It’s obvious that it makes sense to use a credit card to pay taxes, rent, car payments, tuition, utilities, etc. At least when you use the right card and when you take the time to properly do the math and understand it all (always a very good thing to do for everything in life). We want to help you with that today.

Knowing how to do the math properly is literally one of the 6 most important things in the world of travel rewards.

It’s vital!!! We can evidently never repeat this often enough. Even if you don’t like math, you really need to learn. It’s going to help you save so much money and points.

So I’m taking advantage of the recent update to our guide on bill payment services (a must-read if you haven’t done so already) to take a closer look at these simple calculations.

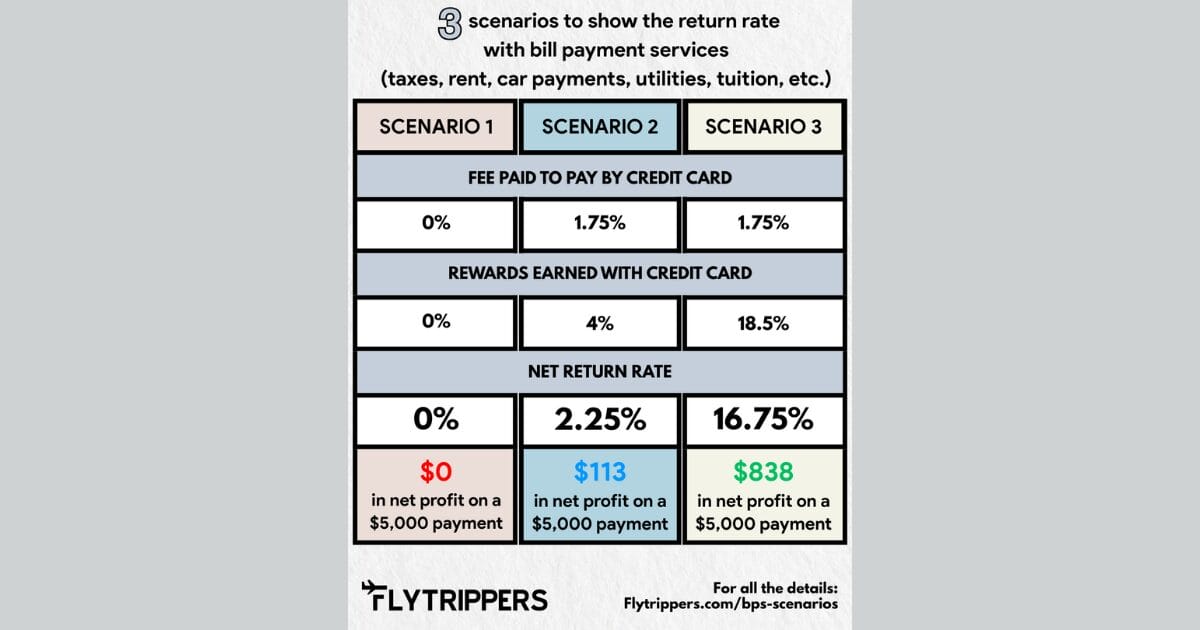

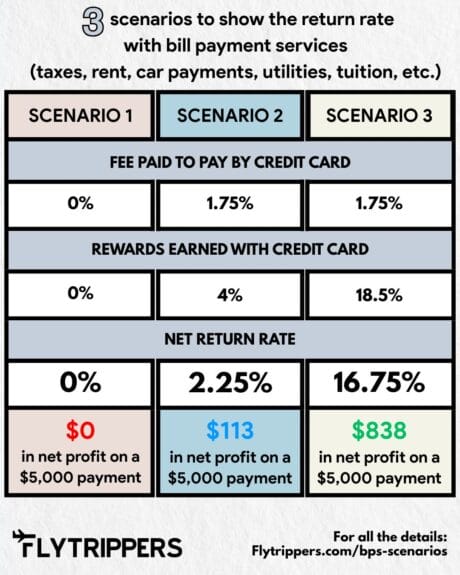

Here are the 3 scenarios.

Infographic of calculations for the 3 scenarios

Here’s the infographic that very clearly summarizes the 3 scenarios for payments that can’t normally be made by credit card.

Scenario 1 is what just about everyone does. It’s objectively not a very good option to get 0%, as you now see I hope. Of course, it’s normal not to know this if no one tells you! That’s the case for so many tips related to travel rewards (and travel in general), so we’re going to help you!

Scenario 2 is the bare minimum that everyone should do! Except that even this… only gives you a 2.25% profit, which is much closer to the 0% that the average person gets than the 16.75% that real pros get! But it’s certainly better than 0%.

Scenario 3 is the best because it’s the so simple trick to always do. It gives you a 16.75% profit… now that’s starting to be good! THAT’S being a pro in the world of travel rewards (not getting a pathetic rate of 1% or 2%)! On one very important condition, though…

Let’s look at each scenario briefly.

Scenario 1: Getting 0%

Here’s how to do this scenario:

- Don’t

This scenario is what you should not do. There’s not much to add here.

Wanting to avoid fees is a normal and good reflex in almost all areas, but certainly not in the counter-intuitive world of travel rewards.

This is the most basic of basics. You’ll never be a pro until you understand that it makes no sense to want to avoid 1.75% in Chexy fees and earn 0%… instead of paying 1.75% to earn 4% (or much more).

Scenario 2: Getting a 2.25% net profit so easily

It’s far from being the most profitable option, but at the bare minimum, you should at least get 2.25% net profit on all these huge expenses!!!

Here’s how to do it very simply:

- You apply for the Scotia Momentum Visa Infinite Card

- You use it on Chexy to pay taxes or other bills

- You pay a 1.75% fee

- You earn 4% in simple cash back

- You can do this for up to $25,000 in spending

It’s really a simple calculation: 4% minus 1.75% equals 2.25% in easy net profit!

So on a $5000 payment, you pay $87.50 in fees, but you get $200 in cash back! Profit of $112.50 so easily, in just a few clicks!

That’s for the simple version for the whole year! But that’s not counting that the first $2000 spent on the Scotia Momentum Visa Infinite Card earns 10% instead of 4%, so $120 more in profit (that bonus that gives you a 10% earn rate is only for those who haven’t had a Scotiabank credit card in the past 2 years, though)!

And that’s not counting the Chexy welcome bonus of $15 after the 1st payment (and up to 10,000 Aeroplan points if you make more payments).

The annual fee for the Scotia Momentum Visa Infinite Card is waived for the 1st year, so your profit really is 2.25%! If you want to continue this way for the 2nd year, the threshold you need to reach in Chexy payments to make this card profitable is $6858! Yes, more math.

(But that’s a decision for 1 year from now, as you know if you’ve read the 6 simple steps to always follow!)

You earn 4% because Chexy is coded as a recurring payment, and the Scotia Momentum Visa Infinite Card always earns 4% on the recurring payments category.

The 4% multiplier rate has a maximum cap of $25,000 in spending per year. But if you want to do more than that, as always, your spouse can get their own card. If you’re solo, as always, you probably have a friend with whom you can make a win-win agreement!

If you don’t earn the minimum income required for this card, there’s an alternative: the Scotia Momentum Visa Card.

That one only earns 2% (not 4%), so it’s less profitable… but it’s still an easy profit. We never recommend wasting a card application on something so low, but since it has no minimum spending requirement, you can apply for it on the same day you apply for a good card.

Scenario 3: Getting a 16.75% net profit so easily

Speaking of good cards… if you want to remember just one thing about travel rewards, it’s that welcome bonuses are the key. So simple! And yet, it is so hard to understand for many, unfortunately.

Here’s how to do it very simply:

- You apply for the TD First Class Travel Visa Infinite Card

- You use it on Chexy to pay taxes or other bills

- You pay a 1.75% fee

- You earn 18.5% back in simple points

- You can do this for up to $5000 in spending

Again: 18.5% minus 1.75% equals 16.75% in easy net profit!

Much better, right?

But be sure to understand that it’s smart to pay the Chexy fees to unlock a bonus only if you take advantage of this to unlock more welcome bonuses! All of this is detailed in the rewards earning section of our guide on bill payment services.

It’s literally as simple as that if you want to maximize the amount of rewards you get: use all your expenses to unlock more welcome bonuses!

Very easy, and it will improve your credit score and give you lots of great travel benefits too!

The TD First Class Travel Visa Infinite Card actually has 4 free annual passes to VIP airport lounges in addition to its huge record-high welcome bonus.

Why earn 1% or 2% when you can earn 18.5%?

You earn 18.5% because you get a welcome bonus of 135,000 points ($675), the earn rate of 2 points per dollar on $5000 in spending gives you 10,000 points ($50), and the card gives you 2 travel credits of $100 each ($200). That gives you a return of $925 on $5000 in spending (18.5%).

TD points can be redeemed for any travel expense at a simple fixed value. The fee for the 1st year is waived here too, so it’s really 16.75% in net profit!

Learning how to travel for less

Join over 100,000 savvy Canadian travelers who already receive Flytrippers’ free newsletter so we can help you travel for less — including thanks to the wonderful world of travel rewards!

Summary

The calculations for these 3 scenarios show you how profitable it is to know the pro tips! Bill payment services allow you to earn more rewards very easily!

What would you like to know about return rates on bill payment services? Tell us in the comments below.

See the flight deals we spot: Cheap flights

Discover free travel with rewards: Travel rewards

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Featured image: Infographic (photo credit: Flytrippers)