Everyone agrees that the coronavirus crisis has been simply brutal for airlines. Like most around the world, Canadian airlines now want a taxpayer bailout. And we’re likely talking about billions of dollars. Not everyone agrees with that, at least not without some conditions.

We’d love to know what you think about an airline bailout in Canada.

Here’s a short explanation of the situation, and then 10 conditions that are in play around the world in terms of airline bailouts.

But keep in mind:

- these AREN’T our predictions (airlines might just get a blank cheque with no questions asked)

- these AREN’T our suggestions (we don’t even agree with many)

It’s just an overview of what is being considered around the world so you can form your own opinion and share your thoughts. To get the discussion going.

Basics Of Canadian Airlines’ Bailout

I am an aviation geek and I love airlines personally. But I am also not oblivious to the fact that airlines are not the most popular type of company at any time—even though many of the common complaints against them aren’t necessarily justified as I have often said.

Airlines are especially unpopular with casual travelers or non-travelers, who make up a vast majority of taxpayers who will now be asked to foot the bill for a billions of dollars in bailouts (well, none of us will really be asked, but maybe public opinion can once again play a big part in political decisions).

And public opinion isn’t particularly good right now, with airlines refusing their legal requirement to offer refunds when they cancel flights (that’s obviously condition #1 below). They are either tactically using this as leverage to increase their chances to get a bailout, or they just don’t care about customers at all, depending on your level of confidence in airlines or your outlook on their current predicament.

The fact of the matter is, whether you want the airlines to get taxpayer money or not, they likely will.

I mean… I understand why many don’t want them to get money, but I can’t really understand someone realistically believing that they won’t get it, considering all the money the federal government has already given out during the crisis—and how airlines are arguably the hardest-hit companies.

Some argue that citizens need help more than airlines and that the bailout billions should therefore be used for citizens. But if the government even remotely adhered to that principle, they would have long ago at least done like the US and EU and required airlines to refund travelers. They didn’t.

So while we want your opinion on whether the bailout itself is a good idea, to be realistic we’ll focus on what conditions could at least be in it if we’re going to give out billions.

10 Conditions Being Considered Around The World

Here’s a list of what many want to see included in bailouts. Since for once the government has most of the leverage, many wish that they use that position of force to change the airline industry for the better. Probably a bit utopian, but hey, we never know!

1. Refunds

This is the most obvious one and arguably the only one that everyone agrees should be in there (which doesn’t mean it will be, by any means).

Refunding customers should be a condition. Airlines have been skirting Canadian contractual laws (and explicit US and EU regulations) and it’s simply untenable for the government to give them taxpayer money and ALSO let the airlines confiscate the money that belongs to travelers.

If airlines were going to not ask for a bailout (which I never believed was even a possibility as I said from day one), then maybe you can argue they should keep travelers’ money.

But they shouldn’t have both. Which is why we are trying hard to help you get the refund you are entitled to, you should sign up for free to get updates, we’ll soon have very useful content for you.

There is a petition circulating to require the government to enforce the right to a refund as a condition of any bailout (petition #1), and another general one to ask for refunds that has even more signatures (petition #2). We strongly encourage you to sign both, it takes a minute and can’t hurt.

The US gave airlines a whopping $25-billion bailout, but they also told airlines in no uncertain terms that they had to refund travelers.

Many Canadians have lost income due to the crisis and need the money they are entitled to, not a lousy voucher. If you don’t see the big deal and still think vouchers aren’t that bad… they are. Don’t miss our article about the 5 reasons why refunds are much better than vouchers—sign up.

2. Employees

Another basic condition is that employees should not be furloughed. The bailout shouldn’t benefit just the shareholders, but employees too.

That’s what we’ve seen in the US, and in some way, Canadian airlines are already getting a sort of bailout (like most Canadian businesses) in the form of the 75% wage subsidy, so this condition is one that is already somewhat imposed. Wages are obviously a major cost for airlines.

I don’t want to get too “business” with you, so I’ll keep this one simple.

In the past 5 years, Air Canada has spent $800 million (including $378 million just last year) in stock buybacks to increase its own share price (by reducing the number of shares in circulation).

In other words, instead of setting money aside for tougher times, they spent it to boost the share price… and now they don’t have enough money and want taxpayer money.

They’re not alone: all major US airlines were very strongly criticized for this (they spent 96% of their free cash flow on stock buybacks), and that’s why many down there wanted to tell them that this liquidity problem is one of their own making and didn’t want to give them a taxpayer bailout at all.

Or at least, they wanted a condition in the bailout that would limit their ability to start doing that again in the future and avoid once again having to ask taxpayers to pay for the consequences. It didn’t make it into the US bailout though.

Of course, the coronavirus was a literally unprecedented event whose scope no one predicted… but still, in such a volatile industry where the slightest drop in demand destroys an airline’s finances, many wonder why airlines should get to have their cake and eat it too, letting taxpayers foot the bill when the airlines decided to use their cash flow in such a way.

4. Equity Stakes

On that same topic, one that many believe should be a non-negotiable condition is the government getting shares of the companies they are injecting cash into, so that taxpayers can at least get a return on their investment, even if it’s in the future.

Some say this: airlines want more money than other companies, fine. But there should be more conditions too. The US government, not know for its socialistic views, has required shares in US airlines in their own bailout: they got stock warrants for United, Delta, American, and Southwest. When converted at a fixed price, the US government will be a shareholder in the country’s 4 largest airlines, albeit a minor one.

5. Bailout Structure

It’s not just about becoming a shareholder in the airlines. The bailout shouldn’t be just a free handout; at least some portion should be a loan that they can repay when things get better.

The US bailout was structured so that the amount of the bailout that would benefit taxpayers (through payroll and income taxes generated, and unemployment payments saved) would be grants that did not need to be repaid (70%). But the remaining 30% of the bailout is in the form of loans that need to be repaid over 10 years.

Finally, US President Trump considered asking for the grants to be a prepayment for future US government air travel at a 50% discount, to save taxpayers a lot of money in the future (the government is a huge customer for airlines).

But this would have been terrible for airlines, who can count on that government business travel as guaranteed future revenue, so they didn’t want to deprive themselves of these sales. That measure also didn’t make it into the final bailout. It’s not clear if it was a real proposal or just Trump thinking out loud “sarcastically” once again.

6. Consumer Protections

In many countries, experts are requiring better consumer protections as part of bailouts.

We’ve already told you how Canada’s passenger rights compensation regulation is very different from the EU’s and favors airlines much more than passengers. These just took effect in December 2019, so clearly this government wasn’t very motivated to take the side of travelers, even very recently.

But could a strengthening of those measures be a condition to impose on airlines if they want a bailout? For example, requiring a refund more explicitly when the airline cancels a flight for any reason, like US and EU regulations stipulate for all flights no matter the airline. Or fixing the current completely useless flight delay compensation rule.

The government clearly could use their current leverage to do it (and they should)… but they probably won’t.

7. Executive Pay

Criticizing executive pay is the favorite pastime for many. They are calling for airline executive pay to be limited by this bailout. For what it’s worth, I highly doubt this will ever happen.

For example, Air Canada’s CEO Calin Rovinescu’s 2018 compensation was over $64M. That’s a $12M compensation package and a whopping $53M in stock options exercised (now you might understand one of the reasons for the aforementioned strategy of using liquidity to prop up the stock price instead of keeping a rainy day fund).

I am not one to think the government should get involved in how much money private companies pay any employee, personally. Airlines are global businesses that compete globally for customers but also for talent, and they need to be able to attract the most qualified candidates. It’s their money anyway.

But if they’re going to get hundreds of millions of dollars from taxpayers, I understand why many people don’t want us taxpayers to be paying for the astronomical bonuses executives get, as we’ve seen way too often.

Even if the coronavirus isn’t their fault, it’s not the fault of the 1M+ Canadians who’ve lost their jobs too, and they still lost their income and would understandably be frustrated that the future taxes they pay go to multi-millionaires.

Many don’t want airline executives to be rewarded personally with the money that is meant to save jobs and keep our aviation industry alive so that consumers aren’t stuck with higher fares.

Many Air Canada executives have taken a pay cut during the coronavirus pandemic, but many want these to last longer as a condition of the bailout, for all airlines who get money.

8. Taxes

There is a push to reduce taxes on flights as a short-term measure, but even maybe longer-term! We’ve shown you before how taxes on plane tickets in Canada are so much higher than in most countries, especially the US.

While a C$100 ticket from Toronto would include C$48 in all kinds of taxes (and even taxes on taxes), a C$100 ticket in the US would include just C$26 in taxes (46% less). Not to mention that $100 tickets in Canada are extremely rare, but thanks to those low taxes (and ultra low-cost carriers), they’re very common in the US—but I digress.

Due to the coronavirus, the US has temporarily reduced taxes (that are already sooooo low). All in all, the fixed amount of taxes in the US is capped at ≈US$14, plus a 7.5% federal excise tax on the fare. For the rest of 2020, the US government has suspended the 7.5% tax AND over $4 of the fixed amount. This will help stimulate demand for the rest of the year to try and make the recovery as good as possible for airlines.

In Canada, in addition to requesting quick direct financial aid, Montreal’s La Presse reports that the National Airlines Council of Canada (which represents airlines) also wants the government to “review the many taxes and fees that make operating costs higher than in other countries”.

Could that happen? Now that would finally be some good news from this coronavirus. Let’s hope for the best.

9. Business Decisions

This is the one I completely disagree with the most, but all around the world politicians are trying to use bailouts to be able to meddle into the airlines’ business decisions. For example, they are trying to get involved in deciding where an airline should or should not fly.

This is obviously a terrible idea and I’m confident this one will be discarded. Again, airlines compete globally and if their hands are tied by politicians, they won’t be able to make the decisions that are required to be competitive, and that’s bad for everyone (especially consumers).

It’s government meddling that is already a big part of why airfares are so expensive Canada: in addition to the taxes we just mentioned, there are many regulations and restrictions limiting our airlines’ competitiveness (Air Canada’s CEO himself said it explicitly).

A worrisome example is in France: as a part of the conditions of Air France’s bailout, the government has completely banned short domestic flights. Forever. Airlines should be able to decide to fly wherever they want to fly.

This move illustrates the reasons many speculate that the 15-year union between Air France and KLM could be coming to an end. The Dutch government doesn’t like the French government getting too involved and diluting its own decisional power and influence. Both governments own equal stakes, but won’t be providing equal bailouts, creating tensions.

The French government will also require them to choose Airbus planes over Boeing planes for their fleet renewal. Good luck getting good prices when the seller knows you have no choice but to do business with him (airlines usually never pay list prices for aircraft—the price negotiation is always vital).

In fact, Lufthansa, Europe’s largest airline group, is considering filing for bankruptcy protection instead of taking a bailout that would require them to let the German government decide what they must do with their business, like where to fly to. Yes, they’re considering simply refusing the billions!

Finally, in the US, the bailout requires airlines to keep at least one daily flight to every single destination they serve, so that those who need to fly for essential reasons can do so.

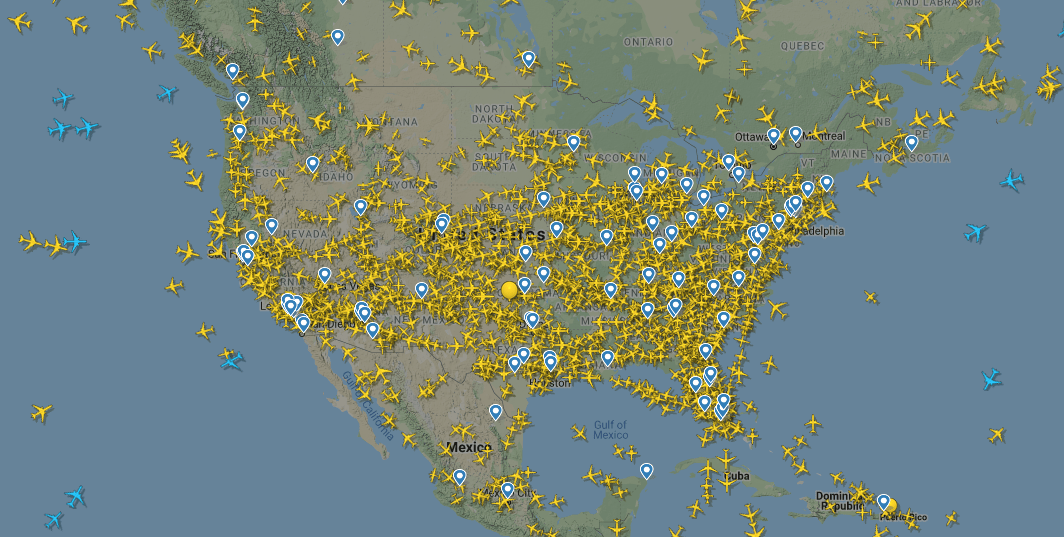

The intention is good, but in practice, it has meant hundreds of nearly empty planes uselessly flying around the US at any given point, like yesterday at 1 PM:

This is a teaser for our post next week about how many people are still flying in the US right now (with an update of the Canadian numbers from 3 weeks ago).

But let’s just say this requirement will almost definitely not make its way into the Canadian bailout.

Summary

It’s very likely that Canadian airlines get a taxpayer bailout, and a massive one at that. We’d love to know your thoughts on whether or not you agree, but since it will likely happen no matter your opinion, we’d also love to know which conditions you think the government should impose as part of the bailout.

What do you think of the bailout? Tell us in the comments below.

Explore awesome destinations: travel inspiration

Learn pro tricks: travel tips

Discover free travel: travel rewards

Featured image: planes at Toronto-Pearson (photo credit: Wikimedia Commons)

Advertiser Disclosure: In the interest of transparency, Flytrippers may receive a commission on links featured in this post, at no cost to you. Thank you for using our links to support us for free, we appreciate it! You allow us to keep finding the best travel deals for free and to keep offering interesting content for free. Since we care deeply about our mission to help travelers and our reputation and credibility prevail over everything, we will NEVER recommend a product or service that we do not believe in or that we do not use ourselves, and we will never give any third-party any control whatsoever on our content. For more information on our advertiser disclosure, click here.

Customer refunds necessary.

Any bailout money given needs to be paid back with combination of money and shares.

Government should have a small equity stake in airlines.

No executive bonuses until money paid back.

Lower taxes paid for tickets ( too much tax on tax).

Companies should be mandated to “save” a certain portion of their profits for unexpected issues instead of buying back shares.

No furlough of airline employees

We should be entitled to a full refund. I am over 65 and giving me a voucher is not acceptable. If I should die before June 2022 my coucher is not transferable and the fact that we may have another episode in the falll is not very optimistic….

Agree with most suggestions but would like to add a requirement to open up the Canadian airline industry to further foreign competition. Costs of flights in Canada are way too high due to a lack of competition.

In addition, if we need to continue spending taxpayer dollars to stimulate the economy, I would like to see high speed rail be considered for an infrastructure project.

If we didn’t have Canadian Airlines we would need to connect in the US in order to get anywhere within our own country. Considering how many km’s it is for me to travel to visit my family,

and how much cargo is transported via plane so that we can enjoy produce out of season and those tropical fruits we don’t grow in Canada (pineapple, oranges, grapefruit, lemons, limes, avocado and many more)

I think that a Bailout with conditions might be necessary.

Of course I don’t believe the high-paid CEOs should continue with huge paycheques and that if any airline accepts a bailout they would need to transfer a relative stake in the company to the Government.

I just could not imagine all of the northern fly-in-only communities not receiving any supplies or food due to a lack of flights.

Canadian airlines are threatening that they will have to leave the Canadian market if they don’t receive a bail out. Given the fact that my flights were cancelled due to coronavirus, and they KEPT my money, not sure how they are “losing” money. Plus we are charged more than most countries for airfare. I say, please shut down the Canadian airlines then! Canadians will happily use the US based airlines and pay a fraction for airfare! Be gone airlines of Canada and do not ask for a cent from taxpayers!

No buybacks

No executive bonus

No new taxes partial repayment

Refunds NOT vouchers

Open marketplace to purchase equipment