In Canada, the most restrictive credit card eligibility rule is the minimum income requirement. Many good cards require either your personal income or your household income to be above a certain threshold. In *theory*, it’s important to consider this in your travel rewards strategy… In *practice*, it’s very rarely verified.

We’ll cover card eligibility rules other than minimum income requirements in a separate post, but they’re pretty basic. To make this guide simpler, I’ll also exclude business cards for now.

Card eligibility rules are not to be confused with welcome bonus eligibility rules, which are far more important for all our more advanced rewards enthusiasts.

Here are the details about credit card minimum income requirements.

Overview of credit card minimum income requirements

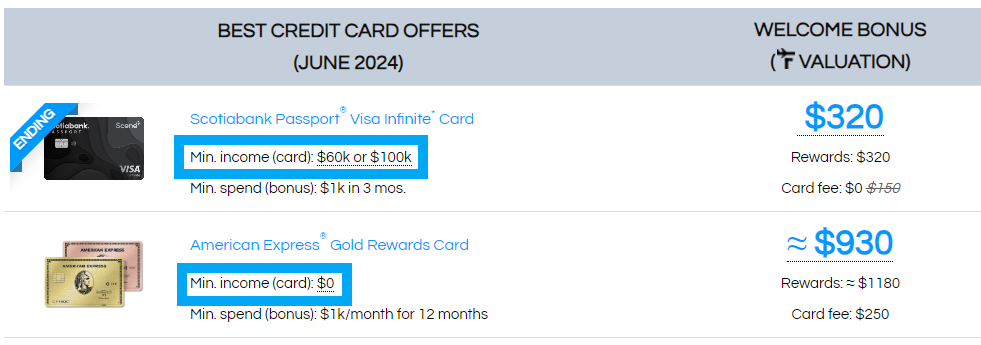

On our Flytrippers resource page for any credit card, you might have noticed the minimum income requirement that is clearly indicated.

Here are the basics of minimum income requirements:

- Many cards have a minimum income requirement

- Especially common among the good cards

- American Express cards are a notable exception

- All 15 Amex cards from Amex Bank have no requirement

- 2 of the 3 Amex cards from Scotiabank do, though

- All of your income counts (it’s income, not salary or wages)

- Investments, pensions, rentals, etc.

- They will ask during the online card application

- They likely won’t verify, though

That part is pretty straightforward.

Here’s what the minimum income requirements can be:

- There are usually 2 different minimums you can use to qualify

- Personal income: you

- Household income: your entire “household”

- Household is never explicitly defined

- And everyone in a household can use the income

- To qualify for the same cards

- Sometimes there is just 1 minimum (rare)

- Personal only or household only

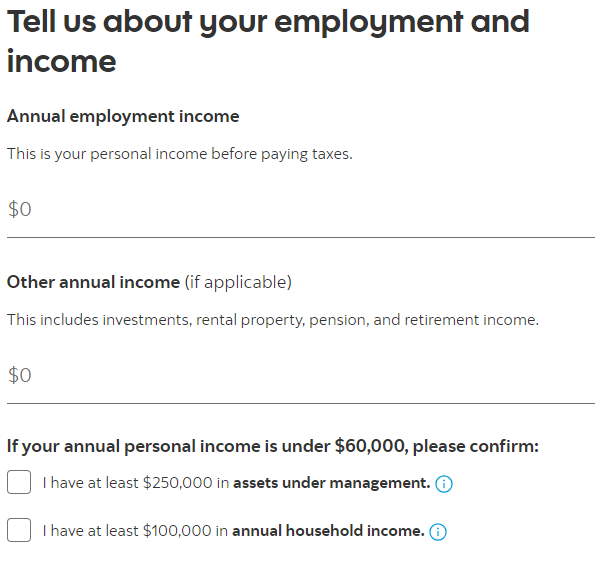

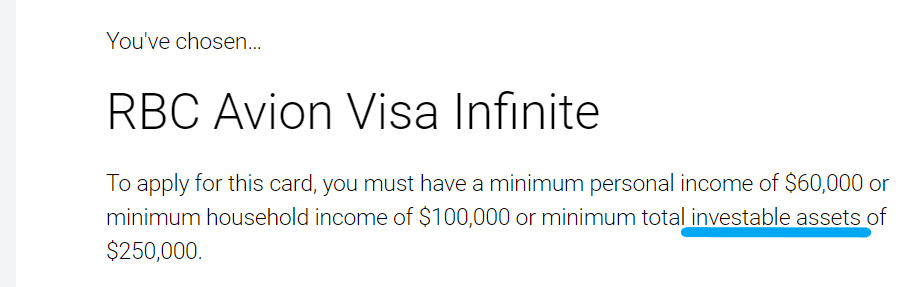

- Some banks have other ways to qualify

- With a minimum amount of investable assets, for example

Here’s an example. If a couple earns a combined $100,000 and has 5 adult kids, all 7 of them are eligible to apply for the Scotiabank Passport Visa Infinite Card (or any card with a minimum household income requirement of $100,000)! Assuming the kids have a good credit score, of course.

Here are the basics of what minimum income requirements really mean:

- In theory, your application’s approval depends on this requirement

- If you put in a lower amount, it will be declined

- In practice, verification is pretty rare

- If they verify, they ask for pay stubs or income tax slips

- If yours doesn’t work, then your application will be declined

If your application is denied, it’s the same as any decline. You won’t get that card (at least not at that time), and that’s pretty much it. In this case, though, you have no recourse to dispute the decline, as the income requirement is clearly stated.

Here are concrete examples of minimum income requirements:

- Amex Bank cards: $0

- Visa Infinite cards: $60,000 (personal) or $100,000 (household)

- World Elite Mastercard cards: $80,000 (personal) or $150,000 (household)

- Visa Infinite Privilege cards (except RBC): $150,000 (personal) or $200,000 (household)

- RBC Visa Infinite Privilege Card: $200,000 (personal) or $200,000 (household)

- Scotiabank Amex cards (Gold and Platinum): $12,000 (personal)

- Some of the other Visa cards: $12,000-$15,000 (varies)

- Some of the other Mastercard cards: $50,000-$100,000 (varies)

- All other cards: $0

How to check card minimum income requirements?

If there’s a minimum income requirement, it’s always mentioned on our card rankings and tables, right below the card name.

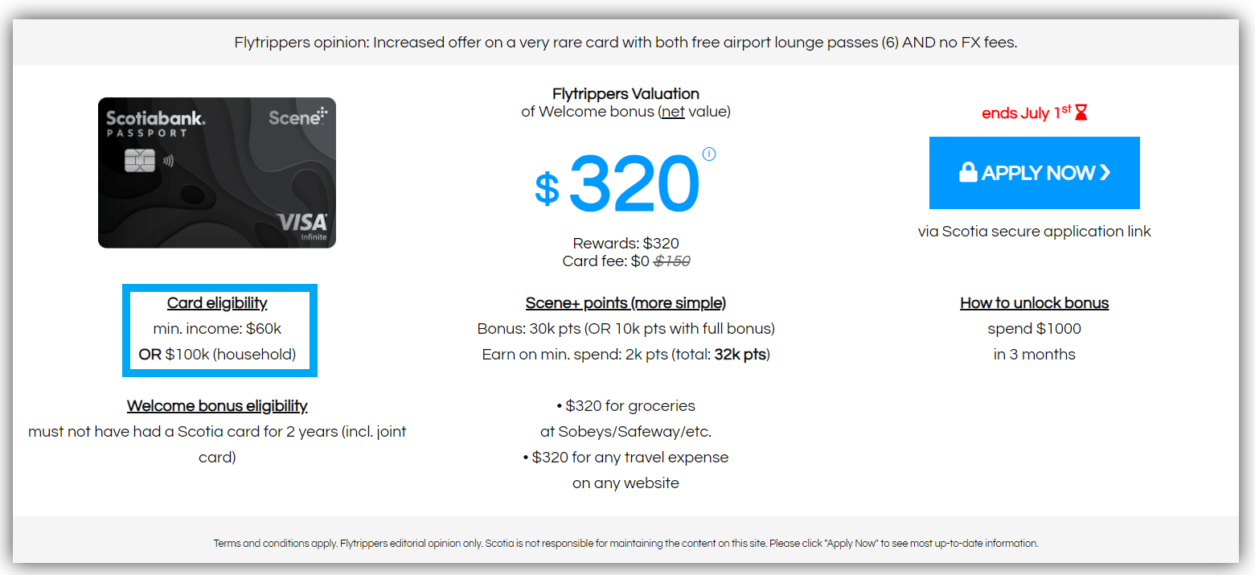

If you click to access our resource page for any card, you’ll also see it in the summary table that’s at the top.

It’s on the left side, along with welcome bonus eligibility rules (on desktop).

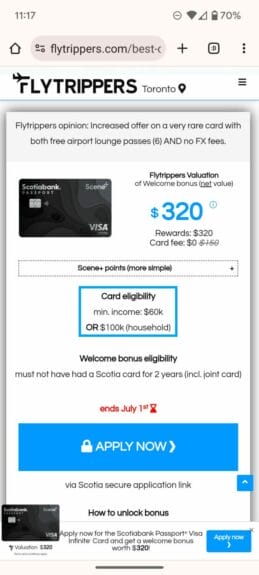

On mobile, it’s in the same summary table at the top, but the section is below the rewards section.

Almost all the good cards have that summary table, but we still need to update some less popular cards to add it.

You should never go to a bank page directly because you should always compare their offers with others (on our Flytrippers always up-to-date ranking, for example). But if you want to find the minimum income requirement (if there is one) on the bank website, it’s usually listed near the top.

The location obviously varies for every bank, though, so it’s much simpler to look on our pages, where it’s always in the same place.

What counts as income for minimum income requirements?

Literally any income. Some banks actually break it down by type of income in the card application, but many just ask for your total income.

For example, I own a condo that I rent out, and I include that rental income in my income because it’s income. My father, who is retired, includes his investment income because it’s income.

If they wanted to restrict it to only your salary or wages, they would call it a minimum salary requirement, not a minimum income requirement.

What is the difference between personal and household income?

Almost all cards give you a way to qualify based on your own income alone.

But most banks also allow you to use your household’s income too. The example in the overview pretty much clarifies it, but there’s no definition of what is considered a household.

If you’ve ever looked at the very long list of terms and conditions at the bottom of any bank offer, you know banks love to define everything that they want defined.

As they don’t define “household”, you can use the strictest definition (everyone living together) or any other definition you find reasonable really.

How are minimum income requirements enforced?

No bank asks for proof of any kind during the online card application process. But to be clear, if you input your income as being lower than the requirement during the application, your application will almost certainly be declined.

In the rare case that a bank decides to verify your income after the application, they would ask for pay slips or tax slips to be sent or brought to a branch after you’ve applied.

In my case, the only time it’s ever happened in 15+ years getting cards from almost every issuer in Canada was with HSBC Canada, and that bank no longer exists. Me and Flytrippers’ other co-founder Kevin have never been asked for any proof by TD, BMO, RBC, Scotiabank, CIBC, or MBNA (same with American Express, obviously, since they don’t have minimum income requirements).

That doesn’t mean you won’t be asked for proof, though; this is just our personal experience. But most data points from Canadians are in line with that too: it’s very rare. But it certainly happens sometimes, to be very clear!

If you decide to try and they do check, it’s important to understand that you don’t have any recourse, so you have to be willing to abandon your application and move on. Exactly like when you are trying to get a welcome bonus even if the official welcome bonus eligibility rules theoretically make you ineligible.

What are alternatives to minimum income requirements?

Some banks do offer an alternative to qualify, like an amount of investable assets instead of income per se.

Scotiabank and RBC are examples.

However, the amounts are usually high enough that not many people qualify that way if their income is too low for the minimum income requirement.

Which cards have minimum income requirements?

Here is the full list of cards for each level of minimum income requirements.

For cards without any minimum requirements, I split them into 2 to make it easier for you to see the good cards (most Amex cards) and the less good cards (almost every card with no minimum income requirement that isn’t an Amex card).

$0 minimum income requirement (Amex Bank)

Amex has many great cards, and it’s the only bank that does not discriminate by income and has no minimum income requirement for any of its cards (not even Canada’s most premium card, with a $799 annual fee and luxury travel benefits like unlimited access to VIP airport lounges).

Note that Amex business cards are the only business cards that do not require having an incorporated business and that everyone can apply for, so I’m including them.

- American Express Cobalt Card

- American Express Gold Rewards Card

- American Express Platinum Card

- American Express Green Card

- American Express Aeroplan Card

- American Express Aeroplan Reserve Card

- Marriott Bonvoy American Express Card

- American Express SimplyCash Preferred Card

- American Express SimplyCash Card

- American Express Essential Card

- American Express Business Gold Rewards Card

- American Express Business Platinum Card

- American Express Aeroplan Business Reserve Card

- Marriott Bonvoy Business American Express Card

$60k/$100k minimum income requirement

All Visa Infinite cards, regardless of the issuing bank, have the same minimum income requirements of $60,000 (personal) or $100,000 (household).

- Scotiabank Passport Visa Infinite Card

- Scotiabank Momentum Visa Infinite Card

- TD First Class Travel Visa Infinite Card

- TD Aeroplan Visa Infinite Card

- TD Cash Back Visa Infinite Card

- RBC Avion Visa Infinite Card

- RBC British Airways Visa Infinite Card

- BMO Eclipse Visa Infinite Card

- CIBC Aventura Visa Infinite Card

- CIBC Aeroplan Visa Infinite Card

- CIBC Dividend Visa Infinite Card

- Laurentian Bank Visa Infinite Card

- Vancity enviro Visa Infinite Card

- Meridian Visa Infinite Travel Rewards Card

- Meridian Visa Infinite Cash Back Card

- ManulifeMONEY+ Visa Infinite Card

$80k/$150k minimum income requirement

All World Elite Mastercard cards, regardless of the issuing bank, have the same minimum income requirements of $80,000 (personal) or $150,000 (household).

- BMO Ascend World Elite MasterCard

- BMO AIR MILES World Elite MasterCard

- BMO CashBack World Elite MasterCard

- WestJet RBC World Elite Mastercard

- RBC Cash Back Preferred World Elite Mastercard

- MBNA Rewards World Elite Mastercard

- Rogers Red World Elite Mastercard

- National Bank World Elite Mastercard

- ATB World Elite Mastercard

- Cathay World Elite Mastercard powered by Neo

- Air France KLM World Elite Mastercard

- Brim World Elite Mastercard

- Desjardins Odyssey World Elite Mastercard

- Desjardins Cash Back World Elite Mastercard

- President’s Choice Financial Insiders World Elite Mastercard

- President’s Choice Financial World Elite Mastercard

- Triangle World Elite Mastercard

$150k/$200k minimum income requirement

All Visa Infinite Privilege cards (except RBC’s) have a minimum income requirement of $150,000 (personal) or $200,000 (household).

- TD Aeroplan Visa Infinite Privilege Card

- BMO eclipse Visa Infinite Privilege Card

- CIBC Aventura Visa Infinite Privilege Card

- CIBC Aeroplan Visa Infinite Privilege Card

- Desjardins Odyssey Visa Infinite Privilege Card

- Vancity enviro Visa Infinite Privilege Card

$200k/$200k minimum income requirement

A single Visa Infinite Privilege card has a minimum income requirement of $200,000 (personal) or $200,000 (household).

$12k minimum income requirement

The 2 good Scotiabank-issued American Express cards have a minimum income requirement of $12,000 (personal).

Other minimum income requirements

A few Mastercard and Visa cards have different minimum income requirements, but they’re almost all terrible cards you shouldn’t apply for.

$0k minimum income requirement (except Amex)

All other cards in Canada have no minimum income requirement, but most also don’t have a welcome bonus and, therefore, should be avoided if you understand THE most important thing in the entire wonderful world of travel rewards.

Learning how to travel for less

Join over 100,000 savvy Canadian travelers who already receive Flytrippers’ free newsletter so we can help you travel for less — including thanks to the wonderful world of travel rewards!

Summary

Many credit cards in Canada have a minimum income requirement as part of their card eligibility rules. In theory, it’s crucial to know the minimum income requirements and take them into account in your travel rewards strategy. In practice, it’s not often verified.

What would you like to know about card eligibility? Tell us in the comments below.

See the flight deals we spot: Cheap flights

Discover free travel with rewards: Travel rewards

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Featured image: Cinque Terre, Italy (photo credit: Mike Swigunski)

if the welcome bonus is really good but you already have a card at that bank so you are not permitted to apply for the new card. but if you put in an application then you are denied.

Hi Daien, those are really 2 completely separate things. Our guide about eligibility rules for welcome bonuses specifically is coming very soon.

But in short, if the welcome bonus eligibility rules for a specific card state that you must not have had a card from that bank for 2 years (to be clear, Scotia is the strictest and other banks may not have this rule), you won’t be denied if you apply. Or rather, if you’re denied, it has nothing to do with the welcome bonus. You can get the card and your application can be approved, but you might not get the welcome bonus.