Almost all travelers are sadly unaware that almost all credit cards in Canada charge a 2.5% foreign transaction fee. Yes, you’re probably paying that right now and have been for years (even if it’s not written on your statement)… but thankfully, you can avoid it so easily starting now (or do even better).

It’s another of the many (many, many) examples of travel tips that are so simple… but that most people unfortunately don’t even know exist. It’s normal; when you don’t know, you don’t know.

But it’s a good reminder of the importance of taking the time to learn about how to travel for less… just as it’s obviously beneficial to invest time in learning about any subject when you want to become better at it.

Flytrippers happens to be here to help!

So here’s this introduction on foreign transaction fees.

Video on foreign transaction fees

I’ve made a video for this introduction if you’d rather watch than read.

View this post on Instagram

Otherwise, here’s the usual text version.

Overview of foreign transaction fees

Losing money by making payments is literally the complete opposite of what the wonderful world of travel rewards should be (being rewarded by making payments).

Foreign transaction fees are terrible, no matter how you call them:

- FX fees

- Foreign exchange fees

- Foreign conversion fees

- Foreign currency conversion fees

Here are the basics of foreign transaction fees:

- Fee on all transactions in currencies other than the Canadian dollar

- Fee of 2.5% added whether you’re traveling or buying online

- Fee that is unnecessary and on top of the daily exchange rate

- Fee charged very sneakily by your card issuer (the financial institution)

- Fee that doesn’t appear on your statement (hidden in the converted amount)

- Fee that means you’re paying to pay, instead of being rewarded

- Fee that surpasses the regular earn rates on most cards

- Fee charged by all credit cards in Canada, except 5

So it’s thankfully very, very easy to avoid these FX fees.

But how to avoid FX fees depends on 3 scenarios, according to your level of ambition:

- For travelers interested in maximizing

- Become a travel rewards pro

- To do better than just save 2.5%

- For travelers less interested in maximizing

- Get 1 of the 5 no-FX-fee cards below

- To at least save 2.5% on everything

- For travelers really not interested in maximizing

- Get a prepaid card with no FX fees

- Save 2.5% on everything without a new credit card

Below, I go into more detail about these scenarios to help you after I show you clearly which cards have (and don’t have) foreign transaction fees.

Cards that charge foreign transaction fees

There are only 5 Canadian credit cards that don’t charge foreign transaction fees (only 3 if you live in Québec). The famous HSBC card is no longer available and Brim removed the only good feature of their cards, so those have been removed from this table.

| Best credit cards with no foreign transaction fees |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(12% back on $2k)

Rewards: $390

Card fee: $150

Spend required:$2k in 3 mos.

Best for: Airport lounge access 6 passes

ends October 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(11.7% back on $7.5k)

Rewards: $875

Card fee: $0 $120

Spend required:$7.5k in 12 mos. (or $2k)

Best for: Very good travel insurance and earn rate

ends October 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(6.0% back on $10k)

Rewards: $1000

Card fee: $399

Spend required:$10k in 14 mos. (or $3k)

Best for: Airport lounge access 10 passes

ends October 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards with no foreign transaction fees |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: $390

Card fee: $150 (12% back on $2k)

Spend required:

$2k in 3 mos.

Best for: Airport lounge access 6 passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

12k

Valuation (BONUS) Valuation (BONUS)

Rewards: $875

Card fee: $0 $120 (11.7% back on $7.5k)

Spend required:

$7.5k in 12 mos. (or $2k)

Best for: Very good travel insurance and earn rate

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $1000

Card fee: $399 (6.0% back on $10k)

Spend required:

$10k in 14 mos. (or $3k)

Best for: Airport lounge access 10 passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Best for: No minimum spend add-on w/ other card

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Best for: No minimum spend add-on w/ other card

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

There are also 2 prepaid cards that don’t charge foreign transaction fees.

| Best prepaid cards with no foreign transaction fees |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)Rewards: $0

Card fee: $0

Spend required:$0 no welcome bonus

Best for: 0.5% cashback on everything

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)Rewards: $0

Card fee: $108

Spend required:$0 no welcome bonus

Best for: 0.5% cashback on everything

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best prepaid cards with no foreign transaction fees |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Best for: 0.5% cashback on everything

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Best for: 0.5% cashback on everything

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

I’ll be very clear: if your credit card isn’t in that table, you’ve always paid a 2.5% FX fee on everything you’ve bought in a currency other than the Canadian dollar. Simple as that.

I repeat it because there are always many people who say “no no, my card isn’t in that table and it doesn’t charge me”… just because they don’t see any fees on their credit card statement.

The FX fees don’t appear on your statement! That doesn’t mean you’re not paying a 2.5% foreign transaction fee: it just means you don’t know you’re paying a 2.5% in foreign transaction fee.

Every time you make a purchase in a foreign currency, the bank converts the amount into Canadian dollars at the daily exchange rate THEN adds a 2.5% fee that most people don’t know about.

(It’s true that it’s very sneaky of the banks to hide it when so many people aren’t informed on the subject… get revenge by simply taking all the large amounts of free travel they give you so easily with their welcome bonuses!)

If you still don’t believe me (an all-too-common mistake haha), take a look at your credit card‘s official page on the bank’s website. You’ll see that it’s written that you pay a 2.5% foreign transaction fee, in the rates and fees section.

By the way, I’ve excluded the few cards that give you a higher earn rate on foreign transactions to help offset their foreign transaction fees, because they’re frankly terrible. And finally, some rare cards do charge a different percentage instead of 2.5%, but it’s really rare!

What NOT to do to avoid foreign transaction fees

Before telling you how to avoid them, here are a few common mistakes.

Here are the 3 things NOT to do to avoid FX fees:

- Converting money in Canada and paying in cash

- You’ll get a terrible exchange rate that’s worse than FX fees

- And you’ll get zero rewards, so it’s even much worse

- Withdrawing money abroad and paying in cash

- You’ll pay the FX fees at the ATM with debit cards too

- And you’ll get zero rewards, so it’s even much worse

- There are ways to withdraw money almost free

- But even that is not great because you still earn zero rewards

- Choosing to pay in Canadian dollars abroad

- Sometimes the option shows up on the payment terminal

- That’s even worse, much worse… never do that

If you like to travel, you should obviously never pay for anything with a debit card or cash unless they simply do not accept credit cards, no matter whether it’s here or abroad. Here we’re talking about payments; withdrawing cash for less is a whole other topic I’ll keep for a separate post (but I put a teaser at the very end.)

What to do to avoid foreign transaction fees

Here are 3 simple ways to avoid foreign transaction fees, depending on your level of ambition.

Scenario 1: If you want to maximize

It’s simple: it’s better to use a card that gives you a huge welcome bonus and pay a 2.5% foreign transaction fee… than to save 2.5% but earn rewards at the painfully slow normal earn rate of all cards.

The basics in the world of travel rewards (but really it should be the basics of everything in life, if people were better at doing math), is to always look at the total equation. The total value. Never just one side of an equation.

So if you want to maximize the total value you get from your foreign purchases, the best way to avoid foreign transaction fees is not to avoid them at all!

Don’t just look at the 2.5% fee, look at the rewards it gives you too! The total equation.

Welcome bonuses are the key to earning $1,000+ easily every year with travel rewards (like our Flytrippers readers like you who have earned over 2 million dollars in free travel with our deals).

It’s THE most important thing to understand in the whole wonderful world of travel rewards! Welcome bonuses really are the key!

It’s the fast way to get lots of free travel easily! And having more cards will also improve your credit score (contrary to common myth) and give you more awesome benefits. As long as you follow the 3 basic rules, of course.

In short, if you want to be a pro and really maximize, you simply have to aim for 100% of your spending to go towards unlocking big welcome bonuses and avoid as much as possible earning the very slow way with regular earn rates on your purchases.

This includes your foreign currency purchases.

For example, let’s say you’re going to spend $5,000 on foreign currency purchases.

Let’s say you’re a savvy traveler who takes advantage of the welcome bonus on the TD First Class Travel Visa Infinite Card to get $725 for free in simple points that can be redeemed for almost any travel expense.

The bonus gives you 15% back on $5,000 in purchases!

If you deduct the 2.5% foreign transaction fee, you’re still looking at a 12.5% back in net value! If you know how to count, that’s a lot better than using a card that saves you 2.5% and gives you 2%… 12.5% back is a lot more than 2%. It’s 6 times more! It’s not even comparable!

It’s logical to have the reflex to want to avoid the 2.5% fee, but the world of travel rewards is counter-intuitive. Your first impulsive reaction is probably not the right one.

It’s simple: just look at the net value, always! The total value, the total equation!

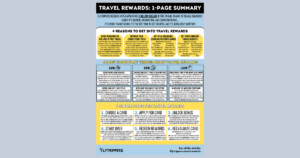

It’s another of the 6 most important things in our infographic that sums up the basics of travel rewards.

If your income is lower, look at the effective return rate of all the other good offers!

Get one of those because it’s better to pay a 2.5% FX fee when you get such a high earn rate with the welcome bonus! When you’re done unlocking the welcome bonus… start over. It’s really that simple.

| Best credit card offers (July 2025) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(≈ 8.8% back on $18k)

Rewards: ≈ $1590

Card fee: $0 $199

Spend required:$18k in 12 mos. (or $5k/$9k)

Best for: ≈ 8.8% back on $18,000 & simple points

ends January 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 7.5% back on $10k)

Rewards: ≈ $750

Card fee: $0 $89

Spend required:$10k in 12 mos. (or $3k/$6k)

Best for: ≈ 7.5% back on $10,500 & simple points

ends January 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(≈ 11.0% back on $10k)

Rewards: ≈ $1901

Card fee: $799

Spend required:$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17

Best for: ≈ 11.0% back on $10,000 & unlimited lounges

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit card offers (July 2025) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

80k/150k

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1590

Card fee: $0 $199 (≈ 8.8% back on $18k)

Spend required:

$18k in 12 mos. (or $5k/$9k)

Best for: ≈ 8.8% back on $18,000 & simple points

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $750

Card fee: $0 $89 (≈ 7.5% back on $10k)

Spend required:

$10k in 12 mos. (or $3k/$6k)

Best for: ≈ 7.5% back on $10,500 & simple points

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1901

Card fee: $799 (≈ 11.0% back on $10k)

Spend required:

$10k in 3 mos. spend $10k in 3 mos. &

make 1 purchase in months 15-17 Best for: ≈ 11.0% back on $10,000 & unlimited lounges

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $775

Annual fee: $0 $139 (15.5% back on $5k)

Spend required:

$5k in 6 mos.

Best for: 15.0% back on $5,000 & simple points

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

12k

Valuation (BONUS) Valuation (BONUS)

Rewards: $875

Card fee: $0 $120 (11.7% back on $7.5k)

Spend required:

$7.5k in 12 mos. (or $2k)

Best for: ≈ 11.7% back on $7,500 & simple points

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $641

Annual fee: $0 $139 (≈ 5.3% back on $12k)

Spend required:

$12k in 12 mos.

Best for: ≈ 5.3% back on $12,000 & lucrative pts

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $1330

Card fee: $250 (≈ 9% back on $12k)

Spend required:

$12k in 12 mos. spend $1k/mo. for 12 mos. &

make 1 purchase in months 15-17 Best for: ≈ 9.0% back on $12,000 & 8 lounge passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

12k

Valuation (BONUS) Valuation (BONUS)

Rewards: $1000

Card fee: $399 (6.0% back on $10k)

Spend required:

$10k in 14 mos. (or $3k)

Best for: 6.0% back on $10,000 & 10 lounge passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $540

Card fee: $120 (≈ 14.0% back on $3k)

Spend required:

$3k in 3 mos. + $1k

Best for: ≈ 10.5% back on $4,000 & lucrative pts

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $525

Card fee: $120 Spend required:

no min.

spend Best for: ≈ 15.6% back on $5,000 & lucrative pts

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No min. inc.

Valuation (BONUS) Valuation (BONUS)

Rewards: ≈ $814

Card fee: $199 (≈ 8.2% back on $7.5k)

Spend required:

$7.5k in 3 mos. spend $7.5k in 3 mos. &

make 1 purchase in months 15-17 Best for: ≈ 8.2% back on $7,500 & lucrative pts

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

But that said…

Even if you’re maximizing, it’s a good idea to always have at least 1 card with no foreign transaction fees as a backup if you ever have to spend in foreign currency and unfortunately don’t have a welcome bonus to unlock (because you finished it too early, for example, since we recommend spacing out your card application days by at least 2 months).

Scenario 2: If you just want to save 2.5%

This scenario is also simple: get one of the 5 credit cards with no foreign transaction fees.

I’ll insert the table again here.

| Best credit cards with no foreign transaction fees |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)(12% back on $2k)

Rewards: $390

Card fee: $150

Spend required:$2k in 3 mos.

Best for: Airport lounge access 6 passes

ends October 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(11.7% back on $7.5k)

Rewards: $875

Card fee: $0 $120

Spend required:$7.5k in 12 mos. (or $2k)

Best for: Very good travel insurance and earn rate

ends October 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)(6.0% back on $10k)

Rewards: $1000

Card fee: $399

Spend required:$10k in 14 mos. (or $3k)

Best for: Airport lounge access 10 passes

ends October 31st

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best credit cards with no foreign transaction fees |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

60k/100k

Valuation (BONUS) Valuation (BONUS)

Rewards: $390

Card fee: $150 (12% back on $2k)

Spend required:

$2k in 3 mos.

Best for: Airport lounge access 6 passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

12k

Valuation (BONUS) Valuation (BONUS)

Rewards: $875

Card fee: $0 $120 (11.7% back on $7.5k)

Spend required:

$7.5k in 12 mos. (or $2k)

Best for: Very good travel insurance and earn rate

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)

Rewards: $1000

Card fee: $399 (6.0% back on $10k)

Spend required:

$10k in 14 mos. (or $3k)

Best for: Airport lounge access 10 passes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Best for: No minimum spend add-on w/ other card

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Best for: No minimum spend add-on w/ other card

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

I’ll tell you the benefits of each in card pairs, but many often ask us for concrete tips on how to elaborate their strategy for travel rewards to plan well, so I’m also including that for the FX fee angle for those who don’t want to aim higher with Scenario 1.

Scotia Passport Visa Infinite Card

The Scotia Passport Visa Infinite Card is by far the best, but it has a minimum income requirement of $60,000 (personal) or $100,000 (household).

It also has a welcome bonus that will give you a nice profit and it also comes with 6 airport lounge passes worldwide.

Normally, for travelers who want to maximize, this isn’t so relevant because it’s so easy to get free airport lounge access with all the other cards that offer free access AND a welcome bonus on top of that. But it can tip the balance if you don’t want a lot of rewards and want to it to be simple.

Scotiabank American Express Cards

For those who earn less, there’s the Scotiabank Gold Amex Card and Scotiabank Platinum Amex Card, which have no minimum income requirement.

These are excellent cards, but just not for the foreign transaction fee component. In fact, they’re great for avoiding FX fees if you’re traveling in the USA. It’s just that outside Canada and the USA, acceptance of American Express cards is much lower. But for snowbirds, for example, it can be handy.

Note that the excellent 5 pts/$ multiplier on the Scotiabank Gold Amex Card only applies in Canada, while other FX no-fee cards have no such restrictions.

Home Trust cards

If you live in provinces other than Québec, the Home Trust Preferred Visa Card and the Home Trust Equityline Visa Card can be interesting.

But scenario 3 is really much savvier so you don’t waste a card application on this when it could be used for a much better card, a credit card with a good welcome bonus.

Scenario 3: If you just want to save 2.5% without credit

This scenario is an interesting alternative: there are prepaid cards that do not charge a foreign transaction fee.

These are not credit cards, but they have some of the benefits of credit cards AND debit cards. You must load money on them to be able to spend that money after.

Prepaid cards are usually not recommended at all, except:

- For those who want to save on FX fees

- To use if you’re unfortunately not unlocking a welcome bonus

- To still have an option to save on FX fees

- In fact, there’s no reason not to get a prepaid card

- These are free and don’t count as a credit application

- For those who have bad credit

- To avoid FX fees without making a credit application

- No risk of spending too much for those who don’t use credit well

- But you still get some benefits and rewards

- It’s infinitely better than paying by debit

There are 2 prepaid cards that are interesting, especially the first one that is completely free.

| Best prepaid cards with no foreign transaction fees |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Valuation (BONUS) Valuation (BONUS)Rewards: $0

Card fee: $0

Spend required:$0 no welcome bonus

Best for: 0.5% cashback on everything

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Valuation (BONUS) Valuation (BONUS)Rewards: $0

Card fee: $108

Spend required:$0 no welcome bonus

Best for: 0.5% cashback on everything

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

|

Best prepaid cards with no foreign transaction fees |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Best for: 0.5% cashback on everything

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Best for: 0.5% cashback on everything

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Terms and conditions apply. Flytrippers editorial opinion only. Financial institutions are not responsible for maintaining the content on this site. Please click "See More" to see most up-to-date information. |

EQ Bank card

The EQ Bank Prepaid Mastercard is an absolute must-have. For ALL travelers, no exceptions.

It’s by far the best prepaid card in Canada (the bar is low and credit cards are obviously better… but still).

It has no foreign transaction fees and is completely free, with no credit check. Really a no-brainer.

You’ll also earn 2.5% in interest on the money you load on the card (or 4% if you do direct deposit), which is a lot better than the interest you earn with traditional bank accounts. And again: it’s free!

You’ll also earn cashback rewards, another thing debit cards obviously don’t give you.

It makes no sense not to get it. Open a free EQ Bank account and then order your free card from your online account. You’ll always save 2.5% on everything when traveling, for free and with no credit check.

I’ll do a separate post about prepaid cards and savings accounts, but please, at a minimum, in the meantime, at least stop using a debit card. It’s so bad for you compared to prepaid cards that have no fees or risks (and eventually aim to get good enough with credit to get the even better benefits and rewards with real credit cards).

KOHO Card

The KOHO Prepaid Mastercard itself is completely free.

But if you add the Extra plan, you won’t have any foreign transaction fees by using this prepaid card.

The Extra plan costs just $9 per month and you can add it just for the months when you’ll be traveling for example, so it’s not very expensive to avoid FX fees.

But it’s hard to recommend paying $9 for something that the EQ Bank Prepaid Mastercard gives you for free without having to do a credit application. The KOHO Prepaid Mastercard does have a great credit-building feature though, I’ve shared a teaser in our post about how to improve your credit score.

Bonus: Wise Card

Flytrippers loves giving you more for your money, so we’ll add this bonus.

The Wise Card is another card that isn’t a credit card and that everyone should have! So I’ll do this quick teaser of our much-anticipated article on withdrawing cash while traveling.

The Wise Card isn’t for purchases in foreign currencies, but rather for cash withdrawals at ATMs. It’s not a prepaid card per se, it’s actually just a better debit card (prepaid cards and debit cards work in a very similar way).

Ideally, you should always pay everything with a credit card obviously, even when traveling. But you probably know that some countries are still very archaic with plenty of places where the only option is to pay with cash as if we were still in 2005.

The Wise Card does not charge foreign transaction fees on ATM withdrawals and does not charge any withdrawal fees either (almost all Canadian bank account debit cards do obviously).

Get it for sure! It’s not a credit card, so there’s no impact! It’s free! No reason not to have it.

You do, however, have a limit on free withdrawals:

- Maximum of 2 withdrawals per month

- Maximum of C$350 total per month

That’s better than nothing!

I’ll do a detailed article on cash withdrawals specifically for other tips, this one is getting long.

Want to get more lesser-known pro tips?

Summary

The 2.5% foreign transaction fee is a sneaky charge that you should stop paying (unless you’re always using a credit card on which you’re unlocking a big welcome bonus). There aren’t many no-foreign-transaction-fee credit cards in Canada, but the Scotia Passport Visa Infinite Card is clearly the best one. And the EQ Bank Prepaid Mastercard is a no-brainer for all travelers, with no exceptions.

What would you like to know about foreign transaction fees? Tell us in the comments below.

See the deals we spot: Cheap flights

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Discover free travel: Travel rewards

Featured image: New York (photo credit: Ryan Gerrard)

I travel to the U.S. for 2 months (Feb,March) and occasionally rest of year. Spent between 3-4 thousand per year. Which card would be best.

As explained in the post, any card with a huge welcome bonus is always the way to get the best overallreturn (whether or not they charge FX fees). Which one is the best depends on your preferences, you can watch our monthly video that gives you an overview of each or check out the card pages for any card.

If you really want to go slower, then at least avoid the FX fees for sure.

There are only 8 and this section of the post above explains which ones are best for which type of traveler.

But if you qualify, the HSBC World Elite Mastercard is usually the best for most, or the Scotiabank Passport Visa Infinite Card for lounge passes.