The single most important thing to understand about the entire world of travel rewards is that welcome bonuses are the key to earning more rewards. You’ll easily get hundreds of dollars with each one you get! But there are important welcome bonus eligibility rules to know about.

Thankfully, they’re pretty lenient and very easy to check (as they’ve always been). So it’s easy to plan your travel rewards strategy.

Welcome bonus eligibility rules should not be confused with card eligibility rules (including the minimum income requirement). You may be eligible for the card itself but still not be eligible for the card’s welcome bonus (and vice versa).

Here are the details about welcome bonus eligibility rules — we’ll have a more detailed guide with every card’s rules in one place soon, but I wanted to give you an introduction right away.

Overview of welcome bonus eligibility rules

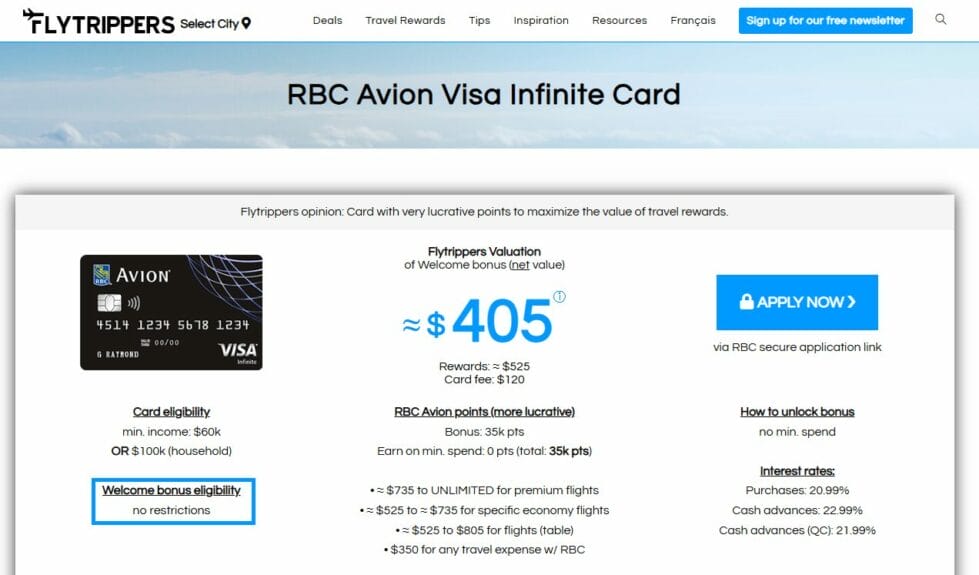

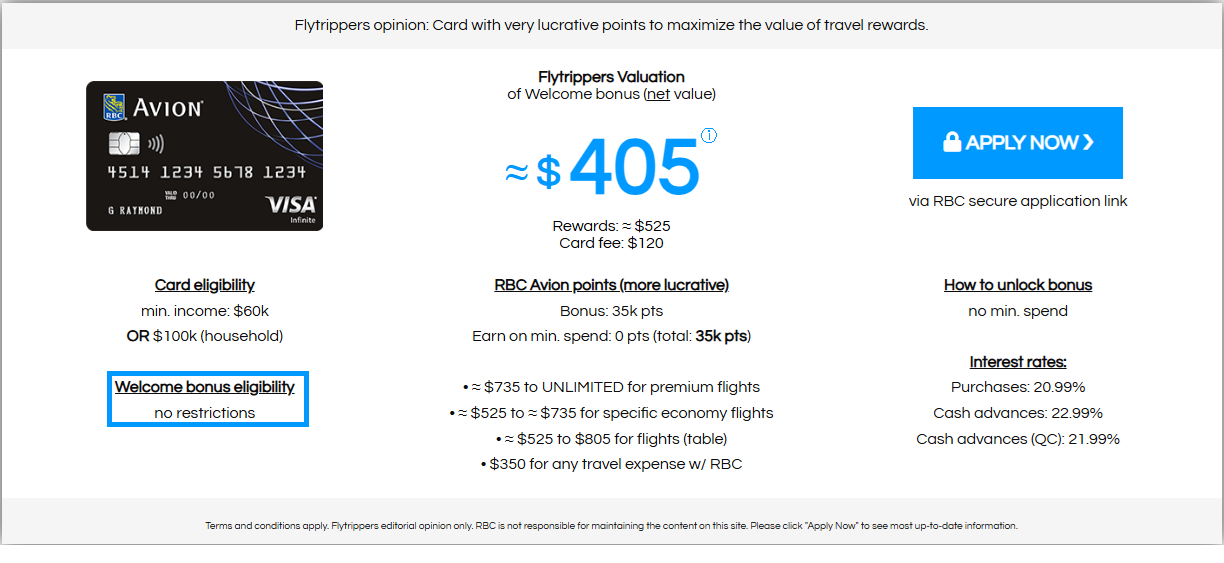

On our Flytrippers resource page for any credit card, you might have noticed the welcome bonus eligibility rules that are clearly indicated.

We put that in the summary table at the top of the page because one of the most frequently asked questions we receive is: “Am I eligible for a card’s welcome bonus if I’ve had the card in the past?”.

The answer is very simple:

- Yes for most cards in Canada (generally)

- Sometimes no (rarer)

- No for the only 2 main exceptions (in theory)

- Amex Bank cards

- Aeroplan cards (no matter the bank)

Indeed, welcome bonus eligibility rules are much more lenient than most people think.

Rules for most cards (except Amex Bank cards and Aeroplan cards)

This category, which includes almost every card in Canada, is not very constraining.

You are generally eligible for a card’s welcome bonus even if you’ve had the card in the past. But there might be a wait time to know about it (often, but not always).

However, we say “generally” because, for some rare cards, you could be ineligible if you’ve had the card before. That rule really isn’t common, especially with good cards. But it exists.

Overview of rules and examples

Here’s what you need to know:

- The rules are not always enforced

- For the waiting period, if there officially is one

- For the rule that makes you officially ineligible, if any

- Rules are per card (not per bank)

- As everything is always different for each card

- The rules for a specific card may change

- With every welcome bonus offer (rare)

- The waiting time may depend on several factors

- Opening or closing the card

- The specific card or all the cards from a bank (rare)

Let’s start with the official rules.

Here are 5 examples of welcome bonus eligibility rules:

- RBC Avion Visa Infinite Card

- No restrictions

- BMO AIR MILES World Elite MasterCard

- You must not currently have that card

- TD First Class Travel Visa Infinite Card

- You must not have activated or closed this card in the last 12 months

- Scotiabank Passport Visa Infinite Card

- You must not have had any Scotiabank card in the last 2 years (including “joint” cards)

- RBC British Airways Visa Infinite Card

- You must not have had this card in the past

Those examples include the full spectrum of possible welcome bonus eligibility rules, from the least restrictive to the most restrictive.

Here are more details about each rule:

No restrictions: You’re eligible for the welcome bonus even if you already have the card currently. Extremely rare, because banks that let you have several of the same card at the same time are very rare.

Not currently having this card: You’re eligible for the welcome bonus if you don’t currently have the card, so that means there’s no waiting time at all.

Not having had the card in the last 12 months: You are eligible for the welcome bonus after a very reasonable waiting period.

Not having had any card from that bank in the last 2 years: You’re eligible for the welcome bonus after a longer waiting period, and sometimes all the bank’s cards count instead of just the specific one. Scotiabank is the strictest, as it’s the only one to include secondary (“joint”) cards.

Not having had the card in the past: You’re not eligible for the welcome bonus if you’ve already had the card. It’s very rarely applied, especially after 2 years…

Enforcement of the rules

Objectively, these eligibility rules for welcome bonuses are not always necessarily enforced.

Many travelers still get welcome bonuses even if:

- The rules mention a waiting period, and they don’t respect the waiting period

- The rules state that you can’t have had the card, and they’ve already had it

It’s just that if you try and don’t get it, you’ve “wasted” a card application because the official rules are clear. But there’s no other downside and some are fine with trying it and just moving on if it doesn’t work.

If you’re just beginning in the world of travel rewards, it’s definitely simpler to follow the rules.

Rules by card

What’s important to understand is that every individual card has its own rules — the rules are not by bank.

As you can see from the examples above, the RBC Avion Visa Infinite Card and the RBC British Airways Visa Infinite Card are at opposite ends of the spectrum, literally. The least restrictive and the most restrictive.

Yet it’s the same bank. It’s just the way it is. Most banks have more similar rules on their different cards, but not all.

Rules by welcome bonus offer

It’s rather rare, but the rules for a particular card may change depending on the welcome bonus offer at the time. It’s normal; welcome bonuses change all the time, so the eligibility rules for that welcome bonus can change too.

For example, when that same RBC Avion Visa Infinite Card that currently has no restrictions has an increased welcome bonus offer, usually, its eligibility rule is to not currently have the card.

To make sure you don’t miss out on any welcome bonus updates, you can join 55,000+ savvy Canadian travelers and sign up for our free newsletter specifically for travel rewards!

Rules for Amex Bank cards

This category for the 15 cards from Amex Bank is very simple because American Express has some of the best cards in Canada and is therefore more restrictive.

In theory, you are not eligible for a card’s welcome bonus if you’ve had that specific card in the past, it’s their only rule and it’s the same for all their cards; to be clear, you can get a welcome bonus once on every Amex Bank card (15 welcome bonuses).

In practice, though, this “once-in-a-lifetime” rule isn’t always enforced after a few years. Some estimate it to be 5 years, others fewer; there’s no way to know for sure.

I’ll repeat it because it’s so important and many travelers unfortunately believe they can get just 1 Amex welcome bonus instead of 15: every Amex Bank card is considered separately. You can — and should — get the welcome bonus on each one without a problem. As I have myself.

This includes “business” cards — Amex business cards are the only ones that do not require having an incorporated business and that everyone can get easily by following special instructions.

Note that Scotiabank issues 3 cards on the American Express network, but those are not issued by Amex Bank and, therefore, are not part of this exception and have the “regular” welcome bonus eligibility rules of the first category.

Rules for Aeroplan cards

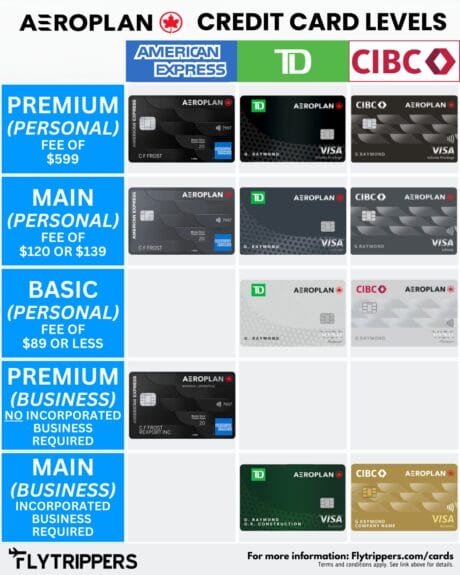

This category for the 11 Aeroplan cards in Canada is the most complex because 3 different banks issue cards with “Aeroplan” in their name.

In theory, you are not eligible for a card’s welcome bonus if you’ve had a card from the same Aeroplan level in the past; to be clear, you can get a welcome bonus once on every Aeroplan level (5 welcome bonuses; 4 if you don’t have a business).

In practice, though, this new “once-in-a-lifetime” rule isn’t always enforced at all. There’s no way to know for sure if it will; but it seems to only be enforced for true abuse and exaggeration.

This Aeroplan welcome bonus rule is in addition to the welcome bonus eligibility rules set by the bank that issues the card. For example, Aeroplan cards issued by Amex are subject to the Amex rules AND this Aeroplan rule.

The rules from Aeroplan and the banks are completely separate. If this Aeroplan rule is enforced, it’s enforced by the Air Canada Aeroplan program directly, not the banks.

The Aeroplan levels are very simple and listed at the end of our page with the best Aeroplan credit cards, with images to make it easier.

Here’s the summary of the Aeroplan levels; it’s really just based on annual fees and whether it’s a personal or business card:

If you prefer the text version:

- Premium level (personal) — Fee of $599

- Main level (personal) — Fee in the $100s

- Basic level (personal) — Fee under $100

- Premium level (business; but no business required)

- Main level (business; business actually required)

So you can get the welcome bonus on the American Express Aeroplan Reserve Card even if you’ve had the TD Aeroplan Visa Infinite Card and vice versa, because they’re separate levels.

You can also get the welcome bonus on the TD Aeroplan Visa Infinite Privilege Card if you’ve had the TD Aeroplan Visa Infinite Card and vice versa. Separate levels.

Note that if you are eligible for U.S.-issued cards (we’ll tell you how to be in a detailed guide very soon), the U.S. Aeroplan Card is considered completely separate.

How to check welcome bonus eligibility rules?

If you access our Flytrippers resource page for any card, you’ll see the welcome bonus eligibility rules in the summary table that’s at the top.

It’s on the left side (on desktop), along with the minimum income requirement, the most important card eligibility rule.

On mobile, it’s in the same summary table at the top, but the section is below the rewards section.

You should never go to a bank page directly because you should always compare their offers with others (on our always-up-to-date Flytrippers ranking, for example). But if you want to find the welcome bonus eligibility rules on the bank website, it’s usually listed in the offer terms and conditions.

The location obviously varies for every bank, though, so it’s much simpler to look on our pages, where it’s always in the same place.

Learning how to travel for less

Join over 100,000 savvy Canadian travelers who already receive Flytrippers’ free newsletter so we can help you travel for less — including thanks to the wonderful world of travel rewards!

I understand applying for cards and collecting bonus.

But I struggle with “what happens after” do you cancel these cards, and avoid the renewal fee on the second year??

Hi Toni,

I highly recommend reading our infographic that summarizes 99% of the most important basic things in the world of travel rewards.

There are also the 6 easy steps to always follow, and the last one is to re-evaluate each card once an annual fee is due. If the card and its benefits provide you with more value than the fee, you keep it. If it doesn’t, you can close it or downgrade it to the no-fee version.

Every traveler is different and so deciding whether a card provides more value than the fee for you is entirely personal and depends on what you value, how you travel, your travel rewards strategy, etc.

So if you already have the card, for instance I have had the RBC Avion for 10 years, how do I go about getting the welcome bonuses again?

Hi Rose, if you’re eligible for the welcome bonus, you simply apply for the card like you do for any card (like you hopefully do many times a year).

We appreciate if you use our secure links at absolutely no cost to you — like through this link for the RBC Avion Visa Infinite Card.