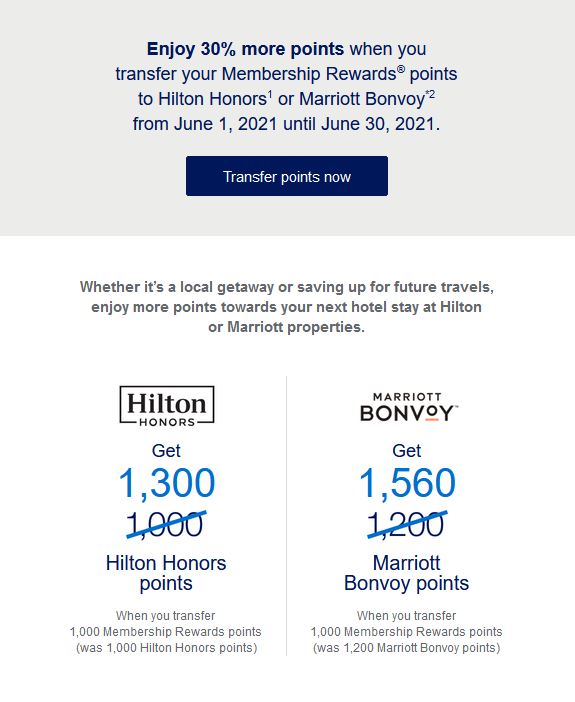

Amex has just come out with a new transfer bonus that is amazing—depending on which American Express card you have. In June, you will get a 30% bonus when transferring your Amex Membership Rewards points to both hotel partners: Marriott and Hilton. That’s 30% more value instantly; 30% more free hotel nights!

Here are all the details, including a lot of useful knowledge and also the often-requested step-by-step guide on how to transfer points online.

I will take this opportunity to share the basics of using those Amex points in case you have the very best credit card in Canada, since many of you just got it recently following our detailed review.

(If that’s your case, congratulations for getting your share of the more than half a million dollars Flytrippers readers have now earned in welcome bonuses alone!)

And by the way, the American Express Cobalt Card is the best in Canada, but that doesn’t mean it’s for everyone. Not the same thing at all. The Marriott Bonvoy American Express Card is the only one we recommend for all travelers. You can read our head-to-head comparison of both cards since we obviously have both ourselves.

Amex MR points vs Amex MR Select points

As you probably know, Amex has many of the best cards for those who want the most valuable travel rewards.

Like most major card issuers, they have 2 types of rewards cards:

- Co-branded cards that earn points from third-party rewards programs (from Marriott, from Aeroplan, from AIR MILES)

- Proprietary cards that earn points from Amex’s own rewards program (Amex Membership Rewards)

Amex Membership Rewards (often abbreviated as Amex MR) is widely considered the very best rewards program in Canada in large part because of the fact that it is a transferable currency.

Transferable means the points can be transferred to other programs. That is almost always the best use since other programs provide outsized value and unlimited value. That’s because they are variable-value rewards that have infinitely more potential value than fixed-value rewards that are always worth the same thing.

There are actually 7 cards that earn Amex MR points (another great transferable rewards program is HSBC; we’ll soon have an ultimate guide about both).

Anyway, as you can see in that infographic, something very important to understand about the Amex program is that there are 2 separate types of MR points:

- Regular Amex MR points (or Amex MR first)

- Amex MR Select points (or MR select tier)

Both are transferable rewards, but the 30% transfer bonus is only an amazing deal for those who have the best card in Canada, the American Express Cobalt Card (but also the Choice Card from American Express or the American Express Business Edge Card).

Because those 3 cards earn American Express MR Select points.

| Best credit cards for Amex MR Select points |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(≈ 8.3% back on $9k)

Rewards: ≈ $900

Card fee: $156

Spend required:$9k in 12 mos.

Best for: Best overall card in Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 16.5% back on $1k)

Rewards: ≈ $165

Card fee: $0

Spend required:$1k in 3 mos.

Best for: Valuable Amex points for free

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards for Amex MR Select points |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $156 (≈ 8.3% back on $9k)

Spend required:

$9k in 12 mos.

Best for: Best overall card in Canada

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $165

Card fee: $0 (≈ 16.5% back on $1k)

Spend required:

$1k in 3 mos.

Best for: Valuable Amex points for free

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

Other cards like The Platinum Card from American Express, the American Express Gold Rewards Card, the Business Platinum Card from American Express, and the American Express Business Gold Rewards Card earn the regular Amex MR points, which can be transferred to Aeroplan, Avios, and a few other airline partners.

If you want to maximize the value of your Amex points, you are almost certainly better off transferring to airline partners. Even this 30% transfer bonus deal does not change that fundamental reality for regular MR points… that’s how much more value you can get with airline partners compared to hotel partners.

| Best credit cards for Amex MR points |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(≈ 9% back on $12k)

Rewards: ≈ $1330

Card fee: $250

Spend required:$12k in 12 mos. spend $1k/mo. for 12 mos. &

make 1 purchase in months 15-17

Best for: 92,000 pts + 4 lounge passes and $100 travel credit

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 8.3% back on $9k)

Rewards: ≈ $900

Card fee: $156

Spend required:$9k in 12 mos.

Best for: 60,000 pts + 5X earn rate no increased offer

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 11.0% back on $10k)

Rewards: ≈ $1901

Card fee: $799

Spend required:$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17

Best for: 140,000 pts + unlimited lounges and $200 travel credit

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards for Amex MR points |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1330

Card fee: $250 (≈ 9% back on $12k)

Spend required:

$12k in 12 mos. spend $1k/mo. for 12 mos. &

make 1 purchase in months 15-17 Best for: 92,000 pts + 4 lounge passes and $100 travel credit

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $900

Card fee: $156 (≈ 8.3% back on $9k)

Spend required:

$9k in 12 mos.

Best for: 60,000 pts + 5X earn rate no increased offer

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1901

Card fee: $799 (≈ 11.0% back on $10k)

Spend required:

$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17 Best for: 140,000 pts + unlimited lounges and $200 travel credit

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $165

Card fee: $0 (≈ 16.5% back on $1k)

Spend required:

$1k in 3 mos.

Best for: 11,000 pts + no fees but way less value

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $814

Card fee: $199 (≈ 8.2% back on $7.5k)

Spend required:

$7.5k in 3 mos. spend $7.5k in 3 mos. &

make 1 purchase in months 15-17 Best for: 67,500 pts + simpler min. spend structure

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $2222

Card fee: $799 (≈ 9.5% back on $15k)

Spend required:

$15k in 3 mos. spend $15k in 3 mos. &

make 1 purchase in months 15-17 Best for: 158,750 pts + unlimited lounges different min. spend

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

There are 4 options to use Amex MR points for travel:

- They can be transferred to airline partners

- They can be transferred to hotel partners

- They can be used for the Amex fixed-point flight award chart

- They can be used as an easy and simple fixed-value travel credit

MR Select points work exactly the same as regular MR points, except they cannot be transferred to airline partners. Everything else is the same.

I have added a section below to share the basics of the different ways to use these Amex Select points.

So in short, with the Cobalt Card and other MR Select points-earning cards, transferring to Marriott is already by far the best use of points… and now is the absolute best time to transfer your stash with this bonus.

Amex transfer bonus

Here is the promo: until June 30th, you will get an excellent 30% bonus when you transfer Amex points.

Transferring 1,000 MR points will now give you:

- 1,560 Marriott points instead of 1,200 (1 to 1.56 instead of 1 to 1.2)

- 1,300 Hilton points instead of 1,000 (1 to 1.3 instead of 1 to 1)

This is what we call a “transfer bonus” in the world of travel rewards, and it’s one of the best ways to get even more value out of transferable point currencies (which are already the most valuable type of rewards, to begin with).

Transfer bonuses are pretty rare, and you’ll only see one once a year or so usually. So it’s important not to miss them if you want to take advantage; make sure to join our free travel rewards-specific newsletter to receive all the important deals and also many very lucrative tips.

Here’s how this Amex transfer bonus works for both eligible partners.

Transfer to Marriott

So just by transferring to Marriott during the month of June, your rewards gain 30% more value. That is HUGE. That’s 30% more free hotel nights.

Let’s say you’ve accumulated 60,000 Amex MR Select points, which is the amount you get with the welcome bonus on the American Express Cobalt Card (and it’s easy to earn a lot more with the incredible earn rate of 5 Amex MR Select points per dollar).

Our Flytrippers Valuation of those 60,000 points is ≈ $648. If you transfer to Marriott with the 30% bonus, suddenly those exact same rewards are now worth ≈ $842!!! You just got nearly $200 in extra value absolutely free.

Those 60,000 Amex MR Select points are now enough for 15 completely free nights in a few amazing destinations like Bali, South Africa, or Spain (or 8 free nights in 50+ countries if you want more options).

That’s a lot of free nights. The Cobalt Card‘s 5 points per dollar earn rate is effectively a 7.8 Marriott points per dollar earn rate thanks to this promo, which is absolutely insane!

If you were to use the 60,000 Amex MR Select points as an easy fixed-value travel credit applicable to any travel expense, it is just worth $600. That’s why variable-value rewards are way more interesting if you like maximizing and getting a good deal: they can provide outsized value and unlimited value!

My own personal travel rewards strategy is to focus on getting more Marriott points with my Cobalt Card when I’m not unlocking the many welcome bonuses I get each year, and I also get many Amex points by using a few pro tips that we literally can’t write here (but might share in another format exclusively to subscribers of our free travel rewards newsletter).

My current stash of Amex Select points grew to over 178,000 and now by waiting for this transfer bonus, the extra 30% will give me at least ≈ $576 in extra value out of thin air! Free!

In other words, if you planned on using your Amex MR Select points for Marriott hotels, now is the best time to transfer them to Marriott.

Just beware: transfers can never be undone. Make sure to understand that you need to use your Marriott points well, because not all redemptions are good. That’s how variable-value rewards work.

If you use them badly or don’t put in any effort, you might be better off with the simple fixed-value travel credit, so don’t transfer. Marriott points are extremely valuable for those specific destinations above, but also for almost anywhere if the hotels are more expensive than usual in cash (for peak dates for example), or for high-end very luxurious properties. But they can easily be worth less for those who don’t bother making sure they are using them well.

Again, that’s the beauty of variable-value rewards. They reward savvy travelers more… at the expense of those who don’t want to put in any effort! You can read the 12 things to know about the Marriott program if you want to learn more.

Transfer to Hilton

As for Hilton, not only is the transfer rate less attractive, even Hilton points themselves are also worth less as well. So it’s definitely not as interesting. You get fewer points, and they’re worth less.

But like Marriott, Hilton Honors is a variable-value rewards program, so it can sometimes offer great value. It’s just not as frequent as with Marriott at all.

If you’ve done the research and have found a great use for Hilton points, it can be amazing. But I would definitely advise against speculatively transferring to Hilton unless you are a pro.

I will share a detailed list of the lowest category Hiltons in a separate post next week so you can decide before the end of this Amex transfer bonus (sign up to our free travel rewards-specific newsletter to get it).

5 ways to use Amex MR Select points

As I said, I’ll have a detailed guide about the Amex MR program soon, but with this promo being for June only, I wanted to already give you a short overview of how much value you can get with the 5 different ways to use Amex MR Select points.

This way you can compare and decide whether taking advantage of this 30% transfer bonus is right for you.

Let’s use an amount of 30,000 points for the example, but you can easily do the math for your specific stash size.

1. Anything other than travel

Value of 30,000 points: < $300

Banks always want you to use your points for merchandise and other stuff that isn’t travel. The fact that they push these very hard should tell you all you need to know about the value it gives you.

Don’t do it. End of section.

2. Fixed-value travel credit

Value of 30,000 points: = $300

Like the majority of non-airline/non-hotel rewards programs, Amex MR Select points can be used as a simple fixed-value travel credit, because a lot of people prefer more simplicity instead of more value. You cannot get less or more, the points are always worth a set amount this way (1¢).

The advantage of AMEX MR Select points is that they are the simplest type of fixed-value rewards: “eraser” points. They can be applied to literally any travel expense and the points will “erase” the expense. No need to book on a specific website, on a specific airline or hotel chain: it can be used for any travel expense.

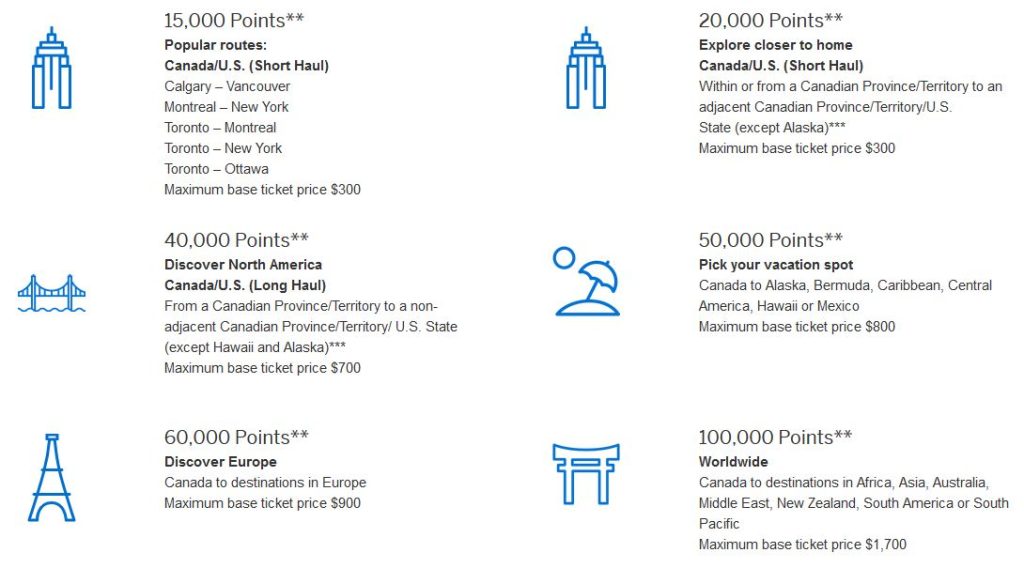

3. Amex Fixed Points Travel flight award chart

Value of 30,000 points: ≈ $400

For those who tend to buy expensive airplane tickets, the Amex Fixed Points Travel award chart can be very valuable. It’s a variable-value reward option.

It’s an award chart that determines the price for specific routes (only works for roundtrips from Canada, so less flexible than airline rewards) on almost any airline, but it also specifies a maximum discount in cash (so not unlimited value unlike airline rewards). This discount applies only to the base fare, before taxes.

For example, for 30,000 points, you can get up to $600 off the base fare on a few popular routes. Many other routes offer great value if the cash price is high, and we value this redemption at ≈ $400 conservatively.

Again, if you follow Flytrippers, if you use the flight deals we spot and if you use our tips to avoid expensive flights… this redemption does not give you the best value. But if you have to buy an expensive flight (last minute, no flexibility on dates, etc.), it can be a great redemption!

Here is the complete flight award chart:

4. Marriott transfers

Value of 30,000 points: ≈ $421

Marriott Bonvoy is the best hotel rewards program for Canadians, and it’s not even close.

If you plan your trips around the best hotels, you can easily get 7 free nights with just 30,000 Amex points. You can check out the 5 countries with the most Marriott category 1 hotels. If you want a lot more options, there are 50+ countries with Marriott category 2 hotels where you could get almost 5 free nights with 30,000 points.

There are thousands of more options, but those will give you the most free nights. Others might save you more money though, as I explained recently when I talked about the deal for 5 nights in an overwater villa in the Maldives for the same price as 21 free nights in Bali.

Have any questions about the Marriott program? I would gladly share my expertise: ask in the comments below!

5. Hilton transfers

Value of 30,000 points: ≈ $273

The Hilton Honors program has a lot fewer lower-priced hotels compared to Marriott. There are just a few hotels at 5,000 points per night, so you could get 7 free nights there (like Marriott, you get one free every time you book 4) but you’d have very few options (Turkey, Mexico, Colombia, Russia, Indonesia, Malaysia). More hotels cost 10,000 points per night, but again there are a lot fewer options than with Marriott.

In short, unless you specifically plan around the lowest-priced Hiltons, this is probably not a good idea. As I said, I will share a detailed list of the lowest category Hiltons in a separate post next week.

How to transfer Amex points

Many have asked for the step-by-step guide with screenshots, so here is exactly how to transfer Amex points to Marriott online; it’s really very easy.

Want to get more content to learn how to earn a lot of free travel?

Summary

The 30% transfer bonus from Amex MR points to Marriott Bonvoy is a great opportunity to get more value out of your rewards if you have the American Express Cobalt Card.

What would you like to know about this transfer bonus? Tell us in the comments below.

Explore awesome destinations: travel inspiration

Learn pro tricks: travel tips

Discover free travel: travel rewards

Featured image: South Africa (photo credit: Hu Chen)

Advertiser Disclosure: In the interest of transparency, Flytrippers may receive a commission on links featured in this post, at no cost to you. Thank you for using our links to support us for free, we appreciate it! You allow us to keep finding the best travel deals for free and to keep offering interesting content for free. Since we care deeply about our mission to help travelers and our reputation and credibility prevail over everything, we will NEVER recommend a product or service that we do not believe in or that we do not use ourselves, and we will never give any third-party any control whatsoever on our content. For more information on our advertiser disclosure, click here.