The brand new credit cards from Porter Airlines are now available: the excellent BMO VIPorter World Elite Mastercard and the BMO VIPorter Mastercard. This exciting launch is an excellent opportunity to properly explain again the most important thing in the world of travel rewards (and a few other tricks)!

Obviously, as with all other good cards in Canada, our Flytrippers resource pages for the cards have literally all the information imaginable (10+ tabs with all the details). It’s always accessible by simply clicking on the card names anywhere on our website.

So I won’t repeat all that here; I’ll just focus on the highlights and some vital reminders if you want to maximize your rewards (and therefore your free travel).

Here is an overview of the new Porter credit cards issued by BMO (Bank of Montreal).

Overview of the new BMO VIPorter credit cards

Let’s start with a summary of the 2 new cards, including obviously their welcome bonuses (THE most important thing, by far).

| New BMO VIPorter credit cards |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(≈ 8.8% back on $18k)

Rewards: ≈ $1590

Card fee: $0 $199

Spend required:$18k in 12 mos. (or $5k/$9k)

Best for: Huge bonus & great travel benefits

ends June 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.5% back on $10k)

Rewards: ≈ $750

Card fee: $0 $89

Spend required:$10k in 12 mos. (or $3k/$6k)

Best for: Great bonus & lower spending requirement

ends June 1st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

New BMO VIPorter credit cards |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1590

Card fee: $0 $199 (≈ 8.8% back on $18k)

Spend required:

$18k in 12 mos. (or $5k/$9k)

Best for: Huge bonus & great travel benefits

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $750

Card fee: $0 $89 (≈ 7.5% back on $10k)

Spend required:

$10k in 12 mos. (or $3k/$6k)

Best for: Great bonus & lower spending requirement

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

The key takeaway is that the BMO VIPorter World Elite Mastercard is phenomenal… for those who have a lot of spending (or who don’t maximize their spending anyway)!

But actually, even by spending less ($9,000) and not unlocking all 3 parts of the welcome bonus, the offer is still very interesting!

Our Flytrippers Valuation is ≈ $1590, because you get ≈ $1590 in points and the annual fee is waived for the 1st year. That can actually give you 15 one-way flights!

Even spending just $9,000 in 180 days will still give you an excellent bonus of ≈ $870 (the 2 first parts of the bonus)! That’s wonderful too!!!

You can get 106,000 VIPorter points by unlocking the full bonus:

- 70,000 points with the 3 parts of the welcome bonus

- 20,000 points when you reach $5,000 (maximum 110 days)

- 20,000 points when you reach $9,000 (maximum 180 days)

- 30,000 points when you reach $18,000 (maximum 365 days)

- 36,000 points with the earn rate on the minimum spend

- Estimate at the multiplier earn rate of 2 pts/$

It’s really an incredible deal. I got it myself (as well as for my girlfriend).

If you want to learn more, here are the 6 most important topics regarding the BMO VIPorter cards:

- The excellent welcome bonus on the main-level card

- The welcome bonus of the main-level card requires a lot of spending

- The welcome bonus for both cards is higher if you followed our advice

- VIPorter points don’t have completely unlimited value like other airline points

- VIPorter points can now be redeemed on Air Transat

- The travel benefits on the main-level card are very interesting

Excellent welcome bonus

When Porter finally understood that the most profitable aspect of being an airline is having a financial partner that issues credit cards, the choice of BMO was honestly a bit concerning.

Why? Because BMO is generally the least interesting of the major Canadian banks in terms of welcome bonuses. And because welcome bonuses are obviously THE most important thing in the world of travel rewards!

So it’s great to see that the bonus is huge on the BMO VIPorter World Elite Mastercard! BMO deserves praise; this is beyond our expectations.

Will it always be like this with this product, or is it to make a big splash for the launch? That’s hard to say.

Our Flytrippers recommendation, if this product interests you, would be to not take any chances and to take advantage of this offer while it’s there just in case. That means planning to get this card in your next round of applications for a card or cards.

Note that the welcome bonus also gives you a companion pass, a kind of 2-for-1 that gives you a free roundtrip when you buy one at full price. Many travelers don’t place a high value on this type of benefit, so I didn’t include it in the Flytrippers Valuation of the offer, but for many people, it gives a few hundred dollars more in value!

Welcome bonus that requires a lot of spending

That said, there is a significant caveat.

To get the full 70,000 point bonus of the BMO VIPorter World Elite Mastercard, you need to spend a very high amount of $18,000 (in a maximum of 365 days).

So it gives a significantly lower effective return rate on your spending, around ≈ 8.8% (≈ $1,590 on $18,000).

There are plenty of people who haven’t understood that the key to maximizing is to get lots of welcome bonuses (or who have understood but just don’t want more rewards, more benefits, a better credit score, etc.)

If you’re among those who don’t maximize, then the effective return rate of ≈ 8.8% isn’t so bad. It’s certainly better than the pathetic rate of 1% or 2% that most people sadly settle for.

But if you like to maximize, it’s a lot of spending to put on a single bonus.

You could instead use this spending more wisely:

- $5000 to get $1025 with the TD First Class Travel Visa Infinite Card

- $5000 to get ≈ $780 with the RBC Avion Visa Infinite Card

- $7500 to get ≈ $744 with the Amex Cobalt Card

That would give you ≈ $2549 instead of just ≈ $1590! And a better credit score! And lots more benefits, like 4 free airport lounge passes!

Obviously, there are many who will say “it’s just a $959 difference.”

It’s 60% more points for exactly the same spending. That’s not nothing: 60% more is the difference between traveling just 2 times a year and instead traveling 3 times a year! A whole extra trip!!!

(And that’s without counting that the points from those cards are all better than VIPorter points; I’ll come back to that in the next section!)

It’s sooooooooooo simple to maximize travel rewards: always use all your spending to unlock huge welcome bonuses.

Very very simple. And yet, so many people have trouble understanding. It’s normal when you don’t know; the world of travel rewards is very counterintuitive. But now you know!

In short, if you were going to spend $18,000 at a terrible earn rate (so on any card on which you aren’t unlocking a bonus), it’s definitely better to do it on the BMO VIPorter World Elite Mastercard!

Also, if you have a lot of spending and want a big welcome bonus, the BMO VIPorter World Elite Mastercard is excellent!

Doing $9000 in the first 6 months and $9000 in the 6 following months is not that bad; it’s the equivalent of $346 per week, and on such long periods, you’ll almost certainly have large expenses that will help you out. It’s a Mastercard, too, so it’s accepted at Costco directly, without having to use the prepaid card trick.

And you also have the option of spending just $5000 or $9000 for bonuses that are slightly lower… but still very interesting.

Welcome bonus that is higher for those who followed our advice

We told you about the official announcement of the new cards in January.

We gave you our pro tip to sign up for the exclusive waitlist to get 10,000 more points (≈ $150), both for the BMO VIPorter World Elite Mastercard and the BMO VIPorter Mastercard.

If you followed our recommendation, stay on the lookout for an email from VIPorter with a unique link to get your extra points this week (it’s a rare time when we recommend not using our Flytrippers link; it’s rare that you can get more points with a special link).

If you missed that, you missed out on an easy $150… but also, what’s even worse is that clearly you’re missing out on lots of other pro tips that would save you incredibly more than that.

To make sure this doesn’t happen again, you should join the 100,000+ savvy Canadian travelers who receive our free newsletter right away… but more specifically our separate free newsletter for travel rewards.

VIPorter points are a bit different from other airline points

The BMO VIPorter World Elite Mastercard gives you a lot of points, but it’s important to understand how they work, obviously.

We’ll have a detailed guide on the VIPorter program soon; we’ve never really talked about it in 8 years because obviously, without credit cards to earn a ton of points easily, the program was completely irrelevant. That certainly isn’t the case anymore.

**Traditional** airline points are the best because they’re the ones that can be worth the most. However, VIPorter points are a bit different and are not **traditional** airline points!

That’s because there’s no award chart with fixed amounts required for flights, unfortunately.

VIPorter points therefore don’t have unlimited value like Aeroplan points, Avios points, and the 5 other currencies of airline points that are easy to obtain in huge quantities for Canadian travelers.

They are rewards of the more simple type, with a **less** variable value (but not quite fixed either). Available seats are not limited; all Porter seats can be booked with points.

You’ll simply get a relatively fixed value on any flight, with no complexities (like when using Aeroplan points the worst way, on Air Canada flights… see next section). You won’t be able to get outsized value, but it also means there are fewer **bad** redemptions as well (something that people who want things to be more simple usually love).

So these aren’t points that will allow you to travel in business class for less than economy class if you want ultra-luxurious lie-flat seats in business class or first class.

On the other hand, Porter has a highly rated economy class experience (no middle seats) and very interesting prices for its flights, especially in points.

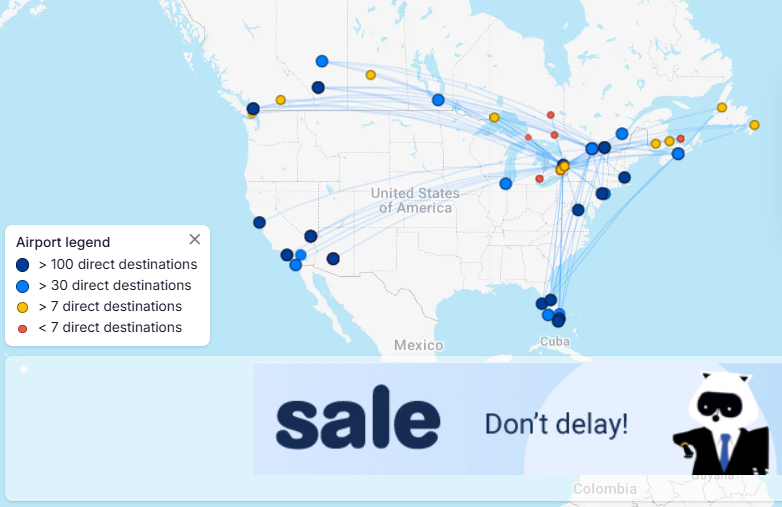

The airline is experiencing explosive growth and has added numerous routes in recent years. There will be even more, including from the new Montreal-Metropolitan Airport (YHU), as early as late 2025.

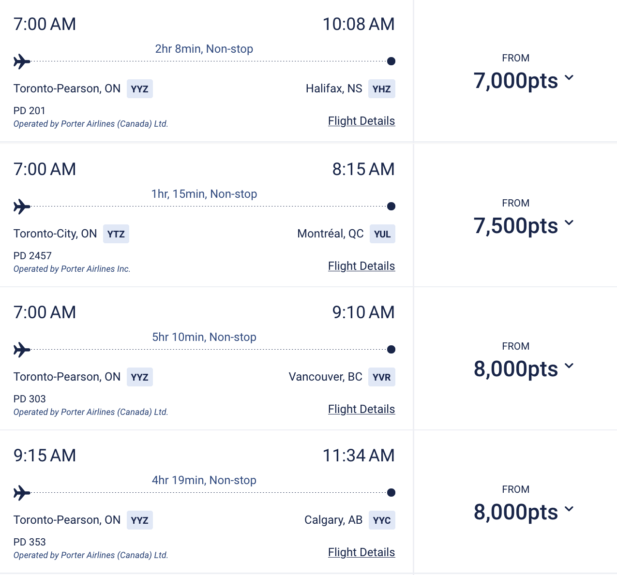

For example, you can travel between Toronto (YYZ/YTZ) and many destinations in Canada for only 7,000 or 8,000 points.

So with the 106,000 points from the welcome bonus of the BMO VIPorter World Elite Mastercard, you would get 15 one-way flights.

That’s simply exceptional!

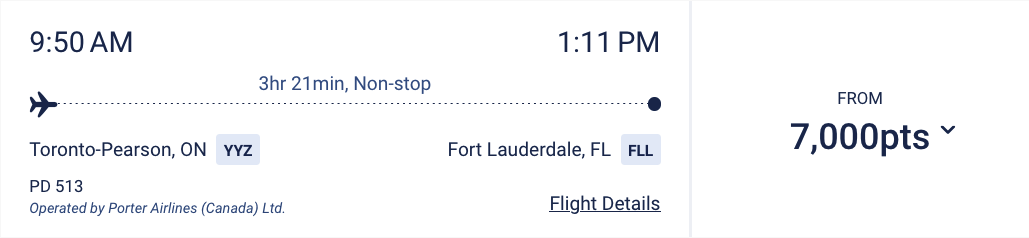

If you’re not boycotting the United States, you can travel between Toronto (YYZ) and Fort Lauderdale (FLL) for only 7,000 points.

That’s really very few points! But it gets better…

VIPorter points redeemable on Air Transat

Another of the most important things to understand in the world of travel rewards is that the best points (airline points) can almost always be used on partner airlines.

Not only that, with many programs, redemptions on partners are much better!

As mentioned, the VIPorter program is a bit different and not as good. It doesn’t have a fixed award chart, but it also doesn’t have a large repertoire of partner airlines.

But since last week, it’s finally possible to redeem points on 2 of their partner airlines. It gives you so many more options for the points from the BMO VIPorter World Elite Mastercard!

The one that’s now available is the most interesting partner, which is Air Transat.

(An airline that hasn’t yet understood that having credit cards is the most profitable part of being an airline; not surprisingly, they lost $100M+ in 2024 for a 6th consecutive year of net losses!)

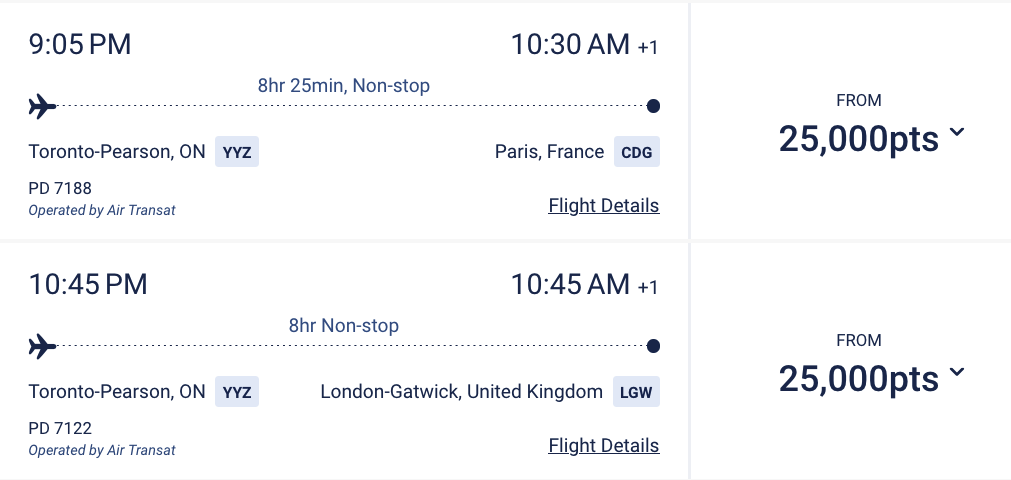

For example, you can travel between Toronto (YYZ) and Paris (CDG) or London (LGW) for only 25,000 VIPorter points (if you book it as a roundtrip, not one-ways)!

Air Transat has a network of super interesting routes to Europe (or the Caribbean if you prefer that), but until now, it wasn’t possible to book them other than with bank points of the more simple type (like those from the TD First Class Travel Visa Infinite Card‘s $1025 welcome bonus).

This even possibly becomes one of the best options in points to Europe (in economy class obviously, not in business class).

You can also use VIPorter points on 1 other partner airline at the moment, which is Alaska Airlines. But with that one it’s special, you must absolutely have a Porter flight AND an Alaska flight on the same ticket. Prices don’t seem very interesting for that option at the moment; we’ll revisit it in our VIPorter guide.

Let’s hope that using VIPorter points will soon be possible on more partners!

Some of the airlines that are Porter partners are not on the list of 114 different airlines that are bookable with the airline points that are easy to obtain in huge quantities. This is the case for SATA (Azores Airlines) and Icelandair, for example. To be continued!

Very interesting benefits with the main-level card

The BMO VIPorter World Elite Mastercard also has several very interesting travel benefits!

By having the card, you automatically get VIPorter Venture elite status!

It’s the 1st card in Canada to give airline elite status; the Marriott Bonvoy Amex Card (the only card that’s for every traveler without exceptions) and the Amex Platinum Card (the very best premium card) give hotel elite status.

I had written that I hoped Porter would be as innovative with their cards as with their business model, and this is a fascinating inclusion.

It’s possibly a new contender for the best credit card benefit of all Canadian cards because having this status gives several benefits.

Not surprisingly, checked baggage is free on Porter flights — like the Air Canada free checked baggage benefit of main-level Aeroplan credit cards.

But it’s even better: the full-size carry-on bag is free too (whereas on Air Canada, the carry-on is only free with premium-level Aeroplan cards).

This benefit for checked baggage and cabin baggage is valid for the cardholder and 8 travel companions on the same reservation (as with Air Canada).

The status also gives you completely free seat selection (for 8 companions too)! Even Aeroplan cards don’t include this benefit!

It also gives you priority lines at check-in, airport security checkpoints (where available), and boarding. It’s really interesting to have this on a card of this level!

It also gives you a bonus earn rate of 6 points per $ on your Porter flights directly with the VIPorter program, which is obviously in addition to what you earn on the credit card you choose to use. In the worst-case scenario, if you’re not using a card on which you’re unlocking a welcome bonus, the BMO VIPorter World Elite Mastercard has a multiplier rate of 3 pts/$ on Porter purchases, so it gives you a total of 9 points per $; that’s a net return of ≈ 13.5%!

It also gives you a somewhat unique benefit, which is priority rebooking in canceled/delayed flight situations. Finally, you have priority access to customer service.

This remains an elite status from an airline that doesn’t have a huge premium service offering and isn’t part of any airline alliance, so it’s obviously more limited than the airline elite status from the main competitor, Air Canada.

But it’s also so much easier to reach; you get it automatically without having to do anything! It’s quite impressive to have all these benefits on a main-level card.

Details of the BMO VIPorter cards

Here’s a quick glance at both cards.

BMO VIPorter World Elite Mastercard

It’s the main-level card, so obviously the BMO VIPorter World Elite Mastercard is the more interesting of the 2 (as always).

It has higher fees than most in this category ($199 instead of $120, $139, $150, or $180).

The fee is waived for the 1st year, though, which appeals to many beginners who don’t understand that the total net value (with the welcome bonus) is the only thing that matters.

But it’s relevant when it comes to deciding whether to keep the card or not (step #6 of the 6 simple steps to always follow that you should know if you’ve read our infographic on the basics of travel rewards).

At $199 in subsequent years, it may still be worth keeping the BMO VIPorter World Elite Mastercard for the numerous benefits, but you need to do the math carefully (as always, basically).

BMO VIPorter Mastercard

It’s the basic-level card, but the BMO VIPorter Mastercard can still be interesting for its welcome bonus later.

(Or if you are not eligible for the better version due to your income and you are not comfortable defining your household income the way you want to — even if banks allow you to define it the way you want to!)

It’s not a no-annual-fee card, so it also has slightly higher fees than the rest of its category, at $89.

The fee is waived for the 1st year too, but there aren’t as many good benefits to justify keeping it in subsequent years.

Learning how to travel for less

Join over 100,000 savvy Canadian travelers who already receive Flytrippers’ free newsletter so we can help you travel for less — including thanks to the wonderful world of travel rewards!

Summary

The BMO VIPorter cards, the most recent additions to the range of Canadian credit cards, are now open for applications! The BMO VIPorter World Elite Mastercard is very interesting and has a huge welcome bonus and excellent benefits. The BMO VIPorter Mastercard is less so for now, but will give you another nice welcome bonus later after you’ve gotten the best one to start.

What would you like to know about the new BMO VIPorter credit cards? Tell us in the comments below.

See the flight deals we spot: Cheap flights

Discover free travel with rewards: Travel rewards

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Featured image: BMO VIPorter credit cards (image credit: Porter)