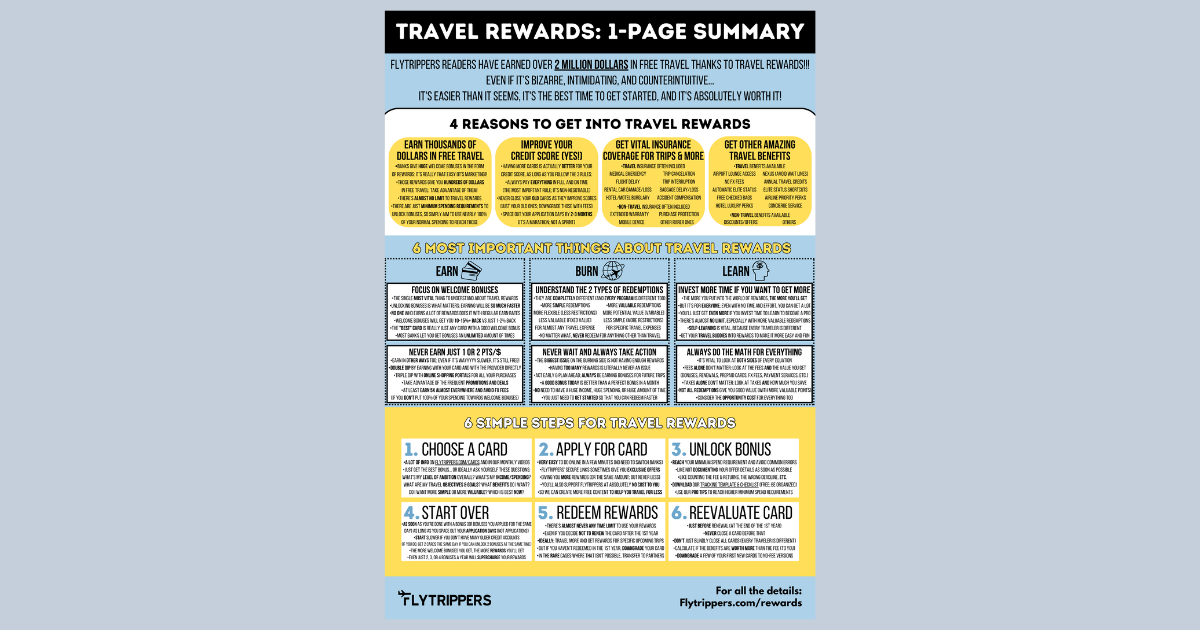

The very basics. Everything you need to know to get into the wonderful world of travel rewards. On just 1 page. All the information in the same place to get started the right way. Here’s the absolutely vital summary you must read first!

I’ll have more details about literally each aspect mentioned in the infographic (join the more than 100,000 savvy travelers who receive our newsletters by subscribing to our free newsletter specifically about travel rewards).

But I want to share this one-page summary with you right now — a version that requires less than 2 minutes and a version to easily become a pro in barely more time.

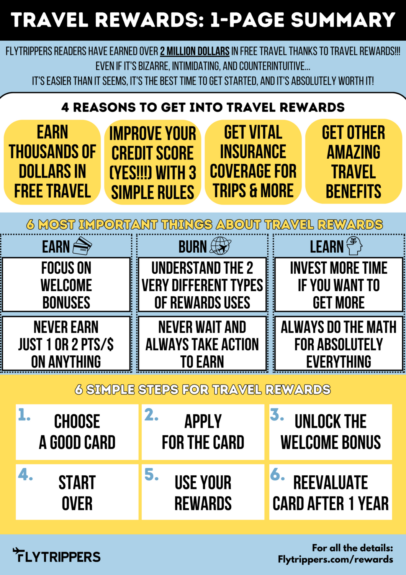

Infographic if you have under 2 minutes

You can see the full-size version.

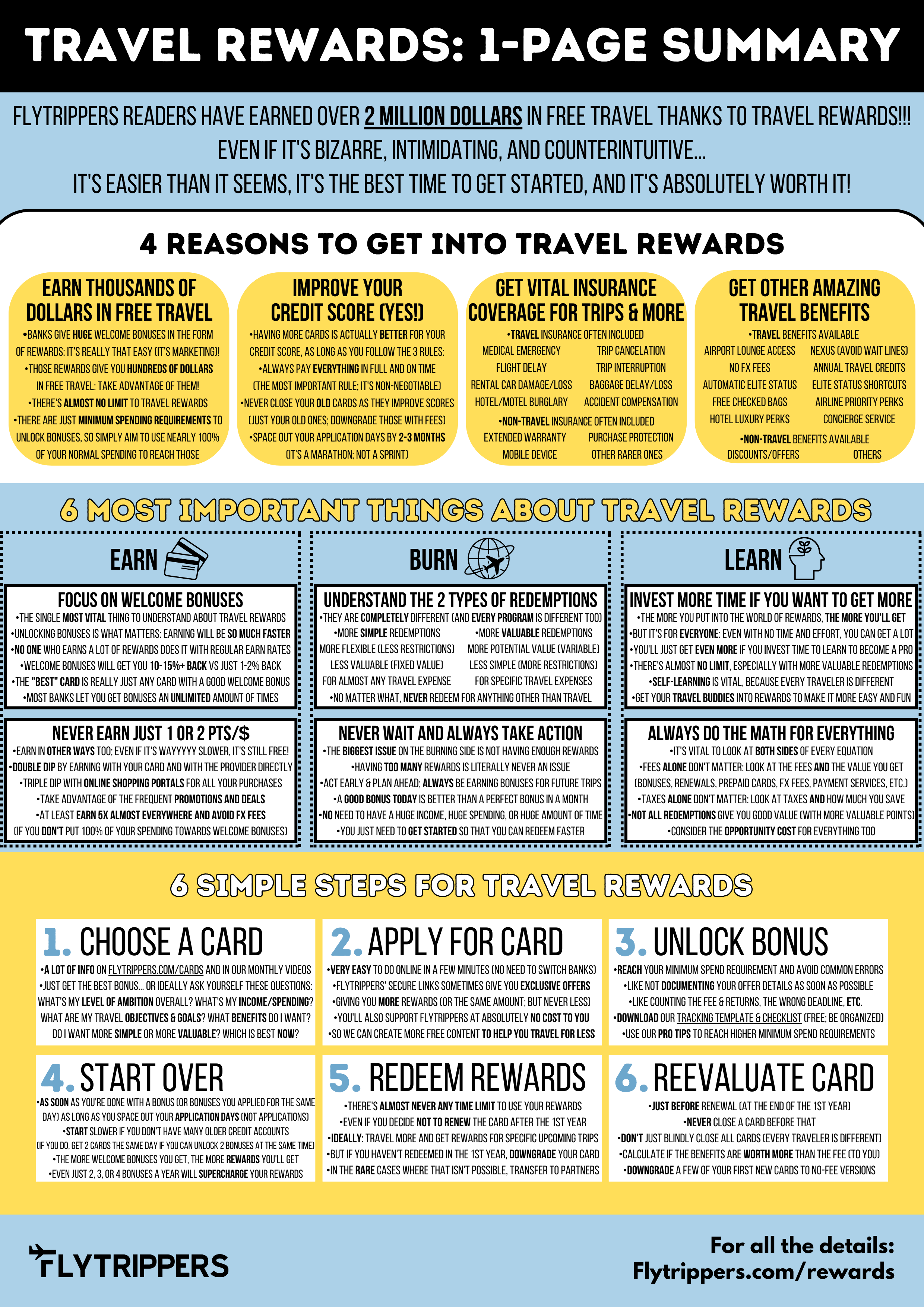

Infographic if you want to really understand all the basics

You can see the full-size version.

4 reasons to get into travel rewards

It’s absolutely worth it! Stay tuned for full details in the coming weeks!

Earn thousands of dollars in free travel

You can get $1000+ completely free with one of the best credit card offers around!

Improve your credit score (yes!)

I apply for several cards each year and have an excellent credit rating by following these simple rules. You can learn more about how to improve your credit score.

Get vital insurance coverage for trips &more

It doesn’t make sense to deprive yourself of all this free insurance, which is so useful!

Get other amazing travel benefits

Not only will it make your trips more affordable, it’ll make them more enjoyable too!

6 most important things about travel rewards

Just by understanding this, you’ll be further ahead than 99% of travelers!

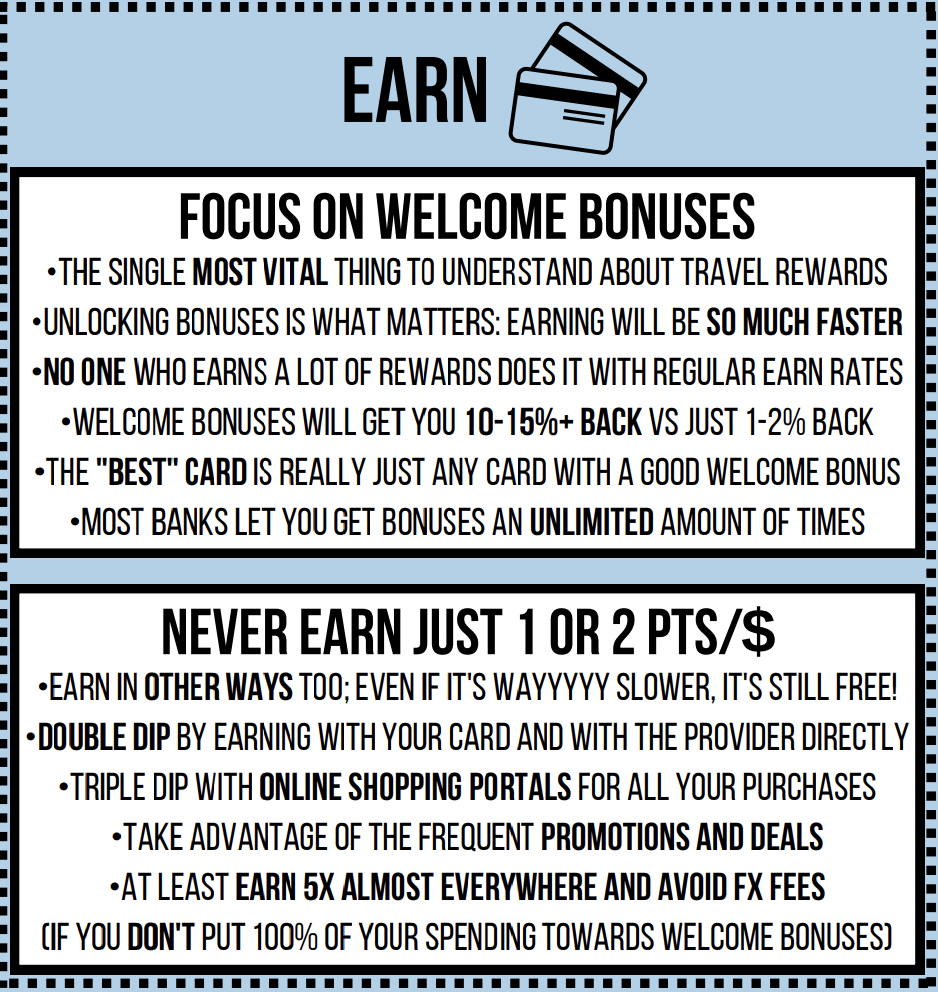

Earn

THE most important thing: welcome bonuses will earn you so much faster than you ever thought possible.

But never earn just the base rate of 1 pt/$ or 2 pts/$! Here’s a teaser of a few ways to earn more:

- Always keep 1 of the 5 cards that earn 5 pts/$

- Use the gift cards trick to get 5 pts/$ everywhere

- At least avoid the 2.5% fee on everything you buy in foreign currencies

- Take all the rewards offered directly by all programs for free

- Buy everything you need online and use a shopping portal

- Take advantage of the frequent promotions and deals (on hotels, portals, etc.)

You can read our guide on how to earn rewards.

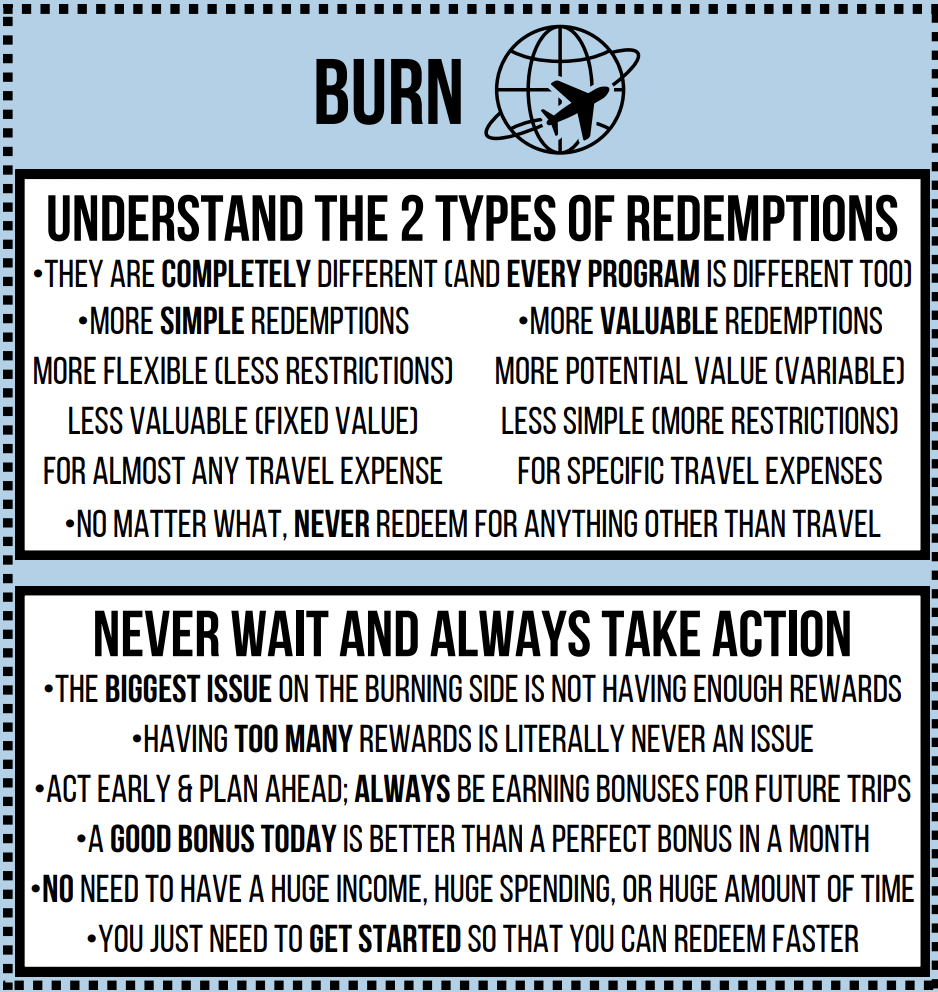

Burn

It’s important to understand what type of rewards work best for you… and to take action!

You can read the basics of the 2 types of redemption options and the 7 main sub-types.

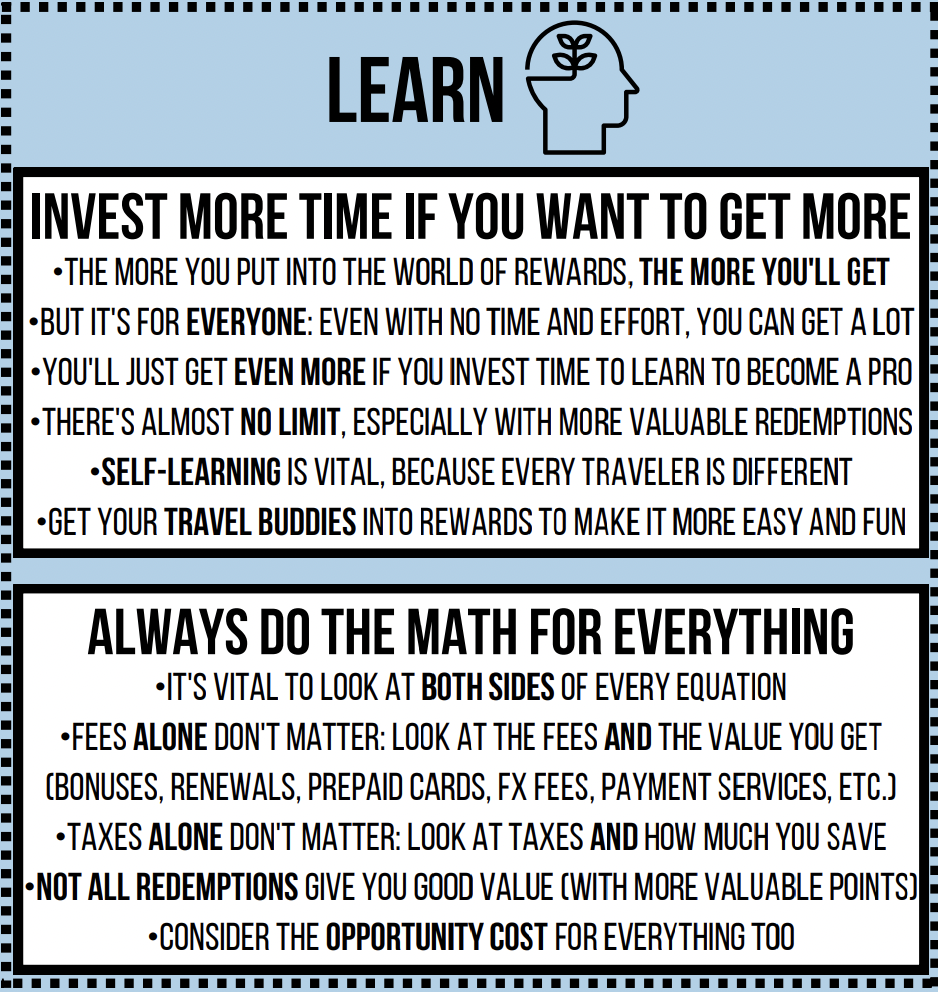

Learn

We’ll have plenty of content (videos and posts) to help you!

6 simple steps for travel rewards

It’s really more simple than it sounds.

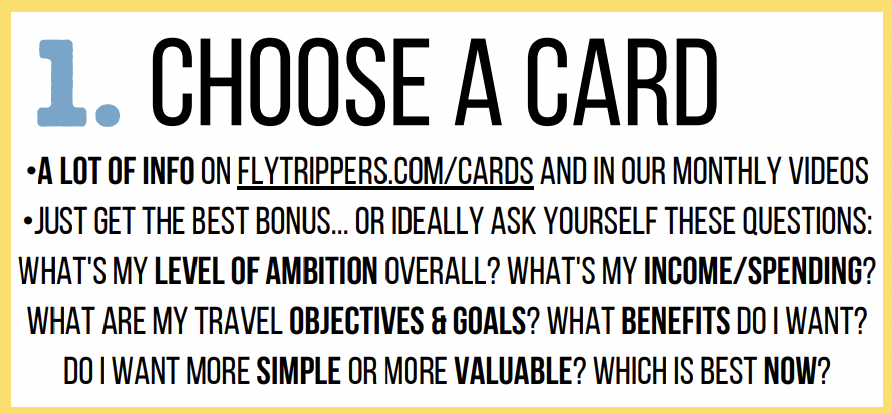

1. Choose a card

Our credit card ranking lists all the best offers. Our guide to choosing your cards helps you each time you’re due for a new one.

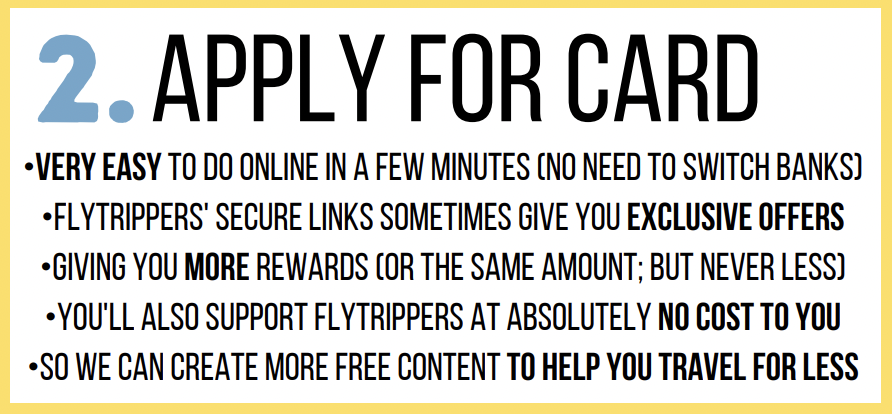

2. Apply for the card

Use our links, we really appreciate it and can’t wait to share even more content with you with our newly doubled team!

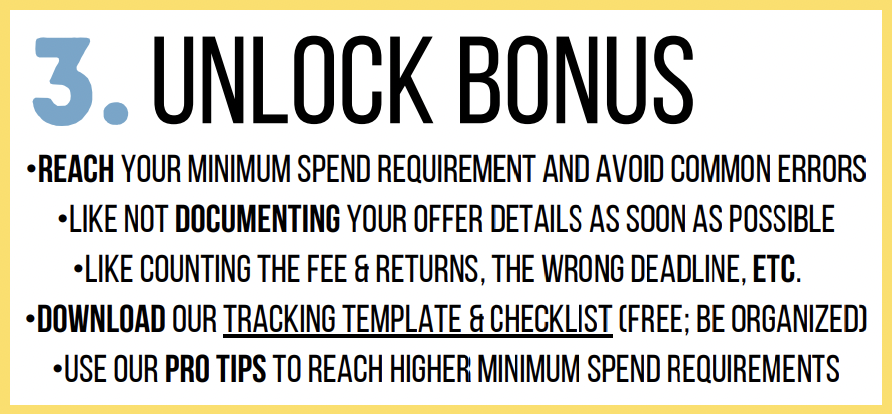

3. Unlock bonus

Download the free checklist now!

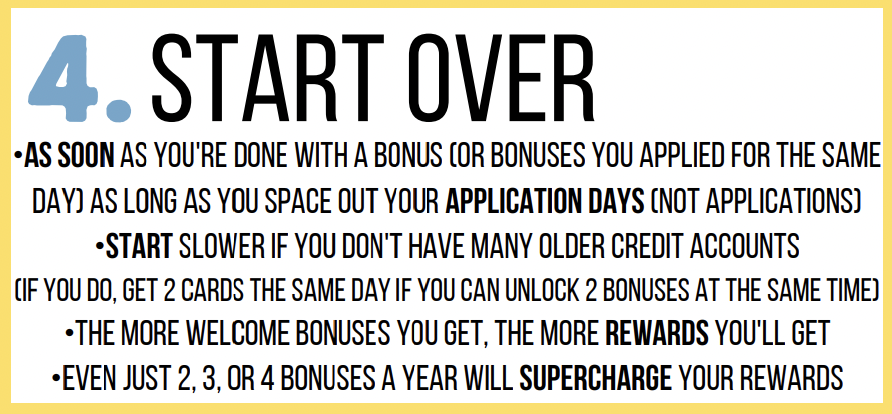

4. Start over

The most important step if you want lots of rewards!

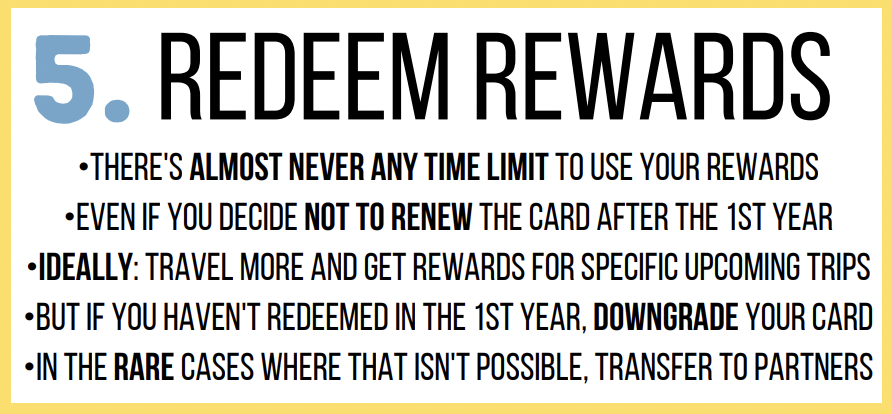

5. Redeem rewards

We’re going to have a lot of content on this one especially!

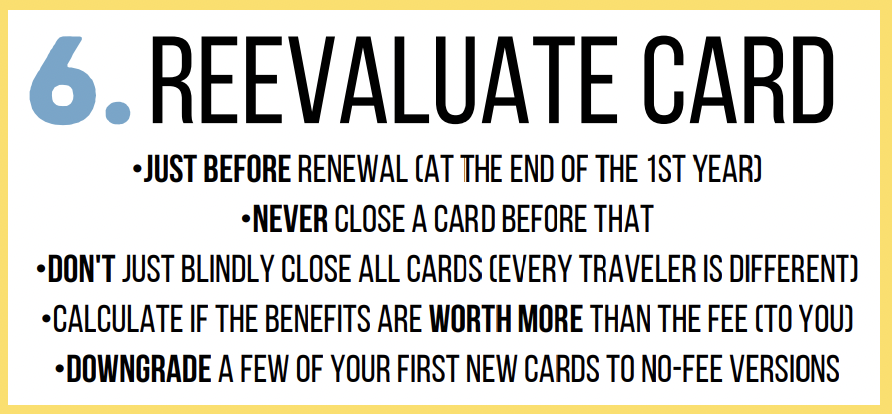

6. Reevaluate card

It’s another occasion when it’s important to know how to count, or rather, to take the time to do it right!

Learn how to earn free travel

Register for free and stay tuned for more!

What would you like to know about travel rewards? Tell us in the comments below.

See the deals we spot: Cheap flights

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Discover free travel: Travel rewards

Featured image: Infographic (photo credit: Flytrippers)

I was thinking of Marriot Bonvoy American Express and Bmo Air Miles World Elite Mastercard

Very important: the Marriott Bonvoy Amex Card should NEVER be closed: it gives you an annual certificate for a free night worth 35,000 points (≈ $315). It’s literally the only card every traveler should always keep, no exceptions. So don’t close it, I can’t emphasize this enough. If you were to close it even if you really shouldn’t, Marriott points are in your Marriott account, it has nothing to do with the card 🙂

The BMO AIR MILES World Elite MasterCard is rarely worth keeping after the 1st year’s welcome bonus, but again your AIR MILES miles are in your AIR MILES account, nothing to do with the card.

if I have rewards on a card that I have not used yet can I still close the card to avoid yearly fees the following years or will I lose my points

Yes, with almost every card in Canada there’s no need to keep the card to keep the rewards. What you need to do to keep the rewards depends on the specific card you want to close. Usually it’s just to downgrade the card to its no-fee version, but not all cards have one. What card do you want to close?