There’s a credit card with some of the best travel benefits. The Scotiabank Passport Visa Infinite Card gives you 6 annual passes for free access to VIP airport lounges, great insurance, and is the only good card with no foreign transaction fee.

To be clear, its welcome bonus of $120 is nowhere near what you can get with the best credit card offers right now (some are as high as ≈ $930).

But the Scotiabank Passport Visa Infinite Card has those key benefits for lounges and FX fees. And the $120 bonus is in the form of Scene+ points, which are rewards of the more simple type: you can redeem them for any travel expense on any website. It’s super easy.

Here are the details.

Overview of the deal

Here are the highlights:

- $120 with the welcome bonus

- Simple rewards

- 6 annual passes for VIP airport lounges

- No foreign transaction fee

- Great insurance coverage

In short, if you’re just getting started or want a card with great travel benefits, getting the Scotiabank Passport Visa Infinite Card could make sense… but you should probably get a better one now and wait until a better offer to get this one (we send offer updates to the 55,000+ savvy Canadian travelers who receive our free newsletter specifically for travel rewards).

IMPORTANT: If you’re not yet part of our Flytrippers fans who have earned over 3 million dollars in free travel with our travel rewards deals, you need to know that having more credit cards improves your credit score (contrary to the very common and very wrong myth).

As long as you follow the 3 simple rules, which include not closing your current cards (at least not your oldest ones). If your current old cards have a fee, you can simply downgrade them to a no-fee version if the card no longer provides value to you.

Here’s exactly what you need to do to take advantage of this deal:

- Apply for the Scotiabank Passport Visa Infinite Card

- Through our secure Scotiabank link

- Get amazing benefits as soon as you receive the card

- They’re unrelated to the welcome bonus

- Unlock the welcome bonus

- By spending $1000 in a maximum of 3 months

- Easy to do for just about everyone

- Get $270 to spend on any travel expense

- 27,000 Scene+ points

- The simplest travel rewards that exist

- Fee of $150 for a net value of $120

Here’s all you need to know about the benefits and key features of this card.

Who is eligible for this deal?

There are always 2 parts to eligibility:

- Card eligibility

- Welcome bonus eligibility

Card eligibility

Like all 15+ Visa Infinite cards issued by various banks in Canada, the Scotiabank Passport Visa Infinite Card has a minimum income requirement.

In theory, your annual income must be either $60,000 (personal) OR $100,000 (household).

In practice, they don’t verify that often. You can read more about card eligibility rules.

Welcome bonus eligibility

Apart from American Express, all major banks in Canada allow you to get welcome bonuses even if you’ve had the card in the past. Scotiabank is the strictest in terms of wait time and rules, though.

In theory, you cannot get the welcome bonus on the Scotiabank Passport Visa Infinite Card if you’ve had any Scotiabank credit card in the past 2 years. They’re also the only bank to include additional cards (“joint” cards) you had under someone else’s account.

In practice, they don’t always apply that either. Don’t miss our detailed post about welcome bonus eligibility rules soon.

$120 with the welcome bonus

Getting free travel is the main reason to get into the wonderful world of travel rewards.

(The welcome bonus is what you should always look at first, with any card. Welcome bonuses are the key: it’s literally THE most important thing to know about travel rewards. Please read our basics infographic if you didn’t know this!)

Our Flytrippers Valuation of the Scotiabank Passport Visa Infinite Card’s welcome bonus is $120.

It’s definitely lower than many other cards; there’s no denying that. But it does have better travel benefits than most others, too.

The minimum spending requirement to unlock the welcome bonus is also incredibly low: just $1000 in 3 months. That means you get a whopping 12% back with the welcome bonus ($120 back on $1,000 spent).

A bit better than 1% or 2%, right? (That’s why welcome bonuses are the KEY!)

Here’s the math:

- $270 with the welcome bonus

- $150 fee

The Scotiabank Passport Visa Infinite Card earns Scene+ points and you will get 27,000 points by unlocking the welcome bonus. Those are worth a simple fixed value of 1¢/pt for any travel booked on any website.

Here’s the breakdown:

- 25,000 points (welcome bonus)

- 2,000 points (estimated earn on the minimum spend)

To be conservative, we estimated the earn on your $1000 minimum spend requirement to be just 2 pts/$, as that’s the card’s earn rate at all grocery stores. But you’ll actually earn 3 pts/$ if you switch to Sobeys, Safeway, Thrifty Foods, IGA (Québec), Marchés Traditions, FreshCo, Foodland, or Foodland & Participating Co-ops.

Simple rewards

The simplicity of the rewards is certainly a benefit if you want maximum flexibility.

The Scotiabank Passport Visa Infinite Card‘s Scene+ points are not only rewards of the more simple type, but they’re also literally the simplest travel rewards that exist: you can use them for any trip booked on any website.

So, your 27,000 Scene+ points give you a $270 discount on any travel expense. There are no restrictions or rules.

Normally, you should never use rewards for anything other than travel, but this is one of the very rare exceptions: you don’t lose value if you use them at the participating grocery stores and other participating retailers. You’ll still get $270.

It doesn’t get any easier than that.

That means Scene+ points can never be worth more though, so they’re worth less than the other travel rewards that give more value because they’re less flexible. Scene+ points are more simple, so necessarily less lucrative — like everything in life. You can read the basics of the 2 types of rewards.

So, the Scotiabank Passport Visa Infinite Card‘s points are really great for those who:

- Are just beginning

- Want things to be simple

- Are pros but want a nice additional stash to diversify their rewards

6 free passes for VIP airport lounges

For travelers, free access to VIP airport lounges is definitely one of the best benefits among the many offered on Canadian cards. It’s one of the best reasons to get this card.

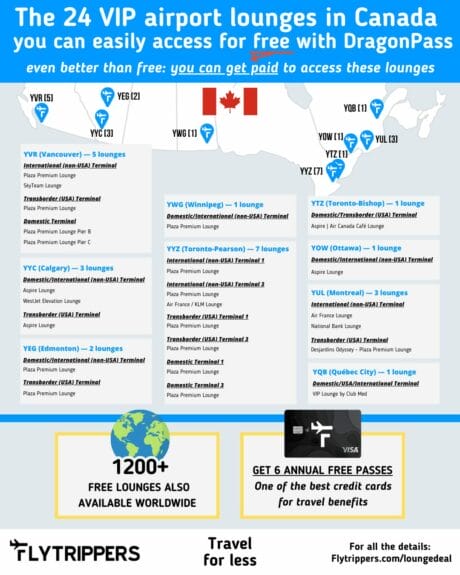

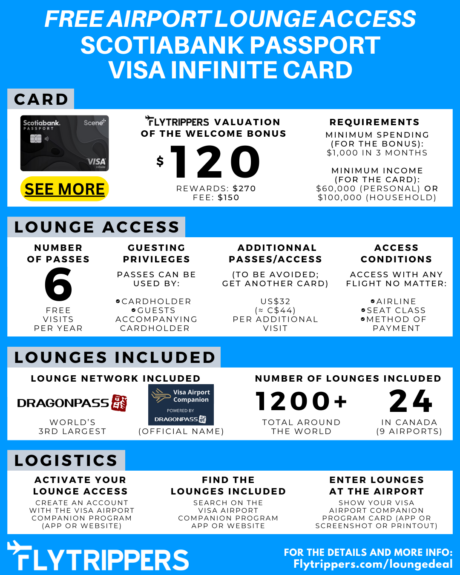

The Scotiabank Passport Visa Infinite Card comes with a complimentary membership to the Visa Airport Companion by DragonPass program and 6 free passes per year of card membership.

This lounge network gives you access to the 1200+ DragonPass airport lounges worldwide, including 24 in 9 Canadian airports.

Lounges are amazing. I’ve had unlimited access myself for over 7 years and can’t recommend it enough. Especially since it’s so easy to get many free passes every year.

At the very least, airport lounges offer:

- Free food

- Free drinks (almost always including alcohol)

- Comfortable seating

- Good Wi-Fi connection

- Cleaner and quieter restrooms

- More relaxed and peaceful atmosphere

You get free access no matter what airline you are flying, what class of service your seat is in, or how you paid for the flight.

So, you can use the benefit even for flights you booked in the past. You can also use the passes for your travel companions.

Here’s an infographic that summarizes the Scotiabank Passport Visa Infinite Card lounge benefit.

Don’t miss our detailed guide to this card’s lounge benefit and airport lounge access in general soon.

No foreign transaction fee

A no-FX-fee card is not necessary if you’re following the pro tips (and therefore always using your spending to unlock welcome bonuses giving you great returns, like 12% back). But it’s a must if you’re not.

FX fees are junk fees many Canadians pay without knowing it. Almost all cards in Canada charge a 2.5% FX fee on all foreign currency purchases.

The Scotiabank Passport Visa Infinite Card doesn’t.

It’s 1 of only 5 no-FX-fee cards, 1 of only 3 no-FX-fee cards that aren’t Amex cards, and the only one of those 3 that also offers a welcome bonus and travel benefits.

Amex isn’t as widely accepted outside North America, so while those cards are good, they aren’t very good for FX fees (unless you unfortunately only travel to the USA). That’s why I say the Scotiabank Passport Visa Infinite Card is the only good no-FX-fee card.

The no-FX-fee benefit sure is a nice plus, but it’s important to understand that you shouldn’t choose this card solely for this reason.

For example, if you choose the TD First Class Travel Visa Infinite Card, you might pay 2.5% on FX transactions. But you’re getting $505 more from the welcome bonus. So you would need to spend $20,200 in foreign transactions on the Scotiabank Passport Visa Infinite Card to save enough in FX fees just to recoup the lost $505 from the welcome bonus…

You can read more in our detailed post about foreign transaction fees.

Great insurance coverage

Free insurance coverage is always one of the best benefits of any good card. We’ll soon share a guide to explain all the different types of coverage.

The Scotiabank Passport Visa Infinite Card has all 8 of the main types of travel insurance:

- Medical travel insurance

- Trip cancelation insurance

- Trip interruption insurance

- Flight delay insurance

- Delayed and lost baggage insurance

- Rental car damage insurance

- Travel accident insurance

- Hotel burglary insurance

Medical travel insurance covers trips of up to 25 days (for those aged 64 and under; only 3 days for those aged 65 and over), which is excellent. As a reminder, you do not need to pay for the trip with your card to be covered by medical travel insurance — that’s just another of the many myths about credit cards.

As for the coverage for your other purchases, the Scotiabank Passport Visa Infinite Card has the 2 main ones:

- Extended warranty

- Purchase protection

How to earn more rewards

Traveling for less is simple: you just need to earn more rewards. And that’s easy to do when you know how.

There are 3 ways to earn more Scene+ points specifically:

- With this card

- With other cards

- With the program directly

With this card

After the $270 from the welcome bonus, the Scotiabank Passport Visa Infinite Card‘s earn rates are just okay.

Anyway, if you’re doing travel rewards the right way, you shouldn’t care so much about earn rates and you should be focusing on welcome bonuses.

If you still care, there are 2 types of earn rates, as always:

- Multiplier earn rate (earn on what is often called a “category bonus”)

- Base earn rate (earn on all other merchant categories)

Here they are for the Scotiabank Passport Visa Infinite Card:

- 3 pts/$ (3%)

- Sobeys-affiliated grocery stores (those listed earlier)

- Gift cards at those grocery stores

- 2 pts/$ (2%)

- Other grocery stores

- Gift cards at those grocery stores

- Restaurants and food delivery apps

- Entertainment (movies, theaters, ticket agencies)

- Transit (rideshares, taxis, buses, subways, and more)

- 1 pt/$ (1%)

- Everywhere else

If you are among the many travelers who think a 3% earn rate on groceries is good, it’s really not (of course, it’s normal to think that if you don’t know about all the cards).

So, if you care about your earn rate, please make sure to get one of the many amazing cards that give you way more than 3%:

- American Express Cobalt Card

- 5 pts/$ — ≈ 7.5% in lucrative points

- 5 pts/$ — 5% in cash back or simple points

- Scotiabank Gold American Express Card

- 6 pts/$ — 6% in simple points (Sobeys-affiliated stores)

- 5 pts/$ — 5% in simple points (other grocery stores)

- MBNA Rewards World Elite Mastercard

- 5 pts/$ — ≈ 7.5% in lucrative points (coming in 2024)

- 5 pts/$ — 5% in simple points

- BMO CashBack World Elite MasterCard

- 5% in cash back

- BMO eclipse Visa Infinite Card

- 5 pts/$ — 3.33% in simple points

Getting one of those cards with great earn rates makes more sense right now, but it can simply be your next card application in 2-3 months if you want to prioritize the Scotiabank Passport Visa Infinite Card’s travel benefits.

With other cards

Having multiple cards is the key to getting more rewards (and a better credit score, and more benefits).

In theory, Scene+ points are harder to earn in huge quantities than almost all other reward currencies due to the Scotiabank welcome bonus eligibility rules explained above.

In practice, you’ll likely be able to get many, so you could combine your points with those earned from the other Scotiabank cards that earn Scene+ points:

- Scotiabank Gold American Express Card

- Scotiabank Platinum American Express Card

- Scotiabank American Express Card

- Scotiabank Scene+ Visa Card

With the program directly

Like with almost all rewards programs, you can (and should) also earn points with the program directly, unrelated to the Scotiabank Passport Visa Infinite Card or any credit card.

But like any reward currency, it’s so much slower than with credit cards.

You can earn more Scene+ points at many retailers, most notably the grocery stores I keep mentioning, Home Hardware stores, Cineplex cinemas, Recipe Unlimited restaurants (Harvey’s, Swiss Chalet, etc.), and more.

Our ultimate guide to the Scene+ program is coming soon, along with many other programs.

All details about the card

If you want to see all the card details, our card resource page has 10+ tabs with all the information you might need.

Questions about the card

Have any questions? Fill out the question form and I’ll personally answer you.

Best alternatives to this card

If you just want the highest amount of free travel:

It has the highest welcome bonus in Canada (premium cards excluded) and also has 4 lounge passes (per calendar year, so 8 in your first year with the card). But it’s a more limited lounge benefit, with only 14 lounges in 5 Canadian airports included. The welcome bonus can also be worth more as Amex points are of the more lucrative type.

If you want 4 lounge passes and have a higher income:

BMO Rewards points are also redeemable for any travel expense on any website and the card is accepted at Costco. It has slightly fewer lounge passes (4 instead of 6) and has a slightly higher minimum income requirement: $80,000 (personal) OR $150,000 (household).

If you want the highest amount of free travel for simple points:

It has the highest welcome bonus for simple points in Canada. You must book through their own travel site to get the maximum value, but even if you want to book on any website (like with Scene+ points), the TD card still gives you more value. However, it has no lounge passes, like almost all cards in Canada.

If you want the best overall card in Canada:

If you’re not going to be getting many cards (but to be clear, you should do it), then you should definitely at least get the best overall card in Canada. Its 5X earn rate — and the immense value of its points of the more lucrative type — is simply phenomenal and unmatched.

If you want to avoid FX fees:

Every single traveler should get this card today (IN ADDITION to a credit card with a welcome bonus). It is not a credit card (no credit check) and it is completely free (no fee whatsoever), so it makes absolutely no sense to not get it. It’s a must-have prepaid card (it works the same as debit card, basically) to easily avoid the 2.5% fee charged by almost every card in Canada.

If you want 10 passes for airport lounges instead of 6:

If lounges are what appeal to you the most, it’s better to have 10 than 6. It’s a premium card that gives you a lower welcome bonus. But it earns you 2% everywhere (and 3% on your trips booked with Scene+).

If you want unlimited access to airport lounges:

The best premium card in Canada gives you a huge welcome bonus. But best of all, it’s full of luxurious travel perks like unlimited access to the largest network of airport lounges, for you and 1 travel companion.

Learning how to travel for less

Join over 100,000 savvy Canadian travelers who already receive Flytrippers’ free newsletter so we can help you travel for less — including thanks to the wonderful world of travel rewards!

Summary

The Scotiabank Passport Visa Infinite Card has amazing travel benefits like free passes for VIP airport lounges, no FX fees, and great insurance. Its Scene+ points are very simple rewards that give you the most flexibility.

What would you like to know about the Scotiabank Passport Visa Infinite Card? Tell us in the comments below.

See the flight deals we spot: Cheap flights

Discover free travel with rewards: Travel rewards

Explore awesome destinations: Travel inspiration

Learn pro tricks: Travel tips

Featured image: Parga, Greece (photo credit: CALIN STAN)