The transition from HSBC to RBC is now complete, and like everyone else who has followed the process, you may have been a little surprised by the conversion rate from HSBC Rewards points to RBC Avion points. Let’s just say they’re certainly not going to win any awards for transparency throughout the process.

But all in all, the change has positive value for all travelers in terms of rewards (for the rest of the year, which is always all that matters if you understand the basics of travel rewards). The RBC Avion program is one of the best, too, if you want to maximize the value you get!

Here are all the latest details now that HSBC officially no longer exists in Canada.

Basics of the HSBC to RBC transition

Here’s a reminder of the highlights:

- Your HSBC World Elite Mastercard no longer exists

- It’s now an RBC Avion Visa Infinite Avion Card

- You keep the 0% FX fee benefit

- With no end date

- So you get it for free until your renewal

- It will then cost you $120 instead of $49

- You get an extra $100 travel credit right now

- $100 (or $200 if you didn’t use the HSBC $100)

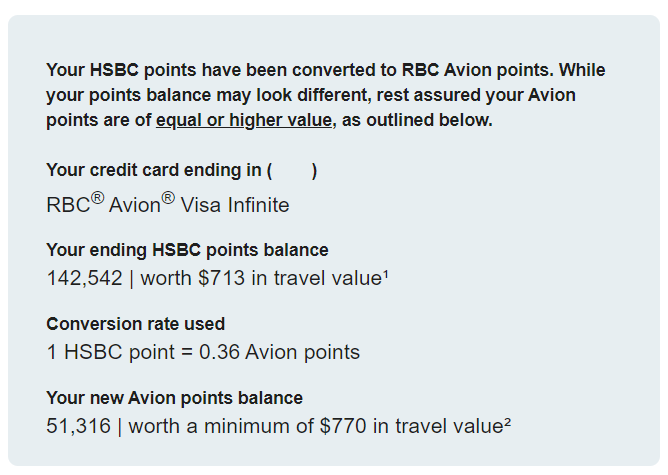

- Your points have been converted at a “comparable” value

- It varies per person, check their email sent on April 1st

- Other HSBC products have also been transitioned

- They were much less interesting

Let’s take a look at each of these elements one by one, for the many of you who took advantage of the great deal on the HSBC World Elite Mastercard.

Value of rewards

Let’s start with the most important thing of all, the value. Let me remind you of a very basic concept: the definition of value is how much money you save by using the points. And it’s very important to do the math correctly in the wonderful world of travel rewards!

Here are the basics according to the different usage options:

- The conversion rate seems to be 1 to 0.36

- For most customers

- To confirm in their April 1st email

- Value is superior for simple uses for any travel

- But in a different way: with a special increased value

- Value a lot superior with the RBC Avion price chart

- Excellent for some flights that are expensive in cash

- Value is slightly lower for transfers to Avios points

- But a 30% transfer bonus is probably on the way

- Value is slightly higher for transfers to Asia Miles

- Less useful program though

- New transfer option to AAdvantage miles

- Not often interesting though

- New transfer option to WestJet dollars

- Absolutely not recommended in this case

The RBC Avion program team had confirmed to Flytrippers a comparable value for the simpler type of use for any travel expense. We assumed that meant a rate of 1 to 0.5 (no choice but to assume, since they didn’t want to be more transparent).

It was logical: HSBC Rewards points were worth 0.5¢/pt for this type of use, and RBC Avion points are worth 1¢/pt for this type of use. And THE thing they promised was to maintain that value.

But they played a little trick on all of us: they decided to maintain the value by giving a lower conversion rate while giving a special higher value to these points for this usage option.

So it’s a bit different.

That’s also very basic: you can’t just look at the quantity of points, you must also look at the value of those points. The American Express Cobalt Card earns 5 points per $, which gives ≈ 7.5%. The BMO eclipse Visa Infinite Card also earns 5 points per $, but that’s 3.33%… less than half. You always have to do the math correctly.

Here are all the details of the value for the 6 different options to use RBC Avion points for travel (which are obviously very different from one another).

Use for any travel expense (more simple type)

Your RBC Avion Points will be worth 1.5¢/pt for simple uses for any trip, instead of the normal 1¢/pt value of RBC Avion points earned without an HSBC card.

This means that, indeed, the comparable value with HSBC points is maintained.

Here’s the math:

- If you had 100,000 HSBC points

- It was worth $500 (value of 0.5¢/pt)

- You now have 36,000 RBC Avion points

- It is worth $540 (special value of 1.5¢/pt)

That’s 8% more value than before. But as we explained, it’s a little less flexible because you have to book with the RBC Avion program instead of being able to book on any site.

We obviously don’t recommend this if you want to maximize the value of your “regular” RBC Avion points. But at a value of 1.5¢ instead of 1¢, it can make sense! It’s less of a waste than it is with “normal” RBC Avion points, anyway!

Use for flights with the RBC Avion price chart (more lucrative type)

Their particular conversion method has the effect of not giving the incredibly higher value that the pros were hoping to get for the more lucrative use options.

These options are the RBC Avion price chart and transfer to airline programs (these transfers are always by far the use that can be worth the most).

Honestly, it makes sense that they don’t give extra value, it makes sense that it’s comparable instead of much better. It’s very understandable. They didn’t need to give more. It’s just a shame they weren’t more transparent.

So, for the other options for using RBC Avion points for travel, the value is just comparable instead of being much better as we’d hoped, including with the RBC Avion price chart.

Here’s the math:

- If you had 100,000 HSBC points

- It was worth $500 (value of 0.5¢/pt)

- You now have 36,000 RBC Avion points

- It is worth up to $840 (value of up to 2.33¢/pt)

That’s 68% more value if you maximize the RBC Avion price chart. To maximize this particular usage option, that means the flight is very expensive in cash (and the tax and fuel surcharge portion of the ticket is low).

For more normal uses without maximizing, the value with the conversion rate remains comparable to your value at HSBC too, and will still often be better than with the simpler use option.

As with any more lucrative type of reward use, the value can vary greatly depending on the use you choose. Because the number of points required is NOT linked to the cash price. So the value depends on the number of points required and the cash price. You just have to do the math! That’s the basics of these more lucrative points!

Use for specific flights with Avios (more lucrative type)

On the other hand, for the best transfer partner, British Airways Avios, the value after the transition is actually a little lower.

This objectively goes against my interpretation of the “equal or higher value” they promised to the government. Lower… is not equal or higher. But I guess it is “comparable” in the sense that it’s a very small difference.

Most importantly, we can expect a transfer bonus soon, which will still allow us to get a better value than with HSBC. So it’s not dramatic, just disappointing.

It’s also worth noting that transfers are much less restrictive with RBC Avion than with HSBC: you can transfer just the amount of RBC Avion points you want very easily (like with American Express points). With HSBC, the minimum number of points you had to have to transfer to Avios was high, and on top of that, after the minimum you had to transfer in inconvenient increments.

Here’s the math:

- If you had 100,000 HSBC points

- That gave you 40,000 Avios points (2.5 to 1 transfer rate)

- You now have 36,000 RBC Avion points

- That gives you 36,000 Avios points (1 to 1 transfer rate)

If you wait for the 30% transfer bonus, you’ll have over 46,000 Avios points, so it’s still going to be better. Sometimes transfer bonuses are 35% too.

Without the bonus, that’s a difference of just 4,000 points for every 100,000 HSBC points you had. That’s more than offset by the $100 travel credit for most people. But it’s lower, so it’s still disappointing.

The worst part is that had they just been transparent, it would have been a very well-accepted rate, it’s the fact that they weren’t upfront about it at all that’s very disappointing.

The fact remains that Avios points literally have unlimited value. Having 36,000 points instead of 40,000 is in the past and no longer relevant. Understanding the concept of sunk costs is part of the basics of knowing how to do the math correctly too.

The fact is, these points can give you so much more than 1.5¢/pt if you use them right. That’s what you have to compare them with now that you have the points, the simple value of 1.5¢/pt. HSBC points no longer exist and are no longer an option, that’s over and therefore no longer relevant.

In business class and first class, Avios points are obviously worth much more than 1.5¢/pt, but even in economy class, they can often be worth more than 1.5¢/pt. It all depends! Here are some examples of good uses of Avios points while you await the detailed guide.

Use for specific flights with Asia Miles (more lucrative type)

In the case of the Cathay Pacific airline rewards program, the value increases with the conversion rate. There are fewer good uses for the program than with Avios, however.

Here’s the math:

- If you had 100,000 HSBC points

- That gave you 32,000 Asia Miles (2.5 to 0.8 transfer rate)

- You now have 36,000 RBC Avion points

- That gives you 36,000 Asia Miles (1 to 1 transfer rate)

That’s a positive difference that gives you 13% more value than with HSBC, and again the logistics are much less restrictive with RBC Avion.

Use for specific flights with AAdvantage (more lucrative type)

American Airlines’ AAdvantage program wasn’t an HSBC partner, so there’s no real comparison. But it gives you extra options you didn’t have before.

Here’s the math:

- If you had 100,000 HSBC points

- That couldn’t give you AAdvantage miles

- You now have 36,000 RBC Avion points

- That gives you 25,200 AAdvantage miles (1to 0.7 transfer rate)

I got an absolutely incredible value of 10¢/pt with my AAdvantage miles this fall, which just goes to show you how much they too can be worth.

But this was a very extreme example, and it was also the first time in my life that I’d used this program that is less attractive than Avios (and even Asia Miles) for oneworld alliance airlines.

Use for flights with WestJet (more simple type)

The WestJet Rewards program is one of the few airline programs that are of the more simple type, so it’s less interesting if you want to maximize value. It wasn’t an HSBC partner either, so at least it’s one more option… but it’s definitely one to avoid with these points.

Here’s the math:

- If you had 100,000 HSBC points

- That couldn’t give you WestJet dollars

- You now have 36,000 RBC Avion points

- That gives you 360 WestJet dollars (100 to 1 transfer rate)

That’s terrible, you’re much better off using your RBC Avion points for any travel expense (including WestJet flights) at a value of 1.5¢/pt. That’ll give you $540 instead of $360.

RBC $100 travel credit

It’s always nice to get $100 without having to do anything. It’s the new RBC travel credit they’re giving you for free for the transition. We already knew everything about this benefit, apart from the expiry date and the logistics of how to apply it.

Here are the basics:

- $100 extra travel credit for free

- Take it, it’s free!

- $100 or $200 travel credit

- $100 if you’ve already used your $100 HSBC credit

- $200 if you hadn’t used your HSBC credit yet

- Can be used on a minimum purchase of $200

- Even if your credit is only $100

- Can be used for hotels or car rentals

- Booked on the RBC Avion site

- Charged to your RBC Avion Visa Infinite Avion Card

- Offer activation/registration required

- On the RBC Offers section on their site/app

- Expiry extended to April 5, 2025

- No matter when your HSBC credit expired

- Can probably not be cashed in with the refundable hotel trick

- I’ll test it for you

The only information we don’t know about the whole transition is whether the RBC travel credit can be easily cashed in as the HSBC travel credit could. Unfortunately, many travelers who don’t follow us or who didn’t believe us really thought they had to use the HSBC travel credit for what was listed when that wasn’t the case at all.

I will test the refundable hotel trick for you shortly. It doesn’t work with RBC Avion points, so it seems unlikely to work for the credit booked through RBC Avion. I’ll let you know in a detailed post about the RBC travel credit.

0% FX fee benefit

This too was already known. Saving 2.5% on everything you buy in foreign currencies completely free of charge (in fact, it’s better than free: you get paid $100 with the RBC travel credit) is a good reason to keep the card until your renewal.

Here are the basics:

- You keep the 0% FX fee benefit

- Instead of 2.5% on almost all other cards in Canada

- Instead of 2.5% on the “regular” RBC Avion Visa Infinite Card

- Special grandfather clause

- Only for former HSBC World Elite Mastercard holders

- No end date for this benefit

- So at least you get it for free until your renewal

That’s why it makes no sense to close the card, either your new one or your existing RBC Avion Visa Infinite Avion Card if you already had it at the time of transition.

The only drawback to keeping the card is that it makes you ineligible for the RBC Avion Visa Infinite Avion Card’s welcome bonus, but that was easy to circumvent if you followed our advice more than 2 months ago. So sign up for our free newsletter specifically about travel rewards and you’ll never miss any of our content (or be sure to check it out if you’ve already signed up).

It’s so simple: the only time to close any card is at your renewal.

But since there’s been this transition to a new bank, it’s clearly an exception case. If you don’t want to keep the 0% FX fee and want to take advantage of the transition to close the card before your renewal, make sure you at least use the completely free $100 credit they give you beforehand! And make sure you have an alternative so you don’t pay 2.5% on all your foreign currency purchases.

Earn rates and insurance

Earn rates and insurance coverage are inferior, but really shouldn’t even be considered right away if you’re a pro.

When your card renewal comes due, that’s when it’ll be relevant to look at. I’ll be doing an in-depth analysis of renewal value very soon, this article is already long and most people don’t like to read too much apparently!

Learning how to travel for less

Join over 100,000 savvy Canadian travelers who already receive Flytrippers’ free newsletter so we can help you travel for less — including thanks to the wonderful world of travel rewards!

Summary

The transition from HSBC to RBC is now complete. The points conversion rate gives comparable value as promised, but not the much better value we’d dreamed of. On the other hand, the RBC Avion program can give you so much more value — and the free $100 credit and the maintained 0% FX fee are very positive too!

What would you like to know about the completed HSBC to RBC transition? Tell us in the comments below.

See the flight deals we spot: Cheap flights

Discover free travel with rewards: Travel rewards

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Featured image: Tayrona Park, Colombia (photo credit: Azzedine Rouichi)

Hi Andrew, you say in the article “until renewal” does this mean the benefits like 0% FX will disappear if you choose to renew?

Example: my HSBR world elite card was set to renew in September 2024 so now the RBC Avion card is set to renew in the same term. If I choose to renew, will I keep these grandfathered benefits?

The benefit stays, I just mean it made no sense to cancel the card mid-year when it’s already paid for and you can get the FX benefit until the renewal for free. It’s still there after renewal, but then you’re paying $120 to save the FX fee when you can save it for free with the EQ Bank Card (Prepaid Mastercard) for example.

Hi Andrew, do you know when we can expect the 30% Bonus Avios promotion? Also, how long does the transfer take? I am looking at booking a trip in May and wondering if I should wait for the promo or transfer right away.

Thanks

Hi Danny,

Unfortunately there is no way of knowing in advance. The transfers can take about a week.

So if you have found availability for a good redemption, it’s probably best to jump on it now. Unless you prefer getting 30% more value for a future redemption.

I book a lot of hotels for work and appreciated the HSBC card for the increased points received for travel bookings, the no foreign currency exchange rate, and the ability to book travel on any site, and then easily redeem my HSBC points against that travel. When you are forced to booked with a credit card travel site, the prices might not be as good, there is less flexibility on what you can book, and always a hassle if you need to change your booking (vs dealing directly with the hotel). It’s a bummer to see this flexibility go. I don’t think there are any cards left in Canada that offer the flexibility to book anywhere and then redeem your points against that travel?

Hi David,

First, the FX fee element is not as important as everyone seems to think, at least if you truly want to maximize, which is by using your spending to unlock welcome bonuses. Same for the earn rate.

And for redemptions, yes many people prefer more simplicity over more value. Because this option is simpler, it obviously gave you a lower value with HSBC (compared to transferring to airline partners).

That said, plenty of cards let you apply the points to any travel expense without losing any value and are less of a “waste” than using RBC Avion points (that are so valuable) for that.

The best in your case could be the Scotiabank Passport Visa Infinite Card that also has no foreign transaction fee. The Scotiababk Gold American Express Card earns the same flexible Scene+ points and has a better welcome bonus and its no-FX-fee feature is just as good if your hotels are in the U.S. or otherwise accept Amex cards.

All cards that earn BMO Rewards points allow you to apply the points to any travel expense, like the BMO eclipse Visa Infinite Card, the BMO eclipse Visa Infinite Privilege Card, and the BMO Ascend World Elite MasterCard for example.

Others like TD Rewards Points from the TD First Class Travel Visa Infinite Card (one of the highest welcome bonuses right now) can also be used for travel booked on any website, but you can get 25% more value if you book through their portal so it’s better to do that.

it appeared late afternoon yesterday

Indeed, it is now there, thanks 🙂

Hi Andrew

I don’t see the travel credit anywhere when I look in my new RBC Avion credit card (formerly HSBC) account at RBC. I looked in my credit card online account and in the Avion rewards account (that has my transferred to Avion former HSBC points) and don’t see the new $100 (Or $200 as explained above) travel credit anywhere. Do you know where and when it will show up?

thanks Donald

Hello Donald, they said it would be available starting the 4th, but I still don’t see it either. If you want to confirm the amount you’ll get, it’s in the email they sent you on April 1st 🙂