The key to Travel Hacking is obviously to pay as much as you can with your credit cards, earn points and miles and be rewarded for your daily expenses. Here is an extremely practical tip.

If you are here, it’s because you already know everything about travel hacking credit cards. Here is something to get even more points, an extremely practical tip.

You’ve heard a lot about welcome bonuses at the launch of our travel hacking section, but in this second round of articles, we offer some tips for daily accumulation and use of points too. And many more articles are coming.

This blog is about a way to pay with a MasterCard bills that you wouldn’t usually be able to pay by credit card, free of charge. But only some providers (to pay your mortgage or any other bill, read how Plastiq works).

The most convenient is probably your electricity bills, but you can also pay the Canada Revenue Agency, certain municipal taxes and many others in this way, and at least get Points and Miles in exchange for these expenses.

Free points? That’s good travel hacking.

The Paytm app

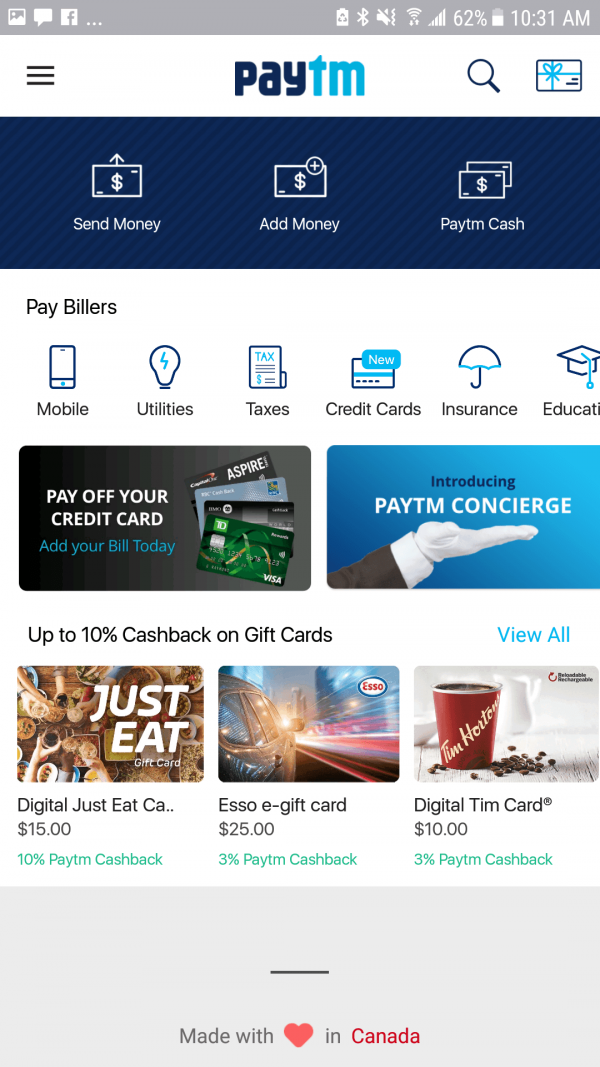

It’s really a great app, and it’s made in Canada. It allows to pay suppliers using a credit card, and it’s completely free at the moment, for Mastercard cards only.

If you want to use American Express or Visa, there will be a fee. It’s no longer worth using in most cases (details at the end of the article).

So take advantage of it to accumulate points… or reach your minimum amounts easily and unlock your welcome bonus. I have tested it for you myself, so I strongly recommend using it for your next electricity bill at least!

How does it works? You’ll need to download the Paytm app, which looks like this:

While creating your account, you can enter the promo code “PTM6486601” which will give you $10 worth of Paytm Points, their own reward program (we’ll get back to you soon on that). Those are the Paytm Points that you will accumulate for your payments on the app, but of course in addition to your credit card Points.

Then you will come to the main screen, which has the provider categories in the middle, but also a magnifying glass to search for a specific provider in the upper right.

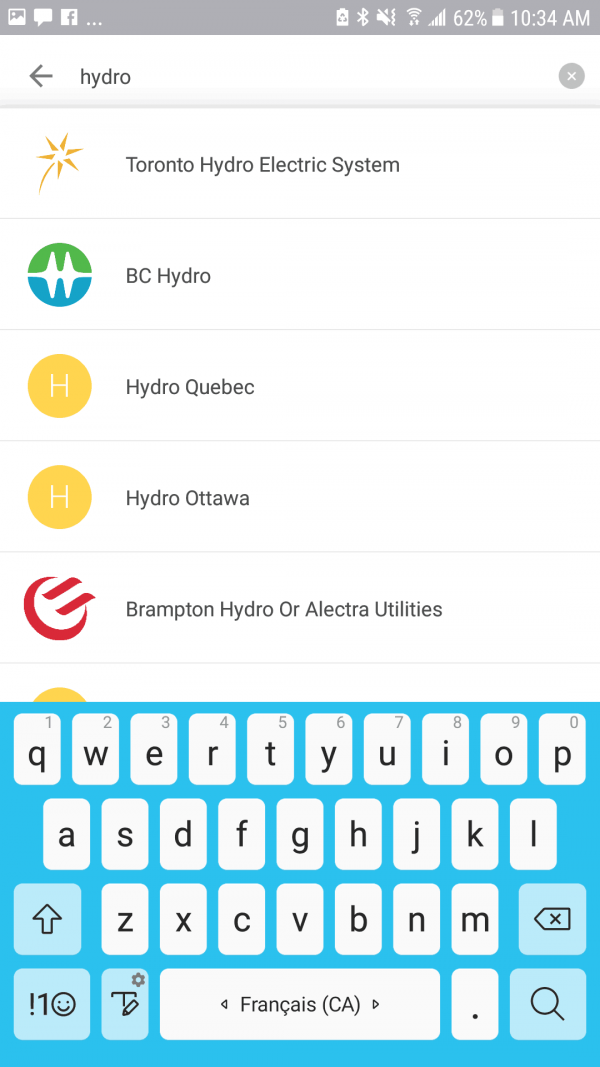

Take Hydro-Québec/BC Hydro/Toronto Hydro, for example, suppliers that most of you have to pay regularly and pay without getting points right now.

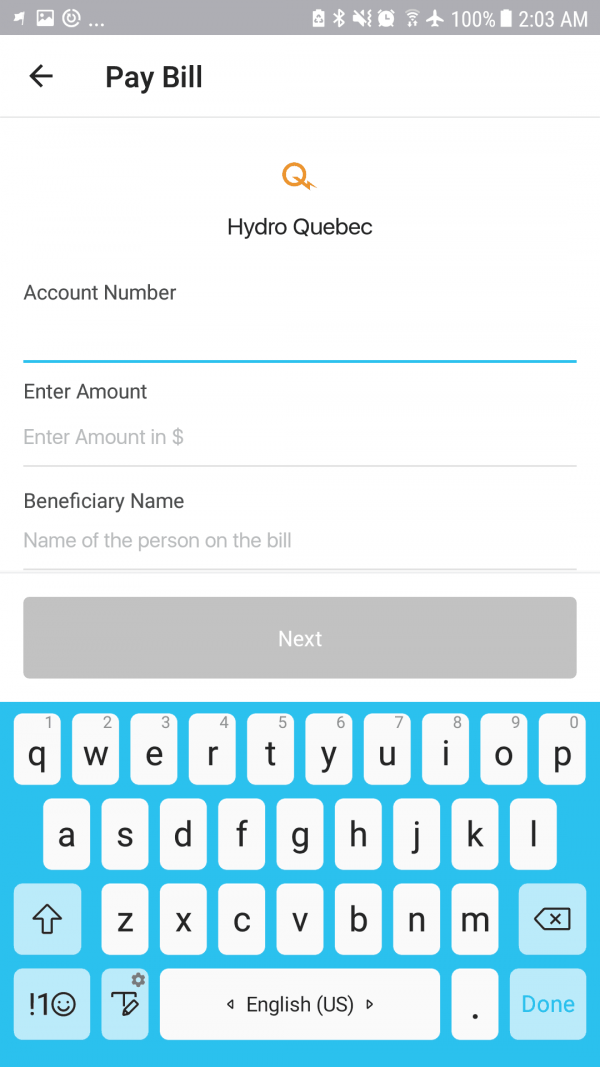

You arrive at the data entry screen for your bill. Enter the bill number, the amount, and your name. It’s that simple.

Then you see the payment screen. It won’t cost you a penny more than the amount of the bill you entered, provided you pay by Mastercard. So you don’t pay a penny more and you get interesting rewards for free.

In some cases there is no charge that appears, in others, the service charge appears, and then appears in negative directly below to show that it is canceled. At some point, this promo will probably end.

In the meantime, you can pay hydro bills, the Canada Revenue Agency, some school taxes, municipal taxes, etc.

When the promo is over, it may still be worth it in some cases, but I would not recommend it in 99% of cases, unless you have a card that gives you a return in Points that will be higher than the fee.

Otherwise, it would only be worth it if you are completely unable to reach the minimum amount of expenses to get the welcome bonus of a credit card (even after reading our advice here) and this is a last resort.

A welcome bonus of 30,000 Aeroplan for example, is worth $450… if you miss it completely, you lose $450, better spend a little money to reach the amount rather than lose it. But this is one of the only cases where it will be worth paying their fees. I repeat, for now it’s still free, no stress.

Another case that may be profitable later even with the fee, if you have an extremely expensive flight to book, and that by calculating the cost of Paytm, it still saves you money. One example to illustrate: by paying $7,500 in Paytm, which gives you 7,500 Aeroplan Miles, enough for a short-haul one-way ticket that is say $500 in cash, and you have zero flexibility. Well the 2% fee will cost you $200, the taxes $200… you still save $100: it’s worth it.

By the way, the application offers other features, for now I have only used it to pay bills, I will come back with other utilities as appropriate, or tell us in the comments if you have tried them! Paytm is not available on your computer, you must absolutely go through the app.

In short, enjoy the application while it’s free, it gives you free points and miles! This is travel hacking as we like it! Do you have any questions? Ask them in the comments below.

Want to see our current discounted plane tickets?

Click here to see our flight deals

Want more travel tips and inspiration?

Click here to see the blog homepage

You’ll probably enjoy this article:

How Ultra Low-Cost Carriers Work

Help us spread the word about our flight deals and travel tips by sharing this article and most importantly bookmark Flytrippers so we can help you navigate the world of low-cost travel!

Advertiser Disclosure: Flytrippers receives a commission on links featured in this blog post. We appreciate if you use them, especially given it never costs you anything more to do so, and we thank you for supporting the site and making it possible for us to keep finding the best travel deals and content for you. In the interest of transparency, know that we will NEVER recommend a product or service we do not believe in or that we do not use ourselves, as our reputation and credibility is worth far more than any commission. This principle is an essential and non-negotiable part of all our partnerships: we will never give any third-party any control whatsoever on our content. For more information on our advertiser disclosure, click here.

Travel Hacking Disclaimer: Flytrippers does not give financial advice. You should ensure travel hacking fits your personal situation and obtain professional advice if you so desire. Flytrippers may receive a commission for referrals, however our policy is to only recommend products or services we really believe in (and have ourselves). To read more on our disclaimer, click here.