Like every month, I will present the 4 best current travel rewards deals tomorrow during our live video, so let’s look at each of them in advance. It’s a great opportunity for you to understand the huge differences between how the only 2 types of rewards that exist work, but also between how the offers themselves can be structured, the card benefits, etc.

The key to traveling for less is really simple: take advantage of huge welcome bonuses regularly. You should know this if you’ve read our infographic with all the basics of travel rewards.

And right now, these 4 credit card deals are the best for 99% of travelers, all with ≈ $780 or more in free travel! Whichever you choose, at least get one! Stop wasting your spending by getting a terrible 1% or 2% rate because you’re not currently unlocking a welcome bonus. That’s the absolute worst thing you could do, especially when you know that having more cards improves your credit score, contrary to the very common (and very wrong) myth.

Here are the details of the best deals for November 2024.

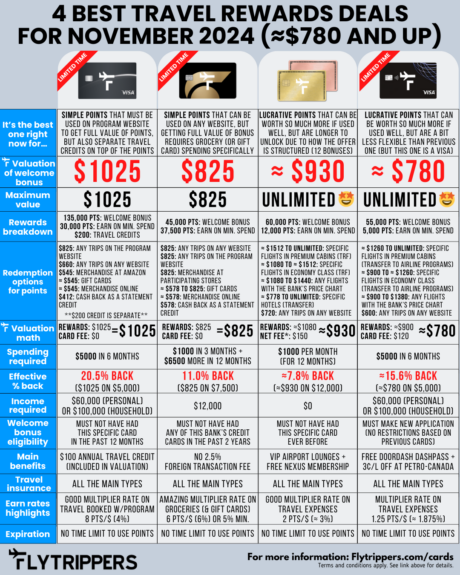

Infographic about the 4 deals

Here’s an infographic that summarizes the 4 best deals.

The 4 deals are:

- TD First Class Travel Visa Infinite Card

- Scotiabank Gold American Express Card

- American Express Gold Rewards Card

- RBC Avion Visa Infinite Card

The first 2 are cards for rewards of the more simple type, while the last 2 are cards for rewards of the more lucrative type.

As always, you can check out our credit card ranking and card resource pages for a lot more information.

But let’s take a look at each of the 4 cards to help you choose the one that’s best for you right now.

TD First Class Travel Visa Infinite Card

It’s the best one right now for…

Those who want simple points but don’t mind that they need to be used on the Expedia for TD website to get the full value (contrary to the next one, with points that can be used for any travel expense on any website). And those who don’t mind that a part of the bonus is in the form of 2 travel credits of $100 each.

The TD First Class Travel Visa Infinite Card has one of the highest offers ever seen in Canada! Bonuses worth over $1000 are extremely rare!

Flytrippers Valuation of welcome bonus

You’ll get 165,000 TD Rewards points by unlocking the welcome bonus on the TD First Class Travel Visa Infinite Card and 2 travel credits of $100 to use in your first year.

The points are worth a fixed amount of $825 for any travel expense on the Expedia for TD website or $660 for any travel expense on any website. The 2 travel credits for $100 are in addition to that, for $1025 in net value.

Maximum value of welcome bonus

It’s $1025. It could never be worth more.

As with everything in life, you either get more convenience or more value. These points are the most flexible and the easiest to use, so they can never give you outsized value.

Rewards details

This is the breakdown of the rewards:

- 20,000 points: Welcome bonus after making your 1st purchase (no minimum)

- 115,000 points: Welcome bonus after spending $5,000 (in maximum 6 months)

- 30,000 points: Earn on the minimum spend (at the multiplier rate of 6 pts/$)

Redemption options

Here is how you can redeem your rewards:

- $825: Any trips on the Expedia for TD website

- $660: Any trips on any website

- $545: Merchandise at Amazon

- ≈ $545: Gift cards

- ≈ $545: Merchandise online

- $412: Cash back as a statement credit

For more details, as always, you can check the tabs on our card resource page for the TD First Class Travel Visa Infinite Card.

Math for the Flytrippers Valuation

You get $1025 in rewards, and the first-year annual fee is waived.

So $1025 minus $0 is $1025.

Minimum spending requirement

To unlock the biggest part of the welcome bonus on the TD First Class Travel Visa Infinite Card, you need to spend $5,000 in a maximum of 6 months (very easy). The other part is as soon as you make your 1st purchase.

You do not need to renew the card to get the welcome bonus; you get the points as soon as you make your 1st purchase and as soon as you reach a total of $5,000 (the 6 months are just your maximum timespan allowed). Well, in this case, they say it can take up to 8 weeks to actually receive the points, but it’s usually not as long as that.

Effective percentage back

You get 20.5% back on $5,000 in spending ($1025 on $5,000). A bit better than 1% or 2%, right?

Minimum income requirement

Your income must be over $60,000 (personal) or $100,000 (household) to be eligible for the TD First Class Travel Visa Infinite Card.

Most banks don’t ask for proof of income, but it could happen. You can read the basics of credit card minimum income requirements.

Welcome bonus eligibility restrictions

TD is in the middle of the pack in terms of welcome bonus eligibility rules.

You must not have had this specific card in the past 12 months to be eligible for this welcome bonus on the TD First Class Travel Visa Infinite Card.

Main benefits

The TD First Class Travel Visa Infinite Card gives you a $100 travel credit every calendar year (so 1 credit in 2024 and 1 credit in 2025). It’s included in our Flytrippers Valuation of the offer because it’s so easy to use for every single traveler.

Another benefit is that on your birthday, you get a bonus of 10% of all the points earned in the year before (points from the welcome bonus are excluded, and there’s a cap of 10,000 bonus points).

Travel insurance

The TD First Class Travel Visa Infinite Card has all the main types of travel insurance. The medical travel insurance is very good, with 21 days of coverage (for those aged 64 and under).

Earn rates highlights

Earn rates are way less important than just about everyone thinks they are, at least if you do travel rewards the right way with huge welcome bonuses.

But the TD First Class Travel Visa Infinite Card does have a good multiplier earn rate of 8 pts/$ (4%) on travel booked on Expedia for TD.

Expiration

You have no time limit to use your points even if you close the TD First Class Travel Visa Infinite Card, just like with almost every travel rewards currency (contrary to the very common myth).

Find out more

I wrote a detailed article about this deal since it’s so good.

All the information is in the tabs on our card resource page for the TD First Class Travel Visa Infinite Card, like with all cards.

Scotiabank Gold American Express Card

It’s the best one right now for…

Those who want simple points that can be used for any travel expense on any website.

In fact, the Scotiabank Gold American Express Card has one of the highest offers ever seen in Canada for simple points. It’s the highest offer seen on this card in a long time.

Flytrippers Valuation of welcome bonus

You’ll get 82,500 Scene+ points by unlocking the welcome bonus on the Scotiabank Gold American Express Card.

That’s worth a fixed amount of $825 for any travel expense on any website, or even $825 for groceries at Sobeys-affiliated stores (Safeway, FreshCo, IGA, Thrifty Foods, etc.) and other Scene+ partners like Home Hardware.

Maximum value of welcome bonus

It’s $825. It could never be worth more.

As with everything in life, you either get more convenience or more value. These points are the most flexible and the easiest to use, so they can never give you outsized value.

Rewards details

This is the breakdown of the rewards:

- 25,000 points: Welcome bonus after spending $1,000 (in maximum 3 months)

- 20,000 points: Welcome bonus after spending $7,500 total (in maximum 12 months)

- 37,500 points: Earn on the minimum spend (at the multiplier rate of 5 pts/$)

That’s what’s a bit unique with the Scotiabank Gold American Express Card; the points from what you earn on the minimum spending requirement are almost as important! That’s what happens when a card earns 5 or even 6 points per dollar (I’ll get back to that).

Redemption options

Here is how you can redeem your rewards:

- $825: Any trips on any website

- $825: Any trips on the Scene+ website

- $825: Merchandise at participating stores

- ≈ $578 to $825: Gift cards

- ≈ $578: Merchandise online

- $578: Cash back as a statement credit

For more details, as always, you can check the tabs on our card resource page for the Scotiabank Gold American Express Card.

Math for the Flytrippers Valuation

You get $825 in rewards, and the first-year annual fee is waived.

So $825 minus $0 is $825.

Minimum spending requirement

To unlock the welcome bonus on the Scotiabank Gold American Express Card, you need to spend $1,000 in a maximum of 3 months (very easy) and an extra $6,500 in a maximum of 12 months (also very easy). These are 2 separate bonuses.

You do not need to renew the card to get the welcome bonus; you get the points as soon as you reach a total of $1,000 and $7,500 (the 3 months and 12 months are just your maximum timespan allowed). This particular deal is better if you spend in grocery stores, but you won’t get that much less if you spend elsewhere.

Effective percentage back

You get 11.0% back on $7,500 in spending ($825 on $7,500). A bit better than 1% or 2%, right?

Minimum income requirement

You must have a personal income of $12,000 or more to be eligible for the Scotiabank Gold American Express Card.

All cards issued by Amex Bank have no minimum income requirement, but this card is issued by Scotiabank even if it is indeed a card that runs on the Amex network (the same network as all Amex Bank cards). It’s a bit unique since Amex is both a bank that issues cards (like Scotiabank or TD) and a card network (like Visa or Mastercard).

Welcome bonus eligibility restrictions

Scotia is the most strict bank in terms of welcome bonus eligibility rules. You must not have had any Scotia credit card in the past 2 years (and Scotia is the only bank that includes “joint” cards on someone else’s account).

These are the official rules… but they aren’t always enforced, and you might be lucky even if you’re technically not eligible. You can read more about welcome bonus eligibility rules.

Main benefits

The Scotiabank Gold American Express Card is one of only 5 credit cards in Canada that doesn’t charge the 2.5% foreign transaction fee on all your purchases made in a currency other than the Canadian dollar.

It’s a junk fee that so many people sadly don’t even know they’ve been paying. They’re avoidable with the EQ Bank Card (Prepaid Mastercard) that is free and that everyone should have, but it’s even better to avoid them with a real credit card that earns more rewards.

Travel insurance

The Scotiabank Gold American Express Card has all the main types of travel insurance. The medical travel insurance is very good, with 25 days of coverage (for those aged 64 and under).

Earn rates highlights

Earn rates are way less important than just about everyone thinks they are, at least if you do travel rewards the right way with huge welcome bonuses.

But the Scotiabank Gold American Express Card does have a phenomenal earn rate of 5 pts/$ (5%) at all grocery stores or 6 pts/$ (6%) at Sobeys-affiliated grocery stores. That includes gift cards you can buy there for many other retailers and even prepaid credit cards to use at Costco and everywhere else. Just take the time to read a few warnings about the gift card and prepaid card trick.

Expiration

You have no time limit to use your points even if you close the Scotiabank Gold American Express Card, just like with almost every travel rewards currency (contrary to the very common myth).

Find out more

I did a video and text summary for this deal since it’s so good.

All the information is in the tabs on our card resource page for the Scotiabank Gold American Express Card, like with all cards.

American Express Gold Rewards Card

It’s the best one right now for…

Those who want points of the more lucrative type… but who don’t mind getting them over a longer period of time due to the offer structure.

The American Express Gold Rewards Card is the highest offer in Canada right now in terms of pure valuation (apart from premium cards like the American Express Platinum Card), but it’s a great example that it’s important to plan ahead!

Flytrippers Valuation of welcome bonus

You’ll get 72,000 American Express Membership Rewards points by unlocking the welcome bonus on the American Express Gold Rewards Card.

These points are worth a variable amount of ≈ $1080 conservatively, but they’re less flexible. You also get a $100 travel credit that you can cash out on day 1 with our pro tip (by applying it to a refundable hotel and then getting the hotel refunded).

Maximum value of welcome bonus

It’s literally unlimited. If you use the points well, they can be worth $1500 easily, even in economy class. In business class or first class, they can be worth $2000 easily.

That’s the beauty of travel rewards of the more lucrative type. You can get outsized value if you want to. The price in points is NOT tied to the price in cash.

Rewards details

This is the breakdown of the rewards:

- 60,000 points: Welcome bonus (12 separate monthly bonuses)

- 12,000 points: Earn on the minimum spend (at base earn rate of 1 pt/$)

That’s what’s a bit unique with the American Express Gold Rewards Card; the bonus is actually 12 separate monthly bonuses during the whole first year.

Redemption options

Here is how you can redeem your rewards:

- ≈ $1,512 to UNLIMITED: Specific flights in premium cabins with airline price charts

- ≈ $1,080 to ≈ $1,512: Specific flights in economy class with airline price charts

- ≈ $1,080 to $1,440: Any flights with the Amex price chart

- ≈ $778 to UNLIMITED: Specific hotels with hotel price charts

- $720: Any trips on any website

- $720: Any trips on the Amex website

- $720: Cash back as a statement credit

For more details, as always, you can check the tabs on our card resource page for the American Express Gold Rewards Card.

Math for the Flytrippers Valuation

You get ≈ $1080 in rewards, and the net fee is $150 ($250 minus the $100 travel credit you can cash out).

So ≈ $1080 minus $150 is ≈ $930.

Minimum spending requirement

To unlock the welcome bonus on the American Express Gold Rewards Card, you need to spend $1000 per month for 12 months. Those are really 12 separate bonuses.

You do not need to unlock each one to get the others, but it’s obviously what you should do because getting all the points is better.

Effective percentage back

You get ≈ 7.8% back on $12,000 in spending (≈ $930 on $12,000). A bit better than 1% or 2%, right?

Minimum income requirement

You are eligible for the American Express Gold Rewards Card regardless of your personal income, as with all cards issued by Amex Bank.

Welcome bonus eligibility restrictions

Amex is also very strict when it comes to eligibility rules for the welcome bonus. You are not eligible for the American Express Gold Rewards Card’s welcome bonus if you’ve already had this specific card before.

These are the official rules… but they aren’t always enforced after a few years, and you might be lucky even if you’re technically not eligible. You can read more about welcome bonus eligibility rules.

Main benefits

The American Express Gold Rewards Card offers free access to VIP airport lounges, but it’s one of the most limited accesses. You can only access Plaza Premium lounges in Canada, but no lounges are included outside Canada. You get 4 passes per calendar year (so 4 in 2024 and 4 in 2025).

You also get a credit to get NEXUS for almost free to avoid almost all airport queues.

Travel insurance

The American Express Gold Rewards Card has all the main types of travel insurance, but no mobile device insurance.

Earn rates highlights

Earn rates are way less important than just about everyone thinks they are, at least if you do travel rewards the right way with huge welcome bonuses.

But the American Express Gold Rewards Card does have one of the best multiplier earn rates for travel expenses, with 2 pts/$ (≈ 3%).

Expiration

You have no time limit to use your points even if you close the American Express Gold Rewards Card, just like with almost every travel rewards currency (contrary to the very common myth).

Find out more

All the information is in the tabs on our card resource page for the American Express Gold Rewards Card, like with all cards.

RBC Avion Visa Infinite Card

It’s the best one right now for…

Those who want points of the more lucrative type… but don’t mind that they’re a bit less flexible than the previous ones.

The RBC Avion Visa Infinite Card offer is at a record-high right now and it’s excellent, but the points are a bit harder to maximize because there are fewer good options.

Flytrippers Valuation of welcome bonus

You’ll get 60,000 RBC Avion points by unlocking the welcome bonus on the RBC Avion Visa Infinite Card.

These points are worth a variable amount of ≈ $900 conservatively, but they’re less flexible than Amex points.

UPDATE: The offer is now worth ≈ $158 more if you take advantage of the new 30% transfer bonus for the portion of the welcome bonus that you get upon approval!

Maximum value of welcome bonus

It’s literally unlimited. If you use the points well, they can be worth $1500 easily, even in economy class. In business class or first class, they can be worth $2000 easily.

That’s the beauty of travel rewards of the more lucrative type. You can get outsized value if you want to. The price in points is NOT tied to the price in cash.

Rewards details

This is the breakdown of the rewards:

- 35,000 points: Welcome bonus upon approval (no spend required)

- 20,000 points: Welcome bonus after spending $5,000 (in maximum 6 months)

- 5,000 points: Earn on the minimum spend (at base earn rate of 1 pt/$)

That’s what’s a bit unique with the RBC Avion Visa Infinite Card; the main part of the bonus doesn’t even require a dime in spending!

Redemption options

Here is how you can redeem your rewards:

- ≈ $1,260 to UNLIMITED: Specific flights in premium cabins with airline price charts

- ≈ $900 to ≈ $1,260: Specific flights in economy class with airline price charts

- ≈ $900 to $1,380: Any flights with the RBC Avion price chart

- $600: Any trips on the RBC Avion website

- $348: Cash back as a statement credit

For more details, as always, you can check the tabs on our card resource page for the RBC Avion Visa Infinite Card.

Math for the Flytrippers Valuation

You get ≈ $900 in rewards, and the fee is $120.

So ≈ $900 minus $120 is ≈ $780.

Minimum spending requirement

To unlock the full welcome bonus on the RBC Avion Visa Infinite Card, you need to spend $5,000 in a maximum of 6 months (very easy). But the main part is given to you upon approval.

You do not need to renew the card to get the welcome bonus; you get the bonus points as soon as you get the card and as soon as you reach a total of $5,000 (the 6 months are just your maximum timespan allowed). Well, in this case, they say it can take up to 60 days to actually receive the points, but it’s usually not as long as that.

Effective percentage back

You get ≈ 15.6% back on $5,000 in spending (≈ $780 on $5,000). A bit better than 1% or 2%, right?

Minimum income requirement

Your income must be over $60,000 (personal) or $100,000 (household) to be eligible for the RBC Avion Visa Infinite Card.

Most banks don’t ask for proof of income, but it could happen. You can read the basics of credit card minimum income requirements.

Welcome bonus eligibility restrictions

You must simply make a new application to be eligible to the current welcome bonus on the RBC Avion Visa Infinite Card.

RBC often has no restrictions based on your previous cards, so it’s the least strict bank about this.

Main benefits

The RBC Avion Visa Infinite Card offers a free DoorDash DashPass and a 3¢/L discount at Petro-Canada.

Travel insurance

The RBC Avion Visa Infinite Card has all the main types of travel insurance.

Earn rates highlights

Earn rates are way less important than just about everyone thinks they are, at least if you do travel rewards the right way with huge welcome bonuses.

But the RBC Avion Visa Infinite Card does have a good multiplier earn rate for travel expenses, with 1.25 pts/$ (≈ 1.875%).

Expiration

You have no time limit to use your points even if you close the RBC Avion Visa Infinite Card, just like with almost every travel rewards currency (contrary to the very common myth).

Find out more

I wrote a detailed article about this deal since it’s so good.

And all the information is in the tabs on our card resource page for the RBC Avion Visa Infinite Card, like with all cards.

Learning how to travel for less

Join over 100,000 savvy Canadian travelers who already receive Flytrippers’ free newsletter so we can help you travel for less — including thanks to the wonderful world of travel rewards!

Summary

These 4 deals are currently the best for 99% of travelers! As always, welcome bonuses are the key to traveling for less: you get ≈ $780 or more in free travel whether you get the TD First Class Travel Visa Infinite Card, the Scotiabank Gold American Express Card, the American Express Gold Rewards Card, or the RBC Avion Visa Infinite Card. We’ve broken down each of them to help you choose the card that’s best for you according to the reward types that you prefer, the key benefits, etc.

What would you like to know about the best offers for November? Tell us in the comments below.

See the flight deals we spot: Cheap flights

Discover free travel with rewards: Travel rewards

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Featured image: Cannon Beach, Oregon, United States (photo credit: Unsplash+)