There are currently pretty amazing deals that aren’t just good: they’re among the best we’ve ever seen in Canada. This one happens to be the most interesting for many Canadian travelers! In terms of value, it offers an incredible ≈ $945 from the welcome bonus alone, the highest in Canada (premium cards excluded). If there was just one card deal you had to take advantage of this year, this is probably the one (or definitely one of the other excellent ones running right now).

The American Express Aeroplan Card’s increased welcome bonus gives you many reward flights. Aeroplan points are the most valuable in Canada!

You’ll get a net value of ≈ $945 according to our conservative Flytrippers Valuation — but the offer can also give you over $1000 pretty easily!

First, you can watch our video presentation of the Amex Aeroplan Card if you prefer that format.

Important: if you’re not part of the Flytrippers readers who have now earned over 1 million dollars in travel rewards thanks to our welcome bonus recommendations, start by reading the 6 basic things to know about travel rewards.

Because in this review, we’ll assume you know that:

- welcome bonuses are the key and it doesn’t matter whether or not you can use your card for 100% of your purchases

- you always have to pay everything on time and there’s no “scam”

- having multiple cards is better for your credit score

- you must not cancel your current cards

- annual fees alone are irrelevant

- there are 2 types of travel rewards that work very differently

(1 million dollar sidenote: you may know Flytrippers from our many appearances in the mainstream media as travel experts or from the 50% off flight deals we spot, but our readers have also earned 1 million dollars just with welcome bonuses! Read why you should stop missing out and why that million makes us so much happier than the thousands of dollars we’ve earned ourselves for our own trips).

So let’s get started with the review of the Amex Aeroplan Card (officially the American Express Aeroplan Rewards Card).

Overview of Flytrippers’ take on the Amex Aeroplan Card

Our detailed editorial card reviews always start with a section that goes straight to the point, including:

- Why get the card

- Who should get the card

- How to get the card

Why get the Amex Aeroplan Card

Here are the 5 best reasons to get the Amex Aeroplan Card:

- The incredible increased welcome bonus with a net value of ≈ $945

- The valuable Aeroplan points

- The lower Aeroplan prices on Air Canada for cardholders

- The free checked bag on Air Canada and the other benefits

- The few insurance coverages included

I’ll explain each one below.

The new detailed page about this card also has all the information under several tabs if you want to know everything!

Who should get the Amex Aeroplan Card

Here are the travelers who should consider getting the Amex Aeroplan Card:

- Those who want the best travel rewards offer right now (premium cards excluded)

- Those who don’t want a premium card

- Those who don’t want access to airport lounges

- Those who want Aeroplan points that are a little more complex, but much more valuable

- Those who can spend $3000 in 6 months (equivalent to ≈ $115 per week; 6 months = 26 weeks)

There are so many exceptional offers right now that the Amex Aeroplan Card may not even be the best one for you, even though it’s really great and has no minimum income requirement (meaning anyone can get it).

We have a head-to-head comparison between the American Express Aeroplan Card and the American Express Gold Card, the 2 that are the most similar and have the best welcome bonuses (premium cards excluded).

The Amex Gold Card can actually be the better deal for most travelers, even if it costs $30 more for the same amount of points in the welcome bonus (so a net value of ≈ $915 instead of ≈ $945). Those points can be used on any travel expense too, which is simpler but less valuable, as opposed to not having the option with the Amex Aeroplan Card. The Amex Gold Card also offers 4 airport lounge passes for example.

Speaking of airport lounge access, there are also 2 premium cards that offer unlimited access and welcome bonuses of ≈ $1211 and ≈ $1126. We have a head-to-head comparison between The Platinum Card from American Express and the American Express Aeroplan Reserve Card, those are the best!

Among the record 13 cards with welcome bonuses worth $533+, other cards have:

- lower minimum spending requirements

- flexible rewards that can be used in more ways

- lower fees (although it makes no sense to look at just that)

- unlimited access to airport lounges worldwide or a few passes in Canada

- welcome bonuses with a higher net value (higher rewards and higher fees)

- hotel points that can give you up to 11 nights completely free

- simpler welcome bonus structures that allow you to spend anywhere

- better earn rates (although earning with regular purchases is definitely not the way to go to earn fast)

- more acceptance because they’re not Amex cards (although it makes no sense to choose just based on that)

We’ve put together a very comprehensive guide on the different offers currently available so you can find the one that’s right for you. It’ll really help you make your choice.

This is such a great opportunity to get started in the world of travel rewards, so I‘ll be happy to personally answer any questions you may have on the subject; just send your questions to points@flytrippers.com!

How to get the Amex Aeroplan Card

Here’s the 6-step simplified process to take advantage of this deal:

- Apply for the American Express Aeroplan Card (secure Amex link)

- Unlock the main welcome bonus by spending $3000 in 6 months

- Unlock another optional welcome bonus by spending $2000 of those $3000 at the grocery store (including gift cards)

- Unlock another optional welcome bonus by splitting the $3000 evenly ($500 per month for 6 months)

- Get 71,000 Aeroplan points (welcome bonuses and earnings on the minimum spend)

- ≈ $1065 in rewards for only $120

- Flytrippers Valuation of ≈ $945

- Effective rate of ≈ 32% back on $3000 in 6 months

- Use Aeroplan points to get:

- ≈ $1065 off specific rewards flights

- It’s easy to make sure the points never expire!

You can download our free 29-page guide to the Amex Aeroplan Card for EVERYTHING you need to know to get started.

You’ll also get our checklist for when you get a new card to avoid common mistakes, plus some other handy tools as a bonus.

Highlights of the American Express Aeroplan Card

Here’s a detailed look at the 5 best reasons to get the American Express Aeroplan Card.

1. The incredible increased welcome bonus with a net value of ≈ $945

First, the most obvious. The welcome bonus is always the most important thing to consider for any card.

The increased offer on the Amex Aeroplan Card will give you a whopping 71,000 Aeroplan points!

The points are worth ≈ $1065! That gives you up to 11 reward flights! Those are extremely valuable points; I’ll give you concrete examples of how to use them in the next section.

But I’ll start by explaining what’s special about this bonus: it’s actually 3 separate welcome bonuses that are independent of each other.

But it’s really easy to maximize your free travel by getting the 3 of them!

Structure of the increased welcome bonus

The increased welcome bonus offer gives you:

- 45,000 points: Standard welcome bonus (minimum spend of $3000 in 6 months)

- 10,000 points: Bonus rate as a welcome bonus (5X the points on groceries and restaurants for 3 months; maximum $2000)

- 15,000 points: Additional monthly welcome bonus (2,500 points for each month during which you spend $500; so split the $3000 evenly)

- 1000 points: In addition to the welcome bonuses (you’ll get at least that with the regular earn rate on the remaining $1000 in spending)

So to make it quite simple, it’s really easy to do:

- Spend $2000 at the grocery store in 3 months

- Equivalent to ≈ $154 per week

- Easy to achieve with our tip of getting gift cards at the grocery store for gas, clothing, and everything else

- Plenty of grocery stores accept Amex

- Spend $1000 anywhere in 6 months

- Equivalent to ≈ $38 per week

- Easy to achieve with our pro tips

- Otherwise, there are 4 cards that require less and give $533+

- Split that $3000 evenly each month

- $500 per month for 6 months

And if you want it to be even simpler, as long as you spend $3000 anywhere in 6 months (that’s only ≈ $115 per week), you’ll get the biggest part of the welcome bonus!

But as pros, we always like to maximize everything!

Analysis of the increased welcome bonus

Seriously, getting 71,000 Aeroplan points for $120 is amazing!

Not too long ago, getting 25,000 or 30,000 points was good for a non-premium card! Here it’s almost 3 times that! That’s phenomenal.

Quite a deal! Another good example of how absurd it is to avoid cards that have fees just for the sake of avoiding fees. A card that costs $0 but gives $0 is obviously worse than a card that costs $120 and gives ≈ $1065.

It’s pretty standard to pay $120 to get a good welcome bonus; you won’t often get hundreds of dollars in value without paying that.

If you don’t understand that, unfortunately, you’ll never get a lot of travel rewards, so it’s essential to read the basics. There’s no way to be a pro if you hesitate to pay $120 to get $1065! None.

Value of the increased welcome bonus

Here’s a summary of the math behind the welcome bonus:

- ≈ $675 from the standard welcome bonus (45,000 Aeroplan points)

- ≈ $150 from the welcome bonus’ special rate (10,000 Aeroplan points)

- ≈ $225 from the monthly welcome bonus (15,000 Aeroplan points)

- ≈ $15 from the earnings at the regular rate (1000 Aeroplan points)

- –$120 in fees

That’s what adds up to a net Flytrippers Valuation of ≈ $945! That’s simply amazing!

2. The very valuable Aeroplan points

The Aeroplan points you earn with the Amex Aeroplan Card are variable-value rewards.

These are infinitely more valuable than fixed-value rewards. It’s a bit more complicated, but it can give you outsized value and unlimited value (yes, unlimited!) and be worth twice our Flytrippers Valuation too!

And good news: of all the variable-value rewards currencies, Aeroplan points are the best for those who don’t want to rack their brains too much!

That’s because they’re a bit flexible since they work based on 2 separate pricing systems.

So you can use Aeroplan points either:

- For reward flights on 40+ airline partners

- Often the best use to maximize value

- Often more complex, therefore more valuable

- Number of points required is guaranteed and fixed by the award charts

- Number of points required is completely independent of the cash price

- Number of available seats is limited

- For reward flights on Air Canada

- Often the best use to maximize the flexibility you get

- Often less complex, therefore less valuable

- Number of points required is not guaranteed and not fixed

- Number of points required is based on the cash price

- Number of available seats is not limited

So on top of being literally the best points in Canada (they’re #1 in the 5 essential programs for Canadians we listed in our free cheat sheet), Aeroplan points are perfect for those who are starting out in the wonderful world of variable-value rewards.

So, in other words, with the 71,000 Aeroplan points you’ll have earned, you’ll get either:

- ≈ $1065 off certain specific flights (if you use your points well)

- ≈ $1500 off certain specific flights (if you use your points very well)

- ≈ $710 off any Air Canada flights at a minimum (if you don’t want to rack your brain)

Here’s a brief overview of how both Aeroplan price systems actually work, while you wait on our ultimate guide to the Aeroplan program coming very shortly. You can also attend our free webinar all about Aeroplan points this Monday.

Aeroplan points for reward flights on partner airlines

With variable-value rewards, you normally need to be more flexible to get the most value.

Our Valuation of ≈ $945 is by using your points for flights while being at least vaguely aware that not all point redemptions are good (that’s one of the basics of travel rewards). You can easily get more value.

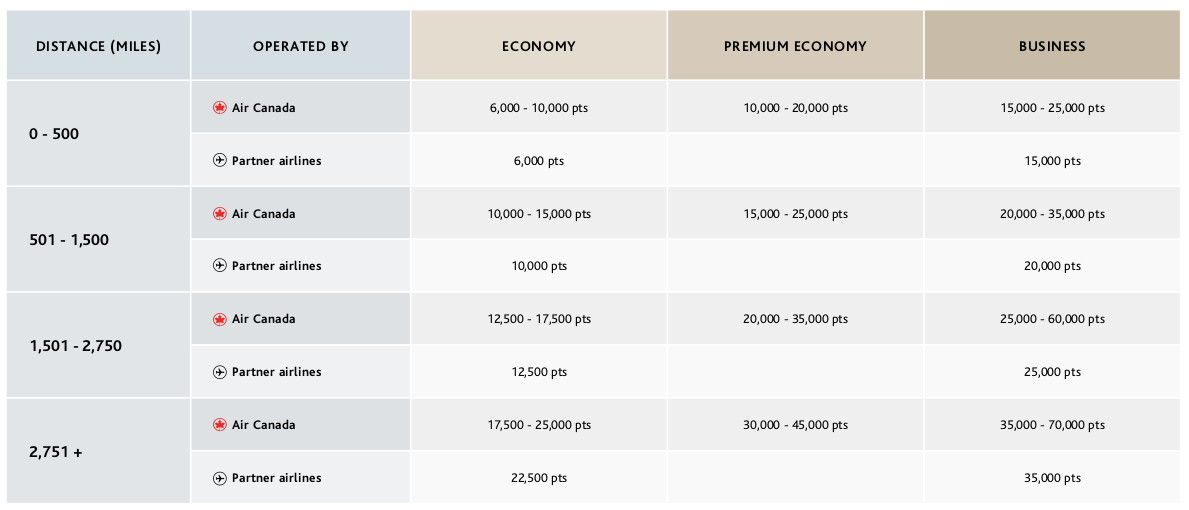

Aeroplan is the program with the most airline partners in the entire world, so it’s pretty easy to maximize the value! With airline partners, the price of flights is fixed and guaranteed! Always!

A flight under 500 miles within Aeroplan’s North America region will always cost 6000 points on United, Avianca, Copa, or Canadian North (the main North America region-based partners among the 40+).

No other price is possible. Because that’s what the Aeroplan award charts say (there are 10 award charts to cover the entire world; short-distance flights on all continents are often the best use, along with business class flights of course if you prefer quality over quantity).

So the number of reward flights listed below are what you are guaranteed to get with the Amex Aeroplan Card‘s welcome bonus alone. As long as you find seat availability on partners, hence the attractiveness of Aeroplan having the most partners of any airline rewards program in the world.

Here are a few concrete examples of what the 71,000 Aeroplan points can give you to show you how valuable it can be:

- 11 one-way short-distance reward flights such as Montreal-New York or Montreal-Washington

- 7 one-way medium-distance reward flights such as Montreal-Miami or Montreal-Nashville

- 5 one-way longer distance reward flights such as Montreal-Costa Rica or Montreal-Mexico

- 1 one-way business class reward flight such as Vancouver-Japan or Montreal-Switzerland

- 10 one-way short-distance reward flights in several regions of the world

- 13 completely free nights in beautiful hotels in specific destinations like Bali

You can check out the 18 good uses of Aeroplan points to see more concrete redemption examples and read the basics about the Aeroplan program while we prepare our ultimate guide.

Aeroplan points for reward flights on Air Canada

There’s a different pricing system on Air Canada for the simple reason that most people always prefer to have everything be more simple instead of more valuable, unfortunately.

So the whole process is pretty much the same. In short, the only difference is that when there are no more seats available at the lowest price (the price on the award charts for partner airlines), on Air Canada you can use your points to pay for any seat!

This obviously means that you will pay more points in these cases. But at least you have the option of using your points more badly, rather than just not being able to use them at all. It’s what those who don’t like to maximize want; Aeroplan gave it to them.

Limiting seats is what allows programs to guarantee low fixed prices of course. By offering all seats, it’s inevitably going to be a worse use of points more often.

But not always: prices on Air Canada might be as low as on the partners, or even cheaper! It’s just that it’s not guaranteed at all, the prices vary according to the cash price. That means you don’t need to be as flexible to use your points, but it’s simply a worse use of them.

That said, even if you don’t want to maximize your points or use them with airline partners, you’ll get hundreds and hundreds of dollars in net value with the Amex Aeroplan Card‘s welcome bonus — that’s still an amazing offer, and it’s almost unbeatable as far as simpler rewards are concerned.

3. The lower Aeroplan prices on Air Canada for cardholders

As we just explained, the pricing system for Aeroplan reward flights has 2 different components depending on whether you fly on Air Canada or on partner airlines.

In short, as an Amex Aeroplan Card holder, you’ll get preferred fares on Air Canada. Flights will cost you slightly fewer points than if you were not a cardholder.

It’s not a huge discount, but it can save a few thousand points in many cases.

4. The free checked bag on Air Canada and the other benefits

I’ll mention a few other benefits of the Amex Aeroplan Card.

Free checked bag

It’s so much nicer to travel light and we recommend never bringing checked bags as most flight pros do, but we know that most people like to bring too much stuff all the time.

So, this Amex Aeroplan Card benefit can be very interesting: you get a free checked bag for you and up to 8 other travelers on the same reservation as you.

Of course, the 1st flight on your itinerary must be operated by Air Canada.

If you fly Air Canada often and usually bring too much stuff, this benefit can easily give another $100 in value (you’ll maybe even break even on the annual fee in year 2 as well) on top of the ≈ $945 in net value you get with the rewards.

Free supplementary cards

You can get free supplementary cards (“joint” cards) so that someone you trust can help you earn more points (and have them all in the same Aeroplan account).

It doesn’t count as a credit application for the additional cardholder and it doesn’t prevent them from eventually getting their own card, which your travel buddies should of course do to get their own welcome bonus, because welcome bonuses are the key.

You can also choose a $50 supplementary card if the person needs to have the free baggage benefit (if they’re traveling without you). The free supplementary cards don’t have this benefit.

Base earn rate

It’s not with what you earn on your purchases that you’ll earn fast — it’s with welcome bonuses — but the perk of the Amex Aeroplan Card, which earns valuable points, is that the base rate of 1 point per dollar is worth ≈ 1.5% instead of just 1% like you get on many cards (excluding categories with multiplier rates).

That’s still 50% more rewards. And since their value is unlimited, you could also be earning the equivalent of 2% or more as well!

By the way, the only multiplier rate on this card is 2 points per dollar (≈ 3%) on what you spend with Air Canada and 1.5 points (≈ 2.25%) on restaurants and food delivery apps.

As mentioned in the welcome bonus, a special bonus rate of 5 points per dollar at grocery stores and restaurants is in effect for the first 3 months, up to a maximum of $2000 (or 10,000 points).

Other benefits

You get Uber Pass free for 6 months, which gives you free delivery and 5% off Uber Eats orders over $15 (before taxes and fees). It also gives you “perks” on Uber, but that’s vague.

You get access to the Amex Offers program: discounts, credits, and special offers throughout the year. That can add up to a lot of value.

You can also take advantage of the American Express Experiences program, which gives you access to exclusive virtual and in-person experiences and ticket pre-sales for many events.

You get access to The Hotel Collection program, which are privileges at luxury hotels (like a US$100 hotel credit and a free room upgrade), if you like to pay for expensive hotels.

You get shortcuts to Aeroplan Elite status, but it’s mostly for those who travel and spend a lot with Air Canada.

If you’re interested, the Amex Aeroplan Card is made of 70% reclaimed plastic.

Finally, the Amex Aeroplan Card is a charge card instead of a traditional credit card, which just means that there’s no option of making only a minimum payment. So it doesn’t change anything if you pay everything on time, as you obviously should. But for pros, it’s a benefit because it doesn’t count towards the limit of 4 “real” Amex credit cards you can have at the same time (you can have 4 Amex cards plus the Amex Aeroplan Card or the Amex Platinum Card or Amex “business” cards, all of which don’t count towards the total).

5. The few insurance coverages included

One of the best benefits of good travel credit cards (apart from the obvious travel rewards for free travel) is the insurance coverage included free of charge.

It makes no sense to miss out on all that!

The Amex Aeroplan Card offers a few types of coverage:

- Flight delay insurance

- Baggage delay insurance

- Lost or stolen baggage insurance

- Car rental theft and damage insurance

- Hotel burglary insurance

- Travel accident insurance

- Purchase protection insurance

- Extended warranty

It’s good, but it’s missing a few coverages compared to the Amex Gold Card which has almost the same welcome bonus value.

First, medical travel insurance coverage is not offered, but it’s not that big a deal; unlike the other types of credit card insurance coverage, medical travel insurance coverage is valid whether or not you pay for the trip with your card.

This is always the case for this type of coverage, contrary to the very common myth. So as long as you have it on another one of your cards, you’re covered.

The other ones missing are trip cancellation insurance and trip interruption insurance, but for those, there are COVID-19 exclusions in place right now anyway, unlike the other types of insurance. But if you want coverage for other non-COVID reasons, the Amex Gold Card is better.

The most important coverage is flight delay insurance and the Amex Aeroplan Card has it. It’ll give you $500 to pay for a hotel and meals if your flight is delayed by more than 4 hours, no matter the cause of the delay.

Most importantly, you’ll get it without having to go stand in line with other travelers who don’t have this insurance and without having to beg the airline at all.

I’ve used it 10 times myself and it gave me almost $5000 in free hotels during delays. Plus, I also got over $1000 in hotels for later (since I’m paying for a nice, expensive hotel myself — instead of a standard hotel paid by the airline — which allows me to earn tens of thousands of free hotel points for lots of free nights)!

Plus, you have car rental insurance which is common (stop throwing your money out the window by paying the rental company’s insurance), lost or stolen baggage insurance (useful if you unfortunately don’t follow the #1 tip to avoid the current chaos), and hotel burglary insurance (it doesn’t happen often, but it’s better to have insurance, especially when it’s free).

Finally, you have the standard retail coverage: purchase protection if your item is lost, damaged, or stolen (for 90 days; $1000 maximum per occurrence) and an extended warranty (doubled; up to 1 extra year).

Our ultimate guide to the different types of travel insurance is coming soon.

Want to get more content to maximize your Aeroplan points?

Summary

The American Express Aeroplan Card really does offer you one of the best welcome bonuses in Canada right now. You can get an incredible net value of ≈ $945, very valuable points, discounts on Aeroplan flights on Air Canada, free bags on Air Canada, and other benefits, plus a few insurance coverages (all with no minimum income requirement)!

What would you like to know about the American Express Aeroplan Card? Tell us in the comments below.

See the deals we spot: Cheap flights

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Discover free travel: Travel rewards

Featured image: Costa Rica (photo credit: Nat Fernández)

Hey! I got the Amex cobalt about a year ago as per your recommendation – do you recommend trading cards? Or should I apply for a second?

First, you should always apply for a new card when you’re done with unlocking another’s welcome bonus, that’s the key. Regardless of which card you got. So if you’re done — or even almost done — with the Amex Cobalt Card‘s unique 1-year long minimum spend, you should most definitely take advantage of one of the summer’s record-high offers!!! Which one depends on your preference of course, but everyone should jump on these before Tuesday night.

Then, for your current Amex Cobalt Card, assuming you didn’t make the mistake of closing your old cards you had before starting in the world of travel rewards, you should re-evaluate it just before the renewal, as you should do with all cards moving forward: does it still give you value (we mention this in our important checklist for when you get a new card). This is completely independent of getting new cards.

Every traveler is different, so unlike the welcome bonuses (which are amazing and worthwhile for everyone), subsequent years of a card don’t provide the same value for everyone. I keep my Amex Cobalt Card because I maximize the 5X Aeroplan earn rate and I maximize my Aeroplan points uses, but that might not be worth $158 to you. Depends on your travel patterns.

Let me know if you have any other questions 🙂