.

Here is Flytrippers’ introduction to the HSBC Rewards program, while you await our series of ultimate guides for reward programs launching this spring as travel finally resumes.

Basics of the HSBC Rewards program

There are 3 Canadian cards that earn HSBC Rewards and I’ll share more details about them in a section below…

But here is a table right away, just so you know whether this guide applies to one of the cards in your current travel rewards portfolio (or to one of the cards you are considering adding next).

Best credit cards for

HSBC Rewards

HSBC World Elite® Mastercard®

Card:

Bonus: no welcome bonus

WELCOME BONUS

(

Rewards: ≈ $100

Card fee: $149

Best for: 0 pts

+ $100 annual credit

and no FX fees

HSBC +Rewards™ Mastercard®

Card:

Bonus: no welcome bonus

WELCOME BONUS

(

Rewards: $0

Card fee: $25

Best for: 0 pts

+ low interest rate

and no min. income

HSBC Travel Rewards Mastercard® (excl. QC)

Card:

Bonus: no welcome bonus

WELCOME BONUS

(

Rewards: $0

Card fee: $0

Best for: 0 pts

+ no annual fee

and no min. income

Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information.

HSBC has a strong presence in Canada and it is one of the world’s largest financial institutions, based in London (England).

It should be a very recognizable brand for travelers, as its logo is emblazoned on so many airport jetbridges all around the world.

As you probably deduced, HSBC Rewards is HSBC Bank’s own proprietary rewards program.

The program’s highlights are that the points are among the most flexible you can find, as they can be used as a simple travel credit for any flight, hotel, Airbnb, car rental, train, bus, tour, cruise, or vacation package booked with any travel provider!

And with the HSBC World Elite Mastercard, the points can even be transferred to partner airline rewards programs for a lot more potential value, including one partner that is unique to HSBC in Canada.

Here is a brief summary of the HSBC Rewards program:

- Best use: Reward flights

- Type: Hybrid rewards (variable-value or fixed-value)

- Subtype: Standard variable-value rewards

- Subtype: Eraser fixed-value rewards

- Rewards examples:

- Discount on specific flights (variable value)

- Credit applicable to any travel expense (fixed value)

- Flytrippers Valuation: ≈ 0.6¢/pt

- Maximum value: Unlimited (variable value)

- Minimum value: 0.5¢/pt (fixed value)

- Transferable: Yes (3 airline programs)

- Best partner: British Airways Avios

- Classification: Bank rewards program

- Available cards: 3 (1 issuer)

- Best current offer: HSBC World Elite Mastercard

Introduction to redeeming HSBC points for travel rewards

HSBC Rewards can be used in 2 ways:

- Within the HSBC Rewards program

- With a transfer to 3 airline program partners (with 1 of the 3 cards only*)

*Only the HSBC World Elite Mastercard allows you to transfer points to partners — everything else about the HSBC Rewards program is the same for the HSBC +Rewards Mastercard and the HSBC Travel Rewards Mastercard

Here’s an introduction to the 2 options.

Types of rewards with HSBC points

You can get different types of travel rewards with your HSBC points:

- Within the HSBC Rewards program:

- A fixed-value travel credit for any travel expense

- With a transfer to partners:

- A variable-value discount for specific flights on ≈ 50 airlines

Keep in mind that you can of course mix and match these options too.

If you need a few points for a redemption with a partner program, you can transfer just those and use the other points for a travel credit (or just to keep them to have the option to choose later).

Comparison of the 2 redemption options for HSBC points

In short, here are the most important things to understand about both of your redemption options with HSBC points:

- Within the HSBC Rewards program:

- Very simple

- No potential for outsized value and unlimited value

- No need to use the points “well” and no need to be flexible

- Eraser-type fixed-value rewards

- They erase any travel expense from your statement

- The value of the points is fixed no matter the redemption

- Travel credit is worth 0.5¢ per point

- Can’t be more or less, no matter the redemption

- With a transfer to partners:

- Not very simple

- Potential for outsized value and unlimited value

- Need to use the points “well” and need to be flexible

- Standard variable-value rewards

- They are based on program award charts

- The value of points is variable based on the redemption

- Discount is worth ≈ 0.6¢ per point

- Can be more or less, it depends on the redemption

We’ll have more details about the value in the guide, but let’s just note that our Flytrippers Valuation of HSBC points as variable-value rewards is just 20% higher than as fixed-value rewards (compared to American Express points that provide a whopping 50% more value this way and should really be transferred).

So it’s very reasonable to use HSBC points as a simple travel credit, especially since HSBC transfer partners are harder to maximize than American Express partners, at least for those who might not be frequent travelers (although of course it really depends on every traveler’s situation).

Rules to use HSBC points

The rules vary greatly for the 2 HSBC Rewards redemption options:

- Within the HSBC Rewards program:

- Few rules to follow

- Any type of travel expense

- Any airline, hotel chain, or travel provider

- Any booking website

- Few rules to follow

- With a transfer to partners:

- Many reward flight rules to follow (transfer rate from HSBC points to partner)

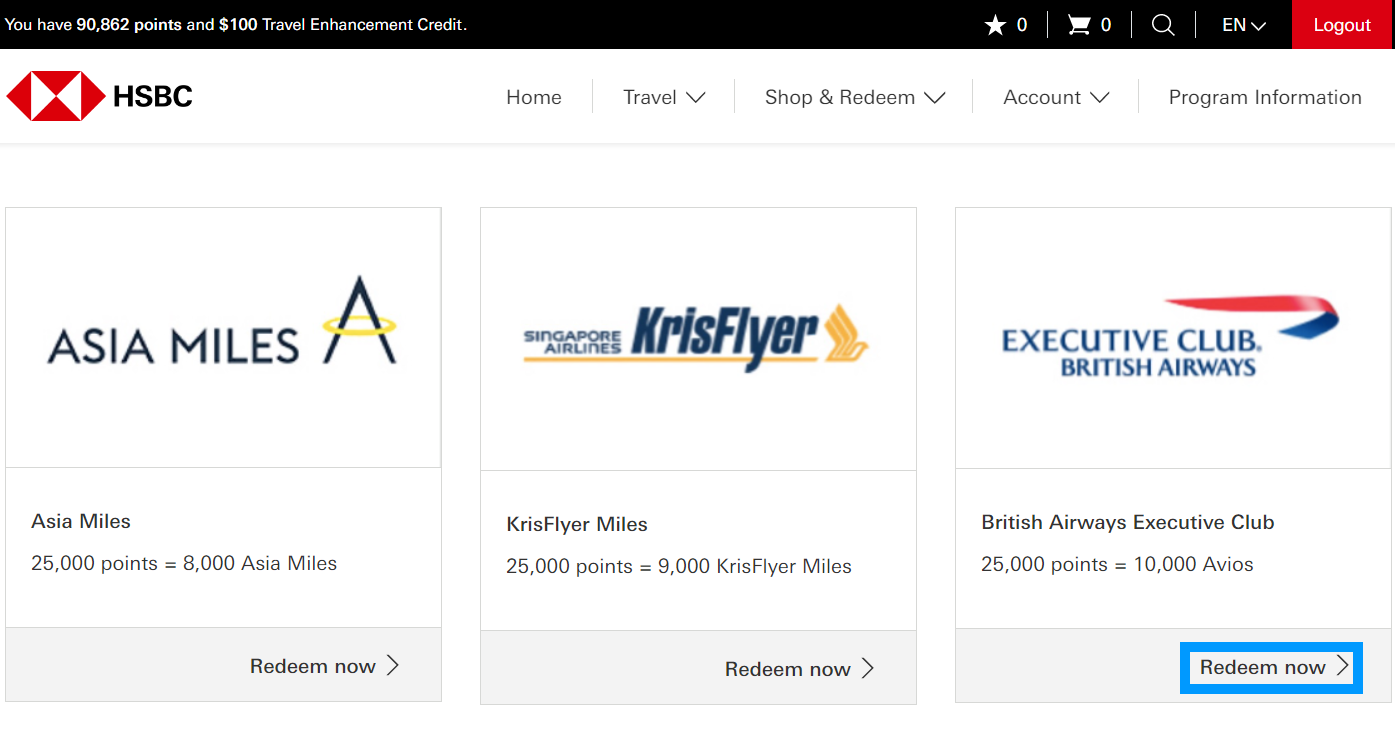

- British Airways Executive Club Avios (25 to 10)

- Singapore Airlines KrisFlyer Miles (25 to 9)

- Cathay Pacific Asia Miles (25 to 8)

- Many reward flight rules to follow (transfer rate from HSBC points to partner)

The travel credit is obviously extremely simple. In terms of partners, the most interesting one is by far Avios. But it’s still more “niche” than the better-known Aeroplan program for example.

Avios points are especially good for certain direct flights, most notably short-distance flights. And like all similar airline rewards programs, Avios points are very valuable for flights with high cash prices (including in business class, a popular redemption).

Also, there is usually a transfer bonus deal (about once a year) that gives you 30% or 40% more Avios points, so 30% or 40% more value for your HSBC points! That’s really excellent if you know you want to use them as Avios points.

How HSBC points work

The next section gives you plenty of redemption examples, but more concretely, here is what your travel rewards can look like with HSBC points:

- Within the HSBC Rewards program:

- 55,000 HSBC points give you a simple $275 travel credit on any travel expense

- No matter the trip you choose, a $275 credit always costs 55,000 points

- No matter the cash price of your trip, a $275 credit always costs 55,000 points

- With a transfer to partners:

- 55,000 HSBC points give you a ≈ $200 to ≈ $400 discount on specific flights (like Toronto-Miami roundtrip)

- Based on the route chosen, the amount of points required varies (fixed by the programs’ award charts)

- Based on the cash price of your flight, the discount varies (the amount of points required is unrelated to the cash price)

The travel credit is simple. Reward flights are what’s often confusing for many. Basically, a roundtrip Toronto-Miami flight always costs 22,000 Avios points on the Avios award chart (so 55,000 HSBC points with the regular transfer rate).

That means your 55,000 HSBC points can save you $200 sometimes or $400 other times… it all depends on the cash price of the Toronto-Miami flight! So sometimes it’s a good use of 55,000 points (if your discount is $400) but other times it’s not (if your discount is $200).

That’s what variable-value rewards are all about. Sometimes those same 55,000 HSBC points could give you savings of $825! That’s 3 times more than as a simple travel credit, for the exact same amount of points… that’s the potential for outsized value and unlimited value.

That potential for outsized value and unlimited value is made possible by the fact that the amount of points required is fixed by the award chart (independently from the price in cash), but to be able to offer these fixed prices, airline reward programs have to limit seat availability of course.

But to be clear, even when there is availability, not all flights are good uses of Avios points! So you have to be more flexible and be more knowledgeable for sure. But they can be worth a lot more!

How to actually redeem HSBC points

We have very detailed sections about each option towards the end of this ultimate guide, but to close out this introduction section, here are the highlights of the process for each:

- Within the HSBC Rewards program:

- You charge any travel expense to your card that earns HSBC Rewards

- You apply your points to erase the expense within 60 days very easily online

- You need to redeem a minimum of 25,000 points and then in 10,000-points increments

- With a transfer to partners:

- You choose a good redemption based on the program’s award charts

- You make sure there is seat availability

- You transfer your HSBC points to the partner program very easily online

- You book the reward flight via the partner program very easily online

How to use HSBC Points to maximize them (best uses)

Here are some concrete examples of the best uses of HSBC Rewards points.

Best uses when transferring to Avios

Here are 10 examples of what you can get with 98,000 HSBC points (the HSBC World Elite Mastercard‘s current welcome bonus), which is 39,200 Avios points.

That can save you ≈ $588 on those specific flights by finding availability.

Note that if you take advantage of the 30% transfer bonus to the Avios program offered pretty much every year (until June 30 right now), you can add 30% to all of those flight numbers right there!

- 2.5 one-way flights from Montreal/Toronto to Miami (11,000 points each)

- 4 one-way flights from Toronto to New York/Chicago/Washington/Philly (9,000 points each)

- 4 one-way flights from Miami to the Caribbean or Central America (9,000 points each)

- 3 one-way flights from Toronto to Dublin (13,000 points each)

- 1.5 one-way flights from Toronto to Dublin in business class (25,000 points each)

- 9.5 one-way flights within Europe (4,000 points each)

- 6.5 one-way flights within Asia (6,000 points each)

- 6.5 one-way flights within Australia (6,000 points each)

- 6.5 one-way flights within Morocco (6,000 points each)

- 6.5 one-way flights within Asia (6,000 points each)

- 2 one-way flights from Boston/New York/Chicago to Madrid (17,000 points each)

For all the details, you can read the top 10 uses of Avios points.

Best uses as a travel credit

There really is no “best” use of it, they are all equal by definition.

The 98,000 HSBC points of the HSBC World Elite Mastercard‘s current welcome bonus simply give you a $490 travel credit applicable on any travel expense.

How to earn HSBC Rewards points (best ways)

First of all, as with all bank rewards programs, you can only earn HSBC Rewards with HSBC-issued credit cards. And one of them in particular makes it really easy to rack up many points with an amazing increased welcome bonus offer currently!

(But if you transfer HSBC Rewards points to the Avios program for example, then you have many other ways to boost your stash of Avios points in other ways; more details in Avios guide.)

Again, here is a brief overview of the 3 cards that earn HSBC Rewards.

Best credit cards for

HSBC Rewards

HSBC World Elite® Mastercard®

Card:

Bonus: no welcome bonus

WELCOME BONUS

(

Rewards: ≈ $100

Card fee: $149

Best for: 0 pts

+ $100 annual credit

and no FX fees

HSBC +Rewards™ Mastercard®

Card:

Bonus: no welcome bonus

WELCOME BONUS

(

Rewards: $0

Card fee: $25

Best for: 0 pts

+ low interest rate

and no min. income

HSBC Travel Rewards Mastercard® (excl. QC)

Card:

Bonus: no welcome bonus

WELCOME BONUS

(

Rewards: $0

Card fee: $0

Best for: 0 pts

+ no annual fee

and no min. income

Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information.

HSBC World Elite® Mastercard®

Let’s start with one of the very best cards for Canadian travelers who earn over $80,000 per year.

After unlocking the HSBC World Elite Mastercard‘s current welcome bonus, you’ll get:

- 98,000 HSBC Rewards points + 2 annual travel credits of $100 each

- Flytrippers Valuation of ≈ $639 net (excluding Québec residents)

- Details of the welcome bonus offer

- Points from the welcome bonus worth ≈ $360

- Points earned on the minimum spend worth ≈ $108

- Travel credit worth $100 (1st year)

- Card fee of $0 (1st year)

- Points from the optional renewal bonus worth ≈ $120

- Travel credit worth $100 (2nd year)

- Card fee of $149 (2nd year)

- Minimum spend required: $6,000 in 6 months

- Minimum income required: $80,000 (or $150,000 for household)

- Subsequent years’ fee if you decide to keep it: $149 ($49 net after the annual $100 travel credit)

- Québec residents only: Offer is structured differently

- 110,000 HSBC Rewards points total

- Flytrippers Valuation of ≈ $562 net

- No minimum spend required

- No annual fee waiver the 1st year

With the HSBC World Elite Mastercard you will earn:

- 6 HSBC Rewards points per $ (≈ 3.6% or 3.0%) on travel

- 3 HSBC Rewards points per $ (≈ 1.8% or 1.5%) on everything else

Here are just a few highlights of the HSBC World Elite Mastercard:

- One of the highest free welcome bonuses ever seen in Canada

- One of the very rare cards in Canada that does not charge a 2.5% foreign transaction fee

- Great base earn rate and a great multiplier rate on the travel category

- Points can be either very easy to use or extremely valuable with transfer partners

- Comes with an annual $100 travel credit

You can apply now via the secure HSBC link or read more details on the HSBC World Elite Mastercard.

HSBC +Rewards™ Mastercard®

This card is very attractive for many types of travelers, including those who are not eligible for the first one.

After unlocking the HSBC +Rewards Mastercard‘s current welcome bonus, you’ll get:

- 37,000 HSBC Rewards points

- Flytrippers Valuation of ≈ $185 net (excluding Québec residents)

- Details of the welcome bonus offer

- Points from the welcome bonus worth ≈ $175

- Points earned on the minimum spend worth ≈ $10

- Card fee of $0 (1st year)

- Minimum spend required: $2,000 in 6 months

- Minimum income required: $0

- Subsequent years’ fee if you decide to keep it: $25

- Québec residents only: Offer is structured differently

- 40,000 HSBC Rewards points total

- Flytrippers Valuation of ≈ $175 net

- No minimum spend required

- No annual fee waiver the 1st year

With the HSBC +Rewards Mastercard you will earn:

- 2 HSBC Rewards points per $ (1.0%) on dining and entertainment

- 1 HSBC Rewards point per $ (0.5%) on everything else

Here are just a few highlights of the HSBC +Rewards Mastercard:

- No minimum income requirement

- Good welcome bonus for a low-fee card

- Very flexible points

- Low interest rate (so if you don’t pay your balance in full each month, this is a good option while you rectify that)

You can apply now via the secure HSBC link or read more details on the HSBC +Rewards Mastercard.

HSBC Travel Rewards Mastercard®

The no-annual-fee version is one of the rare cards of this type with a decent welcome bonus.

After unlocking the HSBC Travel Rewards Mastercard‘s current welcome bonus, you’ll get:

- 26,000 HSBC Rewards points

- Flytrippers Valuation of ≈ $130 net (excluding Québec residents)

- Details of the welcome bonus offer

- Points from the welcome bonus worth ≈ $125

- Points earned on the minimum spend worth ≈ $5

- Card fee of $0

- Minimum spend required: $1,000 in 6 months

- Minimum income required: $0

- Subsequent years’ fee if you decide to keep it: $0

- Québec residents only: Offer is structured differently

- 25,000 HSBC Rewards points total

- Flytrippers Valuation of ≈ $125 net

- No minimum spend required

With the HSBC Travel Rewards Mastercard you will earn:

- 3 HSBC Rewards points per $ (1.5%) on travel*

- 2 HSBC Rewards points per $ (1.0%) on gas and everyday transportation (like subways, trains, and taxis)

- 1 HSBC Rewards point per $ (0.5%) on everything else

*Multiplier rate capped at $6,000 in annual travel spending

Here are just a few highlights of the HSBC Travel Rewards Mastercard:

- No minimum income requirement

- Good welcome bonus for a no-annual-fee card

- Very flexible points

- Travel insurance (even interruption coverage)

- Multiplier earn rate (decent for a no-fee card)

You can apply now via the secure HSBC link or read more details on the HSBC Travel Rewards Mastercard (coming soon).

How to manage HSBC Rewards (logistics)

Here are more details on some of the more logistical elements of the HSBC Rewards program.

Expiry rules for HSBC Rewards

HSBC Rewards points don’t expire as long as you have a credit card that earns HSBC points and your account is in good standing.

However, as with all bank-owned rewards programs, you cannot keep your HSBC Rewards points if you close your card.

That said, for all bank programs, it’s still easy to not lose your points thanks to these 3 options:

- Use them before closing the card

- Keep them by downgrading your card to a no-fee version

- Transfer them to a partner program (when allowed)

So you can keep your points even if you decide to close the HSBC World Elite Mastercard or the HSBC +Rewards Mastercard to avoid the annual fees after the first year (or after the second year in the case of offers with a renewal bonus in addition to a welcome bonus).

Use HSBC points before closing the card to avoid expiry

Using your HSBC points before closing the card is pretty simple.

You always have a full year when you get a new card, so that should be enough to book a trip in most cases.

Keep HSBC points by downgrading your card to a no-fee version to avoid expiry

If not, as with all cards, you can simply downgrade the card to a version with no annual fee. That allows you to keep the points but also to keep a card that will age and improve your credit score for free.

For HSBC points specifically, you can downgrade to the HSBC Travel Rewards Mastercard with no annual fees.

But you will no longer be able to transfer them to partners as you can with the HSBC World Elite Mastercard. So for that card, compare that option with the last one.

Transfer HSBC points to a partner program (when allowed) to avoid expiry

Only with the HSBC World Elite Mastercard you could transfer the points to an airline partner to keep them.

If you do this, you will no longer ever be able to use them as a simple travel credit.

Creating an HSBC Rewards account

You need to create an HSBC account after you receive your card (if you don’t already have any other HSBC cards or accounts). Create an account online on the HSBC website (red button in the upper right corner). They also have a convenient app.

You’ll be able to make payments on your card by adding HSBC as a bill in your existing bank account, of course. But creating an HSBC account will allow you to manage your card and, more importantly, your rewards (and your annual travel credit for the HSBC World Elite Mastercard).

If you like, you can always call HSBC using the phone number on the back of your card, but it’s so much easier to do everything online in 2022.

And that’s it for the set up, for those who are sure they will always want to use HSBC Rewards points as a simple travel credit. We’ll have more details and screenshots for redemptions in the ultimate guide.

For others — and this is obviously optional — if you want to eventually transfer your points to the British Airways Avios program (the British Airways Executive Club, as it’s officially called) to use them that way, you’ll need to create a British Airways Avios account as well. This is separate. We’ll soon have more about that too.

Pooling HSBC Rewards points in one account

You’ve probably already figured it out: earning points as a couple is twice as fast. You can’t pool HSBC Rewards points from different travelers together, but with how the program works, it’s not really necessary anyway.

If you have the HSBC World Elite Mastercard and want to use your HSBC Rewards points as Avios points, you can pool Avios points from different travelers into one shared household account.

How to take advantage of the HSBC Rewards program benefits (other than points)

Here are more details on a very interesting benefit:

- HSBC annual travel enhancement credit

HSBC annual travel enhancement credit

The HSBC annual travel enhancement credit is one of the best perks of the HSBC World Elite Mastercard (not offered on the HSBC +Rewards Mastercard or the HSBC Travel Rewards Mastercard).

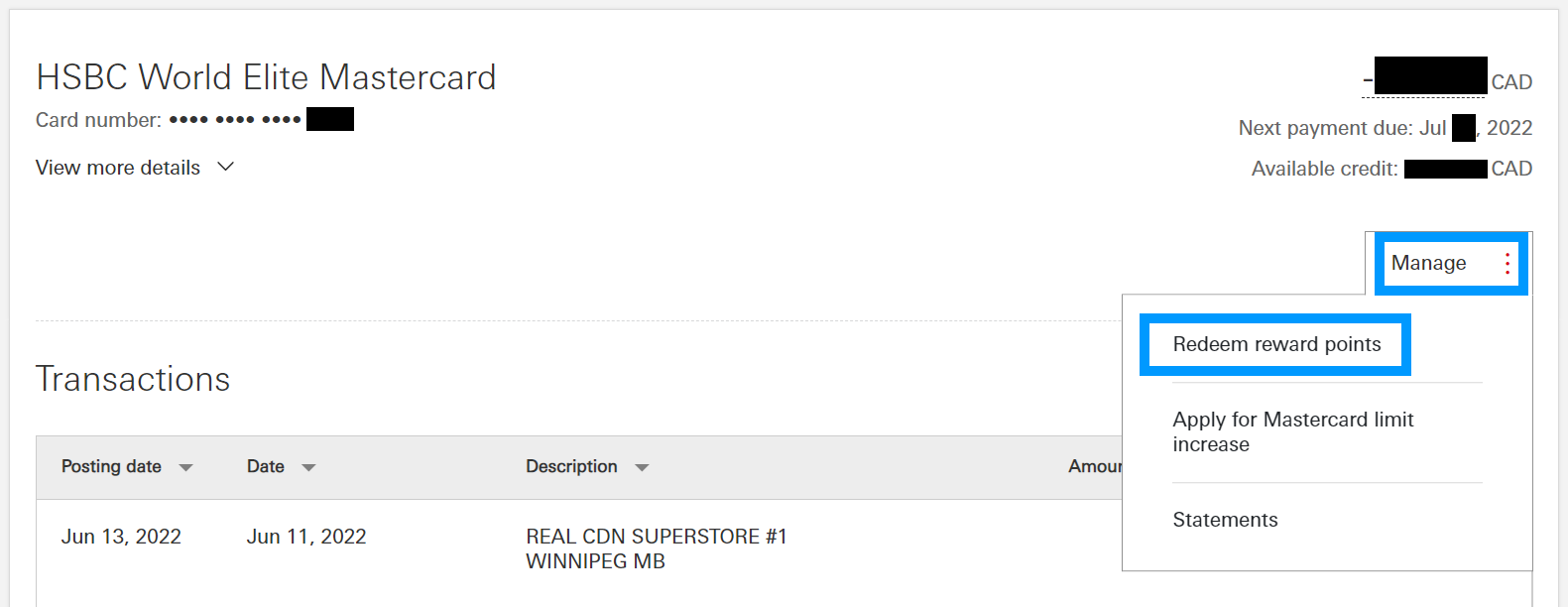

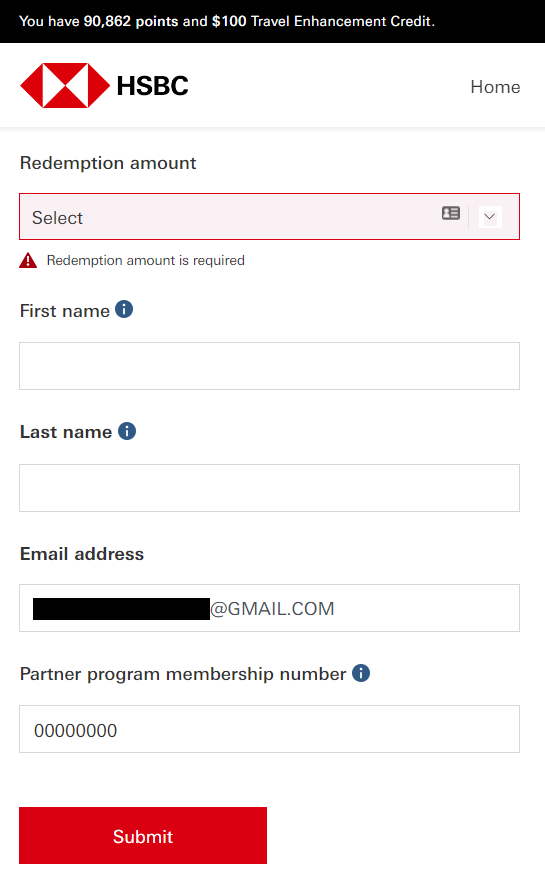

Every year, a $100 credit will appear on your HSBC Rewards account (in the top bar).

It is theoretically meant to be applied to airline seat upgrades, airline baggage fees, and airport lounge passes… but in practice, you can apply it to any travel expense.

So it’s a very easy-to-use $100 credit that almost entirely offsets the annual fee after the Year 1 welcome bonus and the Year 2 renewal bonus (starting in Year 3, the net balance of $49 is also completely offset as long as you spend $1,960 per year in foreign currencies, at least assuming you don’t have another card with no FX fees).

You can soon read our step-by-step guide on how to redeem your HSBC travel enhancement credit online.

How to book travel with HSBC Rewards points (step by step)

Here’s a more hands-on section on the booking process.

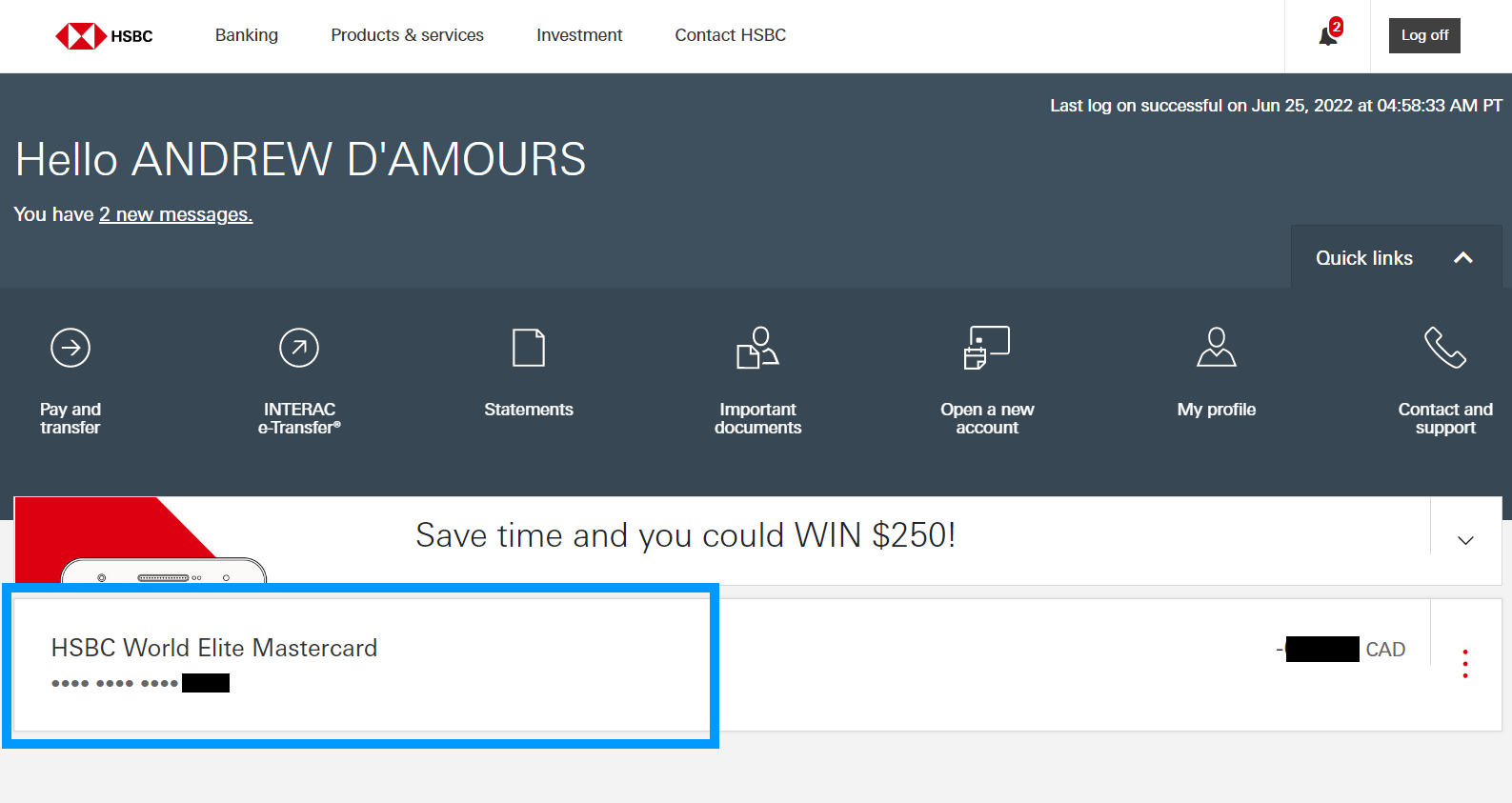

Accessing the rewards portal

First, you log in to the HSBC website.

On the welcome screen, click on your card.

Then click “Manage” and select “Redeem reward points.”

Depending on how you want to use your HSBC points, you have 2 options, both under the “Travel” tab obviously.

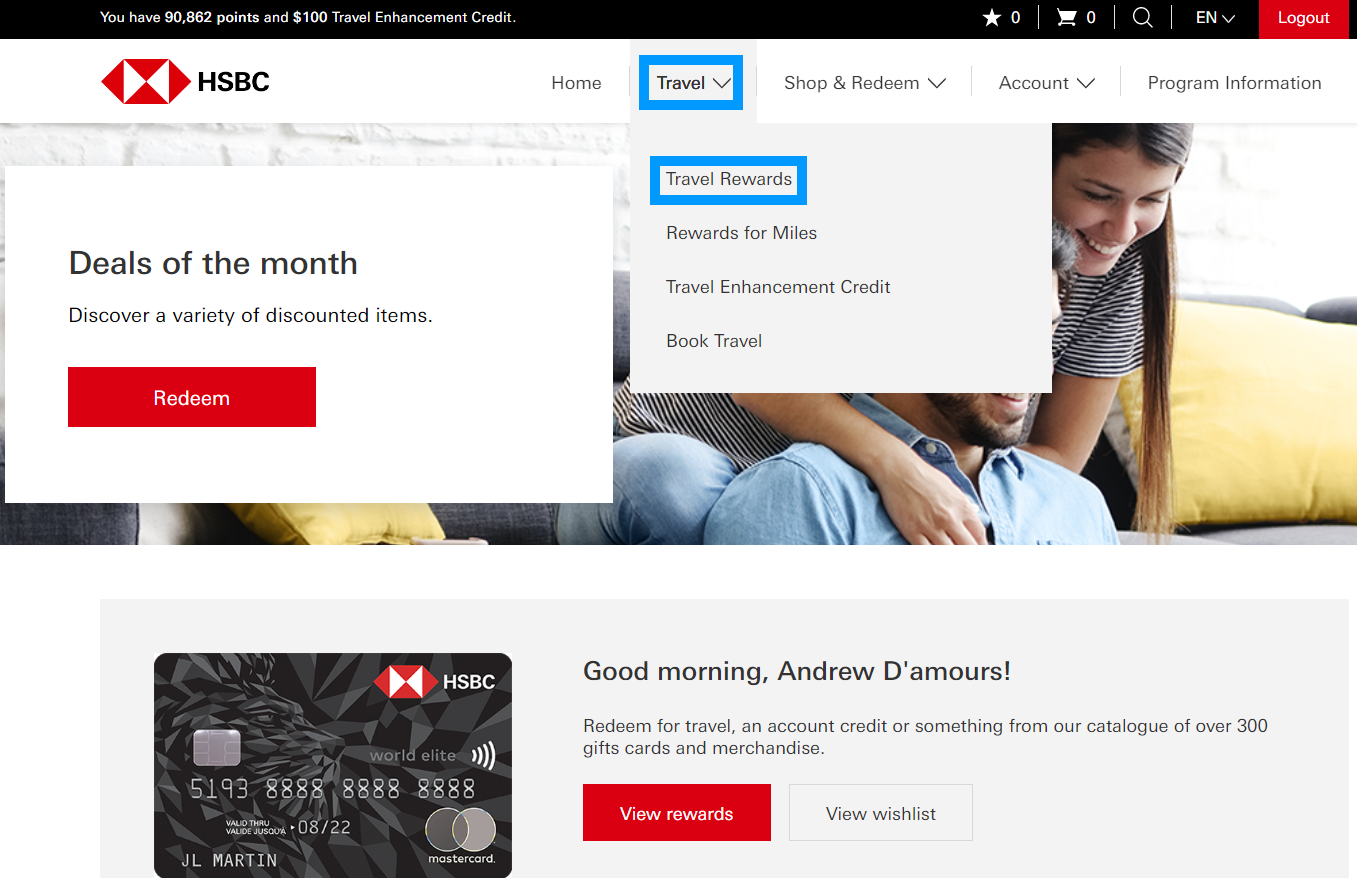

Booking with the simple travel credit

You can select “Travel Rewards” for the simple travel credit.

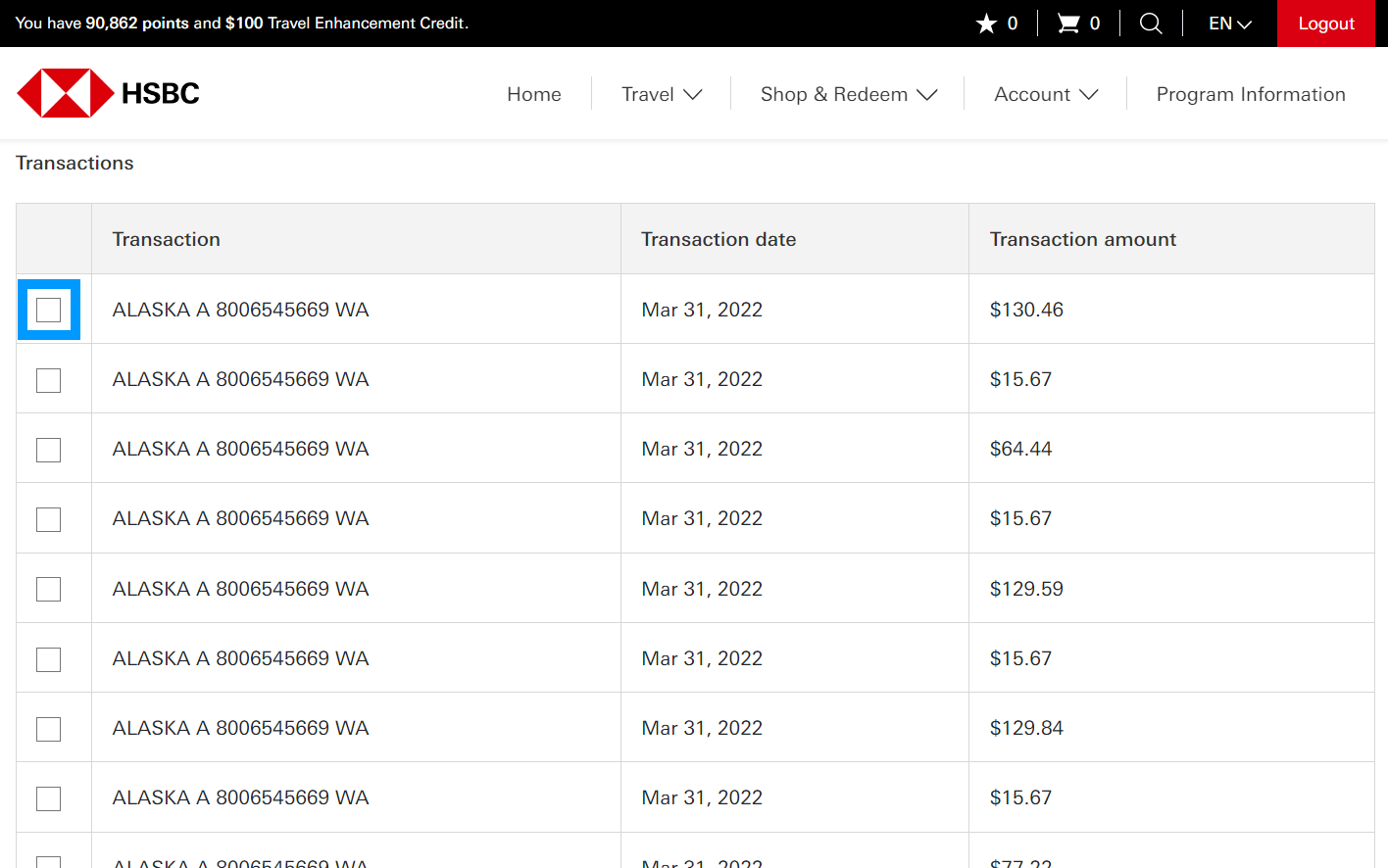

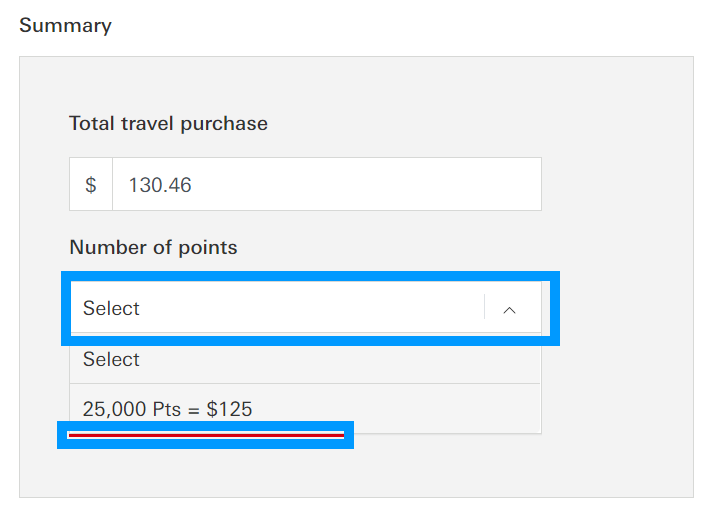

You’ll see a list of all travel expenses you charged to your card in the past 60 days (in my case it’s a ton of Alaska Airlines bookings, I’ll explain that funny story in a separate post soon).

You simply select the travel expenses you want to erase with your HSBC Rewards points with the checkbox.

The box at the bottom of the page will fill out, you’ll have to select how many points to apply in the dropdown menu and then click on the red button that is just below.

Booking as airline points

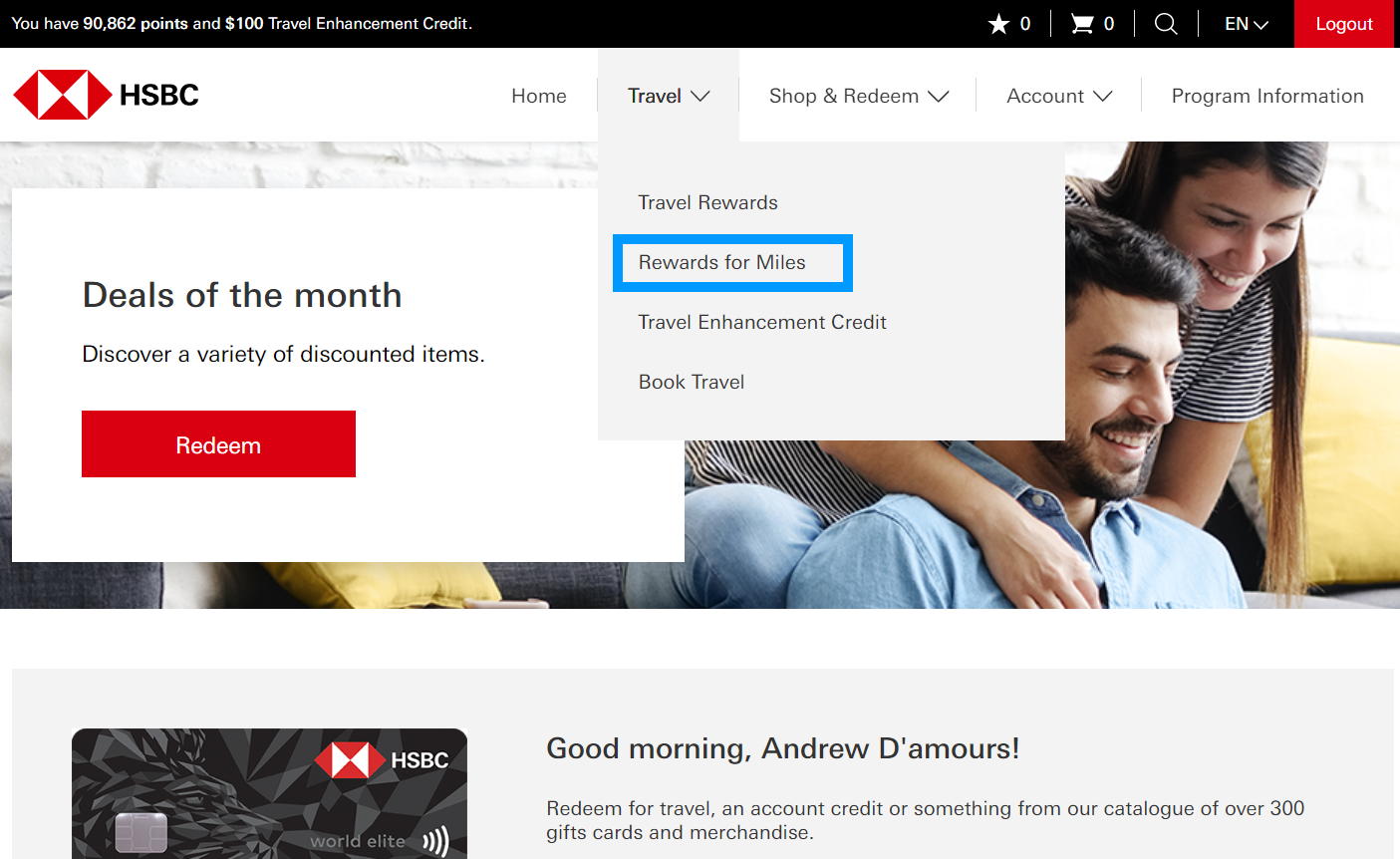

On the rewards homepage, you must select “Redeem for miles” to transfer your points.

You’ll see your 3 transfer partner options, you simply need to click on “Redeem now.”

You then fill out the required information and your points transfer will be sent.

Please note that during transfer bonuses, the improved transfer rate is NOT reflected on the transfer page but as long as you are within the promo period, you will get the bonus amount without a problem.

How much is an HSBC Rewards point worth (valuation)

Our Flytrippers Valuation of HSBC Rewards points is 0.5¢ per point for the 2 cards other than the HSBC World Elite Mastercard. It’s simple because these are fixed-value rewards, the value does not change.

If you have the HSBC World Elite Mastercard, our Flytrippers Valuation of HSBC Rewards points is ≈ 0.6¢ per point (20% more). In other words, if a particular redemption saves you 0.6¢ for every point you use, it’s a good idea to use your points.

The value calculation is simple and is always the same no matter the rewards: it’s the number of dollars saved divided by the number of points used.

For example, if paying 25,000 points for a flight saves you $250, you get a value of 1¢ per point ($250 / 25,000 pts = $0.01/pt or 1¢/pt). You need to use the total amount you save for the formula, so the price of the flight minus the taxes that you have to pay of course.

A value of 1¢/pt is more than our Flytrippers Valuation, so we use points to pay, not cash. That is the very basic rule of variable-value rewards: sometimes it’s a good redemption, sometimes it’s not and you should just pay in cash.

But that ≈ 0.6¢ valuation can be different for you, depending on your travel habits (hence the “≈” symbol for all our Flytrippers Valuations of variable-value rewards). I repeat: it’s a conservative estimate for an average traveler. If you’re like us and maximize your Avios points, they can be worth a lot more. If you’re not careful, they can be worth a lot less.

In all cases, even with average redemptions, you can get free travel fairly easily!

How to use HSBC Rewards points (detailed rules)

Here are more details on the different options for using HSBC Rewards points.

Using HSBC Rewards points for a simple travel credit

The intro above should be enough for now, the rest is coming in the next version!

Using HSBC Rewards points for flights

Coming in the ultimate guide.

Using HSBC Rewards points for something other than travel

The best way to use HSBC points for something other than travel is to not do it.

Same as for every other rewards program in the world, which always give less value when you use them for anything other than travel. We certainly won’t encourage you to lose that much value; after all, our mission at Flytrippers is to help you travel more for less!

Want to get more content to maximize your HSBC Rewards?

Summary

The HSBC Rewards program is a pretty straightforward bank rewards program, with lots of options to redeem your points for travel since the points are among the easiest type to use. Points can be redeemed for any travel purchase on your card at a value of 0.5¢ per point. Or, with the HSBC World Elite Mastercard, you can transfer your points to partner airline programs with the potential for outsized value and unlimited value.

What would you like to know about HSBC Rewards? Tell us in the comments below.

Explore awesome destinations: travel inspiration

Learn pro tricks: travel tips

Discover free travel: travel rewards

Featured image: Barcelona, Spain (photo credit: Joseph Guilbey)

Advertiser Disclosure: In the interest of transparency, Flytrippers may receive a commission on links featured in this post, at no cost to you. Thank you for using our links to support us for free, we appreciate it! You allow us to keep finding the best travel deals for free and to keep offering interesting content for free. Since we care deeply about our mission to help travelers and our reputation and credibility prevail over everything, we will NEVER recommend a product or service that we do not believe in or that we do not use ourselves, and we will never give any third-party any control whatsoever on our content. For more information on our advertiser disclosure, click here.

Concernant le crédit voyage de 100$ tu écris: “in practice, you can apply it to any travel expense” J’ai réservé un hotel avec booking.com au Canada il y a une semaine et cette dépense n’apparait toujours pas dans la liste des crédits. Problème?

Bonjour, juste pour ton info si tu préfères, toutes nos pages sont disponibles en français en choisissant l’option dans le menu en haut.

Pour le crédit HSBC, il se peut que certains sites ne fonctionnent pas, peut-être que Booking.com en est un. Pour avoir le même effet, réserve un hôtel remboursable sur un site officiel d’hôtel, applique le crédit et fais-toi rembourser l’hôtel et ça va l’appliquer sur le même relevé que ton hôtel réservé sur Booking.com. C’est toujours plus simple d’appliquer l’astuce de l’hôtel remboursable avec ce crédit HSBC.