You can get thousands of dollars in free travel thanks to the credit card welcome bonuses. But there’s one main limitation that prevents you from getting an unlimited amount: minimum spending requirements (and not the welcome bonus eligibility rules, which are less restrictive than people believe).

You have to spend an amount to unlock the bonus. If you want to maximize your rewards earned, it’s extremely simple: all your spending should be used to reach minimum spending requirements!!!

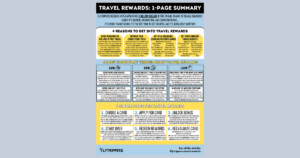

So it’s good to know about how it works and some important warnings. Flytrippers helps you travel for less with its free newsletter specifically about travel rewards, its ranking of the best offers of the moment, and its infographic that summarizes all the basics.

Here’s everything you need to know about minimum spending requirements to unlock credit card welcome bonuses.

What are minimum spending requirements?

Credit cards offer huge welcome bonuses. To get them, you almost always have to put a specific amount of purchases on the card in the first months. That’s the minimum spending requirement.

It’s the only condition to meet to get the rewards. It really is that easy!

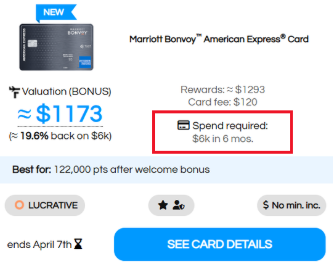

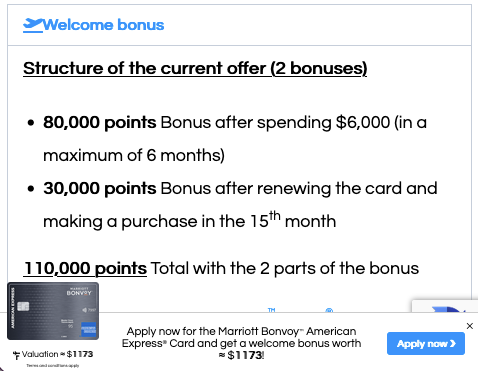

For example, right now, there’s a great welcome bonus that gives you ≈ $1173 in free travel. The minimum spending requirement is higher than usual: $6000 in 6 months.

(It’s the highest offer ever seen on the only card that’s for all Canadian travelers without any exception, the Marriott Bonvoy Amex Card… also available on the Marriott Bonvoy Business Amex Card which doesn’t require having an incorporated business!)

The minimum spending requirement is always clearly indicated in all our card tables. Because it’s the key: it’s how you unlock the bonus!

There are several elements to know about requirements:

- It’s not a scam

- There are tips to meet them

- There’s an important strategy

- There are 5 vital warnings

Let’s look at all that.

Are minimum spending requirements a scam?

No. You reach the minimum spending requirement and you get the welcome bonus. Simple.

Many unfortunately mistakenly believe there are “catches” or that it’s a scam. Oh no.

I’ve reached dozens and dozens of minimum spending requirements myself. Since 2017, our Flytrippers fans like you have even obtained more than 4 million dollars in free travel just by unlocking welcome bonuses.

It’s certainly not a scam.

The scam is when you have $7500 to spend and you spend it on a card that gives you 1% back ($75), instead of spending it on a card that gives you 13.3% back ($1000)!

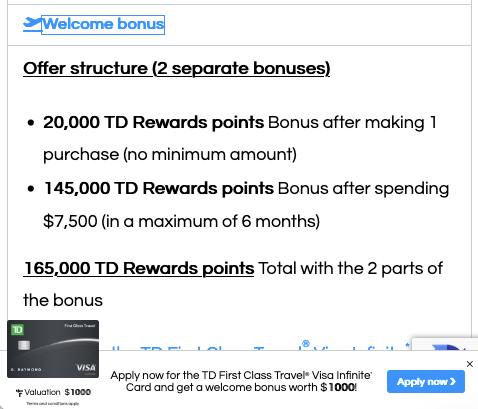

The scam is not taking advantage of huge welcome bonuses, like the one on the TD First Class Travel Visa Infinite Card that gives you $1000 by simply spending what you would have spent anyway!!!

It’s not surprising that most people mistakenly think travel rewards aren’t worth it, when they think it’s about earning 1% when it’s really about earning 13.3%!

How to reach more minimum spending requirements or higher requirements?

There are some important tips to be able to reach minimum spending requirements, which most people unfortunately don’t know.

Since unlocking welcome bonuses is the key to the wonderful world of travel rewards, it’s good to know these tips to be able to unlock more… and get more free travel.

Here are the 6 tips:

- Time your card applications with your planned expenses

- Pay for absolutely all your expenses

- Pay with bill payment services (rent, taxes, tuition, insurances, etc.)

- Pay for your friends and family’s expenses

- Pre-pay your future purchases (including with the refundable hotel tip)

- Pay for things you can get reimbursed or resell

You can read our detailed post on the 6 tips to reach minimum spending requirements.

What are the important strategies regarding minimum spending requirements?

I’m repeating myself because it’s literally THE most important thing, and yet 99% of people still haven’t understood: welcome bonuses are the key.

That means that to earn incredibly more rewards, you just need to use as much of your spending as possible to reach minimum spending requirements. You want to minimize the spending you put on a card that doesn’t give you a bonus.

But all the while protecting your credit score. It’s often an issue for those who have more spending, but who have difficulty getting enough minimum spending requirements to reach without getting cards too frequently.

So you have to adopt the pros’ strategy if you want to maximize your rewards.

Having more credit cards improves your credit score, but only if you follow the 3 rules, including the one to space out your application days for cards (not your applications) by at least 2-3 months.

The strategy is therefore to apply for multiple cards on the same calendar day. That gives you more bonuses, while spacing out your card application days.

Let’s take the example of someone who will apply for 6 cards in the year (a fairly slow pace, but it’s a marathon and not a sprint; you don’t have to go fast at the beginning, obviously).

It’s much better for your credit score to apply for 2 cards on the same day every 4 months, rather than 1 card every 2 months. To space out application days.

That gives you the same amount of welcome bonuses. And it’s also much simpler logistically than always having to choose an offer that has a spending requirement that corresponds exactly to the amount you plan to spend in that period.

What are the 5 important warnings regarding minimum spending requirements?

Flytrippers has created a free checklist for every time you apply for a new credit card! You simply follow that, and you’ll avoid common mistakes regarding minimum spending requirements.

Here are the 5 warnings in that easy-to-follow checklist (which are also in our infographic with all the basics):

- You must know that requirements vary by card and by offer

- You must always document the offer details

- Your countdown for the requirement starts at card approval

- You must always count your net purchases only

- You can never get a 2nd chance for the requirement

Let’s look at each briefly.

You must know that requirements vary by card and by offer

The general functioning of minimum spending requirements is obviously always the same: an amount to spend in a specific period (a time limit). Very simple.

But the requirements are different on different cards. And the same card will have different requirements depending on its different offers (welcome bonuses change throughout the year).

Also, there are 6 different types of minimum spending requirements, in terms of structure (explained in the next section).

Get used to it, it’s a pretty basic concept: everything is always different, because they’re different cards (and different offers). It will always be like that.

What to do: It’s absolutely nothing complicated, but you need to know that details vary, to know that you need to read carefully.

You must always document the offer details

This is to make sure you know what the requirement is. The details of offers are almost never included in the documentation you receive from the bank, nor on your online portal, nor anywhere else. That’s how it is; so, as indicated in our free checklist, take note of them.

Welcome bonus offers change throughout the year, so the offer could change the day after your application. And it happens often, because Flytrippers often has insider information.

For example, we often know the details of offer changes even when they’re not publicly announced. If we aren’t allowed to tell you a specific offer will go down, we’ll often share content about that offer, so you don’t miss the increased offer!

The details of the previous offer completely disappear from the Internet when it expires. Always. If we had $1 for every time someone writes to us because they don’t know what their offer is, I wouldn’t need welcome bonuses to take 9 business class flights in a year! I’m exaggerating, but still! 😂

What to do: Avoid this all-too-common mistake by simply documenting the offer details with every application you make.

Your countdown for the requirement starts at card approval

We often get asked when the time period to meet the requirement starts: the day you apply for the card, the day you receive the card, or the day you activate the card…

It’s none of these answers. The countdown starts when your application is approved.

In practice, that’s the same day as the card application day in the vast majority of cases. But sometimes, especially for a 1st application with a specific bank, it can take a few days for verifications, and that’s completely normal (it’s to protect you, among other things).

Rely on the billing cycle, the specific date indicated on your credit card statement. Your 1st statement starts on the day of your approval. So if you have 3 months for the spending requirement, you have 3 billing cycles. So you have until the last day of the 3rd billing cycle.

What to do: Obviously, ideally, you shouldn’t be too tight, because you effectively have a bit less time than the period indicates (the time lost between approval and receiving the card).

You must always count your net purchases only

Let’s take a minimum spending requirement of $3000 for this example. You need to really have $3000 in net purchases. There are tricks to get $3000 in purchases even when you don’t have $3000 in purchases to make… but you need to have $3000 in net purchases.

Refunds and returns do not count. If your player #2 doesn’t think about it and gets refunded for a $30 pair of jeans that they had bought with the card, and that makes you drop below $3000… you no longer have $3000 in net purchases.

The card’s annual fee does not count. If you only look at the total amount due on your card statement and it includes a fee, even if you paid $3000… you don’t have $3000 in net purchases.

Cash advances, balance transfers, and anything that’s not a real purchase don’t count. You need to have $3000 in net purchases.

What to do: It’s fairly simple… you need to count only real purchases.

You can never get a 2nd chance for the requirement

If you’re missing $1… you won’t get the bonus. If you reached the amount 1 day too late… you won’t get the bonus. It’s that simple.

There’s really nothing you can do; banks won’t budge. You won’t be able to get an exception.

Banks are extremely generous and give you literally hundreds of dollars in free travel… all you have to do is count correctly. It’s honestly not that much to ask.

With our free checklist, there’s also a tracking template. Use it to be well organized. Set alarms and reminders so you don’t miss it.

What to do: Recheck your progress monthly or at least a bit before the time limit so you don’t miss the deadline!

What are the 6 types of minimum spending requirements?

These are only minor variations, but it’s good to know what the types of minimum spending requirements are.

There are 6:

- No spend requirement

- Standard requirement

- Multiple-part requirement

- Renewal requirement

- Monthly requirement

- Special requirement

Let’s look at each type.

No spend requirement

A welcome bonus that doesn’t require an amount to spend. It just requires you to make any purchase, or even to do nothing at all.

It’s not really a minimum spending requirement, but I wanted to include it because it’s a type of bonus offer structure. It’s often in conjunction with another separate bonus.

Example: The TD First Class Travel Visa Infinite Card (the best for simple points right now). You get 20,000 points after the 1st purchase (and more with the other part of the bonus).

Standard requirement

An amount to spend in the first months.

It’s the simplest, but it’s increasingly rare, especially with the best offers.

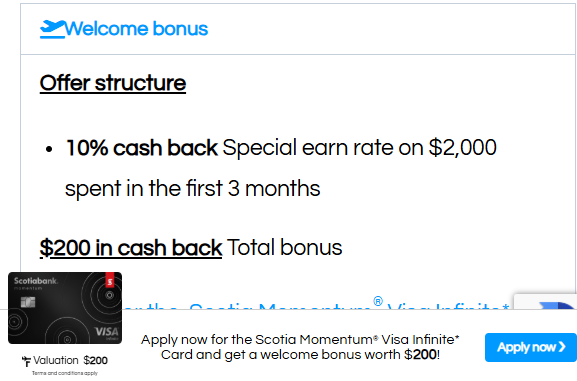

Example: The Scotia Momentum Visa Infinite Card (the best for making a profit with bill payment services). You get $200 (cash back at a fixed value) by spending $2000 in 3 months.

Multiple-part requirement

An amount to spend in the first months, too. But the bonus has multiple parts, and therefore multiple amounts to spend.

It’s now the most common type. The different parts of the bonus are really separate, so you could choose not to unlock them all. It’s independent.

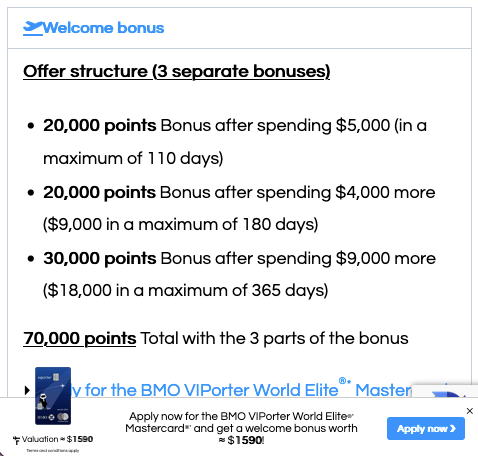

Example: The BMO VIPorter World Elite Mastercard (the best for a big welcome bonus that has a relatively fixed value). You get 20,000 points by spending $5000, then 20,000 points by spending $4000 more, and then 30,000 points by spending $9000 more.

Renewal requirement

An amount to spend in the first months, too. The bonus has multiple parts, too. But one of the bonuses requires renewing the card for year 2.

It’s increasingly common. Most of the time, the part of the bonus that requires renewing the card (which we call the renewal bonus) is large enough to compensate for year 2’s fee.

Example: The Marriott Bonvoy Amex Card (the best right now for absolutely everyone who doesn’t have it yet). You get 80,000 points by spending $6000, and then 30,000 points by renewing the card (which you should already do with this one, it’s the only one that no one should ever close).

Monthly requirement

An amount to spend per month, for multiple months. These are also separate and independent bonuses.

It’s much rarer. But it happens that instead of giving you X months to spend a specific amount spread out the way you want, the requirement requires a specific amount per month for X months.

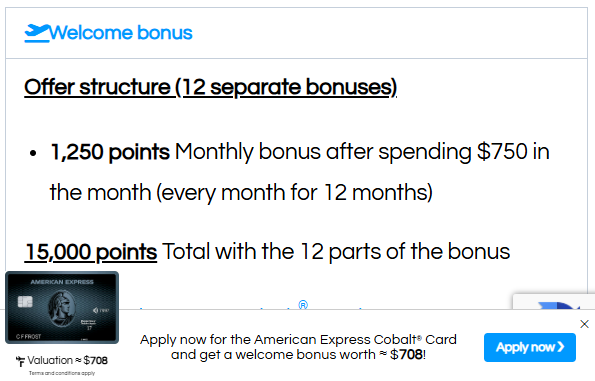

Example: The Amex Cobalt Card (the best Canadian card overall). You get 1250 points per month if you spend $750 in the month (for 12 months), so 15,000 points total.

Special requirement

Another type of requirement that’s a bit peculiar. Sometimes it’s just that the amount to spend must be in a specific category, but it can also be an action to take (like signing up for online statements).

It’s very rare, but it exists.

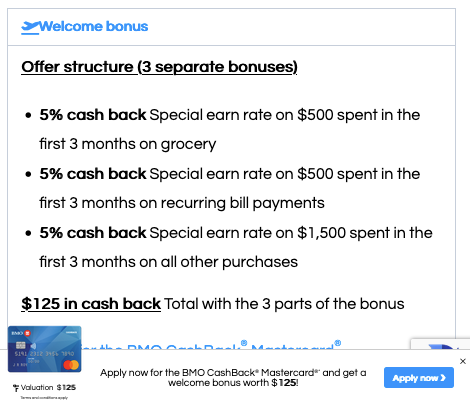

Example: The BMO CashBack Mastercard (not very good, but one of the rare ones with a special requirement right now). You get 5% cash back, but with a portion in specific spending categories.

Learning how to travel for less

Join over 100,000 savvy Canadian travelers who already receive Flytrippers’ free newsletter so we can help you travel for less — including thanks to the wonderful world of travel rewards!

Sign up for our travel rewards newsletter

Sign up for our newsletter

Summary

Minimum spending requirements are one of the most important aspects of the wonderful world of travel rewards. Especially if you want to maximize! These tips, strategies, and warnings will help you get the most free travel possible.

What would you like to know about minimum spending requirements? Tell us in the comments below.

See the flight deals we spot: Cheap flights

Discover free travel with rewards: Travel rewards

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Featured image: Mexico (photo credit: Gabrielle Maurer)